Let's talk about META, catching a falling knife and my favourite TradingView indicator

Shay Boloor is committing the cardinal sin of catching a falling knife

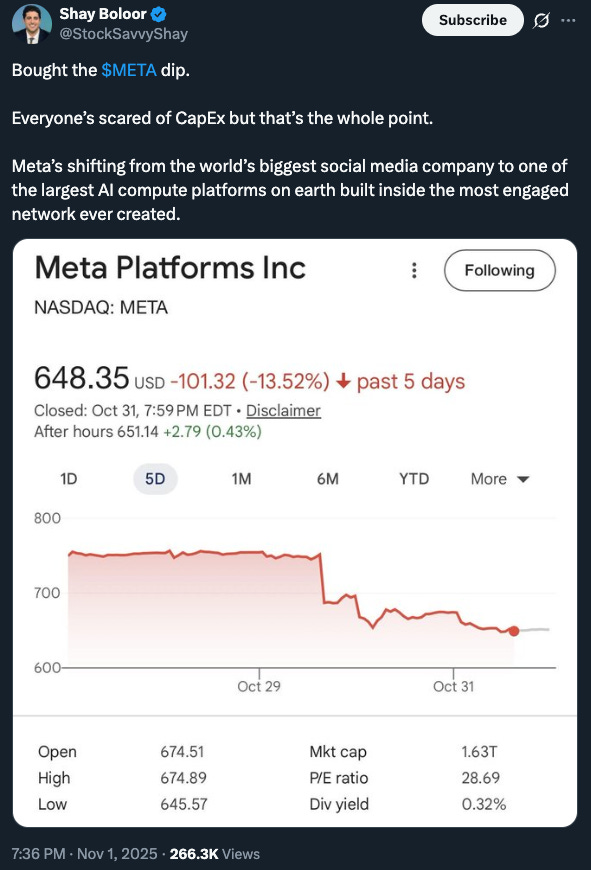

Spotted in fintwit land, a permabull in his natural habitat, doing what he does best, buying the dip:

But first, who the heck is Shay Boloor? He was a total stranger to me until X’s algorithm decided to flood my timeline with his never-ending bullish posts about AI and how he’s the best investor in the entire world. I asked Grok for more details:

Shay Boloor, @StockSavvyShay on X, is a 32-year-old LA-based growth investor specializing in AI, quantum, and space tech. His newfound notoriety exploded in 2025, with over 291,000 X followers generating 55 million monthly impressions. Starting as a 2023 side project to grow a $100,000 portfolio to $1 million (achieved in September 2025 via picks like Palantir and Rocket Lab), it evolved into 44 TV appearances on Bloomberg, Fox Business, and others. As Chief Market Strategist at Futurum Equities (launched June 2025), he hosts shows and shares insights, fueled by recent wins like 541% surges in Oklo and Iris Energy stocks.

My no-BS one-sentence summary: he’s a young and bold trader who got lucky by going big into Palantir and Rocket Lab, holding them through the volatility with his diamond hands. Have you ever heard of survivorship bias?

There are old traders and there are bold traders, but there are very few old, bold traders.

Ed Seykota

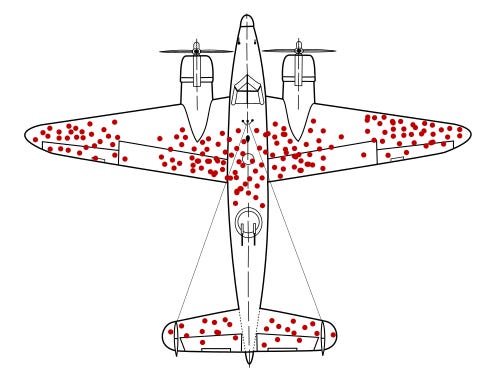

The public has this uncanny habit of only focusing on the handful of successful individuals who made significant money, while the countless traders who lost everything are ignored and disappear from the narrative. That creates a very dangerous perception of the world in general and the market in particular. Success seems easy and achievable for anyone willing to put their money to work. But in reality, beating the market and being successful at stock picking is one of the hardest things to achieve. Sure, you can get lucky and have a good run, but eventually if you have no edge, the pull of mean reversion is too great. And the more successful you feel, the less careful you become, which can turn the following fall into mean reversion into a catastrophic crash.

Buying a random dip on any tech stock is not a strategy and has zero edge. There is a very fine line between trader and retard.

Shay is committing one of the cardinal sins of trading: trying to catch a falling knife. As a famous Chinese philosopher once said (or not):

There are two types of risk embedded in the stock market: systematic risk and idiosyncratic risk.

Systematic risk is not specific to any individual stock or company; it is a market-wide risk affecting all assets. It can be driven by macro-economic factors such as recessions, interest rate changes, or political instability. Or some technical jitters in the market: think 2018 volmageddon or the 2010 flash crash.

Idiosyncratic risk is specific to an individual asset or company and can be reduced through diversification; it comes from company-specific events like a product recall, a management change, or a slowdown in sales growth or margins.

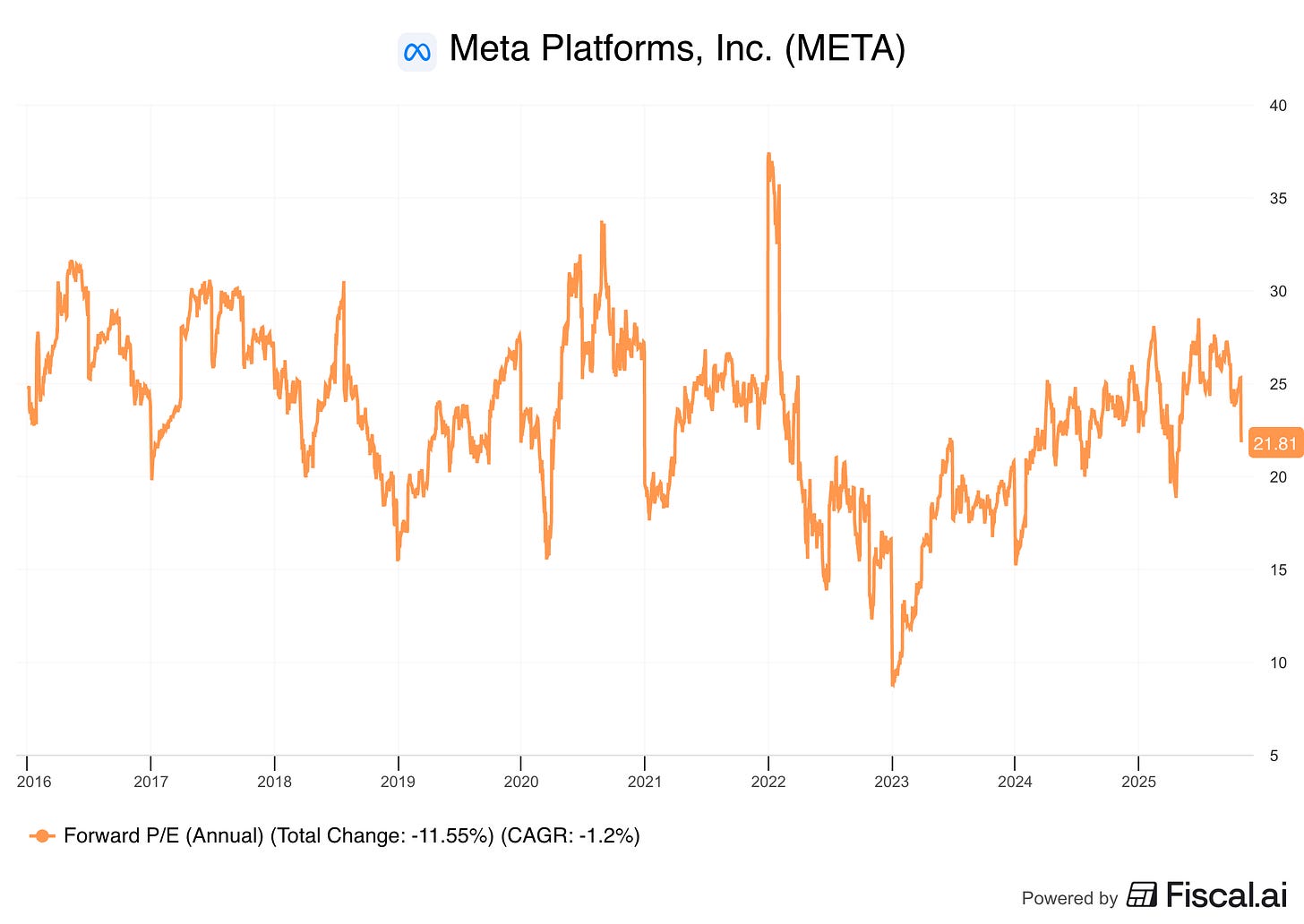

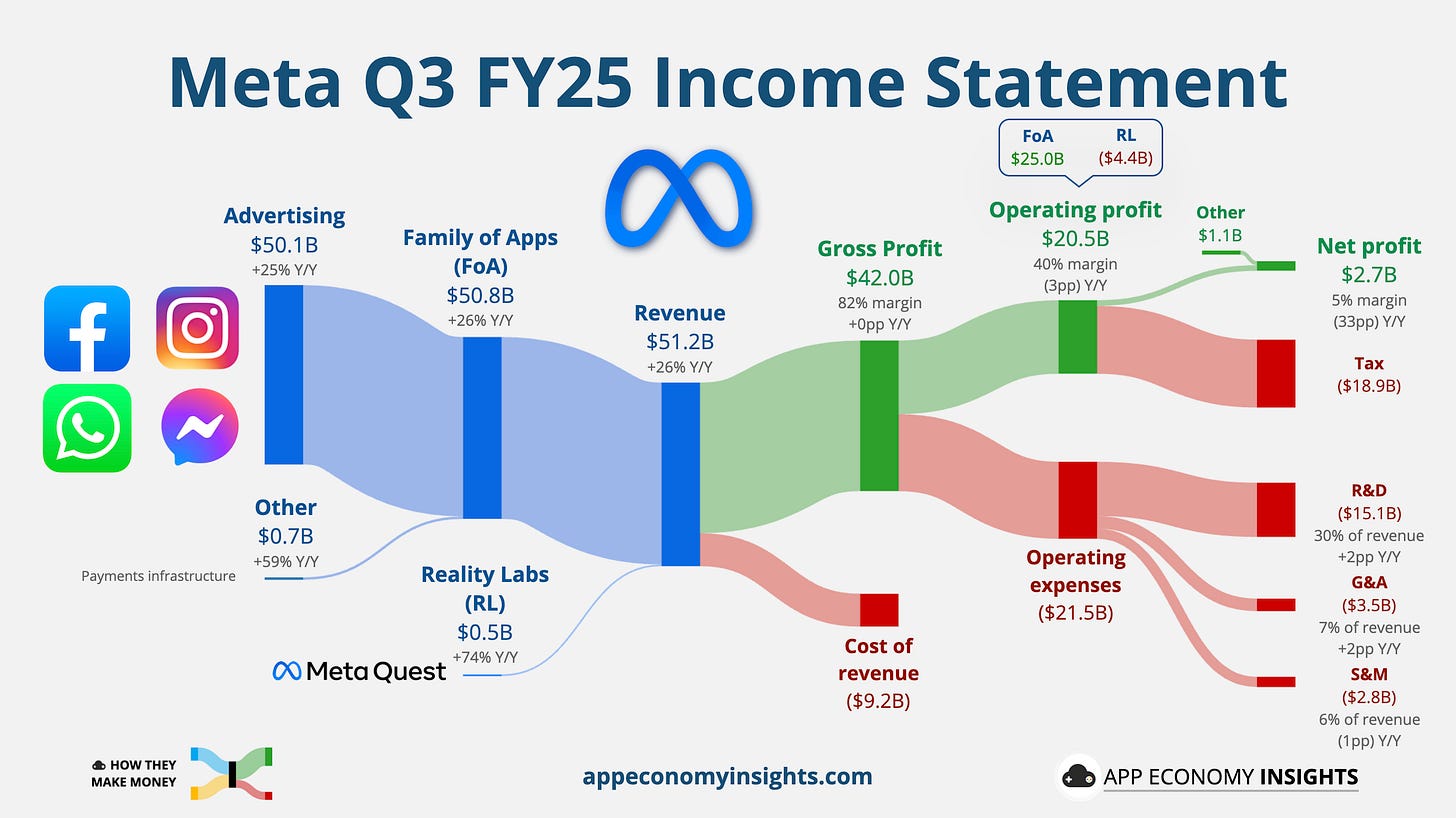

Meta stock has been trading significantly lower following a gap down post-earnings. This is 100% idiosyncratic risk, as the market is re-rating the stock lower for fundamental reasons: the bet on AI expressed through large capex is risky. A riskier business model will introduce more volatility in the earnings. While the top-line growth is still rosy for Meta, the bottom-line growth is taking a hit. Fundamental investors are questioning the ROIC of all this capex. This is a significant shift in the market mood; so far, all companies increasing their AI capex have been rewarded, until META earnings this week.

I wrote the below post on X more than a month ago; it was my cheat note for not doing anything stupid like shorting the AI bull market.

Buying the dip here seems very foolish to me. This is still a rather shallow dip, and Meta is very far from being cheap with a forward P/E sitting at 21.81. So far, this is only a repricing of Meta fundamentals, not some discount sale. Have you seen anyone panic-selling Meta? Have you seen any bears?

Plus, we know how far Crazy Zuck can push things. Remember the Metaverse clown show? Yes, I know Meta is still printing a lot of revenues, they are growing year over year, all their products are deeply entrenched in society (Facebook, IG, Whatsapp), etc. So yes, if Crazy Zuck pulls the plug on the capex, the free cash flow will recover. At least that’s what we learned during the metaverse episode. Is it different this time? According to Zuckerberg’s own words, he is prepared to “misspend a couple hundred billion dollars” on AI capital expenditures rather than risk losing the AI race by underinvesting. He believes that while a potential AI investment bubble is possible, the greater risk for Meta lies in being too conservative with spending and falling behind competitors in what he sees as an “era-defining technological transformation.” He is going all-in. Can he afford it?

Let’s go through Meta’s key items.

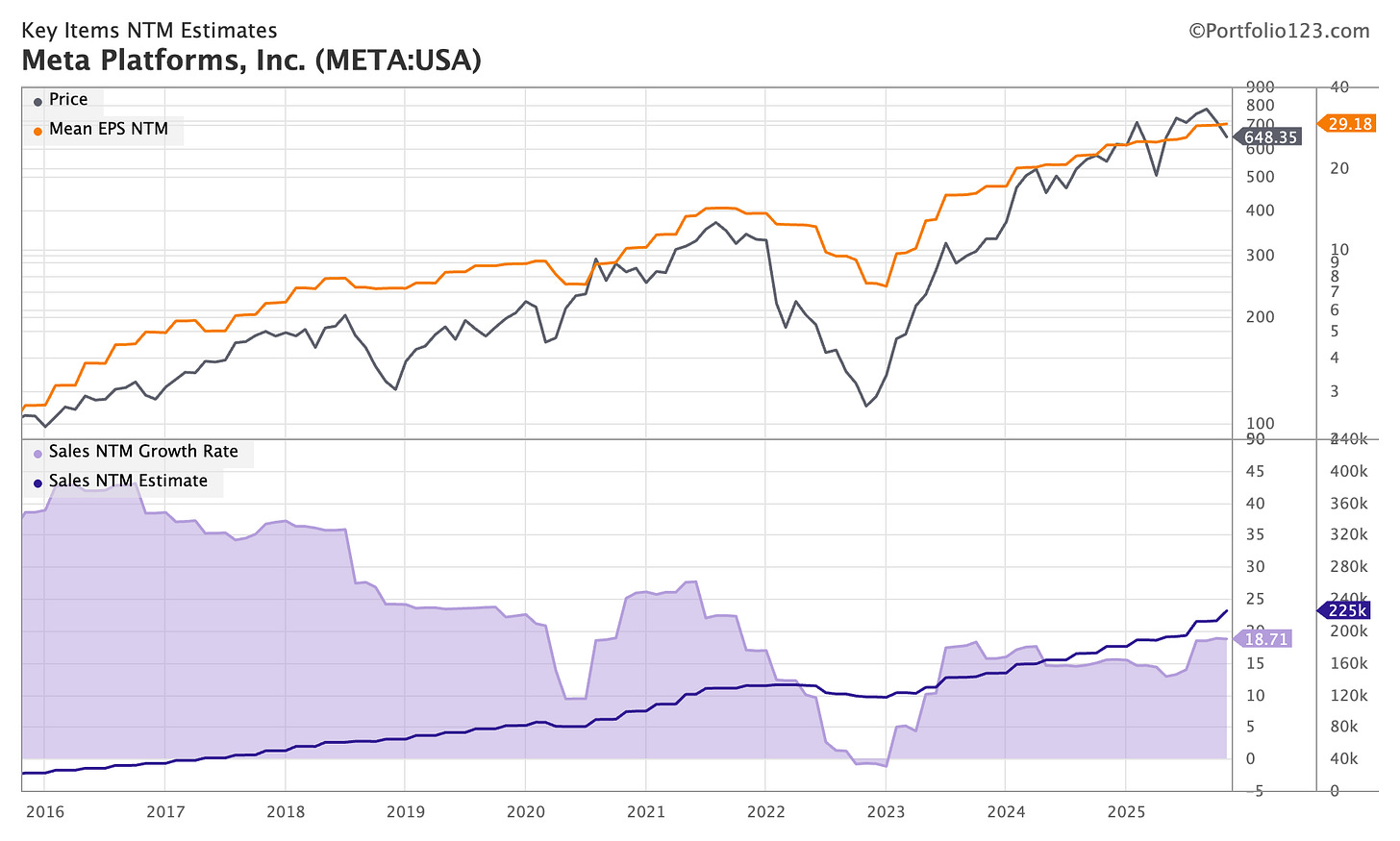

Top-Line Growth: forward sales are forecasted to grow at circa 19% on a next-twelve-month basis. There is a persistent trend in this growth; as the company goes through its life cycle, the maximum growth capacity is decreasing too. Eventually, a company’s growth potential is limited by the growth of the economy. I don’t see Meta having tremendous growth going forward, and that’s precisely what Zuckerberg is seeing. AI is necessary for him to bring back the company into hyper-growth mode; he is not willing to let the company mature and become a boring safe business like Apple. As long as Zuckerberg is the CEO, his company will echo his personality: he always wants more.

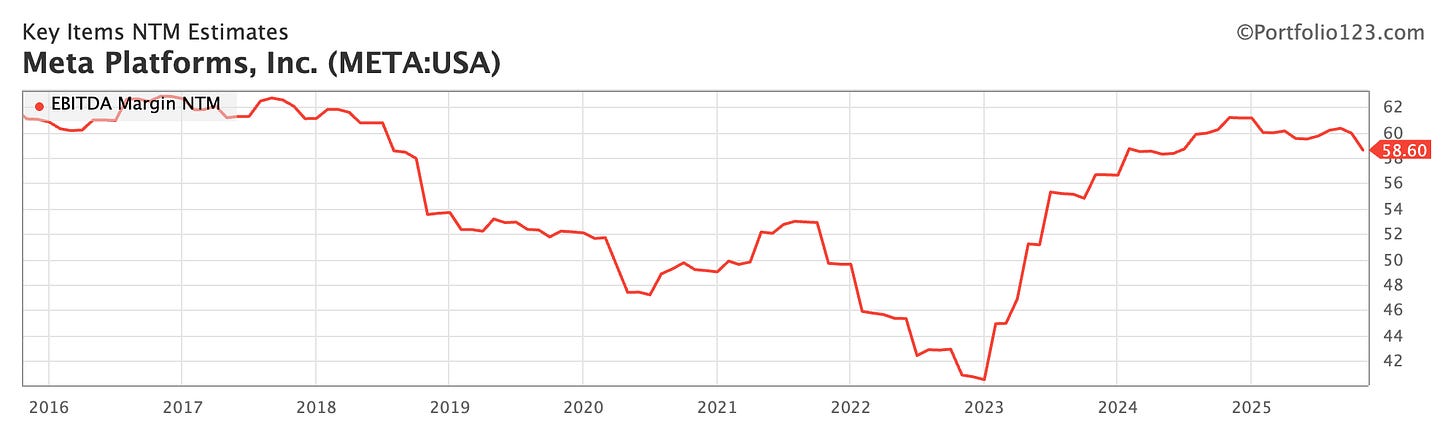

EBITDA margin is incredibly high; the forecasted next-twelve-month margin is 58.60%. Can it go higher? The path of least resistance looks to be lower. There is a lot of cyclicality in this EBITDA margin NTM chart; it tells me we might have peaked here. Again, Zuckerberg needs AI to keep the margin this high

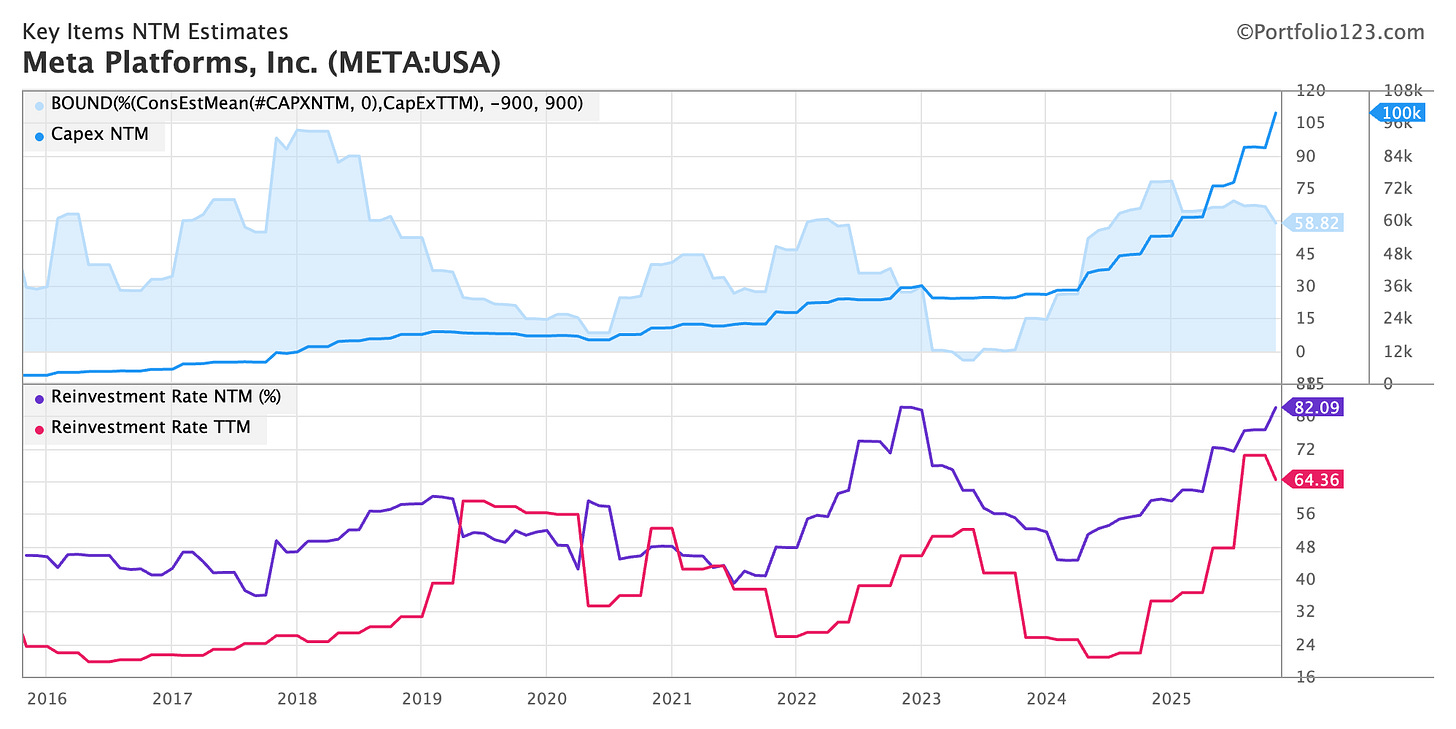

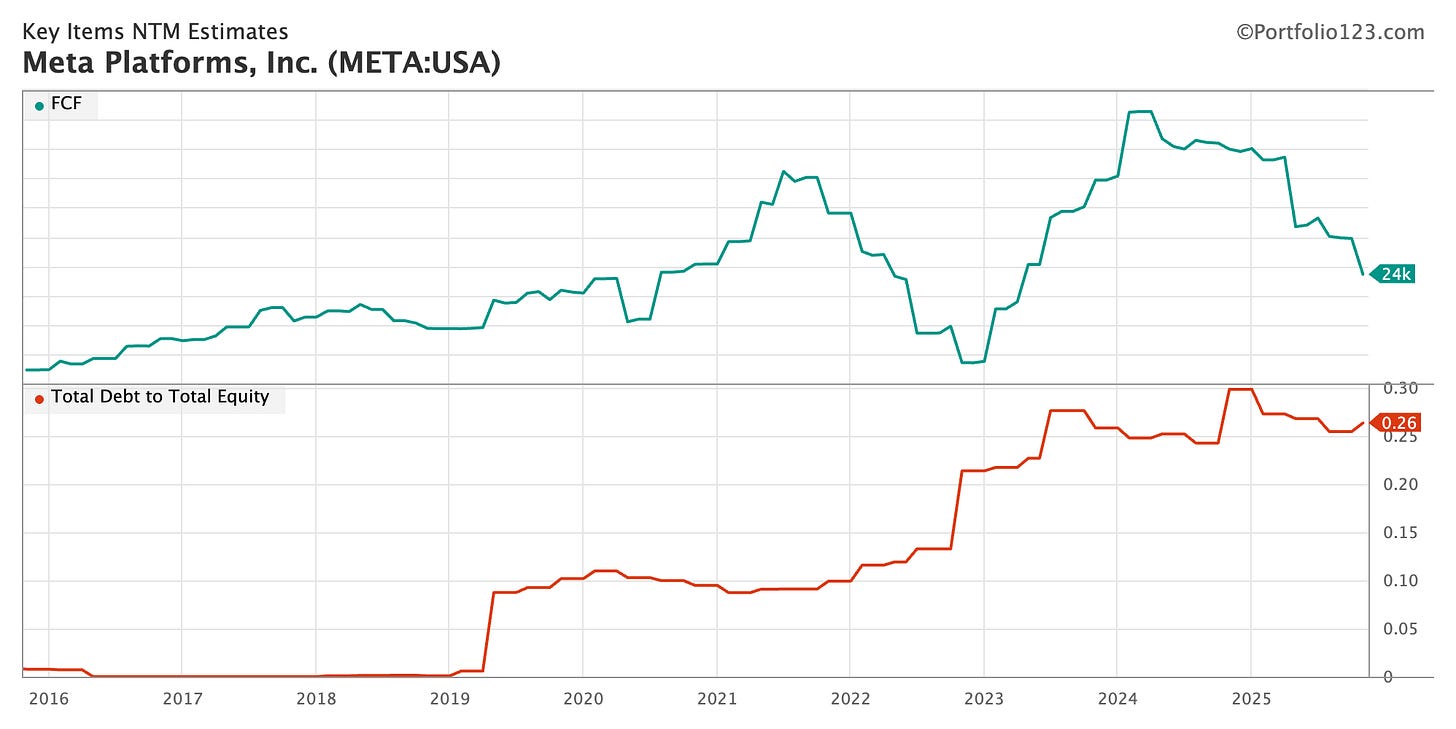

Capex is ballooning; the next-twelve-month capex is forecasted to reach $100 billion. This is the entirety of their free cash flow, and more. The next-twelve-month reinvestment rate (measured as 1 - FCF / EBITDA) is sitting at 82%; this is as high as during the metaverse episode.

Free-Cash-Flow NTM is dwindling and could reach zero very soon.

After going through these key items, the picture is pretty clear. Zuckerberg is betting on AI for the survival of Meta’s growth. He can afford the capex increase, but he also cannot afford to not overspend. This is survival for him because he refuses to let Meta become what it should be: a mature boring business. The sales growth rate is in a long-term downtrend, and 20% growth seems to be the current cycle top. The business is hyper-concentrated into advertising, a highly cyclical stream of income. It will be quite hard to push through this growth ceiling without reinventing the business model. Similarly, the margins are at a cycle high, topping at 60%. The reinvestment rate is now so high that the free cash flow is about to be negative. While much of the capex has been financed through operating income, Meta will have to rely more and more on debt financing. This mechanically increases the leverage in the balance sheet, which is a double-edged sword, and the market is already starting to notice. It is saying out loud what we all have been thinking silently: SHOW ME THE ROIC.

The overwhelming consensus on X about Meta stock price is that all these expenses are easily adjustable and this is a buyable dip. Zuckerberg can stop the spending at any moment. My read is that Zuckerberg doesn’t want to stop the spending unless he is constrained to. This is so important because it leads to a very binary outcome for Meta stock price:

Either the ROIC meets expectations and the market starts to reward the capex again. Meta stock will absolutely moon.

Or the ROIC is not good enough, but Zuckerberg will keep spending until the market tells him to stop. And by telling him to stop, I’m thinking META trading ~30% lower, at least.

While I don’t have a crystal ball, I do have the tools needed to navigate this episode.

The two variables I am closely tracking are: