Hitchhiking the S&P 500 into Year-End

How an options strategy can provide some much-needed beta exposure

We are now well into the Q3 earnings season. About 70% of companies have reported, and all of the Mag 7 have shared their earnings except NVDA. The S&P 500 is pushing through 6,850 as most companies are beating earnings and big tech is on fire (except META 🤮). I am particularly impressed by Alphabet’s results, with increasing revenues across all business lines. They seem to have found the perfect mix of AI revenue boost and capex. I posted yesterday in the chat the following key takeaways from the earnings call, generated by Fiscal.ai:

Alphabet’s strategic investments in Artificial Intelligence are yielding substantial returns, positioning AI as the primary driver of growth across its diverse portfolio. The company’s full-stack AI approach, from infrastructure like its custom TPUs (Ironwood) and NVIDIA GB300-powered A4x Max instances to leading models such as Gemini 2.5 Pro and VO Genie 3, is a key differentiator. This leadership is evident in Google Cloud, which saw its backlog surge to $155 billion and signed more $1 billion-plus deals in the first nine months of 2025 than in the prior two years combined, with over 70% of existing customers utilizing AI products.

Search is experiencing an “expansionary moment” as AI overviews and AI mode drive significant increases in both overall and commercial queries, particularly among younger demographics. AI mode now boasts over 75 million daily active users globally. Monetization is evolving with products like AI Max in Search, which is the fastest-growing AI-powered Search Ads product, unlocking billions of new queries for advertisers. YouTube’s robust performance is underpinned by its “twin-engine” monetization strategy, with Shorts now generating more revenue per watch hour than traditional in-stream content in the U.S., complemented by strong growth in subscriptions like YouTube Music and Premium.

Significant new developments include the upcoming Gemini 3 release later this year, a quantum computing breakthrough with the Willow chip running an algorithm 13,000 times faster than a supercomputer, and the global expansion plans for Waymo into London, Tokyo, and several U.S. cities, with potential for deeper Gemini integration by 2026. Internally, AI is enhancing productivity, with Gemini increasing sales team efficiency by over 10% and managing millions of customer support sessions. The company also incurred a $3.5 billion charge from a European Commission fine, which impacted reported operating income and margin for the quarter.

This post is not about Alphabet, but it is a good example of why this bull market is relentless: the largest companies are printing money and are already leveraging AI to increase their revenues.

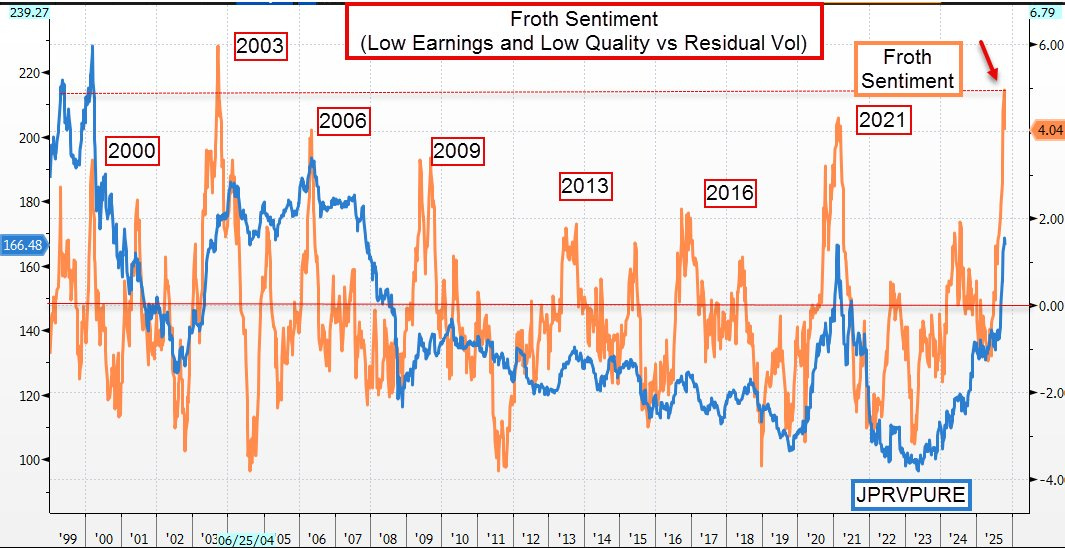

There are spillover effects, though. Pre-revenue companies are being pumped to insane market caps, unprofitable companies are trading at insane multiples, and the momentum factor is outperforming by a large margin.

Everywhere I look, I see froth. It is still debatable whether we are in a bubble or not. Alphabet’s earnings above hint that no, this is not one. However, some parts of the markets are showing incredible levels of froth. And with froth comes leverage, and with leverage comes sharp liquidation events.

A few charts to convince you:

Ratio IWM (Russell 2000) vs. IJR (S&P Small Cap): this is a good indicator of froth because the Russell 2000 doesn’t screen out unprofitable companies. The transparent channel is the linear regression on the ratio +/- 2 standard deviations. The channel in red is anything above 2 std dev. The crappy small stocks are mooning.

JP Morgan Residual Vol factor index is showing very high levels of froth:

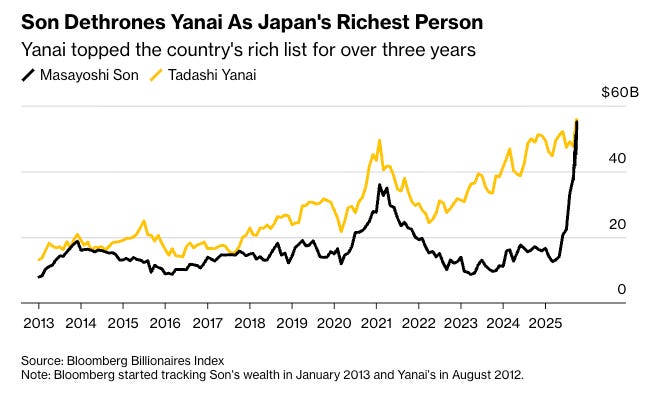

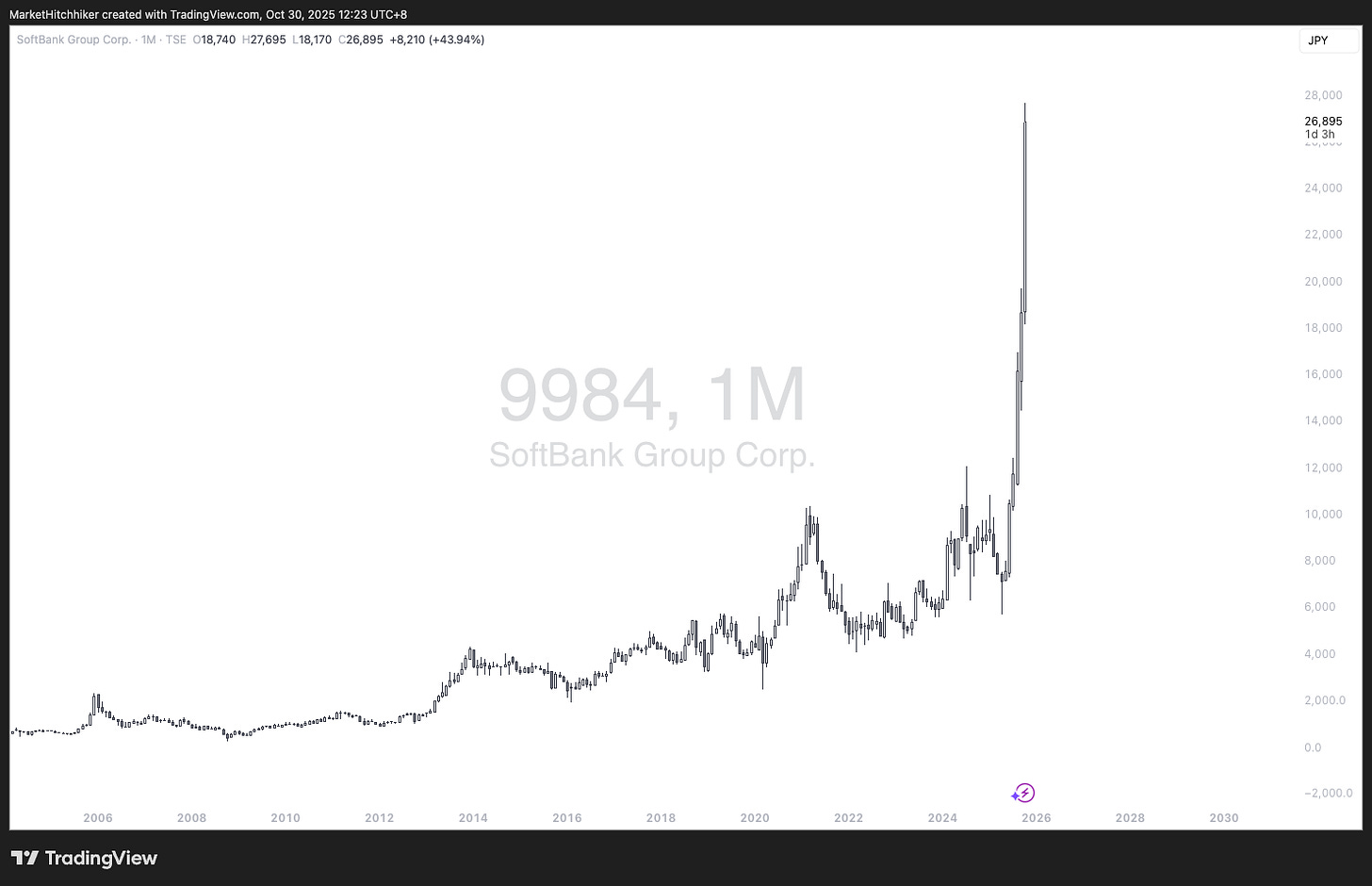

Masaponzi Son Becomes Japan’s Richest With $55 Billion Fortune. It’s anecdotal, but it’s a powerful signal. The froth is not just in the US, it’s everywhere.

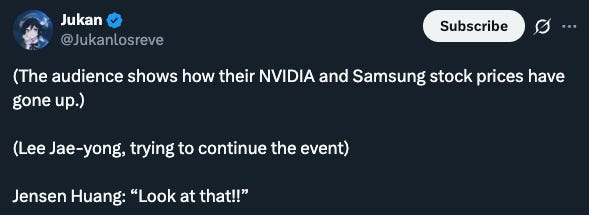

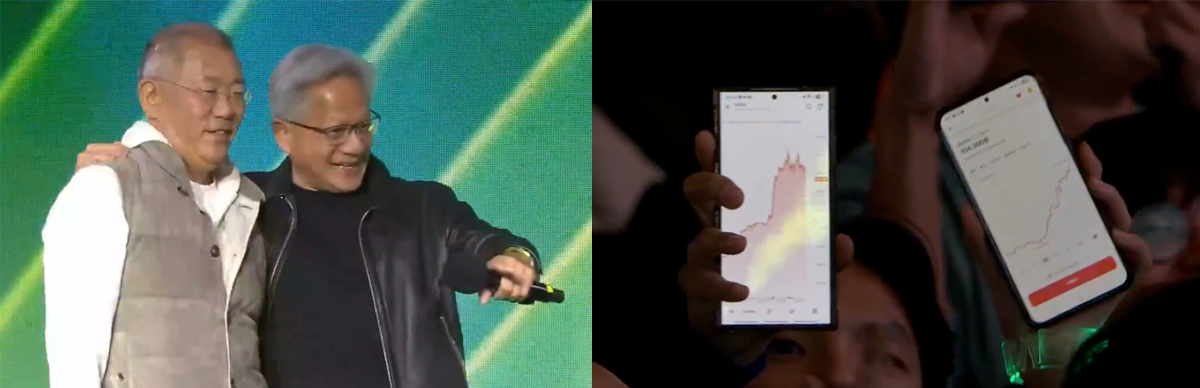

Have you checked the Korean market recently? The Kospi index looks like a shitcoin pumped by Kim Kardashian.

Yes, the fundamentals are good in Korea, there is a nice story, etc. But give me a break:

link to the video here (in Asia, red means up and green means down)

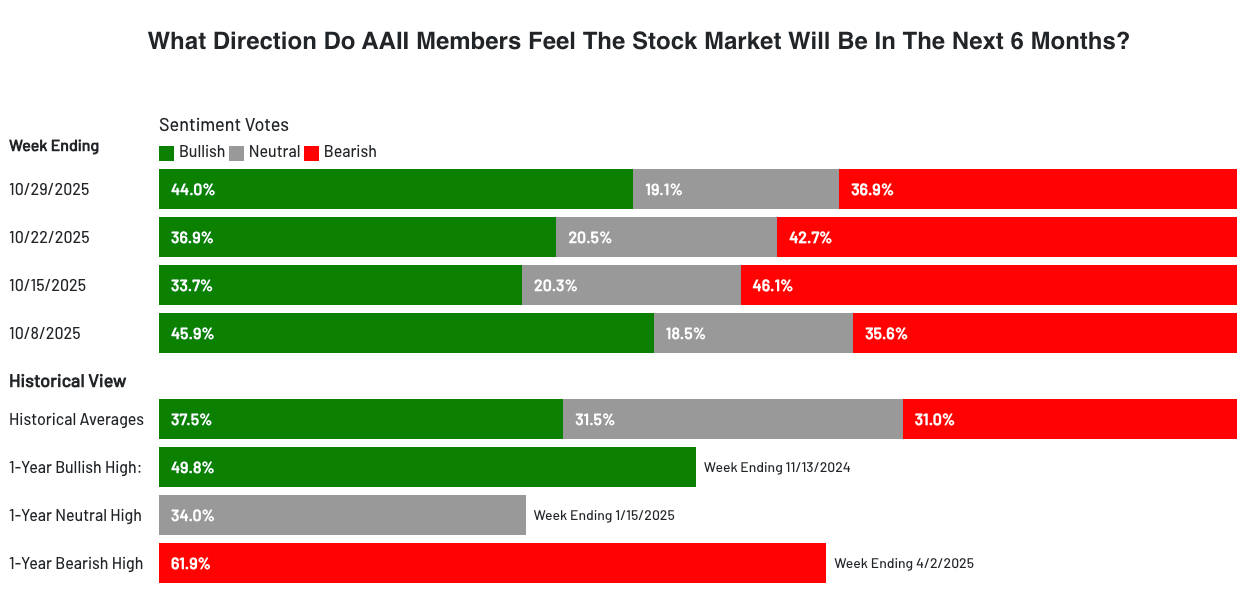

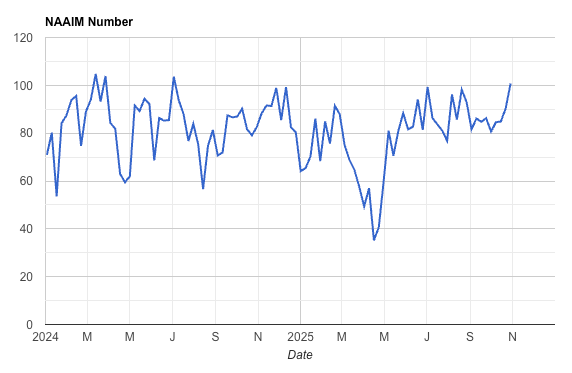

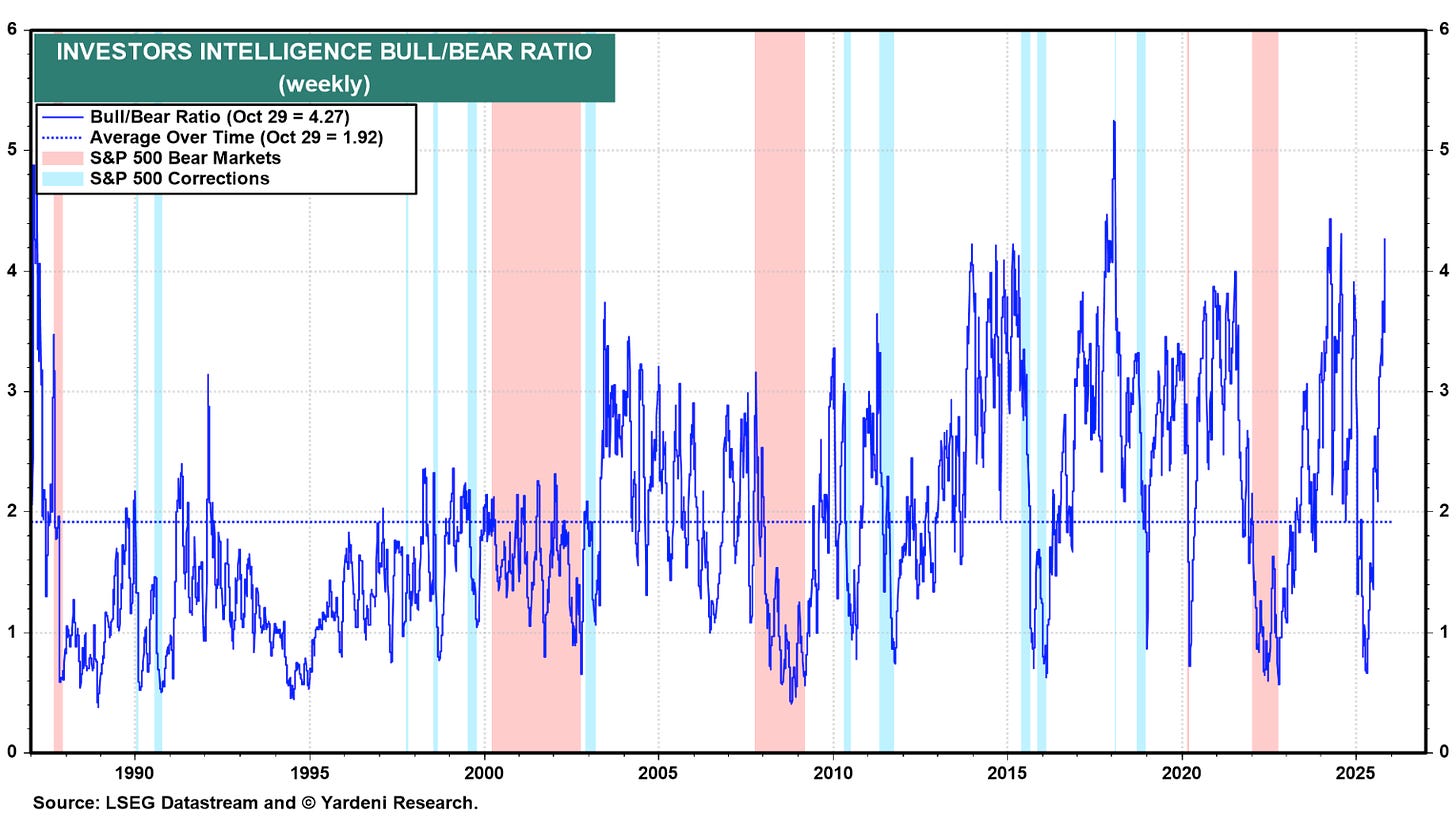

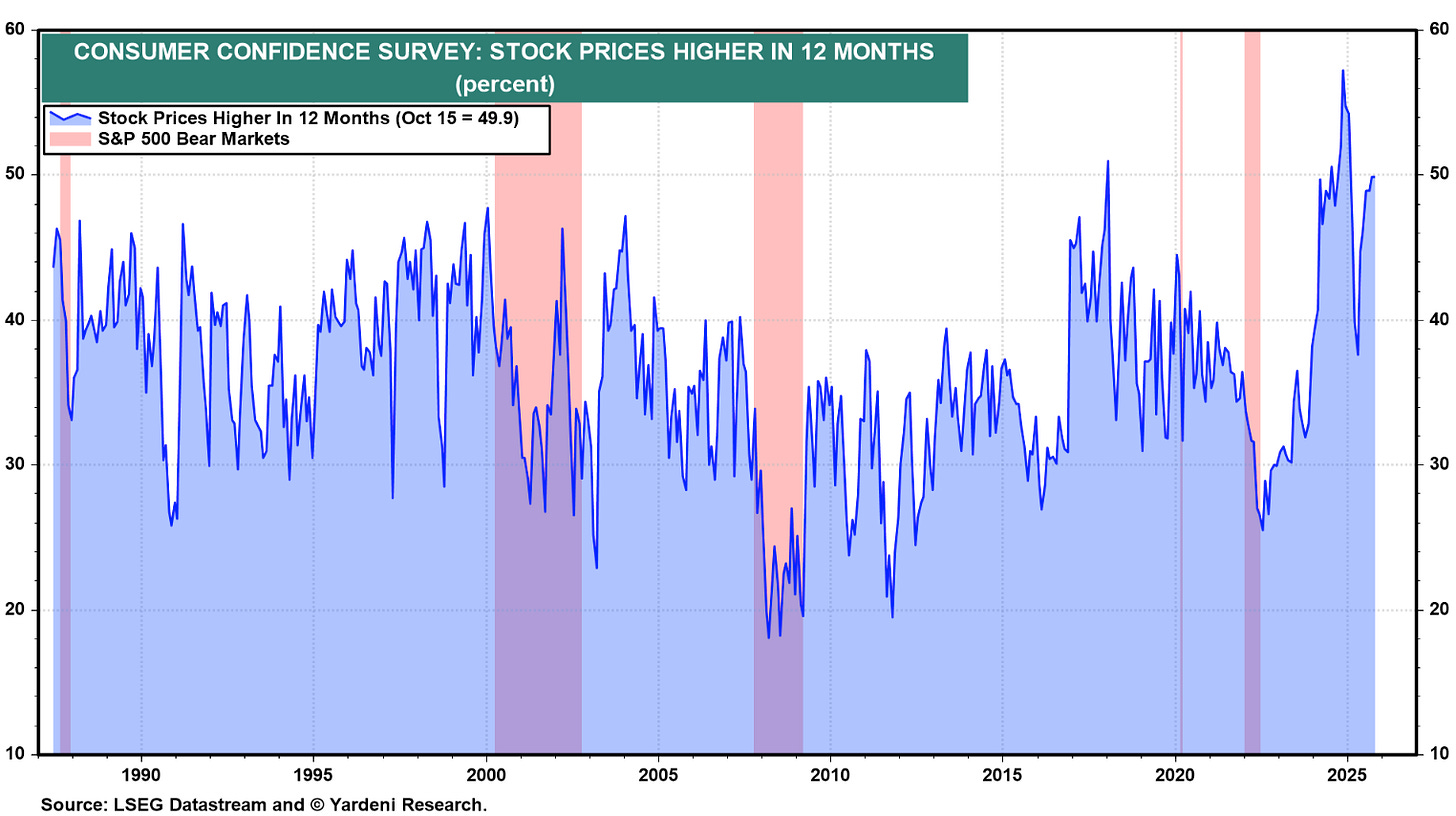

Sentiment is close to max bullish across different surveys:

Michael Burry is… giving up?

I still want to play, but on the long side and wearing my seat belt.

Market is frothy, is it a bubble? Maybe, maybe not. This is not actionable anyway. We could be at the beginning, in the middle, or at the end. And sorry, but I don’t have a crystal ball.

The macro is telling me that we are in a Goldilocks environment. You can read my last macro post here for more information:

In a goldilocks environment you want to own equity beta and duration as a hedge. I have duration (a lot of it) but I don’t have enough beta. I need more beta. My name is Market Hitchhiker because when I see a beta inflecting higher, I hitchhike it. I take it for a ride as long as the trend will allow me to.

In a frothy environment, you better watch your downside, though. And what’s better to manage your risk than an option? It gives you more staying power than a stop loss. But it comes at a cost: the theta. But wait a minute, if the froth is so high, does that mean calls are expensive?

Bingo! You can cheapen your option structure significantly by getting rid of some upside with a call spread. And if you are really a cheap a$$ like me, you can short the upside by using a call ratio.

Let’s play a game: where will the SPX trade by the 19th of December (Dec opex)?

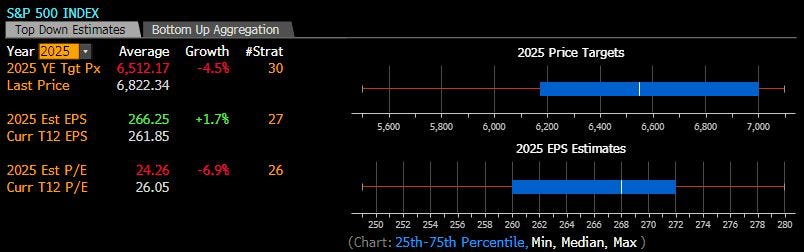

Right now, the index is trading at 22.85x forward 12m EPS (6822/298.62):

The estimated annual EPS for year 2026 is 304.48:

So, if by end of this year the multiple hasn’t changed, we should see SPX trading at 304.48 x 22.85 = 6,957.4

With all the animal spirits out there, I would not be surprised to see the multiple expanding to 23.5. That gives us a SPX trading at 304.48 x 23.5 = 7,155

That’s way above the analysts’ forecasts:

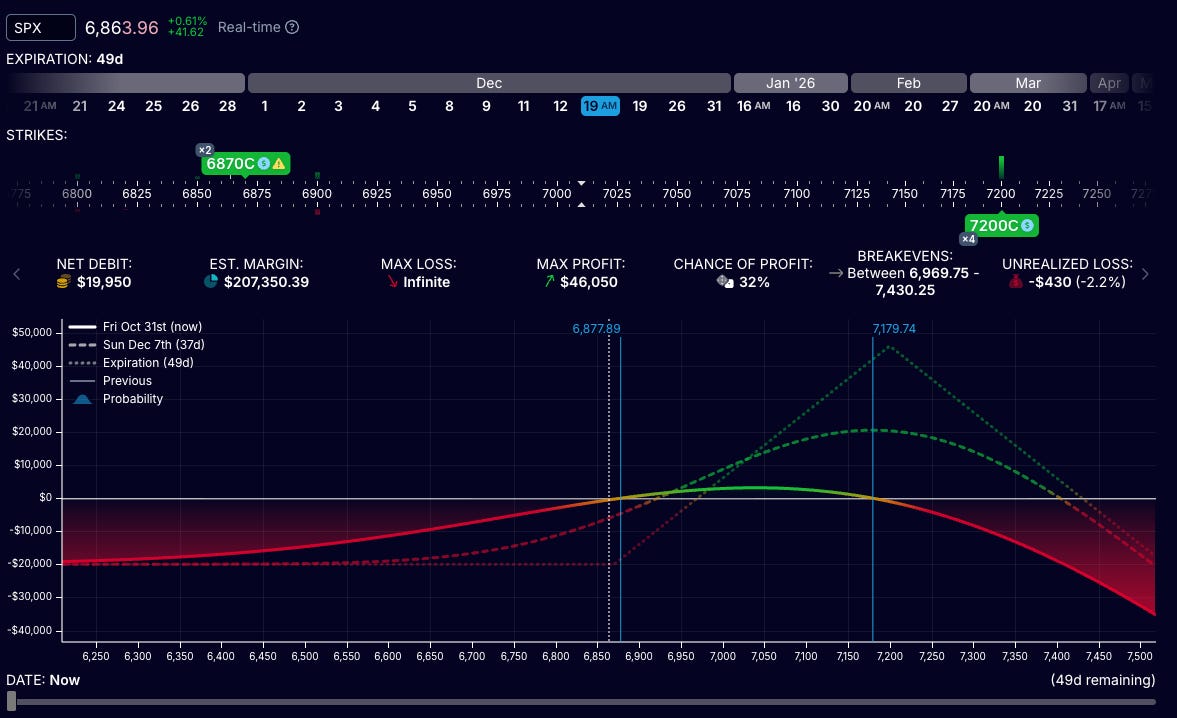

I have been looking at a few different ways to structure the trade. Given the context and the price target I just calculated, I am very comfortable with the below call ratio:

long 1x call strike 6,870 expiring 19Dec2025, delta is ~55%

short 2x call strike 7,200 expiring 19Dec2025, delta is ~20% per option

Quick scenario analysis:

→ If by mid-December my SPX target at 7,155 is reached, I will earn the max profit of this structure

→ If by mid-December the SPX is overshooting my target, I am breaking even at 7,430. Trees don’t grow to the sky, so I’m comfortable with that.

→ If by mid-December the SPX is flat or lower than today, I will lose the premium. Shorting 2 OTM calls allowed me to reduce the total cost by 40% versus an outright long call.

→ If before the expiry the market is trading lower with a vol spike, the vega will cushion the premium and I will be close to delta neutral. The below screenshot illustrates this point with an implied vol increased to 25%:

In conclusion, this option strategy is giving me some much-needed beta exposure, reducing my FOMO while controlling my downside. I have a theoretical unlimited loss on the upside, but I am perfectly comfortable with this.

Plan the trade, trade the plan.

If you have any questions, leave a comment:

And if you enjoyed this post, consider becoming a free or paid subscriber:

![Goldilocks Regime in Full Swing [Week #29]](https://substackcdn.com/image/fetch/$s_!E4Bt!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa1c5fee6-73c9-4e84-a0ce-ad8fe0aa4f40_488x365.png)