A song of ice and fire

A promise is a promise, the oil trade is here

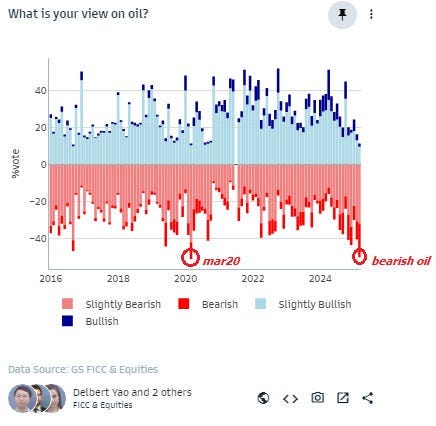

In my latest post, Week #09, I highlighted the stretched sentiment on oil, but also the crowding positioning on the short side:

The market can spin narratives faster than the Trump family can issue meme coins!

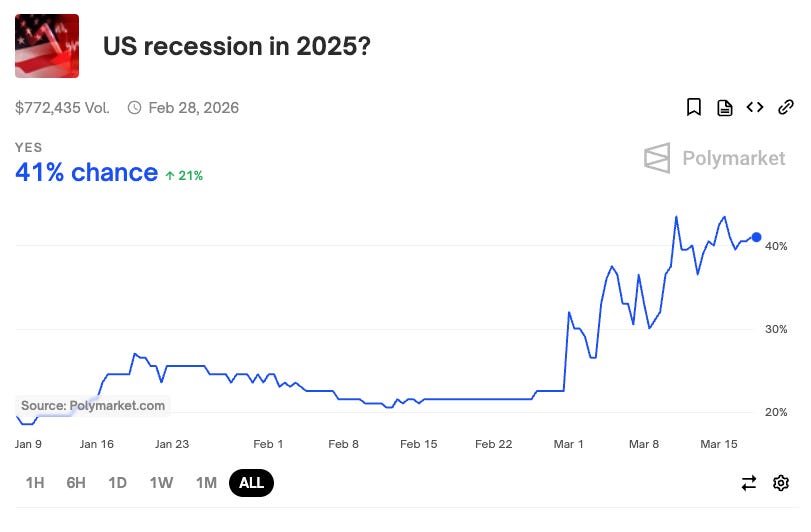

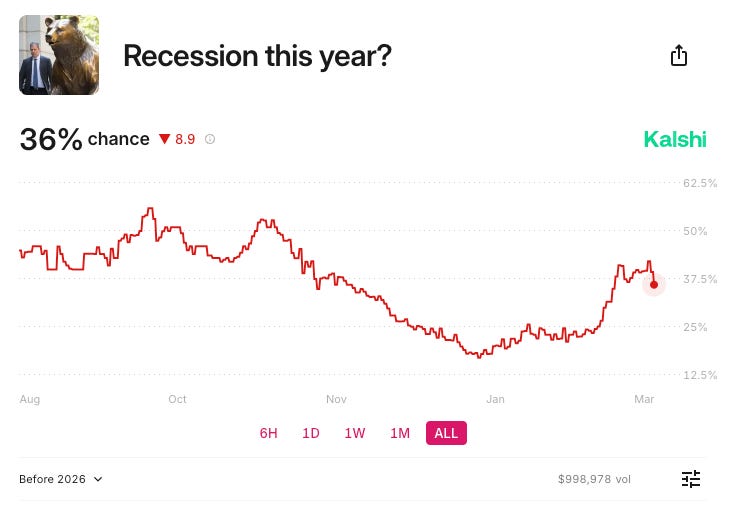

Polymarket and Kalshi are incredibly useful for tracking the probability of any event.

The market’s at a tipping point where sentiment has soured, and it’s now on the verge of pricing in a recession for 2025.

There’s a saying that the stock market has predicted nine out of the last five recessions.

The market is a discounting machine—you don’t need a recession to actually happen for stocks to tank. All you need is an increase in the probability of a recession. We don’t bet on binary events; we bet on probabilities! The same goes for any trade we take: we don’t need a rigid bullish or bearish view on an asset. To make money, we just need to be roughly right about the future distribution of prices. We’ll apply this thinking to our upcoming trade.

So, okay, the odds of a recession have been repriced to around 40% by everyone. I think that’s a bit high. Now I need to find a way to express this view, and first, I need an asset…

Which trading sardine is best to bet on the economy?

OIL

WTI crude oil futures are by far the purest instrument to bet on the economy. They work so well on the downside that we even saw negative prices during COVID—a beautiful sardine! Yum! To understand oil, you need to grasp the supply and demand dynamics. During an economic downturn, demand can be highly elastic and typically drops violently. Meanwhile, supply takes longer to adjust, leading to growing inventories and oil prices sinking lower and lower and lower. So, yes, when hedge funds want to bet on a U.S. economic downturn, they often express it through a short position in WTI crude oil futures. And I want to take the other side of that. Especially when Europe and China are going full Fiscal. Oil is a bet on the world economy.

Let’s do a check list…

Sentiment? Super bearish

Positioning? Crowded short. See the blue columns in the middle panel of the chart below—that’s the hedge funds’ positioning.

Technicals? The market’s range-bound between roughly 60 and 80. We’re at the lower bound after a sharp move down.

Implied Volatility? The Oil VIX is at 33.5%—a neutral reading, pricing well above the short-term realized volatility (around 23%).

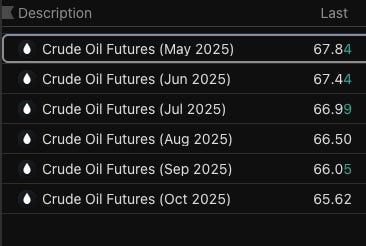

Forward Curve? Pricing backwardation. That means I’ll enjoy positive carry if I buy June Contract.

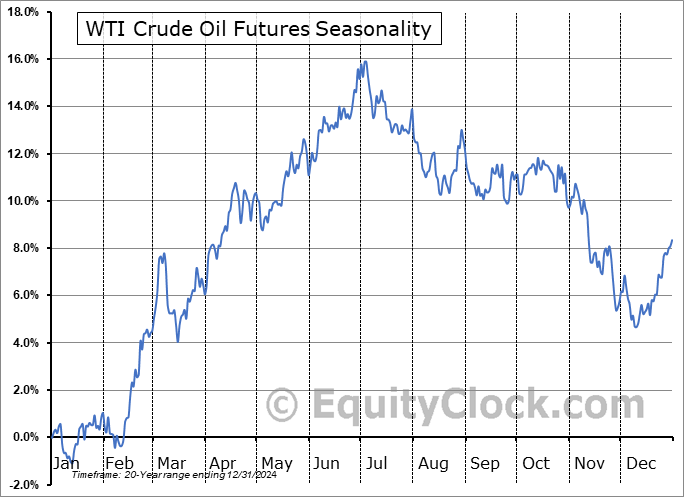

Seasonality? Mid-March looks great.

Overall, it’s a fantastic setup for a long trade on oil. However, oil’s a trading sardine with a weak trend and some mean-reversion tendencies—I don’t want to just buy the future and sit on it. I want to bet on the future distribution of the contract price. I believe in the coming months we will be a bit higher but we’ll stay between 65 and 80. Plus, I don’t want to pay any premium today.

Here’s the structure I came up with:

Short 1x put, strike 62, expiry 15 May 2025 on the June CL contract

Long 1x call, strike 67.5, expiry 15 May 2025 on the June CL contract

Short 2x calls, strike 74, expiry 15 May 2025 on the June CL contract

I paid $105 to enter this trade. Max profit: $19,395. Max loss: unlimited, because I’m using the short calls and puts to finance my long call option. I’m sizing it so I don’t need a stop loss if oil stays in a reasonable range. But I’ll monitor the forward curve—if we slip into contango, I’ll probably stop myself out no matter what. A contango curve would signal I was dead wrong on the recession call and we’re heading for one.

Okay, that’s the trade! Short and sweet. Size properly and stay safu!