Fog of war [Week #31]

Financial conditions aren’t as easy as they claim and the fed’s cutting cycle isn’t over

After two months of government shutdown and a lack of hard data to guide them, macro analysts are all over the place. And in case of doubt, what’s better than diving headfirst into simplistic narratives that fit your priors? A quick glance at my X feed reveals all kinds of conflicting macro views battling for attention. The reflationistas are eyeing the energy sector like it’s about to break out the way miners did. The stagflationary pundits are busy shorting SOFR futures after Powell’s hawkish reversal. Growth Tech bros are watching their AI darlings hold on for dear life. And finally, the modern Cassandras are shorting the stock market in anticipation of a deflationary bust.

Oh, and I almost forgot our crypto frienz, scratching their heads in front of an overlay chart of M2 money supply and Bitcoin.

Sadly, there is no White House hotline for me, so we can’t rely on insider leaks to front-run the tape like Barron’s does. I’m as blind as everyone else here. But fortunately, I still have a few tricks up my sleeve. So let’s dive into the macro update and figure out for ourselves whether we should listen to Cassandra or Melisandre.

Macro dashboard update

Growth

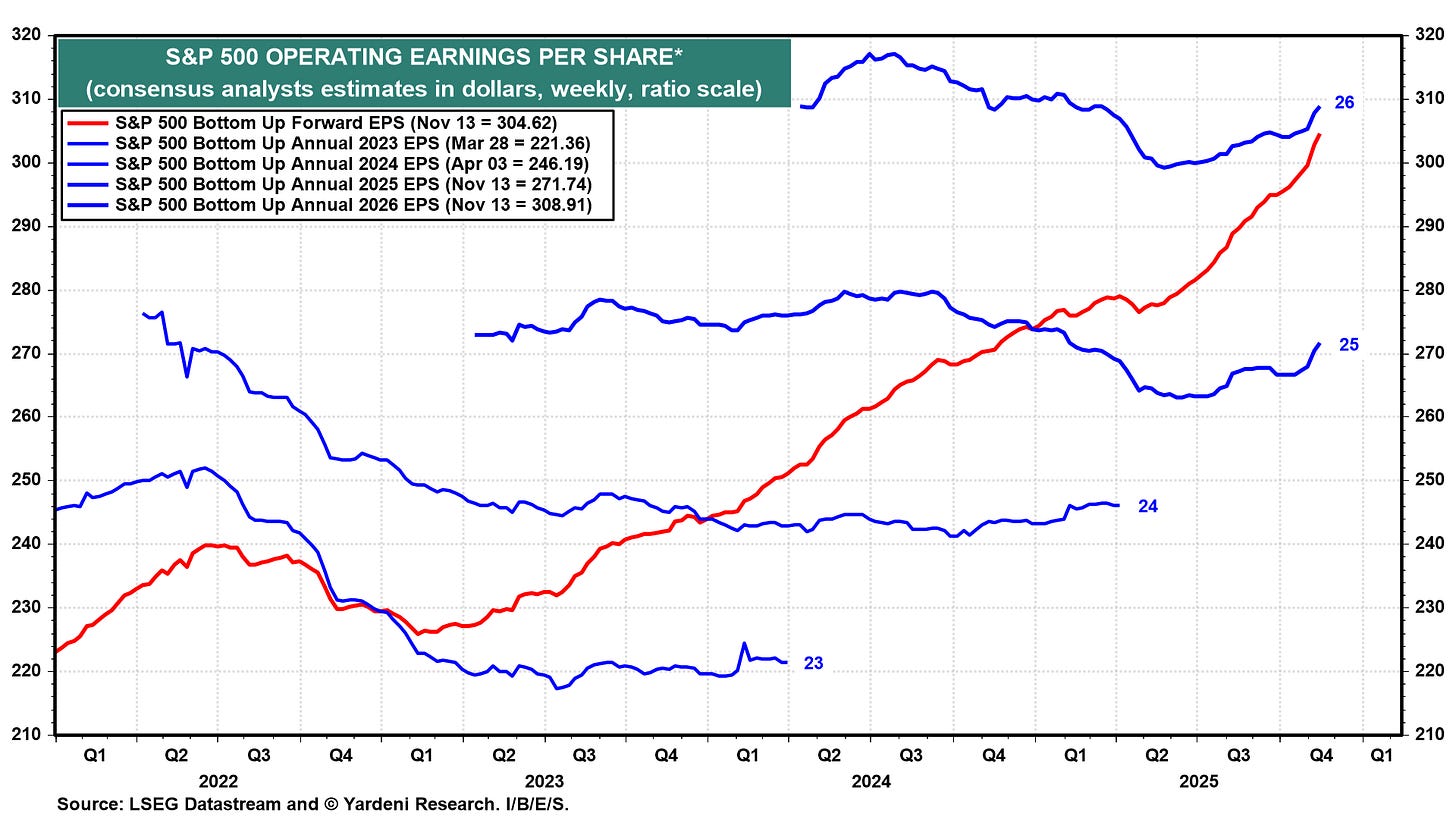

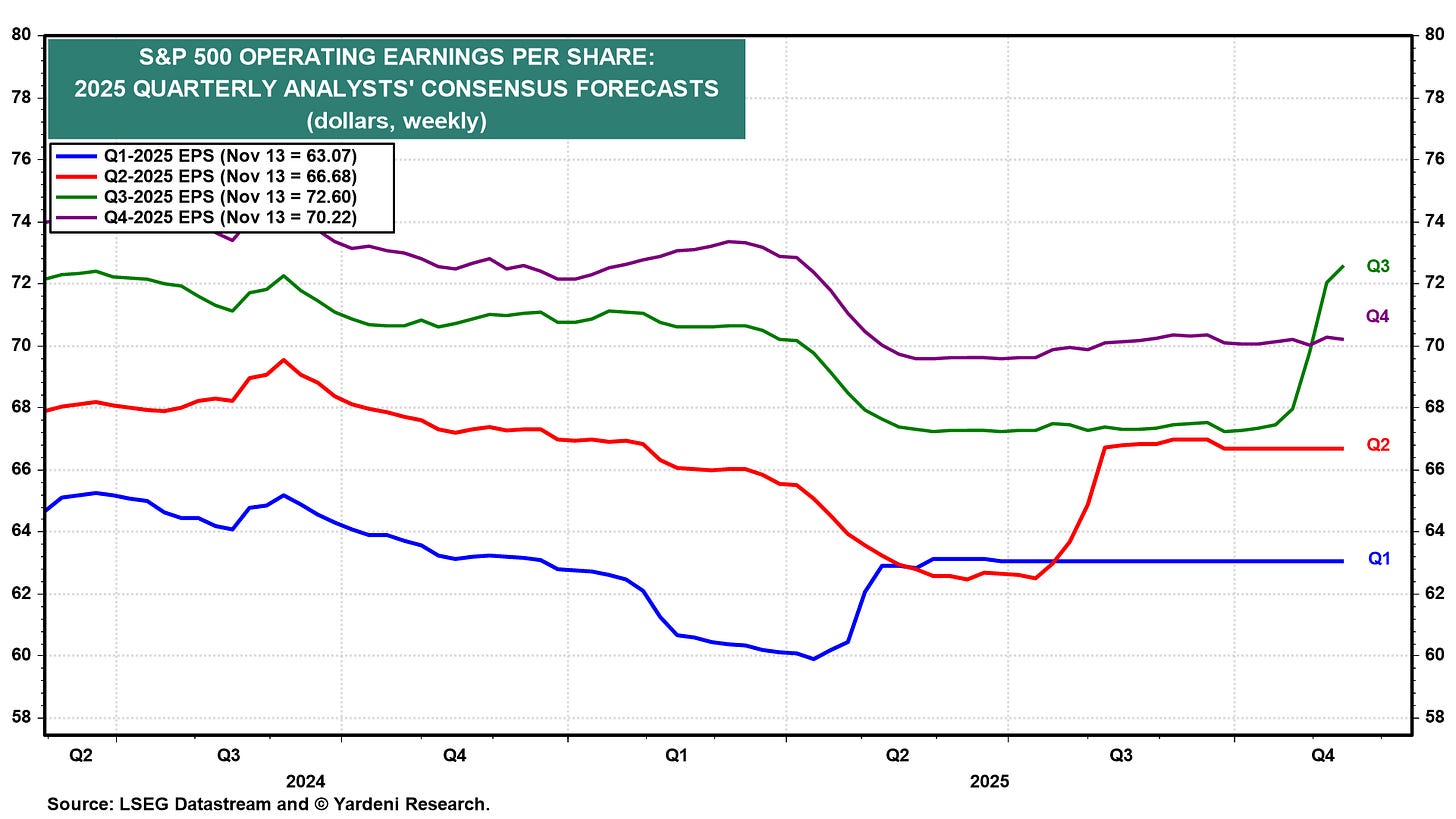

S&P 500 Forward Operating Earnings: Last week we highlighted the sharp increase in the NTM EPS; this week, analysts have again been busy revising up their forecasts.

Apart from NVDA, earnings season is mostly over. The typical hockey-stick recovery for Q3 2025 is about complete.

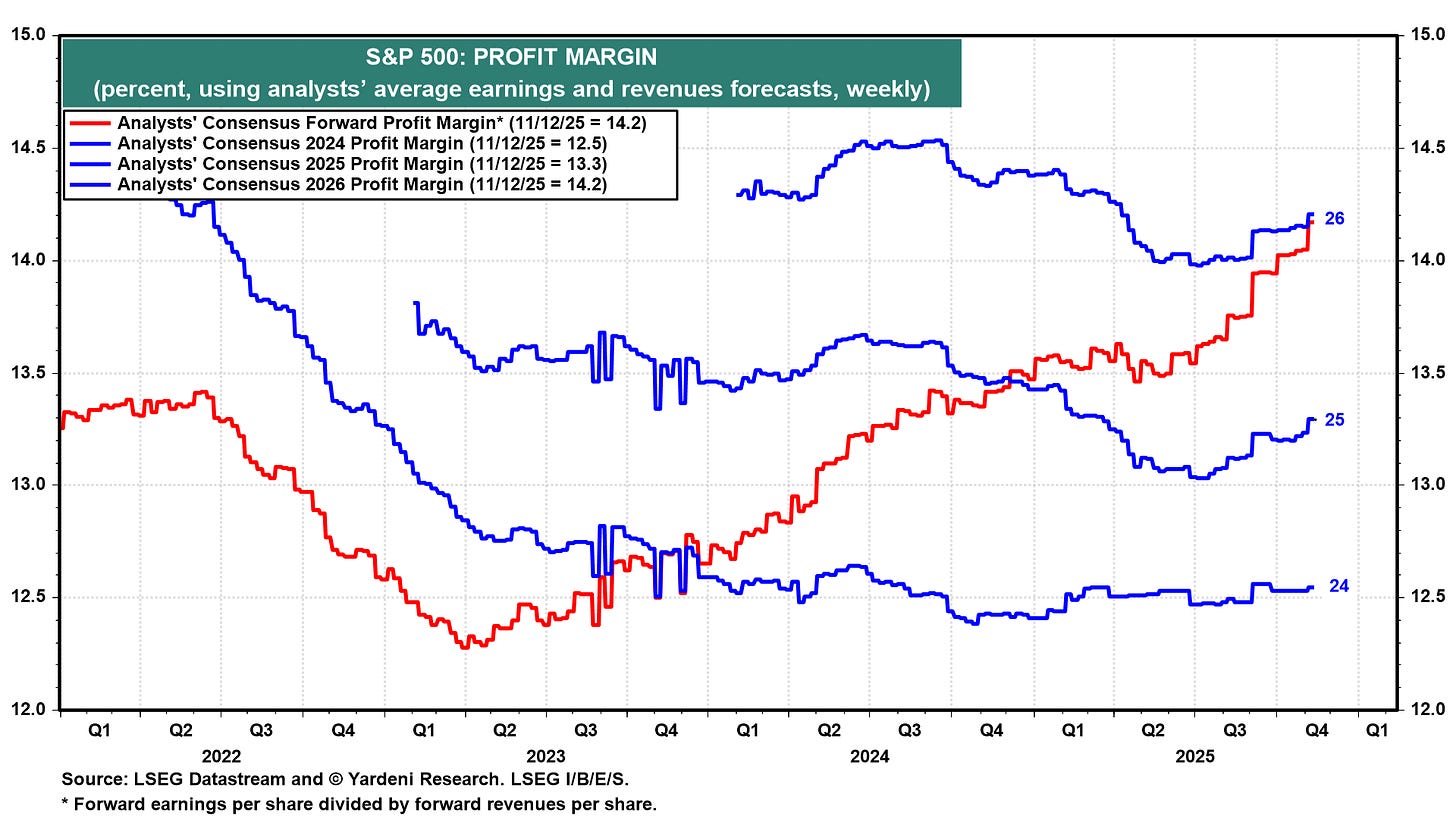

Behind the driver of this EPS growth is the strong uptrend in analysts’ consensus forward profit margin. Earnings can grow either from higher revenues, higher financial leverage, or higher efficiency/margin. It is the latter that is being priced into the earnings forecasts. Despite decreasing free cash flows, EPS are priced to increase amid a productivity boom.

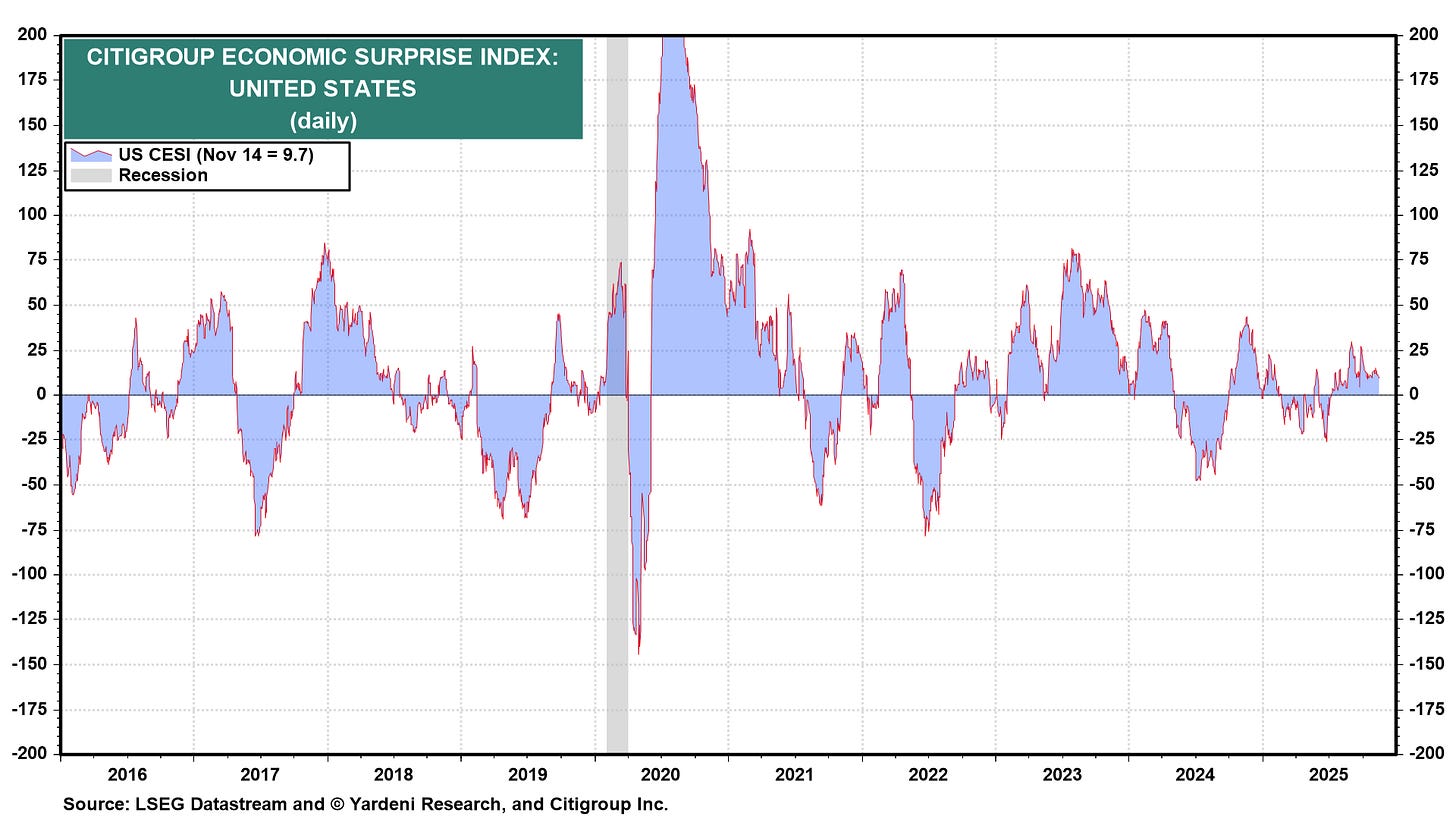

US Economic Surprise: With the end of the US shutdown, we should expect some fireworks anytime soon in the chart below.

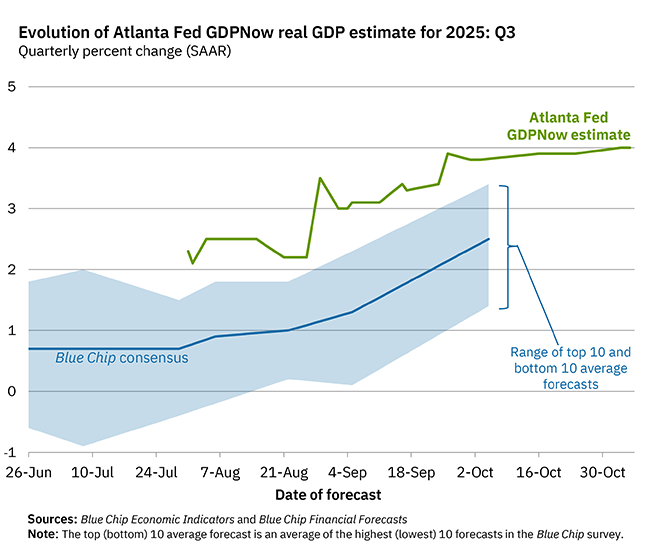

GDP Nowcast: In a similar way, the Atlanta Fed GDPNow should wildly change in the coming days or weeks. This will be market moving!

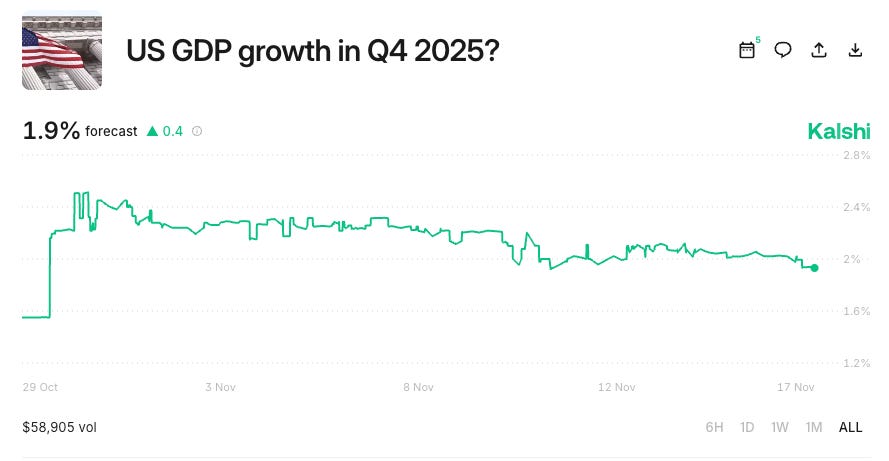

The nowcast will also switch to Q4 as soon as Q3 GDP is out. Kalshi is pricing 1.9% for Q4.

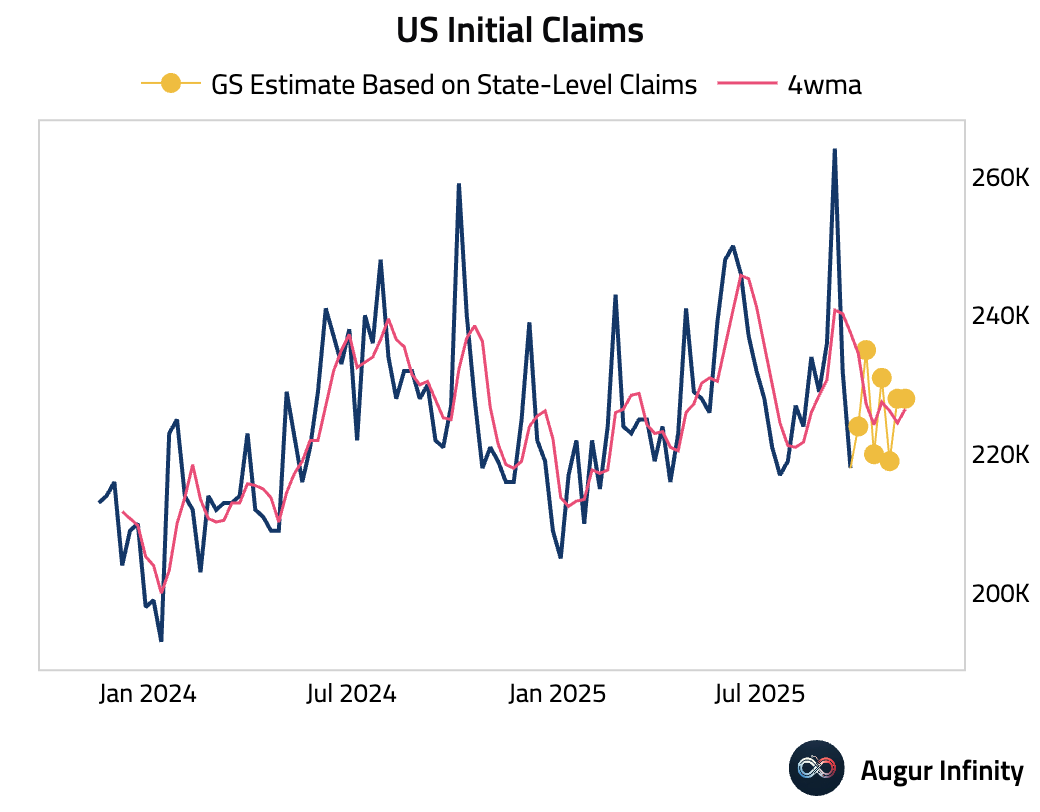

Initial Jobless Claims: Goldman Sachs’ estimate below. They remain rather stable.

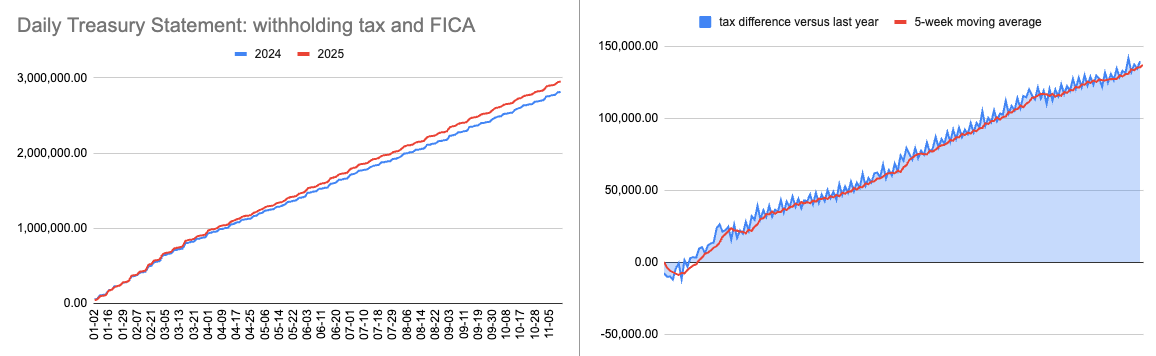

Daily Treasury Statement: Same old, same old. All good here.

→ No update for the Growth category. We remain in a rather high-growth environment with rising earnings. That view will be challenged in a big way with the upcoming releases of hard data. Brace for impact.

Inflation

CPI: Year-over-year inflation rate is 3.0%

Inflation Expectations: As seen last week, inflation expectations remain elevated in the Michigan Consumer Sentiment Survey: near-term (1-year) expectations ticked up to 4.7%, while long-term (5-year) expectations fell to 3.6%. By contrast, the New York Fed’s Survey of Consumer Expectations shows median one-year-ahead inflation expectations cooling to 3.2%, while five-year-ahead inflation expectations rose to 3%. Overall, expectations are still anchored, albeit at a new equilibrium of 3%, which fits the global narrative that inflation has reached a new plateau of 3%. Long gone is the pre-COVID era.

Inflation Swaps: 2-year inflation swaps are comfortably sitting at 2.70%. No reflation fears here.

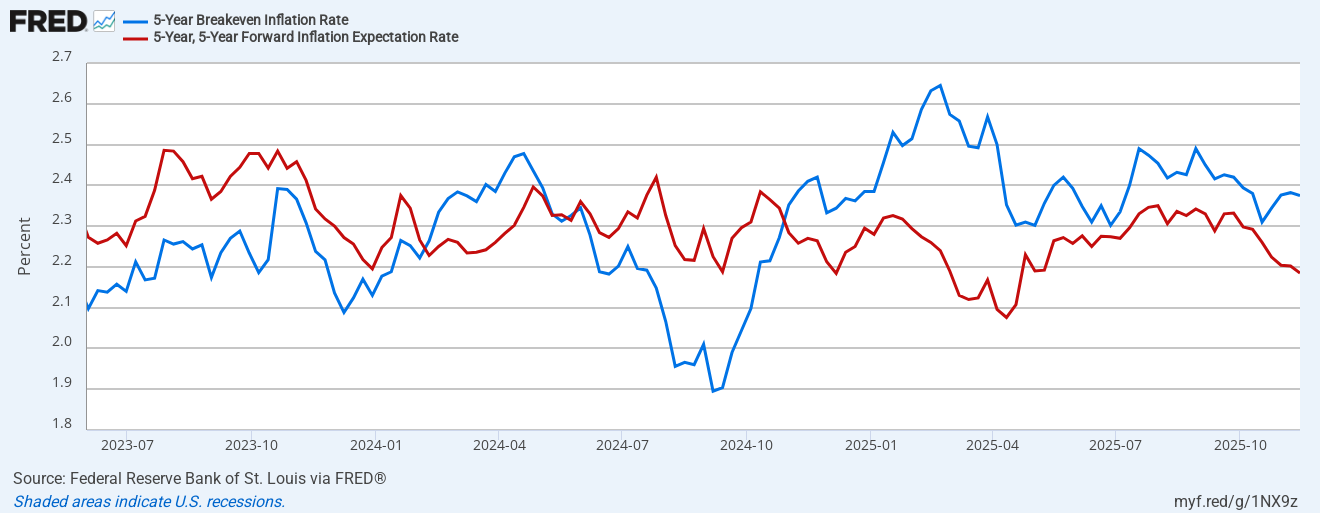

No fear as well on the 5-year and 5-year forward breakeven inflation rates.

→ No update for the inflation category. We remain in a regime where inflation is slightly above target but stable. Goods inflation from the tariffs has been muted by the slowdown in oil prices and wages.

Monetary Policy

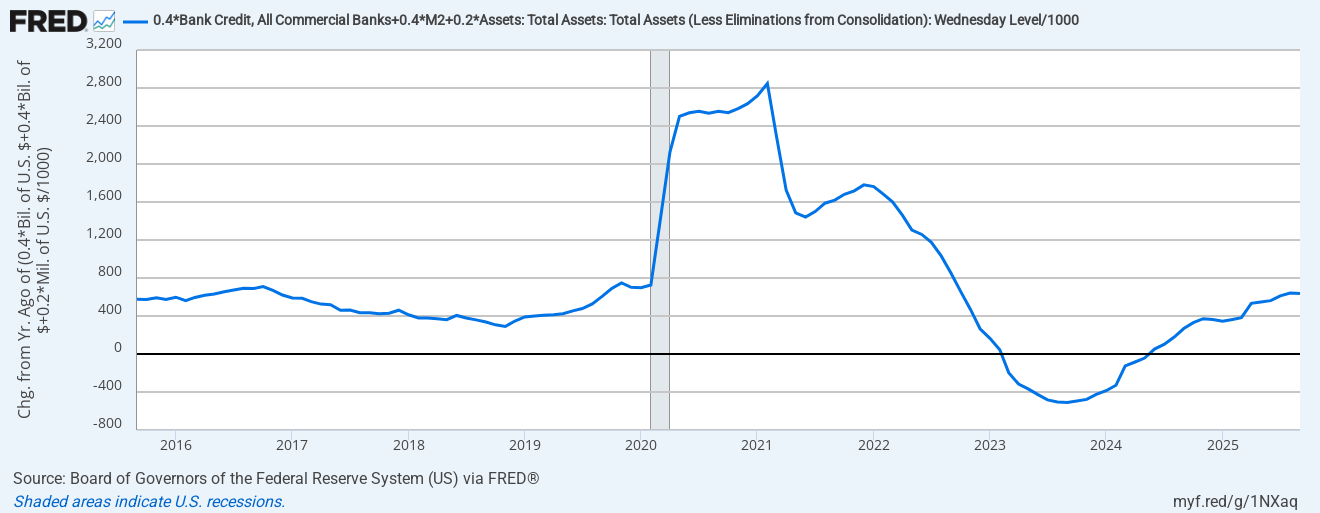

Monetary Impulse: The blended measure of yearly change in banks’ credit, M2, and Fed balance sheet indicates a neutral impulse from monetary policy. The Fed is neither restrictive nor loose.

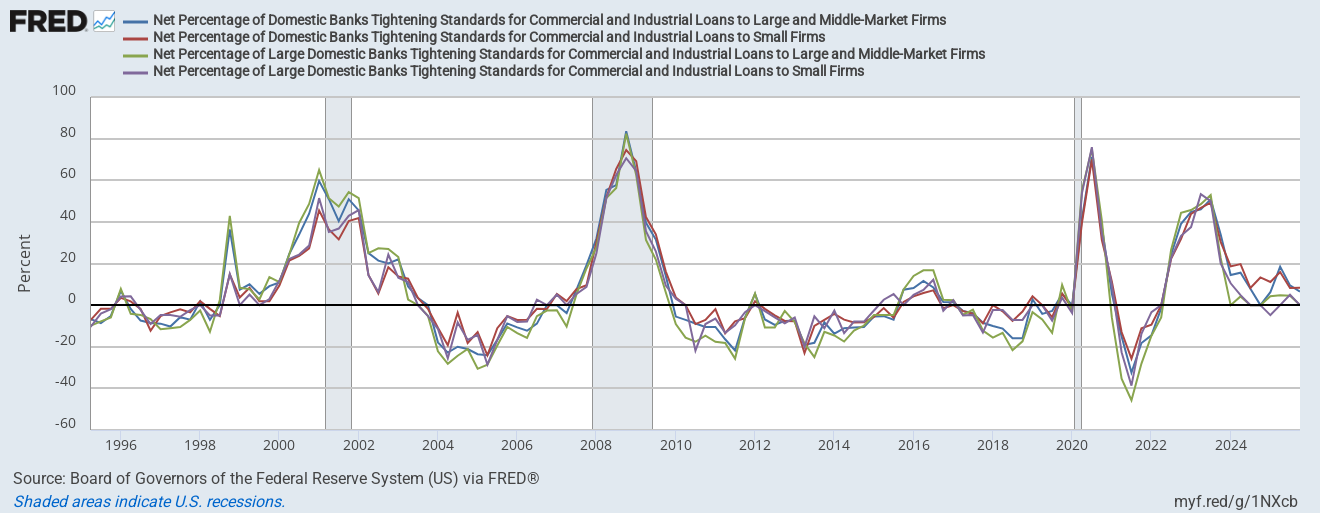

This neutral monetary impulse trickles through the tightening standards of the banks. After completing a tightening cycle in 2023, banks are still somewhat tight. The SLOOS data (chart below) indicates increasing tightening standards. We are not in an easy credit environment despite record-narrow spreads in the high-yield space. Financing has simply been pushed toward private markets.

And cracks are now appearing. One of Blue Owl’s private funds is now restricting investors from pulling money from the fund—this is known as a gate provision.