Inflation expectations are falling [Week #32]

And what Trump and Waller have in common: they micromanage the stock market

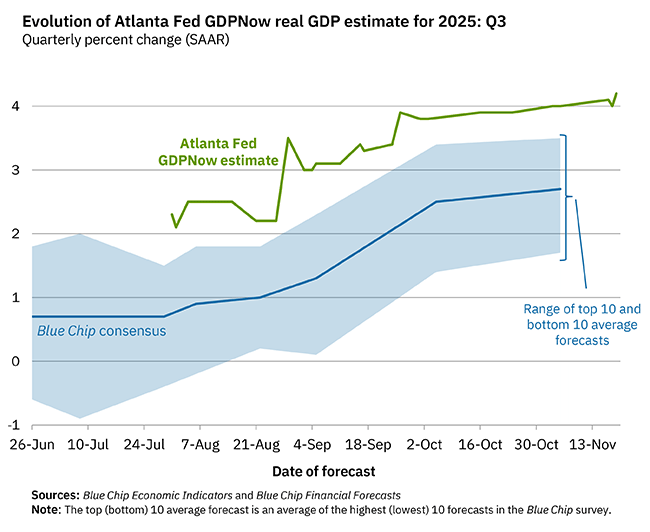

Growth

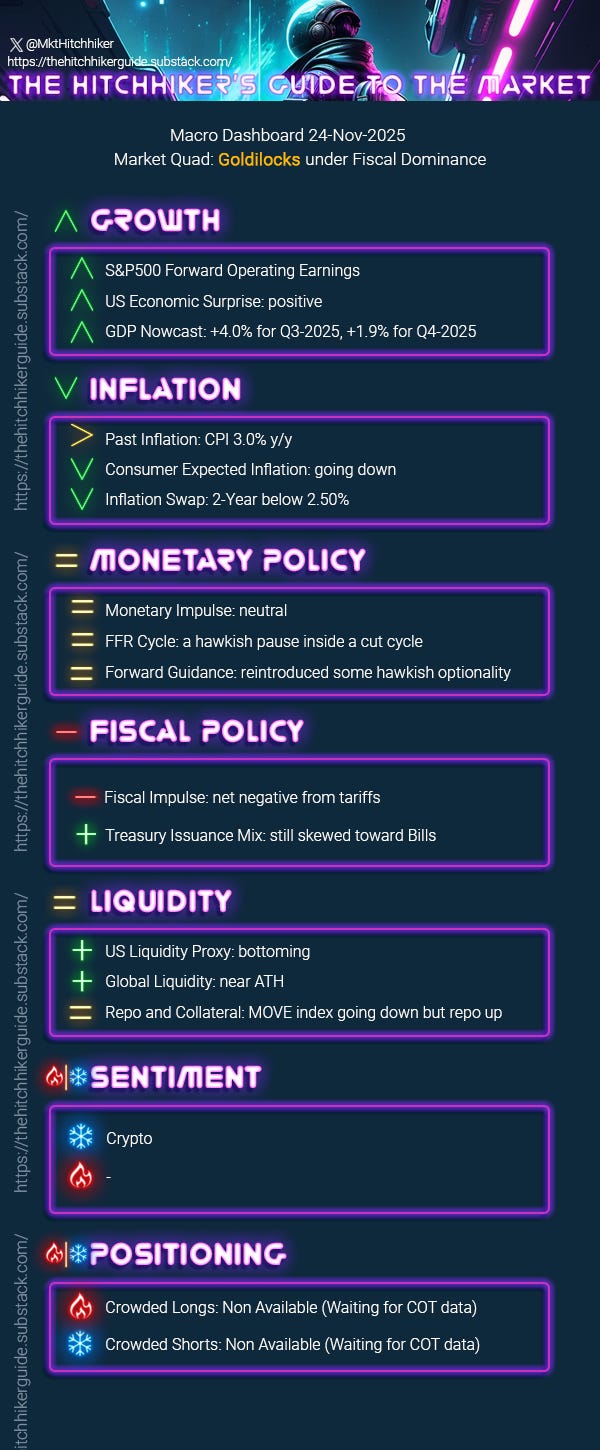

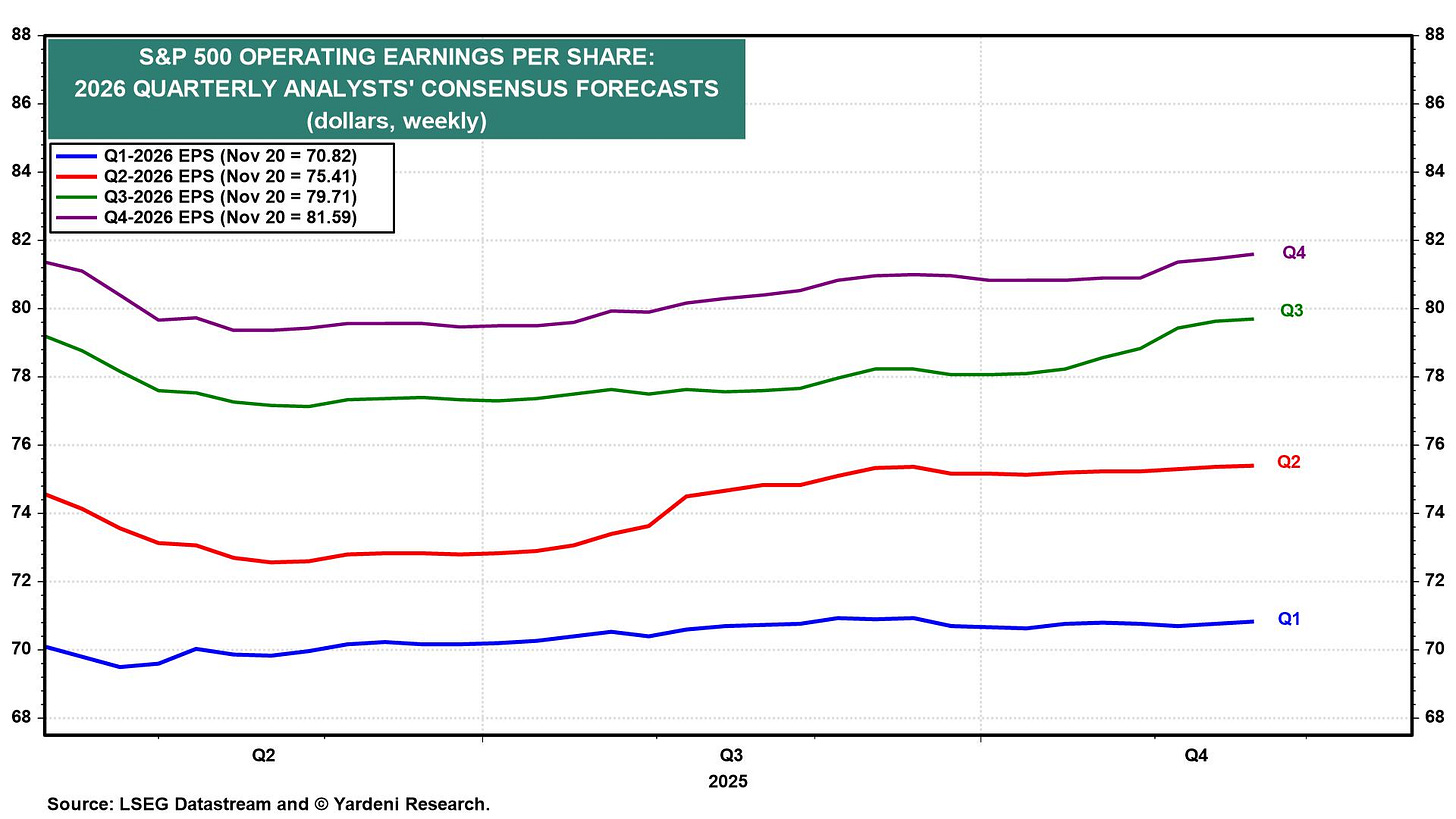

S&P 500 Forward Operating Earnings: The next-twelve-month forecast remains in a melt-up phase, now almost entirely driven by 2026 earnings expectations.

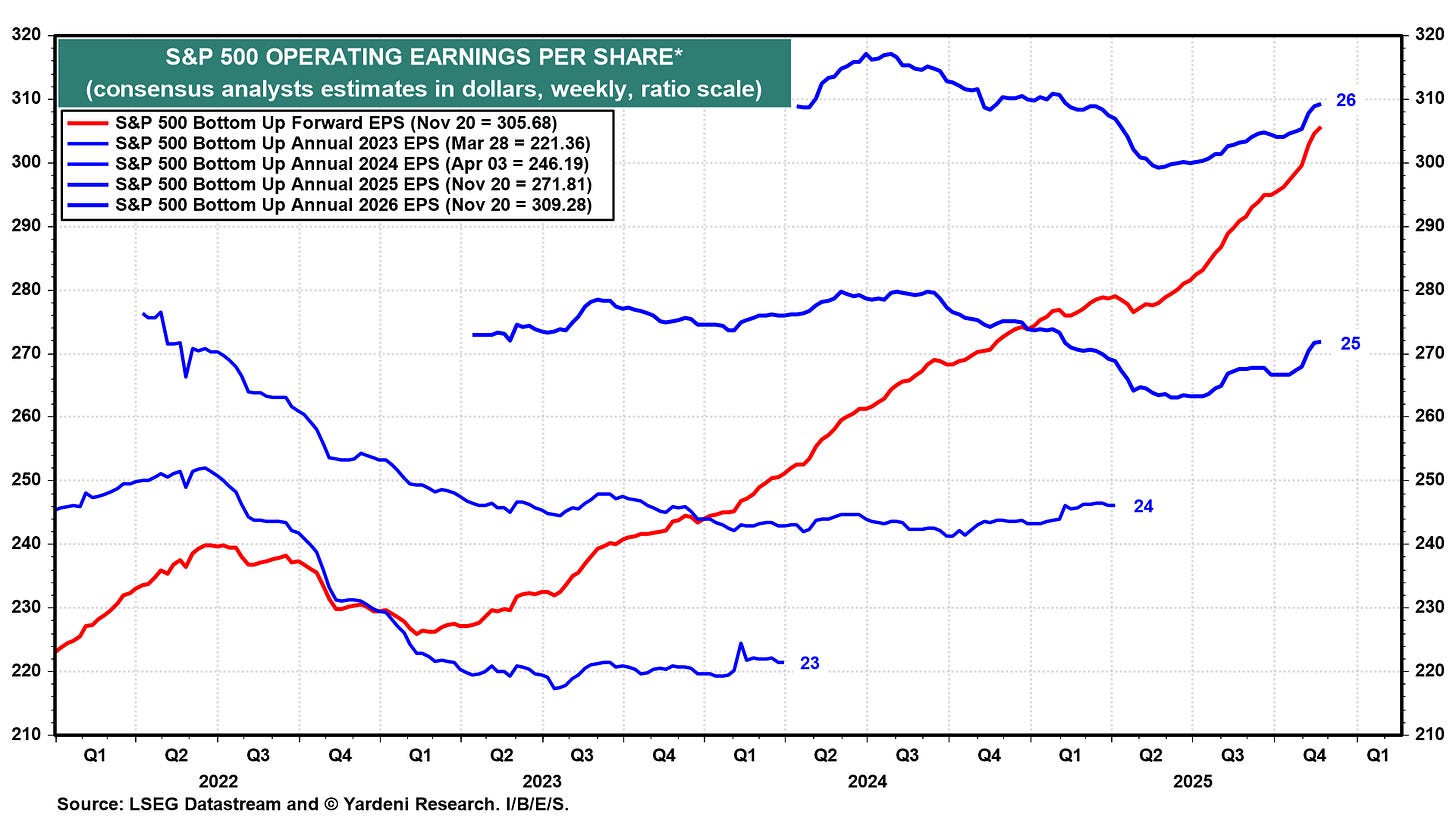

US Economic Surprise: The CESI index remains quiet, as most data are still stale, but expect some movement tomorrow with the September retail sales release.

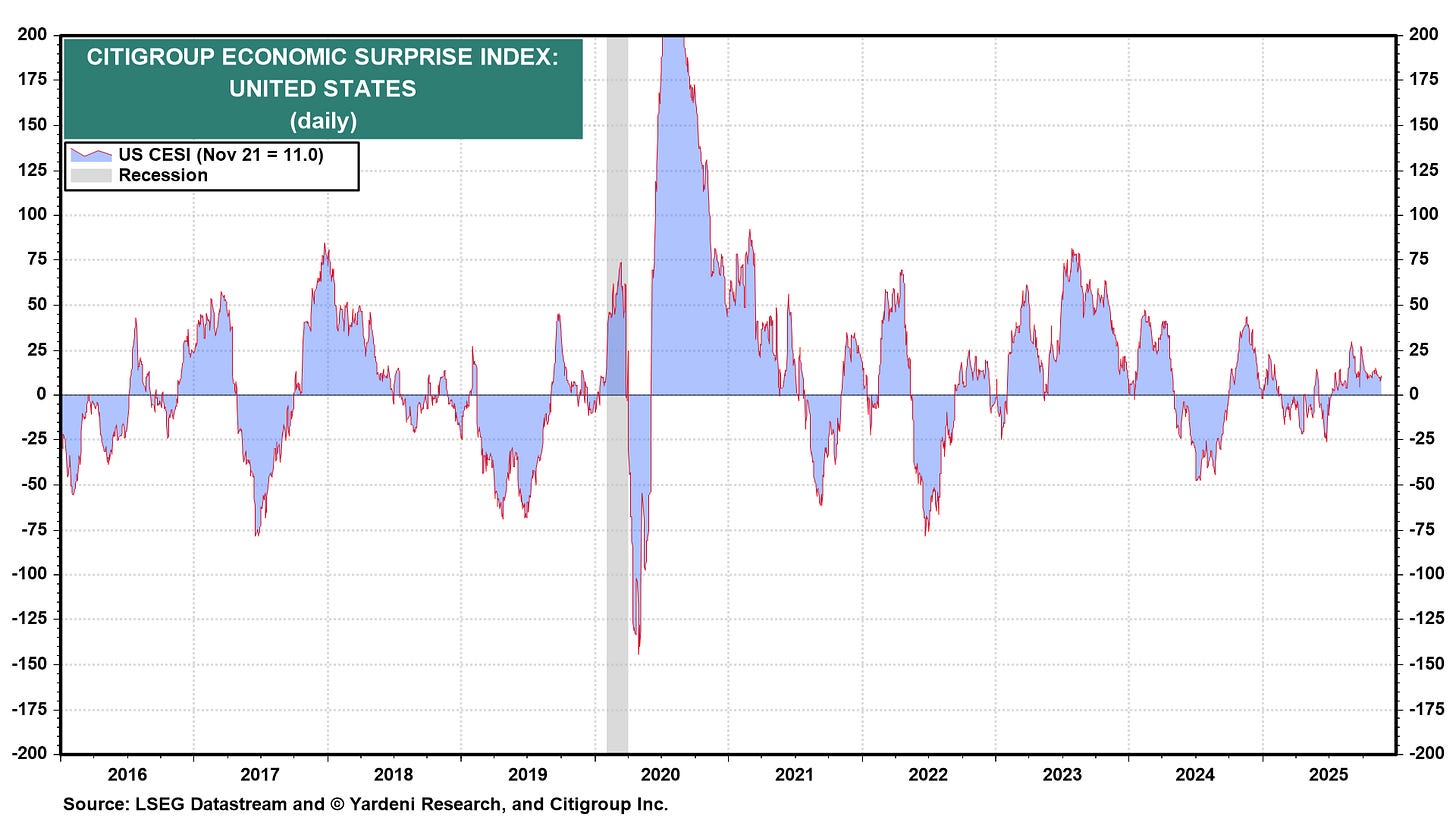

GDP Nowcast: Same story for the Q3 GDP Nowcast, not much new information here.

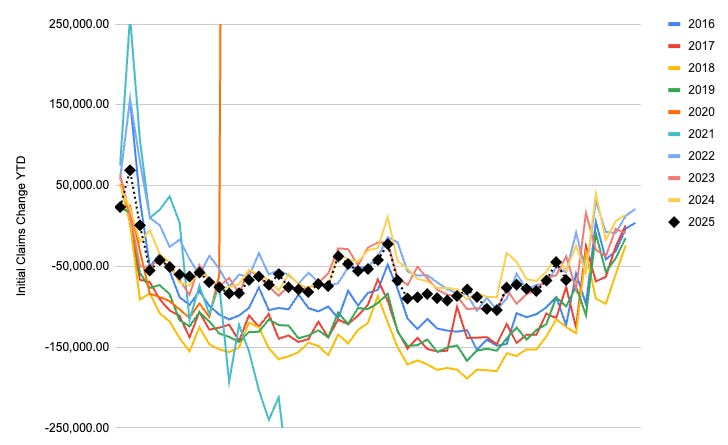

Initial Jobless Claims: Hooray, we finally have some data—and they’re underwhelming. We’re closely tracking the paths of previous years.

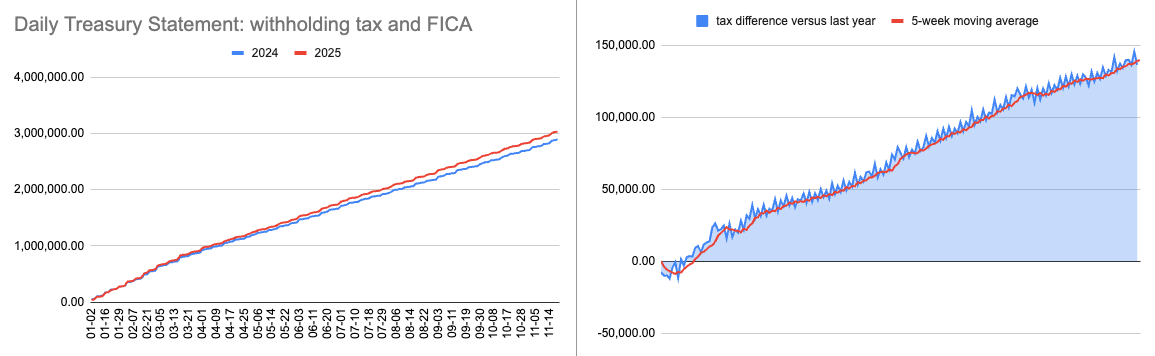

Daily Treasury Statement: Yep same as ever, no sign of tax collection slowing down.

→ No update for the Growth category. The Q3 official number should be released by mid-December. I’m expecting a strong figure, but that’s pretty much irrelevant, as we’re well into Q4. Kalshi is pricing a reasonable 1.9% for U.S. GDP growth in Q4—far from the 4% run-hot kind of number. The consensus narrative is a sluggish Q4 because of the government shutdown, but it will balance out with strong growth in 2026. The analysts got the memo and have been revising up their 2026 forecasts.

Inflation

CPI: Officially, as of October 2025, the year-over-year inflation rate is 3.0%.

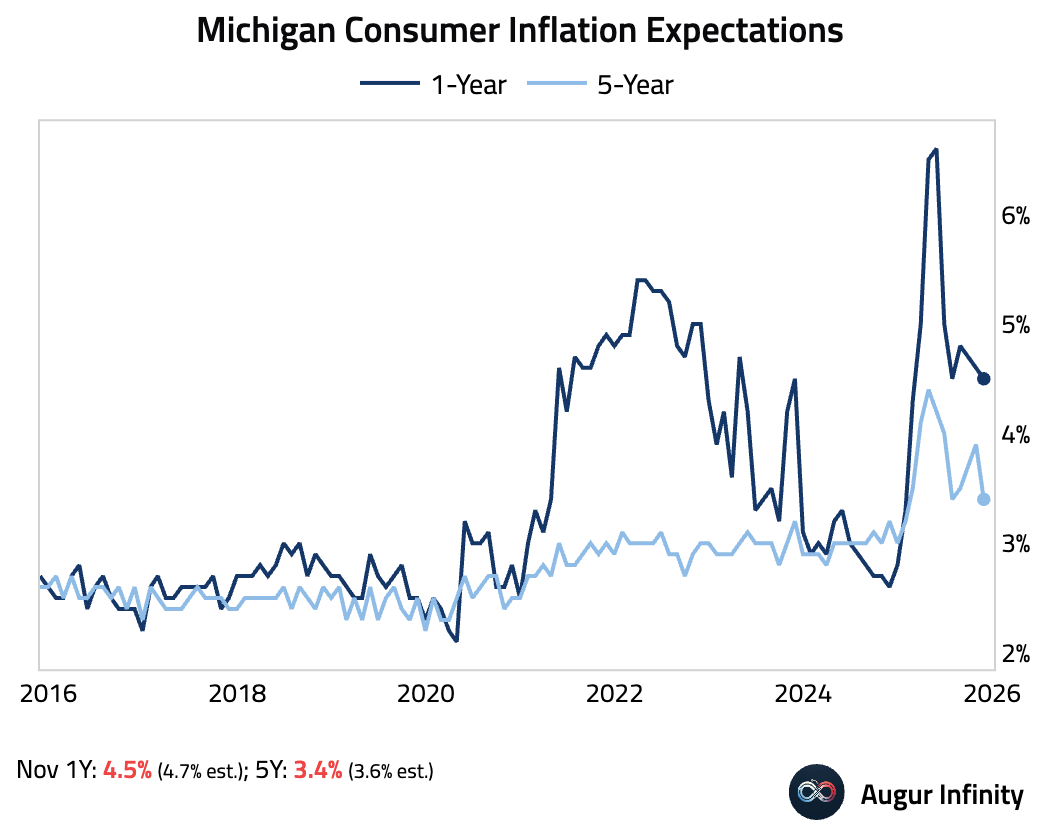

Inflation Expectations: Latest Michigan survey is out, 1-Year expectation now down to 4.5% (vs 4.7% est.) and 5-Year down to 3.45% (versus 3.6% est.).

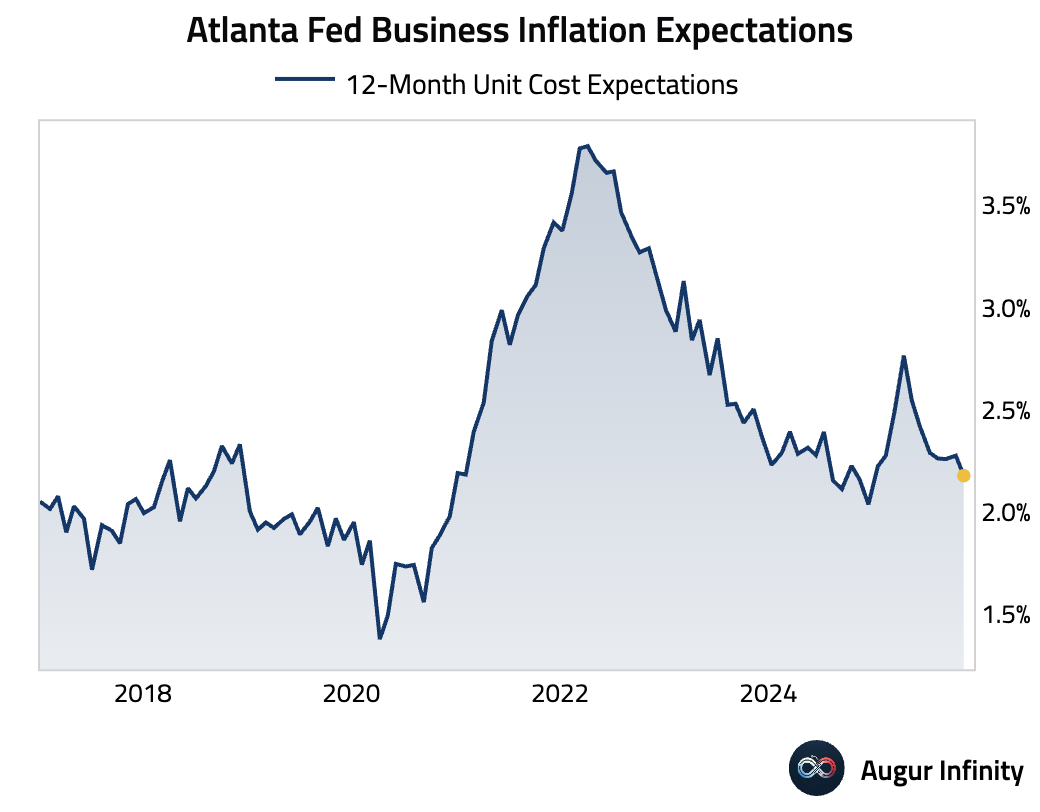

Another data point from the Atlanta Fed Business Inflation Expectations confirms the overall trend of expectations trending back down.

Inflation Swaps: 2-year inflation swap is making a new YTD low! This is an important development.

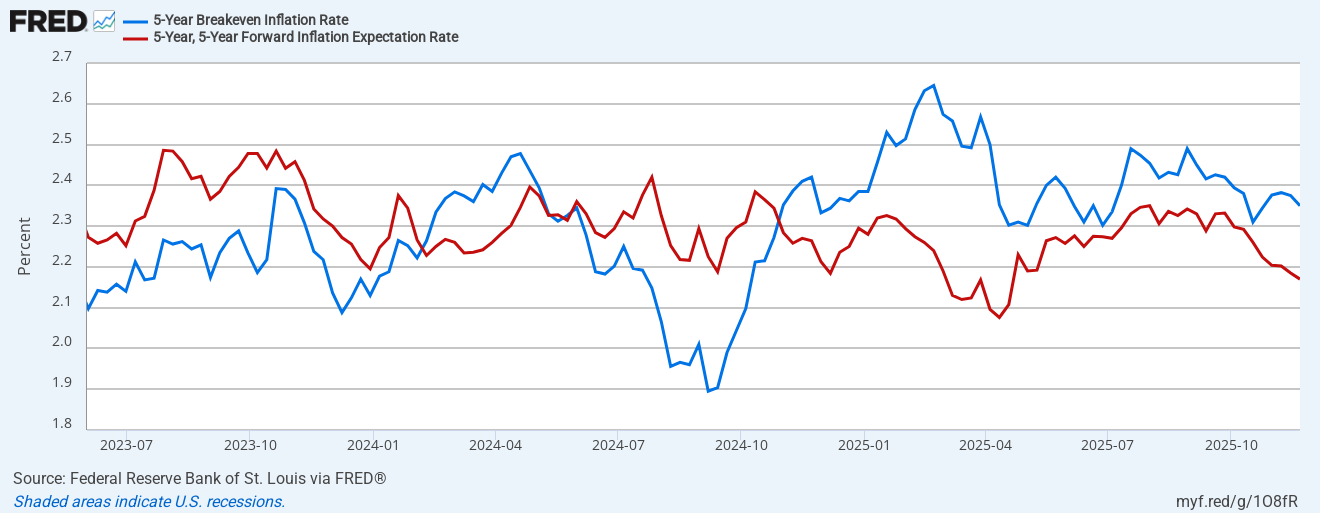

5-year and 5-year forward breakeven inflation rates:

→ I am updating the inflation category with a down arrow. While headline CPI YoY looks uncomfortably above target at 3%, the forward-looking inflation swap market and expectations surveys are trending lower. In markets, second derivatives matter more than absolute levels. As counter-intuitive as it may seem, this is a disinflationary environment.

Maybe it’s not as simple as the “run-it-hot” or “debasement” narrative. Maybe the economy isn’t as strong as it appears. Maybe tariffs aren’t inflationary because they kill demand. Or maybe the economy is simply too difficult to forecast, and the only reliable path is to follow a disciplined macro process.

Monetary Policy

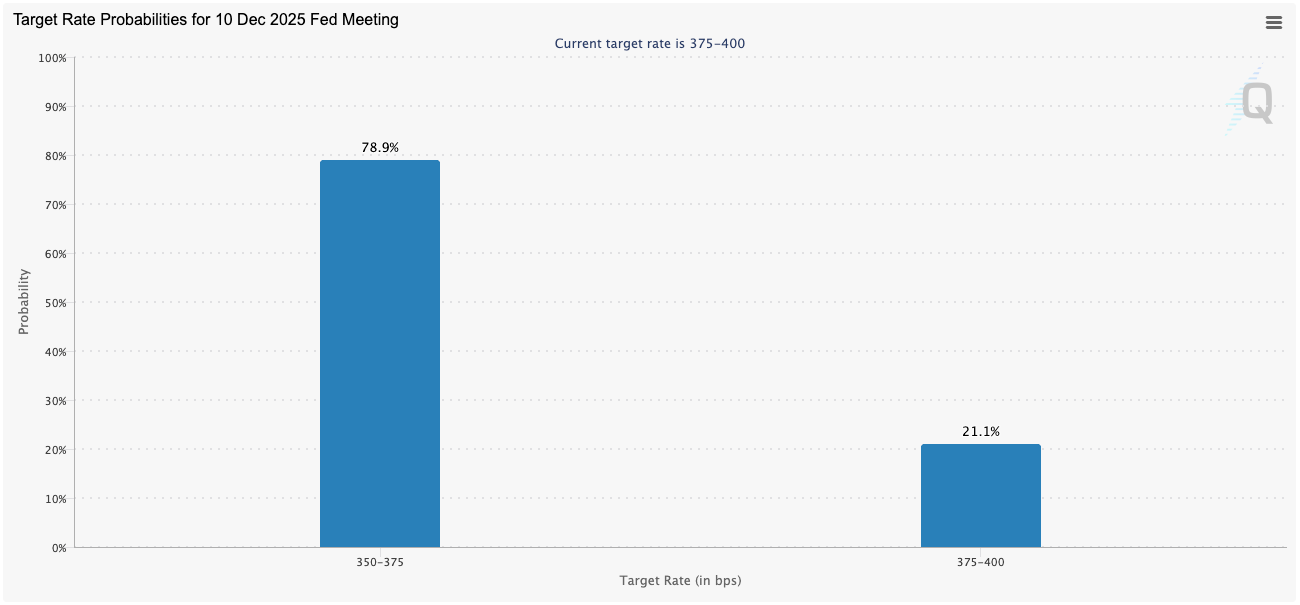

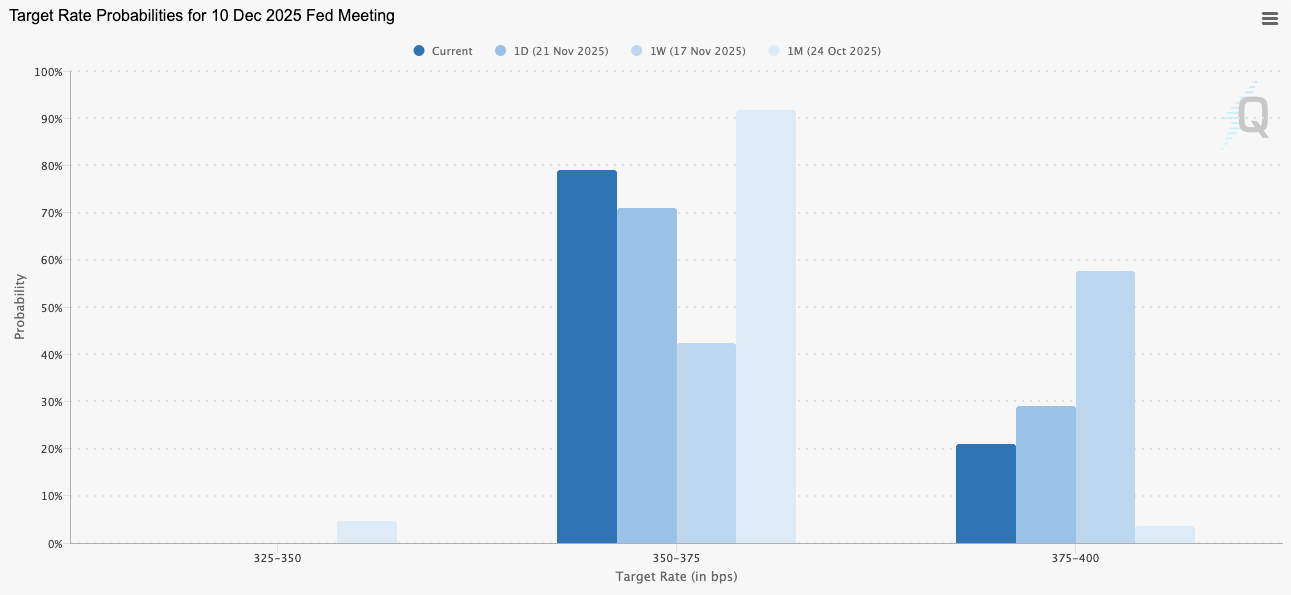

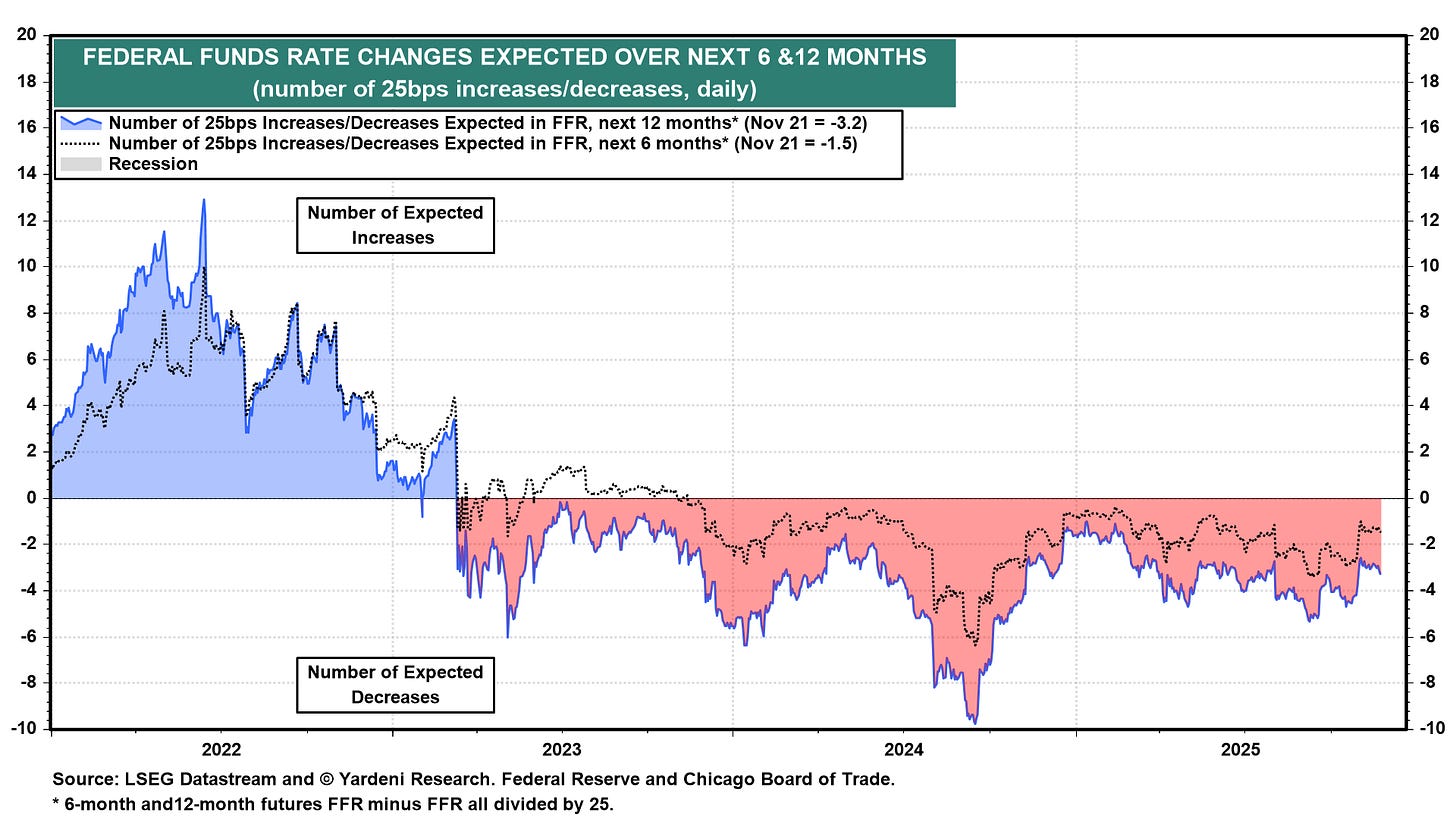

After last Friday’s Fed Williams comment, the market repriced the Fed FOMC again, with a large tilt toward a cut.

The wild swings in the SOFR market are just another sign that this market is centrally planned. We’re almost back to the 90% probability priced in before Powell’s hawkish comments. Interestingly, the U.S. stock market is 3.5% lower.

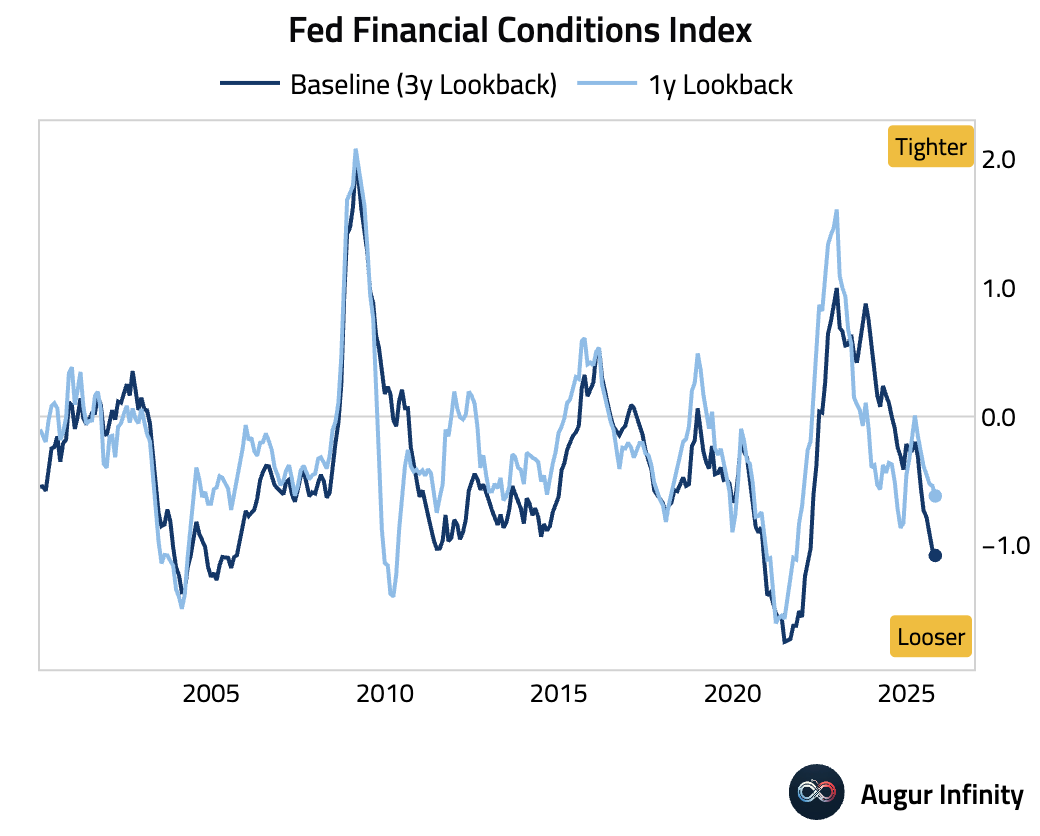

Last week, I spent some time debunking the Financial Conditions Index and how I believe it is widely misleading. The latest data point indicates very loose conditions.

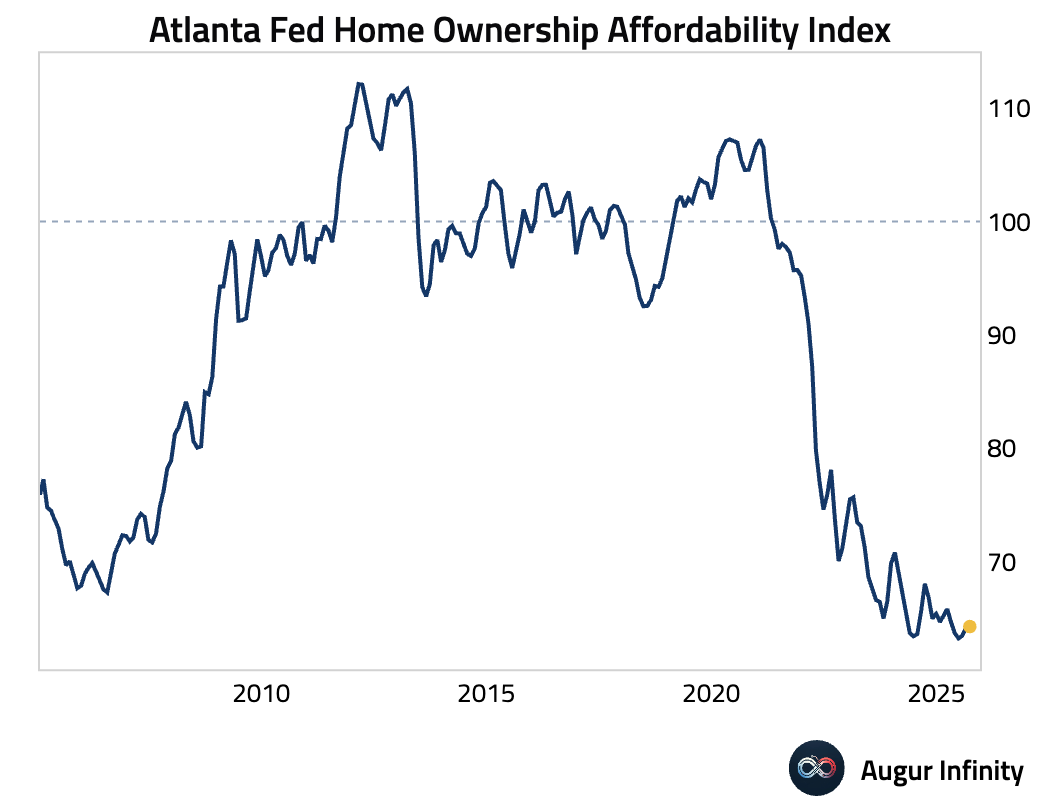

This is happening at the same time as the Home Ownership Affordability Index dipping lower than in 2007. That makes absolutely no sense. Ask any middle-class U.S. citizen if they think financial conditions are loose.

As usual, the chart of the number of cuts priced in.

→ No update for the Monetary Policy category.

Liquidity

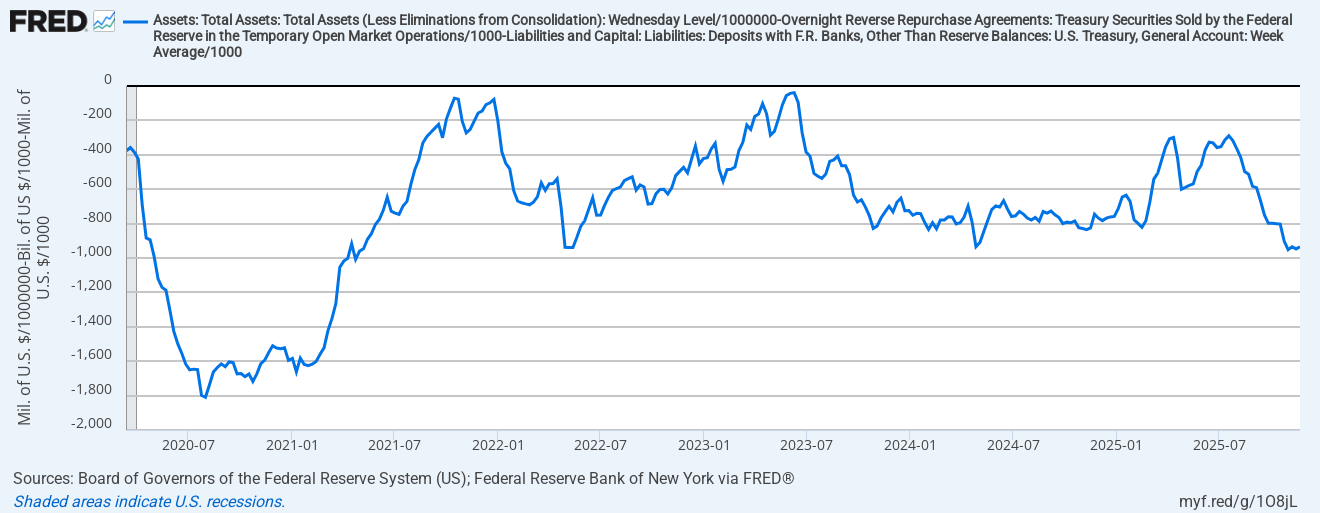

US Liquidity: The bottom is in.

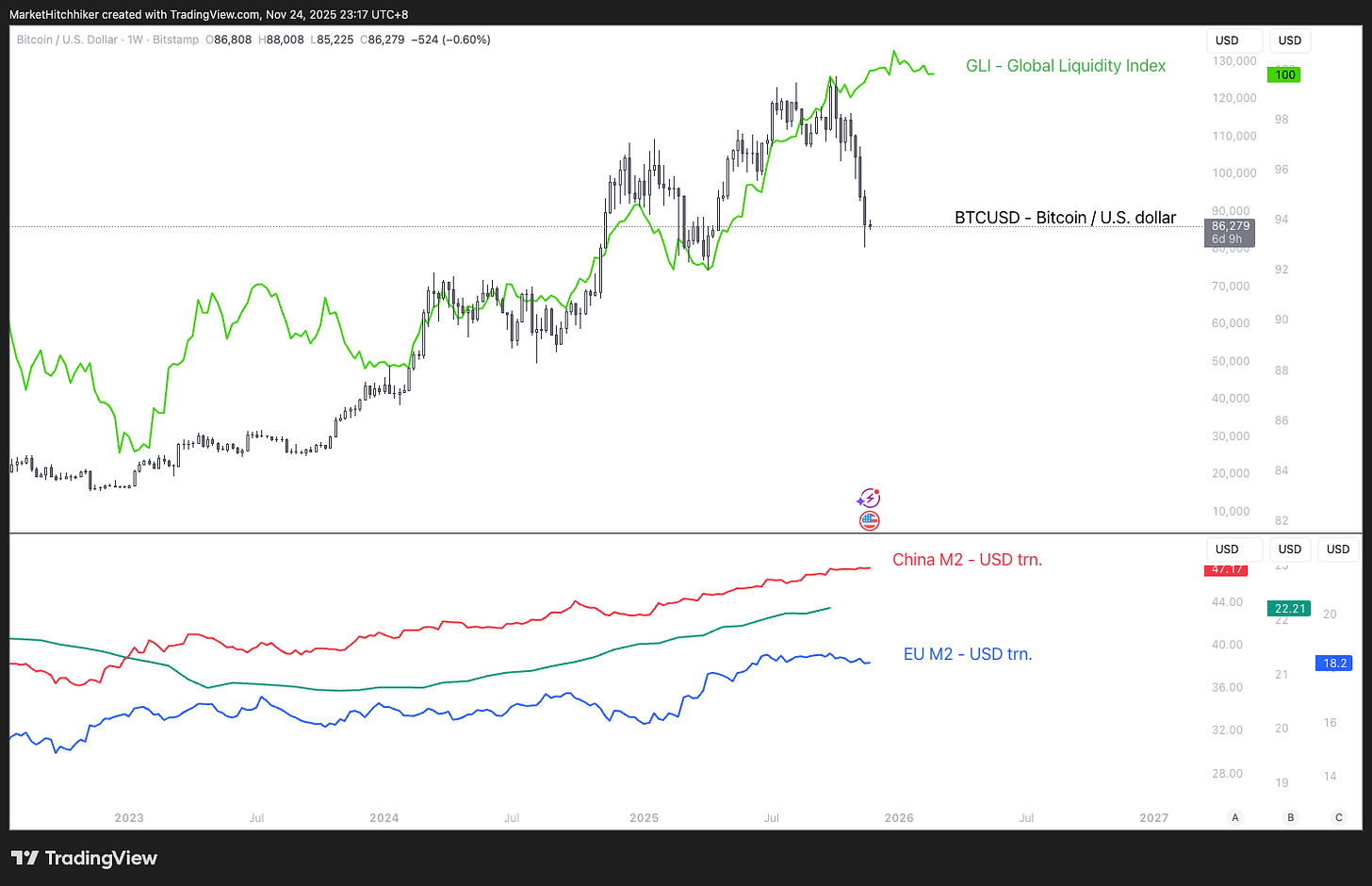

Global Liquidity: Comments from last week are still relevant: The index is hanging by a thread. But keep in mind the end of the US shutdown also means a new data point for US M2 coming soon. That will bring the index back to all-time highs. Crypto has decoupled from the index; the sentiment is getting very negative on Bitcoin just because of that chart. Yes, trading lead/lag relationships only works until it doesn’t. There is no free lunch, especially after such a rally.

→ No update for the Liquidity Category.

Conclusion

I see two important developments since last week:

The market is now pricing a 75% chance of a cut at the December FOMC meeting.

Two-year inflation swaps are now below 2.50%.

This tells me the job market is indeed weak and that the path of least resistance is for rates to go lower. The Fed also communicated through Waller on Friday, while the stock market was struggling—and that marked a local bottom. If both Trump and the Fed micromanage the stock market, then short sellers will have a hard time.

Is this a reason to go long on the SPX? Not necessarily. A market rising on good news is simply the expected reaction. That said, the tape has been weak for the past month, and we’ve broken several key trendlines. If anything, I’m watching for a short entry. Stay tuned.

~ Market Hitchhiker