Goldilocks Regime in Full Swing [Week #29]

Goldilocks economy amid shutdowns and market froth: green lights on growth, Fed easing ahead, and bond vigilantes missing.

Welcome back to another Macro Update. As we navigate through government shutdowns, frothy markets, and a White House that’s all-in on the bull run, the big picture screams Goldilocks: unstoppable growth, dormant inflation, and a Fed ready to keep the party going.

Before diving in, make sure you read my last educational piece on Positioning. You can’t possibly understand the conclusion to this post without reading it first.

Macro dashboard update

Growth

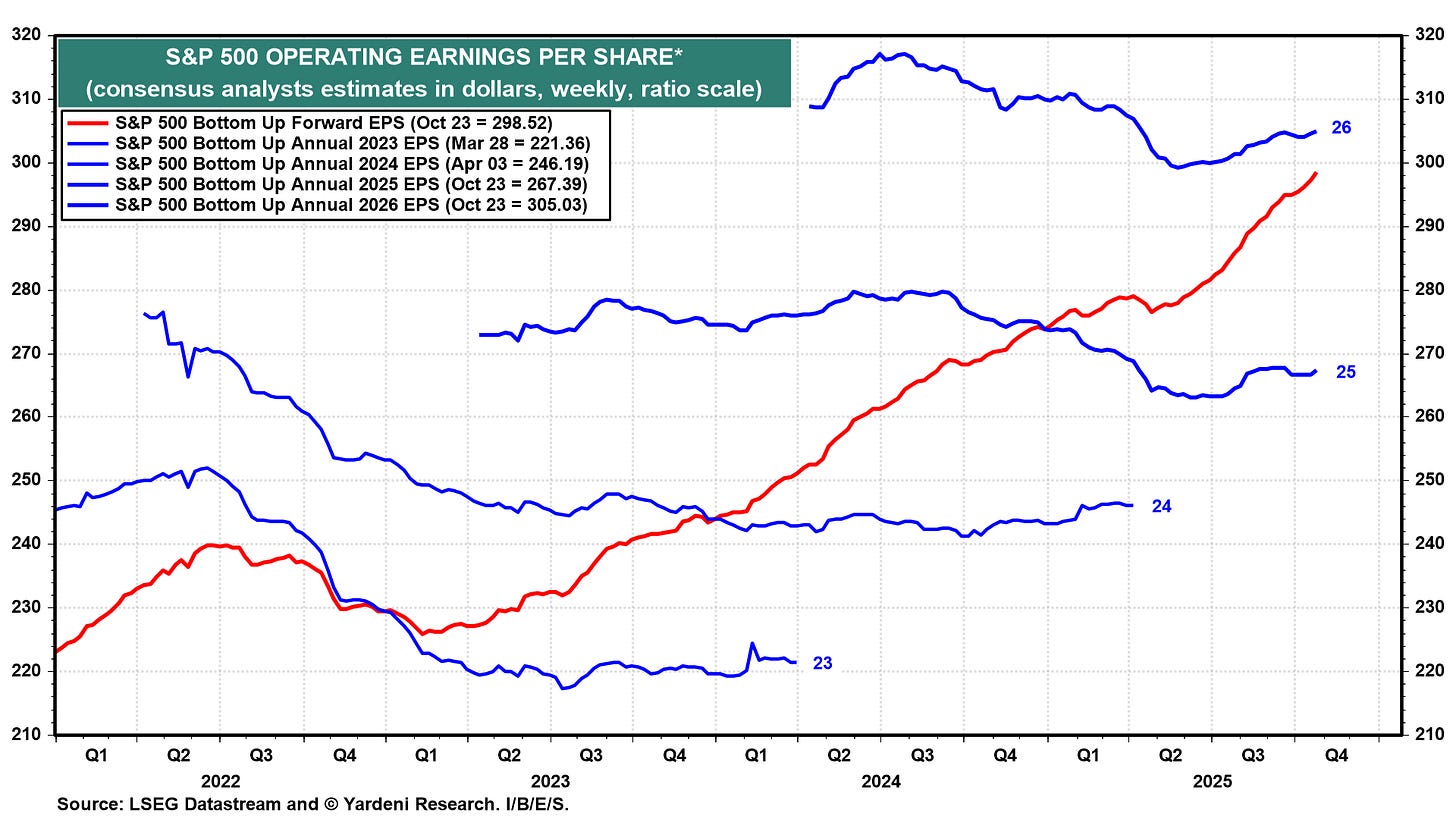

S&P 500 Forward Operating Earnings: Still looking very strong.

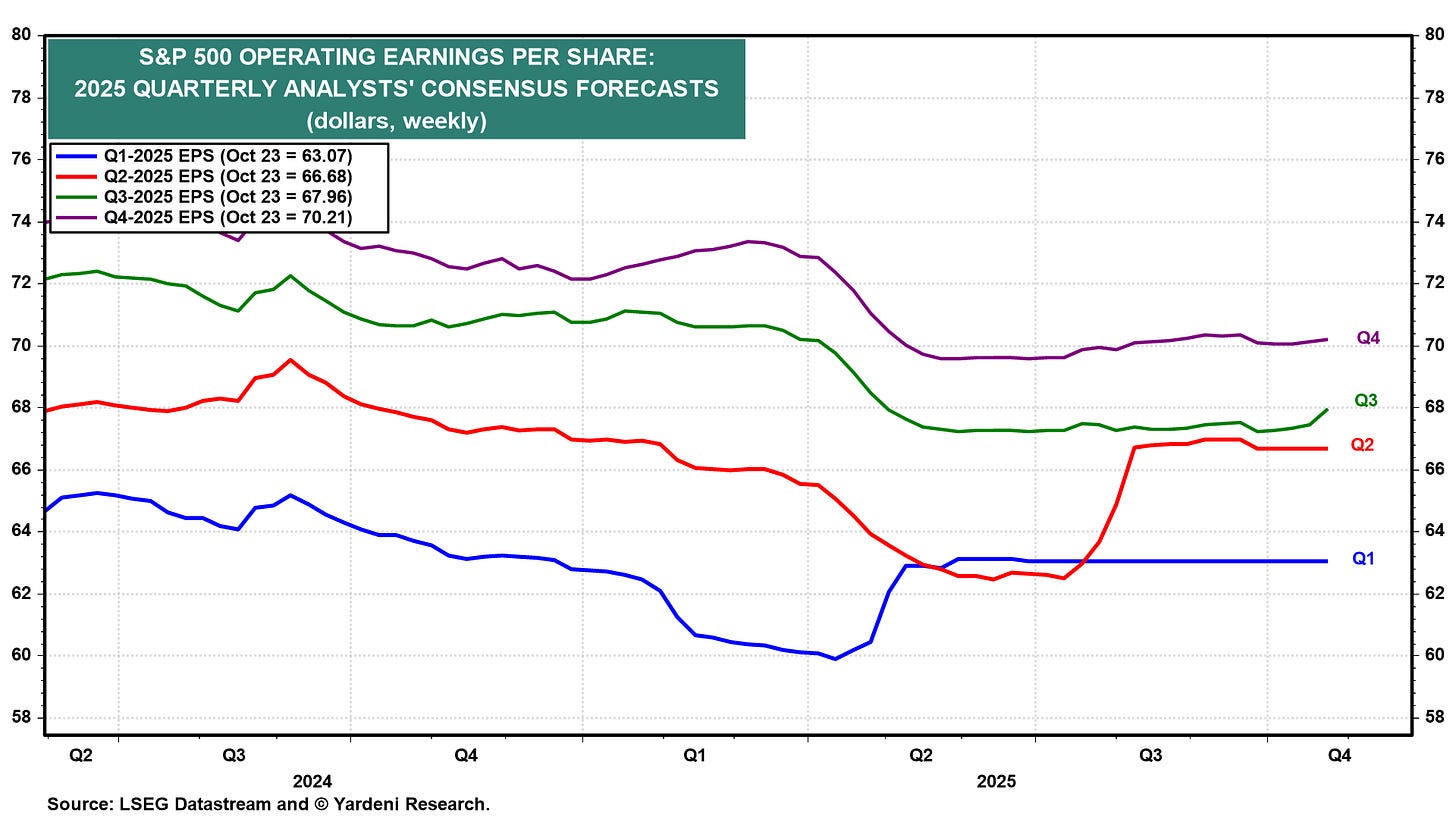

As anticipated, Q3-2025 is starting the typical hockey stick recovery pattern:

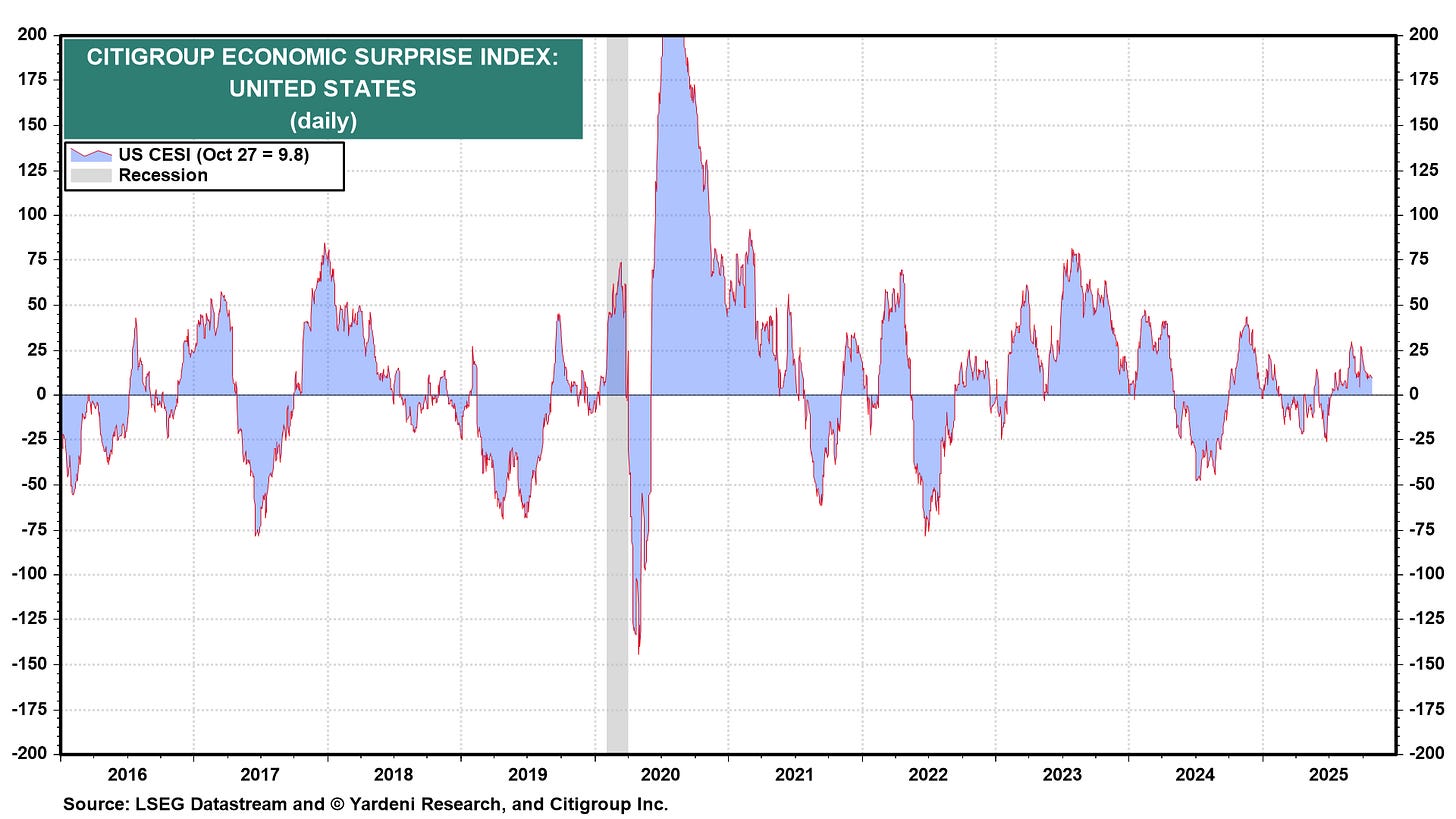

US Economic Surprise: As long as the US government shutdown is ongoing, I am not paying much attention to the CESI index.

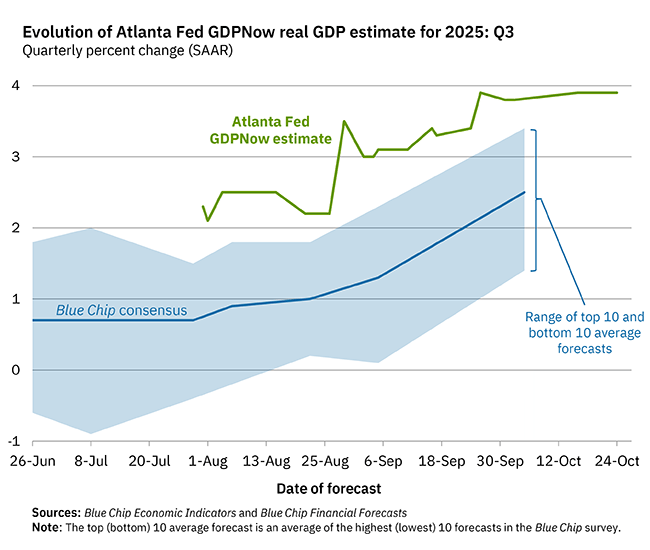

GDP Nowcast: Similar to the CESI index, the GDPNow estimate is mostly stale since the beginning of the shutdown. Blue Chip consensus is still playing catch-up.

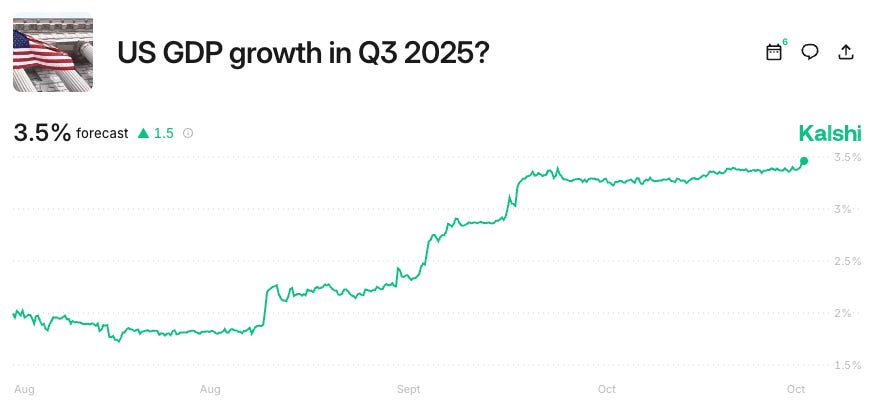

Kalshi: +3.4%.

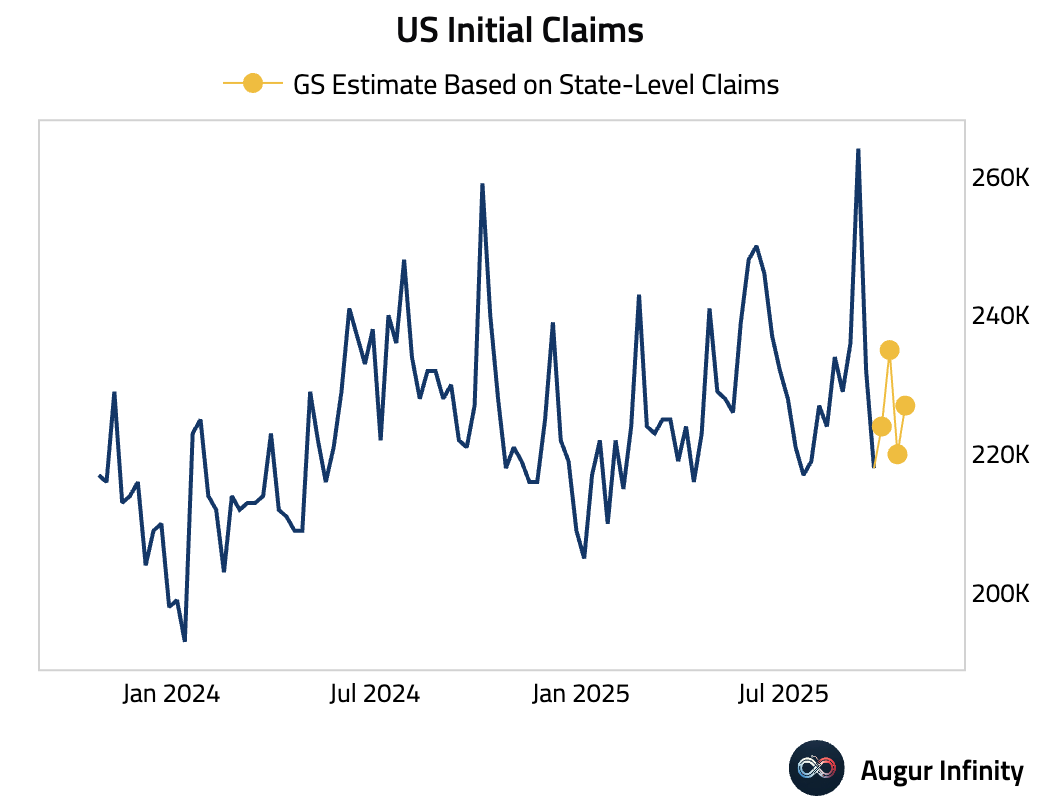

Initial Jobless Claims: We are left with Goldman Sachs’ estimate. Nothing is happening here.

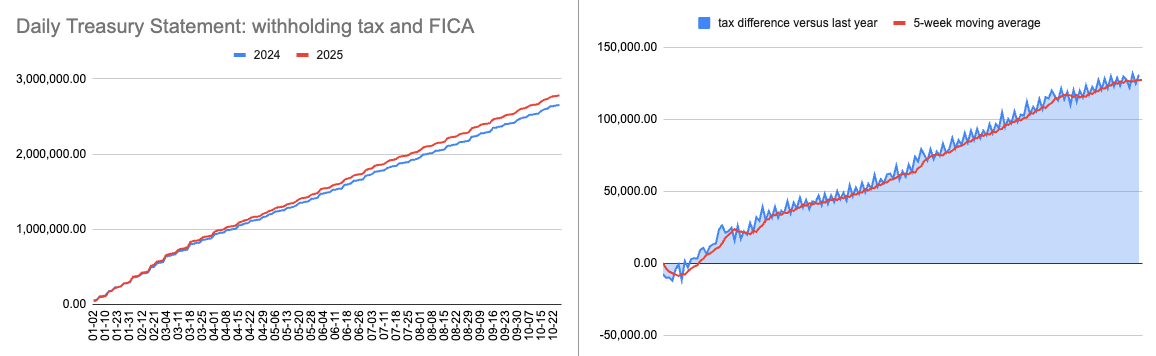

Daily Treasury Statement: The pace of tax collection has been losing momentum recently. It is not yet a red flag, but the trend has definitely been slowing down.

→ No update for the Growth category. Despite the US Government Shutdown, all the lights are green.

Inflation

CPI: September’s inflation was released last Friday. It came below expectations.

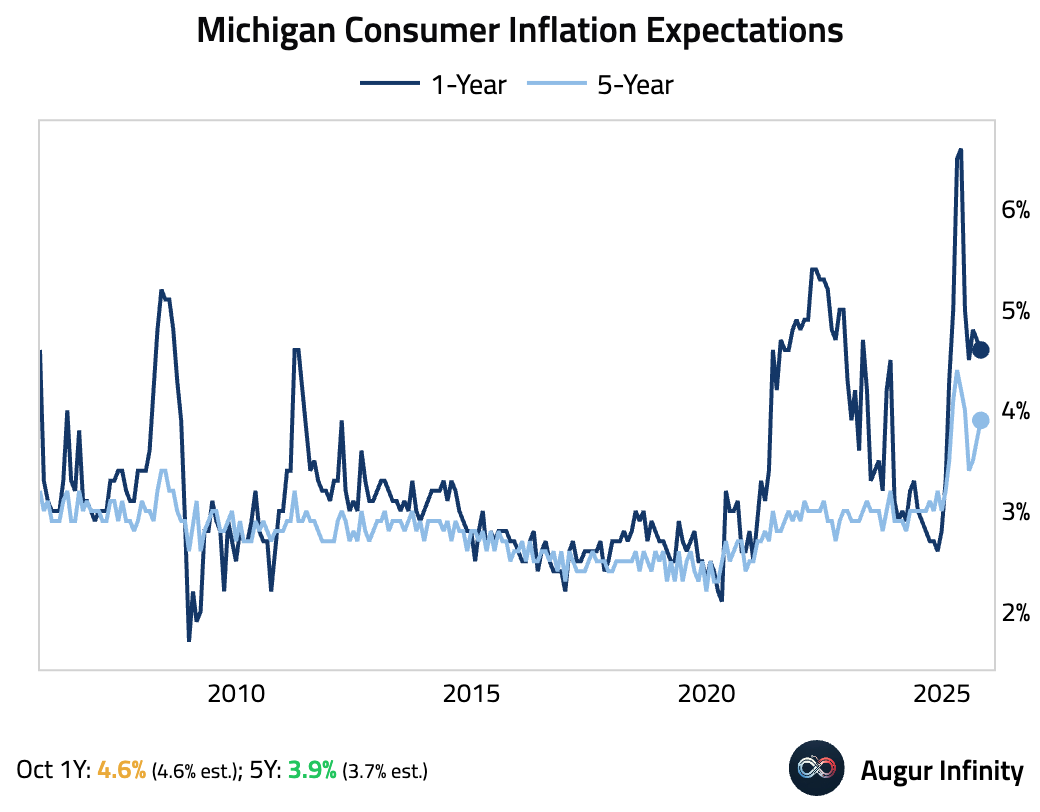

Inflation Expectations: Michigan Consumer Sentiment Survey about expected inflation is giving some contradictory signals, the 1-year-ahead inflation has ticked lower by a small amount while the 5-year-ahead is rising again. Remember to take these surveys with a grain of salt: we don’t know if the sample has a political bias. Other surveys like the NY Fed Survey didn’t spike during the tariffs turmoil.

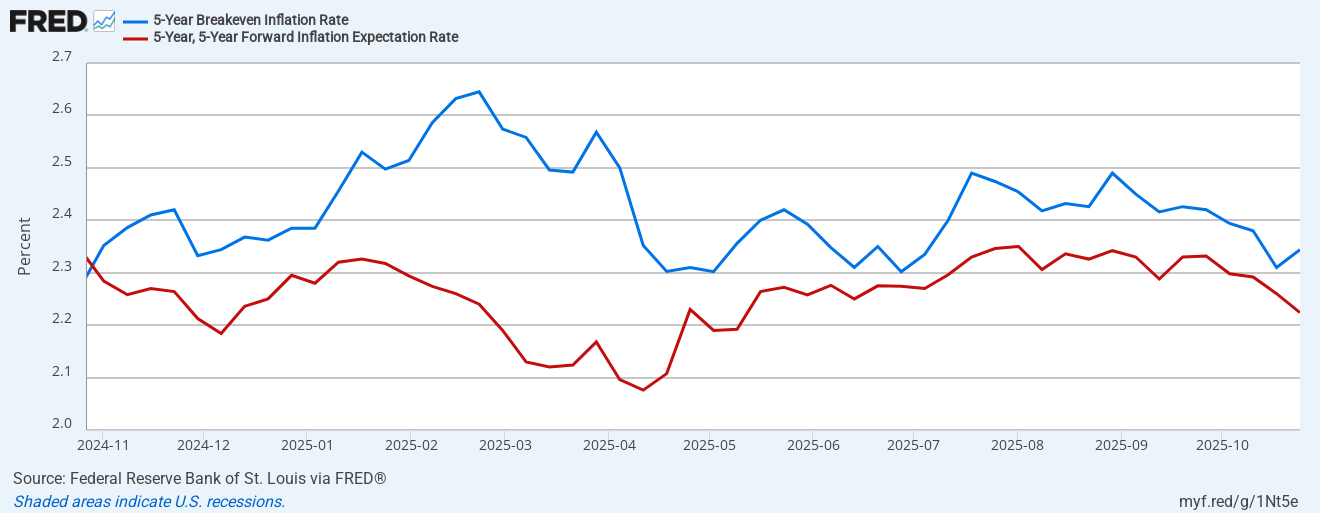

Inflation Swaps: 2-year inflation swap is still trending down, making a new low at 2.70%.

5-year and 5-year forward breakeven inflation rates are also making lower lows compared to last summer.

→ No update for the inflation category. nflation is stuck in the mud at +3% yoy, but the risk of acceleration is very low. Actually, the risk of deflation is now higher than the risk of inflation.

Monetary Policy

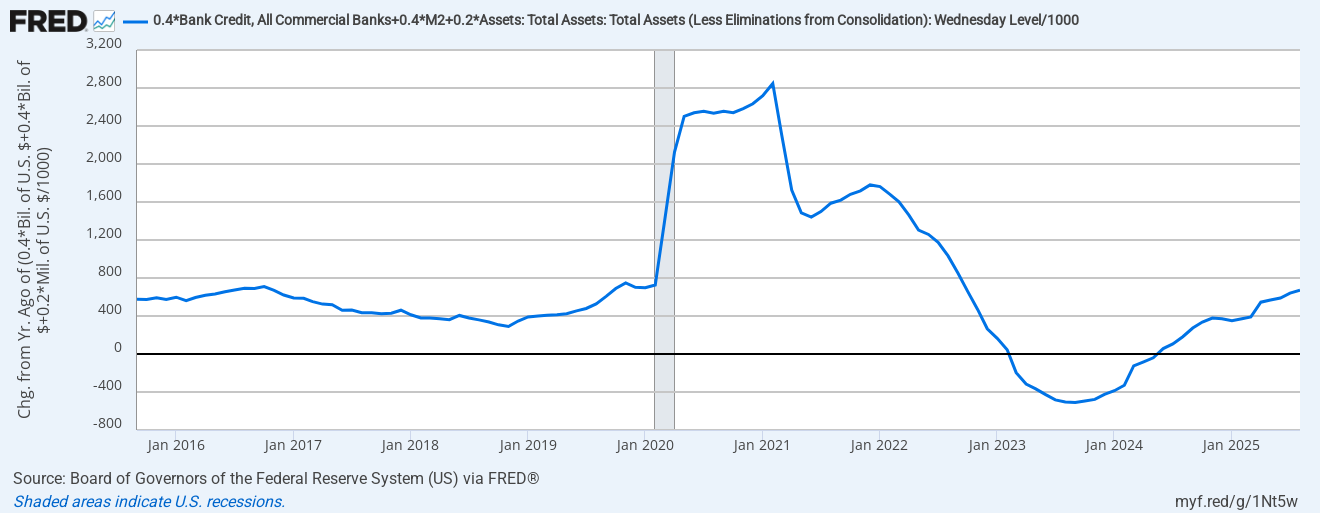

Monetary Impulse: It remains a small positive.

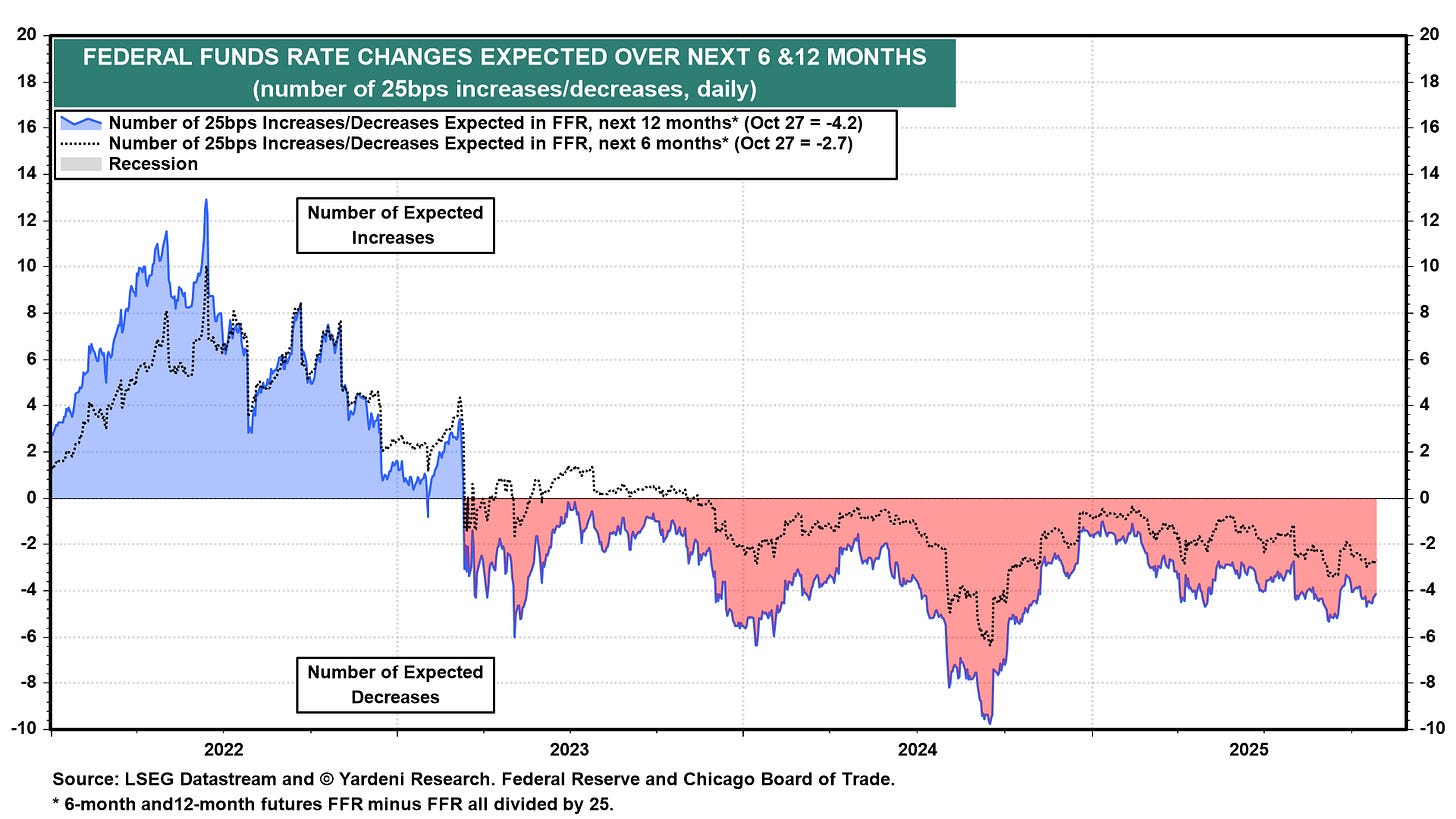

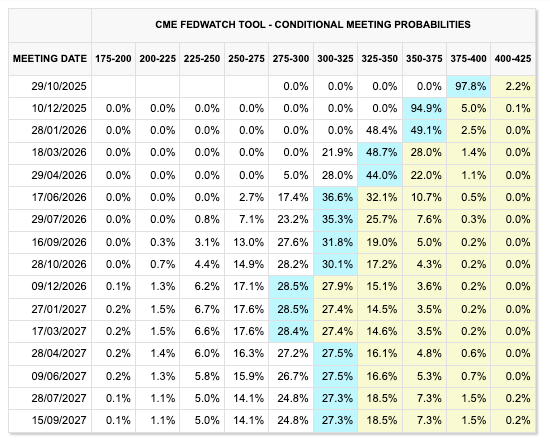

Fed Fund Rate Cycle: The market has found a temporary equilibrium with 2.7 cuts in the next 6 months and 4.2 cuts in the next year. We have been pricing this rough outcome for the past 3 months. Of course the absence of new job data is probably suppressing the volatility here.

Forward Guidance: The big event of the week is the FOMC tomorrow. One cut is a given. I am curious about Powell’s speech; like all of us, he is flying blind during the Government Shutdown. My assumption is that he will be cautiously dovish, and he will probably enact the end of QT. That should get all the Ponzi chasers even more excited!

→ No update for the Monetary Policy category.

Fiscal Policy

The Financial Times published a great article about Scott Bessent; you can read it here.

It is rather difficult to be bearish on the market at the moment. You are basically playing against the White House:

“We want the most America-first policies that are possible, without incurring market wrath,”

I get a lot of stuff wrong. This year my biggest failure was to not pivot quickly enough on my assessment of Trump’s policies. I did short the market at the beginning of the year, on the premise of what should be a catastrophic political agenda: reverse the dual deficit with extreme tariffs. I was initially right and it worked well, but only until Liberation Day. While I did take profit and switched tactically bullish on the lows, I failed to ride the entirety of this bull run. I failed to realize how Bessent could tame Trump’s craziness:

“What gets the people in trouble is they come in, they have these ideas, but they don’t respect the market . . . you’ve got to respect the market.”

“I was just with Trump and he was talking about Bessent, and I think he’s got a huge amount of faith in him,” said David McCormick, the Republican senator from Pennsylvania, who served as the senior Treasury official for international affairs under George W Bush. “He’s viewed as a voice of reason. He’s viewed as someone who gets it done. He’s viewed as someone who has the president’s trust,” he added.

I also got completely gaslit by Main Street turn; it was just for the show. Before Liberation Day:

After Liberation day:

“When it counts, he’s a fighter in our corner,” said one Wall Street lobbyist. “It’s almost like this ‘Bessent put’ — he knows not to go too far where the markets would be disrupted . . . CEOs are pretty fearful of the administration but Bessent is our id.”

Now the question is how high this administration will push the market? The article ends with the below quote:

“My job is to give the president options and outcomes and the president decides how far to push things,” he said.

I believe Trump will push things too far, including the market. I’m raising my odds of a market melt-up into 2026.

Liquidity

In the last weekly post, I dug deeper than usual on the repo market. Fortunately for you, someone much more qualified than me also wrote a great piece on the different layers of financing in the repo market. Joseph Wang, a great central bank watcher, put this article out for free. You should definitely read it and bookmark it: https://fedguy.com/balance-sheet-dominance/

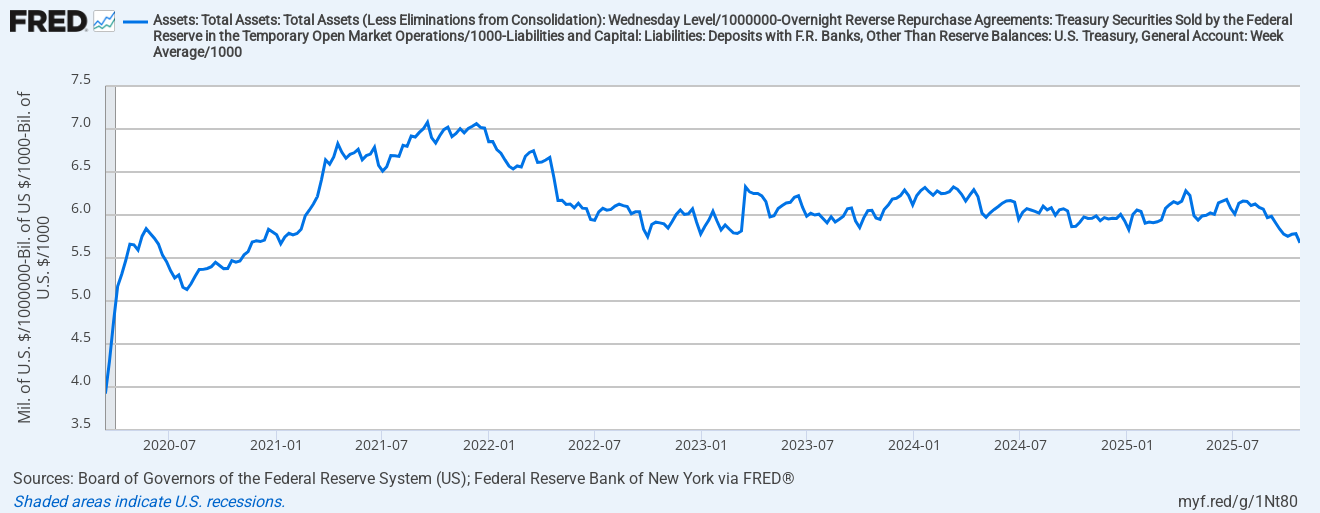

US Liquidity: The proxy liquidity index for the US remains tight. Expect some news from the Fed during tomorrow’s FOMC. We should expect some pro-liquidity measures, but not an outright stimulus.

Global Liquidity: The proxy index remains constructive as China M2 keeps increasing. Bitcoin is still lagging while crypto traders are arguing if the 4-year cycle is still a thing or not.

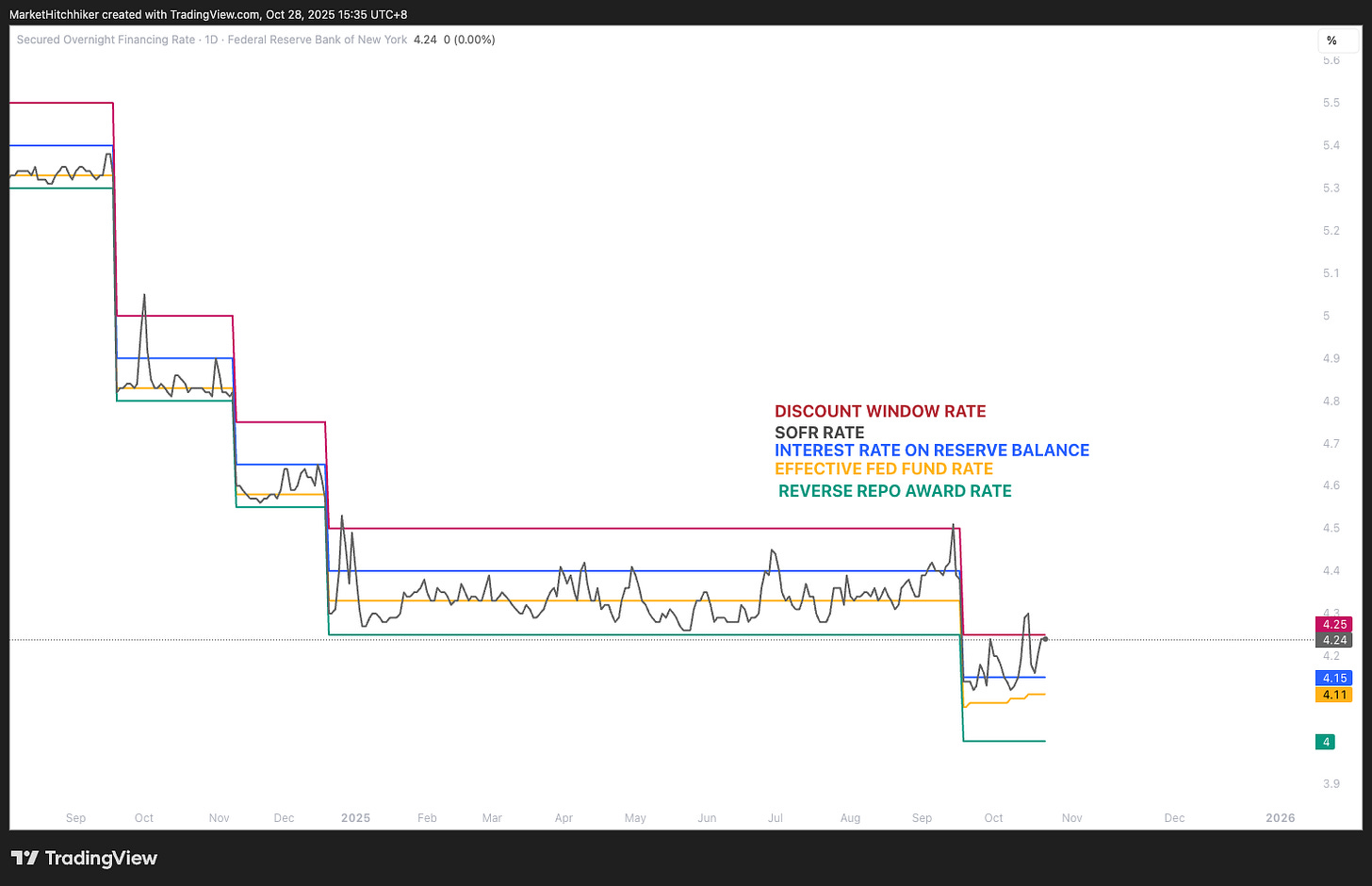

US Repo market: Not much has changed since last week. The lending market is tight but functioning fine.

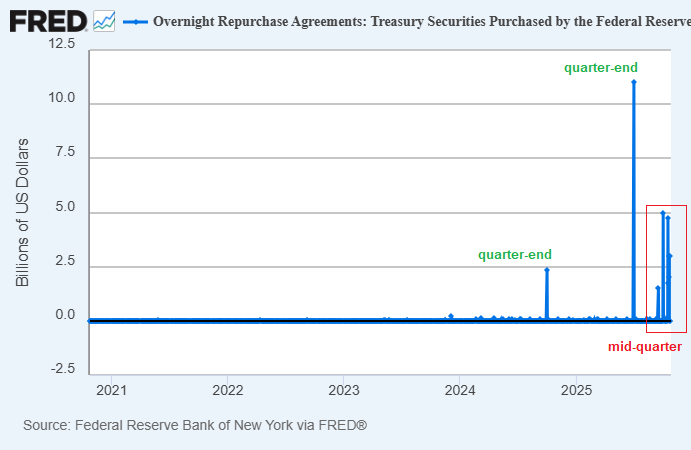

The Fed’s repo facility is being used almost daily. Again, let’s wait for the FOMC for some guidance around this.

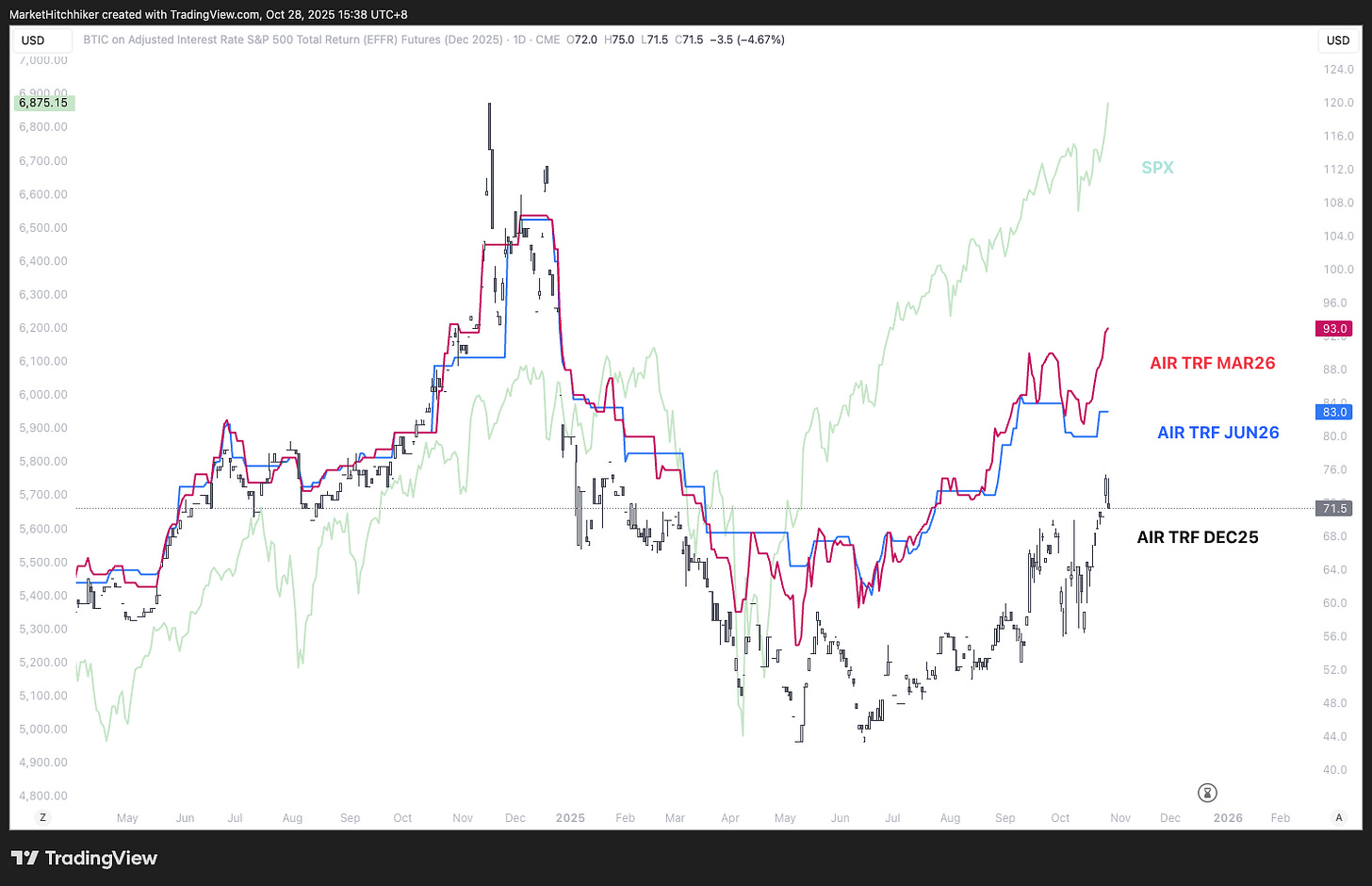

SPX TRF: The chase seems to be on for the TRF players. The cost of leverage on the SPX is increasing at the same time as the spot is ripping higher. Liquidity frictions meeting FOMO. This is a frothy market.

→ No update for the Liquidity Category. Liquidity remains tight in the US, creating some frictions but not expected to lead to any more serious issues. The cost of money is going up as the demand for leverage is ever increasing.