Mind Drift to Clarity #01

~"Clear Thinker" is a better compliment than "Smart"~

Intro

I started this Substack mainly for myself. Putting my thoughts, ideas, and processes on paper is my way of working on self-improvement—and that, in the end, should reflect in my portfolio returns. Notice how I’m not listing portfolio gains as the top priority. They’re a byproduct of a solid process, a hunger for knowledge, and a clear mind. Not the other way around.

Mind Drift to Clarity is a new series for this Substack, and it’s going to be a bit unconventional. I’ll bounce between whatever ideas are swirling in my head at the moment. They might connect, or they might not—it’s a storm of thoughts. Writing them down is how I sift through the chaos to find the signal.

Some books stand out above the rest, and not for any fancy reason—just because I keep coming back to them. Each time I reread one, it hits differently. Read a book at 20, and you catch one layer of meaning. Pick it up again at 30, and it’s the same words, but you’re a different person, and the insight shifts. Ten years later, at 40, you’ll dive in once more—same text, new revelations. These are the kinds of books we call masterpieces.

Naval didn’t exactly write a book in the classic sense. Instead, he poured his thoughts into tweets and threads on Twitter/X. Eventually, someone gathered all his posts, interviews, and podcast bits into one place: The Almanack of Naval Ravikant: A Guide to Wealth and Happiness. For some reason, I keep coming back to it again and again. And one idea that always stands out is this:

So, let’s dive in and pull some clarity out of the mess around us—and within us. I’ll explore different topics along the way. The very end of this post will distill the essential ideas into bullet points. That’s where the clarity emerges.

The unintended consequences of government policies.

My goal as a trader or investor isn’t about being right or wrong. The market deals me a set of cards, and my job is to figure out the odds of winning and play my best hand. I could be completely wrong and still make money; that’s called being right for the wrong reasons—what matters in the end is the P&L, not my ego. If you check my X profile, you’ll spot this quote: ‘I’d far rather be happy than right any day.’ It’s a quirky line from The Hitchhiker’s Guide to the Galaxy, and I love it. A happy trader tends to be a profitable one. You get the drift.

I needed to clear that up because the political landscape is so polarized, and I’m not here to argue about whether Trump’s policies are righteous or wrong. Honestly, I don’t care. I’m not even American! My takes are strictly trading-focused, free of any political slant—at least, that’s the aim. Stripping out all bias is tricky, but it’s a goal worth chasing.

The message is loud and clear: Trump and Bessent are set on ‘cleansing’ the American economy of its government spending habit. They’ve been hammering this point since the election, and they mean business. This is about as close as it gets to austerity, which historically hasn’t been great for nominal growth or, by extension, risk assets. Bessent has said numerous times that public spending is crowding out the private sector. What’s that mean? The ‘crowding out’ effect happens when government spending, especially if funded by borrowing, competes with private investment for limited resources like capital. Heavy government borrowing jacks up interest rates, making it pricier for businesses and individuals to borrow and invest. That squeezes private sector activity and pushes it aside.

This view—Bessent’s view—digs deep into classical economics with its love for limited government, free markets, and the idea that resources are scarce and best allocated through market forces.

Elon Musk echoes the same vibe, constantly praising Milton Friedman while calling John Maynard Keynes ‘a great evil’:

I don’t box myself into labels like classical economist, Austrian, monetarist, or modern monetary theorist. I stay fluid and lean into whatever framework best fits the recent past. So far, Modern Monetary Theory (MMT) is holding the crown. Look at the COVID response: the U.S. government unleashed massive fiscal stimulus and tossed money everywhere. The stock market and economy didn’t blink. It was a huge growth driver. That brings us to a key principle:

The government’s deficit is the private sector’s credit

It’s a powerhouse that can overwhelm any monetary policy. Overdo it, and your economy runs hot—inflation spikes and stock market multiples climb. Underdo it, and things slow down. Multiples melt like snow in the sun.

The austerity program pushed by the Trump administration might pay off for the U.S. economy in the long run. But in the short to medium term, the odds are stacked against it. We are traders, we trade the odds.

All this political meddling brings a great quote to mind. Ironically, it’s from Ludwig von Mises—one of the fathers of the Austrian economic school:

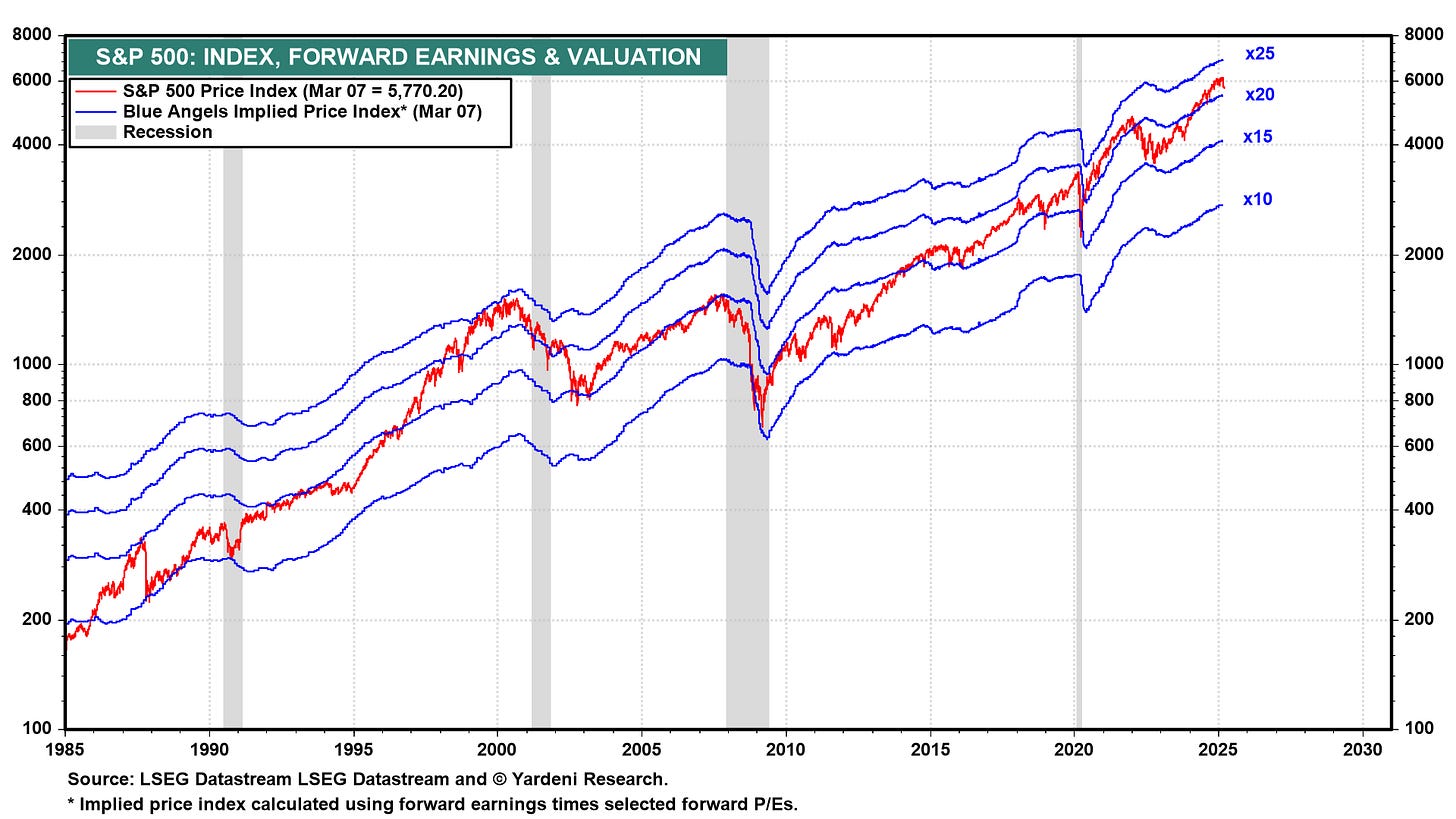

So, is the U.S. stock market about to tank as an unintended consequence of this cost-cutting master plan? Scott Bessent isn’t dumb, actually he is freaking smart. He explicitly warned us the market will feel some pain, and there’s no ‘Trump Put’ to save the day. Especially when the S&P is trading at 21x earnings:

You have to look around corners to spot the next big thing. That’s how you make money.

The unintended consequence is…

The death of TINA.

TINA (There Is No Alternative) suggests that investors have no viable alternative to investing in stocks, as options like bonds or cash offer low returns due to persistent low interest rates and inflation pressures. This mindset drives capital into equities, reinforcing the belief that, despite risks or overvaluation, the stock market remains the only practical choice for growth.

Thank you Grok for explaining my readers what TINA is! Now explain them what US Exceptionalism is.

US Exceptionalism is the belief that the United States is inherently unique or superior among nations, often attributed to its democratic ideals, economic opportunities, and historical role as a global leader. It’s used to justify America’s distinct policies, interventions, or resistance to international norms, framing it as a nation with a special destiny or responsibility.

Mmmhhh… I wonder what happen if you take these two concepts and mix them together…

Of course! The Alchemy of Finance nailed it: the historic bull run in the U.S. stock market came from two extraordinary forces. First, the long-term drop in U.S. interest rates set the stage for TINA—There Is No Alternative. Second, U.S. exceptionalism, fueled by the dollar’s global reserve status and America’s persistent trade deficit, kept the engine running.

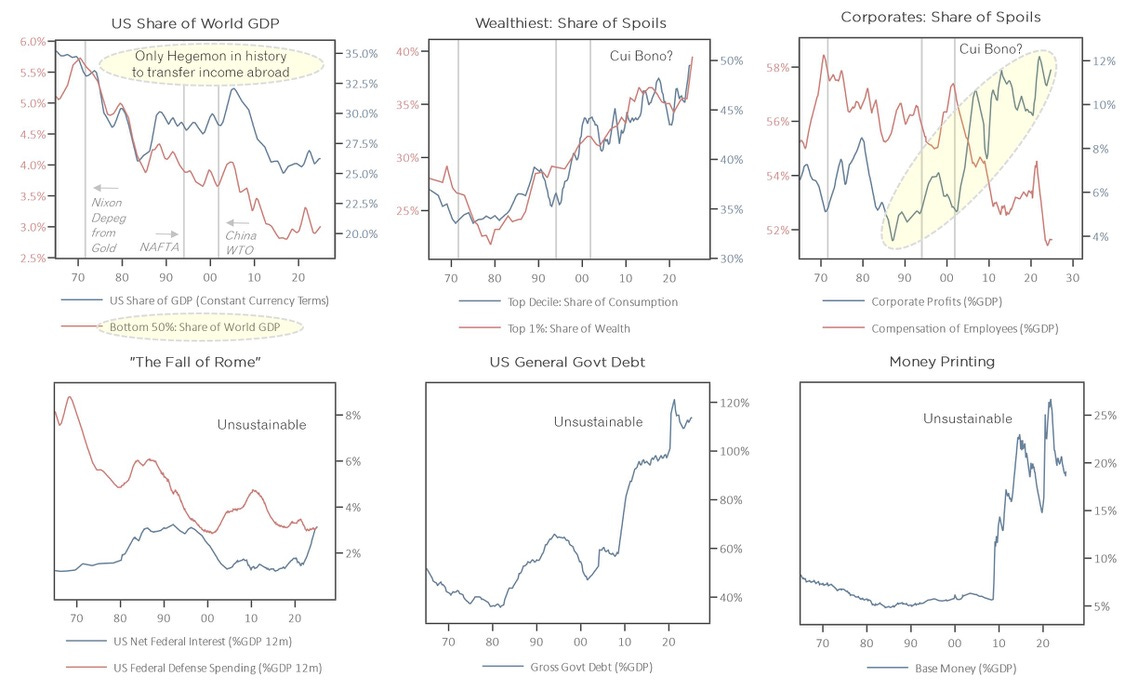

But every story has an ending, and this exuberant bull market is no exception. The flip side is a societal and economic mess: over-globalization, wealth inequality, concentrated corporate profits, unsustainable debt, and currency debasement. These six charts say it all:

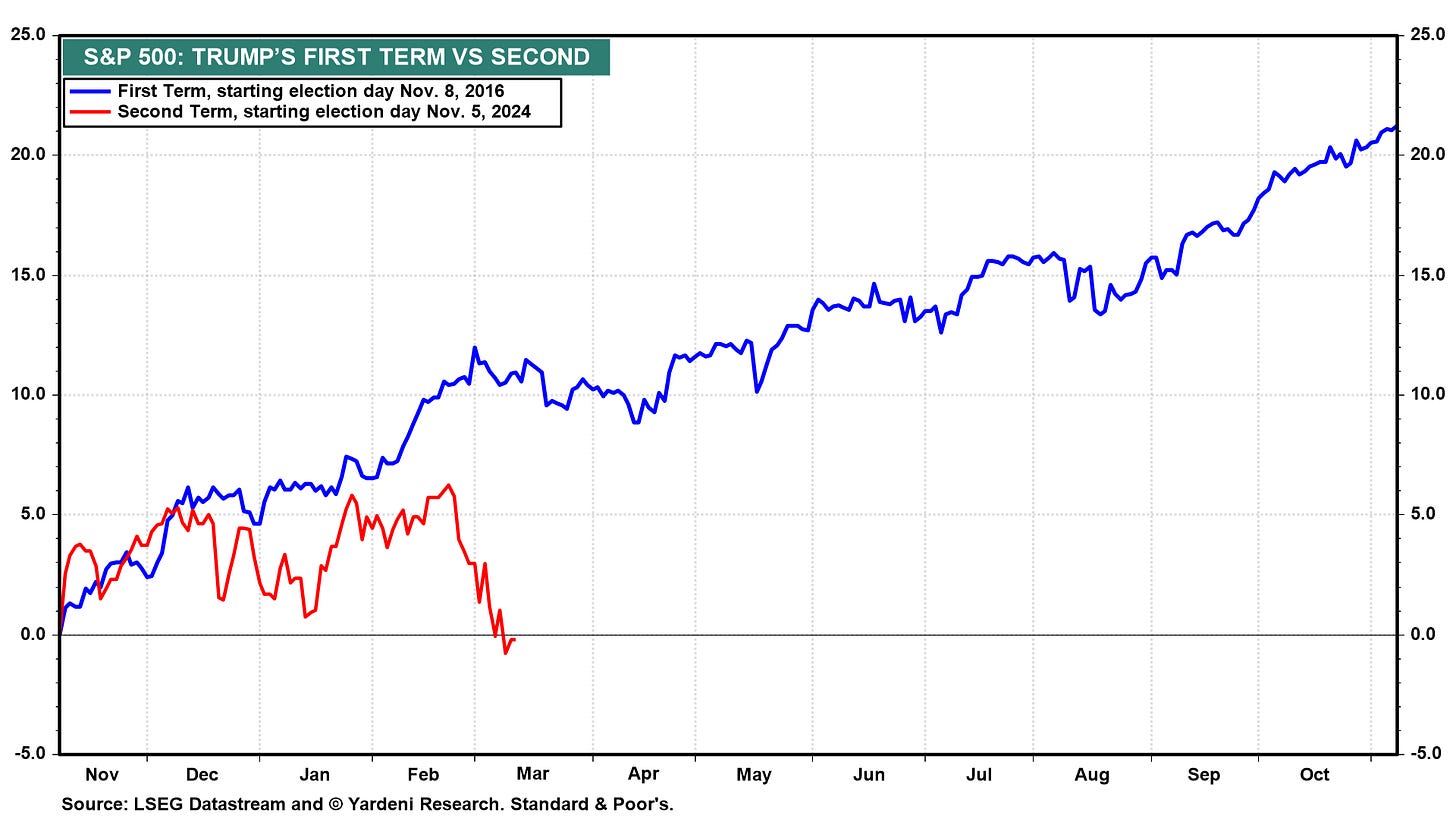

Unlike Trump 1.0, who kicked the can down the road, Trump 2.0 is laser-focused on reversing these trends at any cost. The market has definitely taken notice:

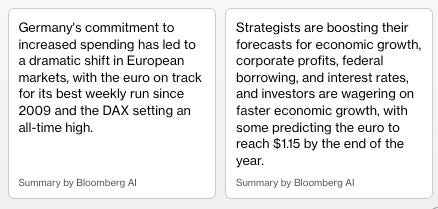

This is all unfolding as the rest of the world shifts to a totally different playbook. By stepping back from the global stage and ditching the role of world peacekeeper, Trump is forcing other economies into survival mode. They’re rearming and pulling the fiscal lever hard.

Trump killed TINA—there’s now another alternative, and it’s not American!

Europe is scrapping all debt brakes and gearing up to spend trillions in the coming years. Debt-to-GDP will climb.

Japan might follow the same path:

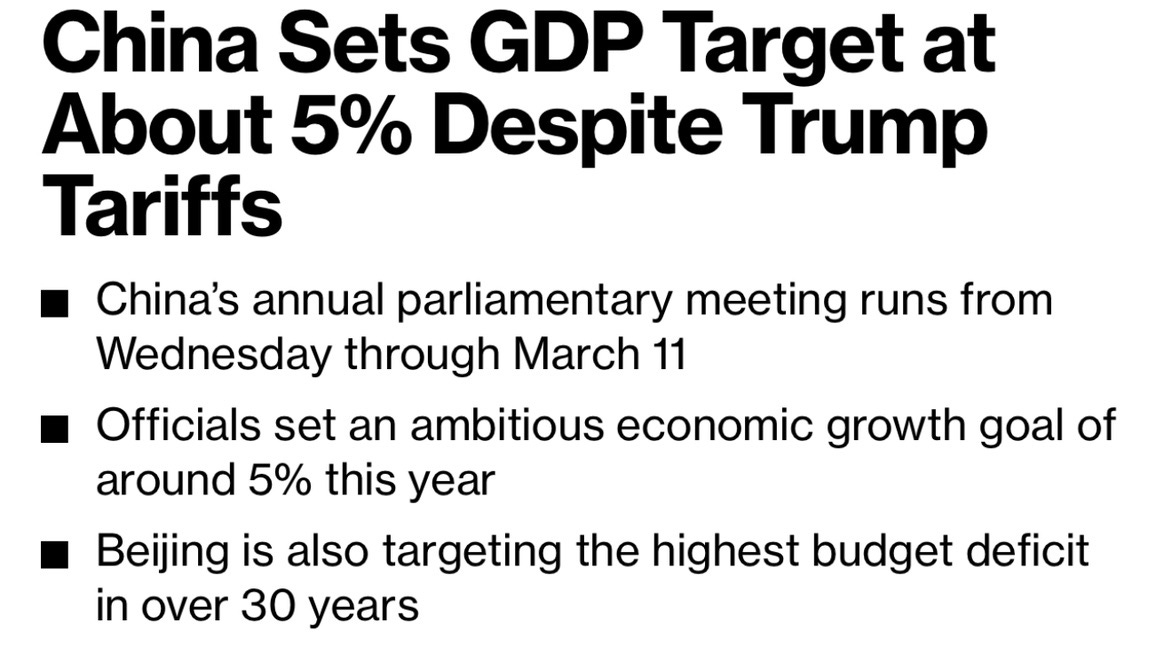

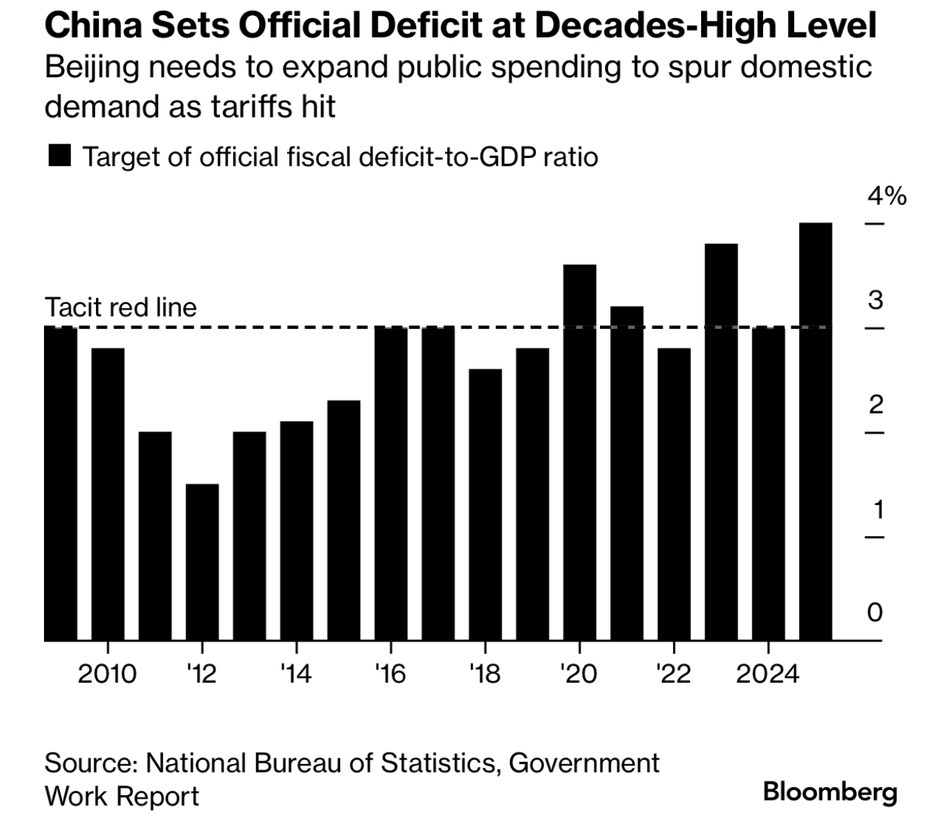

China is diving into full-on fiscal stimulus:

Meanwhile, countries like Brazil are riding a strong tailwind from a weaker dollar and U.S. outflows. The Brazilian stock market is sitting at a 10x P/E with a juicy 8% dividend.

Trading the Trump 2.0 market

Okay, now that we’ve got the big picture of where things stand, let’s get tactical.

What does this mean for asset allocation?

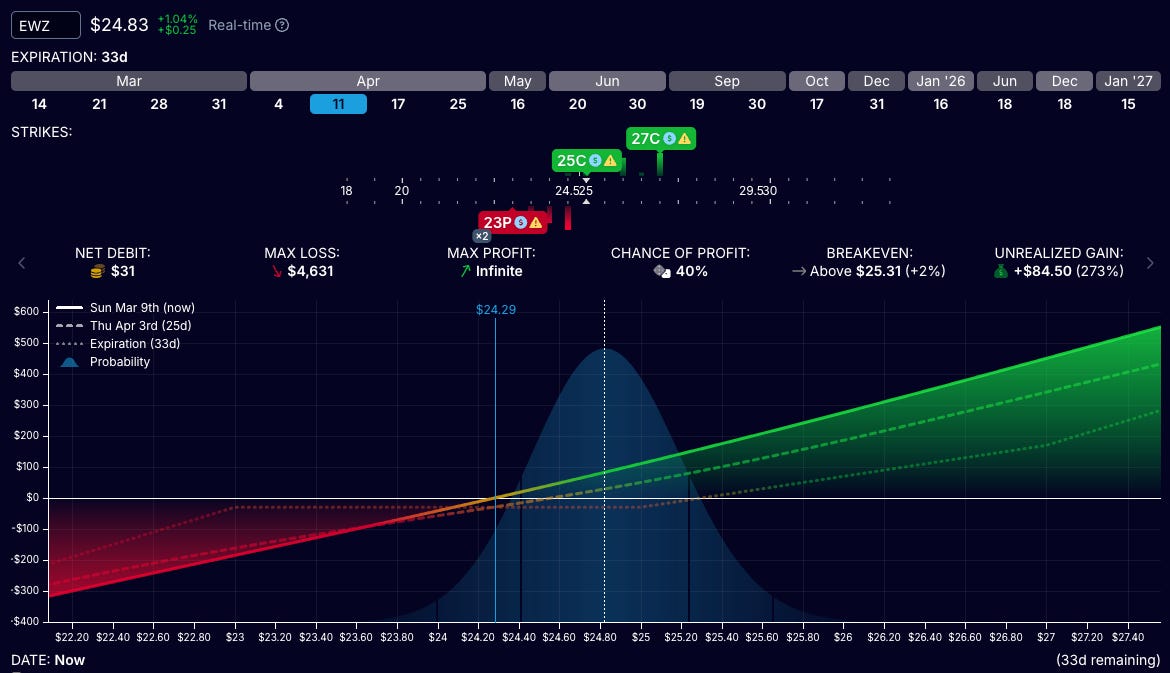

For long-only investors, steer clear of the U.S. stock market this year. Europe, China, Japan, and Brazil look more appealing. The headwinds in the U.S. are obvious. I’m long on some European industrial stocks to ride the fiscal spending wave. I’m also long on Chinese stocks, betting on fiscal stimulus and the Chinese AI boom. And I’m long on Brazilian stocks through the EWZ ETF.

I like this chart for EWZ. We corrected but held above the Fibonacci 0.618, paired with a DeMark 9. The relative performance against the SPX has been overwhelmingly positive this year. This trade still has legs.

Here’s the option structure I bought:

The cost of the structure is basically zero. I’m getting this exposure for free by opening up my downside if the ETF price drops below 23. I’d be thrilled if it dips and I get assigned the shares. If not, I’ll just ride the stock at no cost.

Should we be bullish on U.S. Treasury bonds?

That’s where things get a bit tricky…

If American Exceptionalism holds strong, then yes, we could keep buying U.S. Treasuries as a safe-haven asset. But the U.S. is already running a hefty 7% deficit-to-GDP. In a recession, with tax receipts tanking alongside GDP, we might see stress on U.S. creditworthiness. That could flip us into an Emerging Market playbook: yields rise as the economy slows. This scenario feels unlikely but entirely possible. We need to watch the stock-bond correlation closely. A negative correlation is essential to keep TINA and American Exceptionalism alive. Some folks struggle with this—they see stocks drop and bonds rise, and they panic. Chill out, man. If the negative correlation holds, we can safely buy the dip.

The margin for error is tight, though. Trump can’t afford a recession. If he doesn’t ease up and the market crashes 10-15%, the Fed will likely slash rates from 4% to around 2.5%, give or take. They won’t go back to zero. That would trigger a bull steepening of the yield curve, typically adding 100-150 basis points to the US10Y-US2Y spread. So, we’d end up with a U.S. 10-year yield at… 4%. That’s what Kuppy’s meme above is hinting at.

So, no, bonds aren’t an attractive investment. They’re decent trading sardines if you want to bet on a short-term growth scare, but don’t expect them to save your equity portfolio in a stock bear market.

Is it a short-term correction or a bear market?

A short-term correction usually isn’t driven by fundamentals. It’s a random event sparking a big deleverage in the system. Everyone rushes to sell as a VaR shock hits—volatility spikes, and risk limits shrink for banks and hedge funds. These moves show up as high correlation within the SPX. It’s a liquidity crunch. You’ve heard the saying: tops are a process, bottoms are events. The second part is especially true for sharp corrections.

I don’t see that playing out now. The selling has been orderly. Correlation is still low—COR1M at 30%. The dispersion index (DSPX) is stable and high, meaning the market’s busy sorting winners and losers from a Trump presidency. On balance, there are more losers than winners, so the market’s drifting down. This isn’t a degrossing event. We saw a similar pattern in the 2022 bear market, and that’s my base case right now. This year will be tough for stocks—a slow leak downward or just a flat tape. We’ll get some strong rallies along the way, perfect chances to reload on shorts and long VIX positions.

Make volatility great again

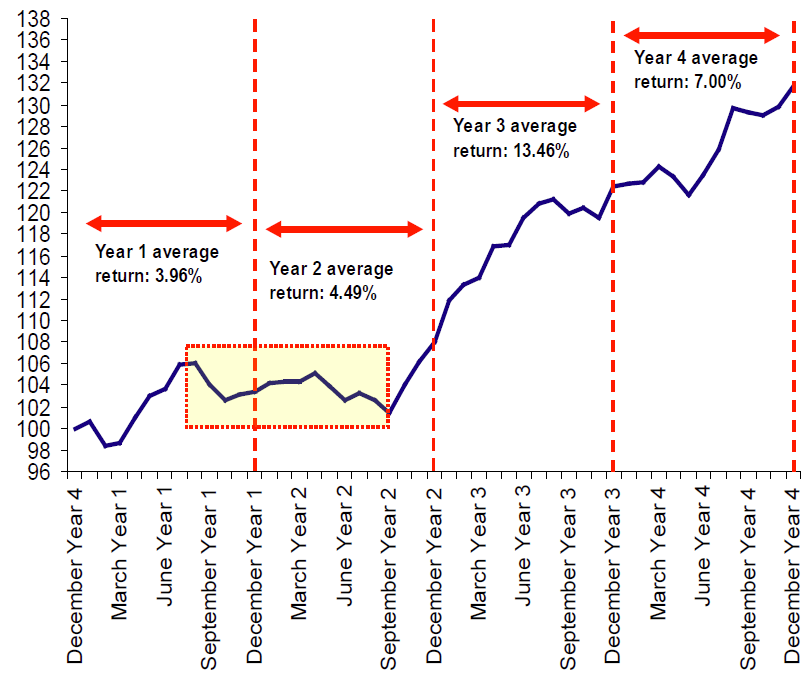

Below is the SPX seasonality for U.S. presidential cycles. On average, mid-year 1 to the end of year 2 delivers weak returns. I think Trump 2.0 will follow suit.

The first two years of this cycle will be range-bound, driven by headlines. Markets too high? Trump talks them down with tariffs or other bombshells. Markets too low? He tweets pro-market comments or dials back tariffs. My take: the VIX will hover between 14 and 20 on average. It’s the only mean-reverting asset you can easily trade—milk it! Just don’t blow up. Sizing is everything.

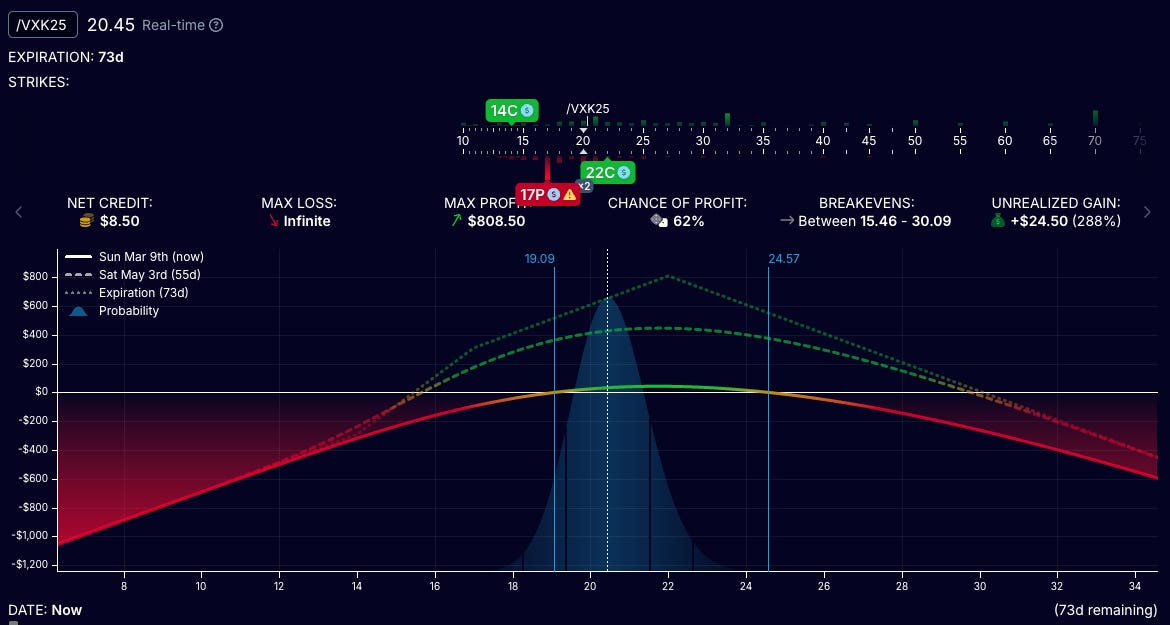

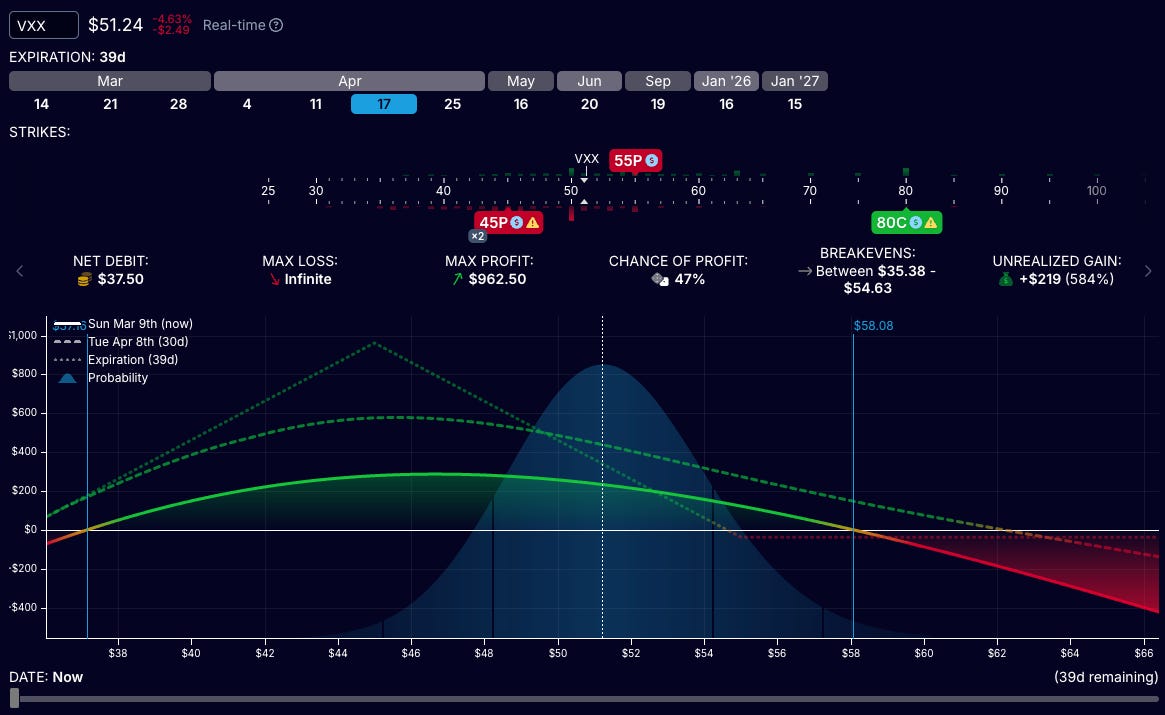

Earlier this week, I shared a VIX options trade. I’ll get paid if the VIX stays within a wide 15.5-30 range—about as close to ‘free’ money as it gets. The trick is not oversizing. If VIX spot spikes to 50, futures might hit ~40. You need to weather the drawdown and add more short VIX to your position.

I’ve also added this VXX structure to my portfolio, again betting on the VIX staying in a range, though a bit lower than the last trade. If there’s a VIX spike, I’d be happy to short the VXX ETF at 80. Sizing, once again, is king.

On being contrarian

If you’ve been reading my posts since day one, you might peg me as a hardcore contrarian. Since January, I’ve been warning against owning U.S. stocks, betting on a U.S. dollar trend reversal, and doubling down on other contrarian plays.

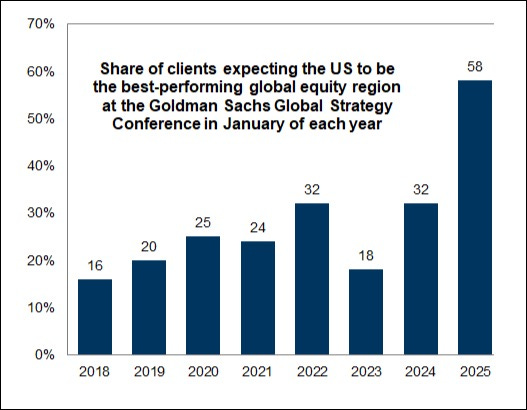

This kicked off when everyone was riding high on optimism:

Funny how sentiment flips fast:

Remember my first post Missing: a wall of worry ?

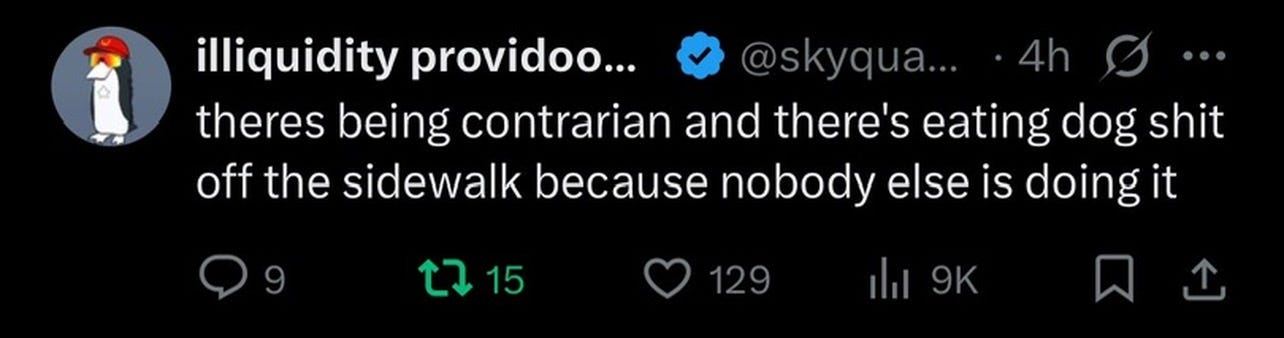

The cure to this madness is a healthy contrarian approach: a shrewd investor can identify points of extreme greed or fear and take action against the trend. However, it requires careful planning and a very good understanding of the market signals flashing in front of their eyes.

Getting in front of a trend, solely based on price, is asking for trouble. An overbought market can always get more overbought (Cocoa, Nvidia), and oversold can always get more oversold (Oil future dipping in negative price).

We don’t want to be contrarian price, but contrarian participation (positioning & sentiment)

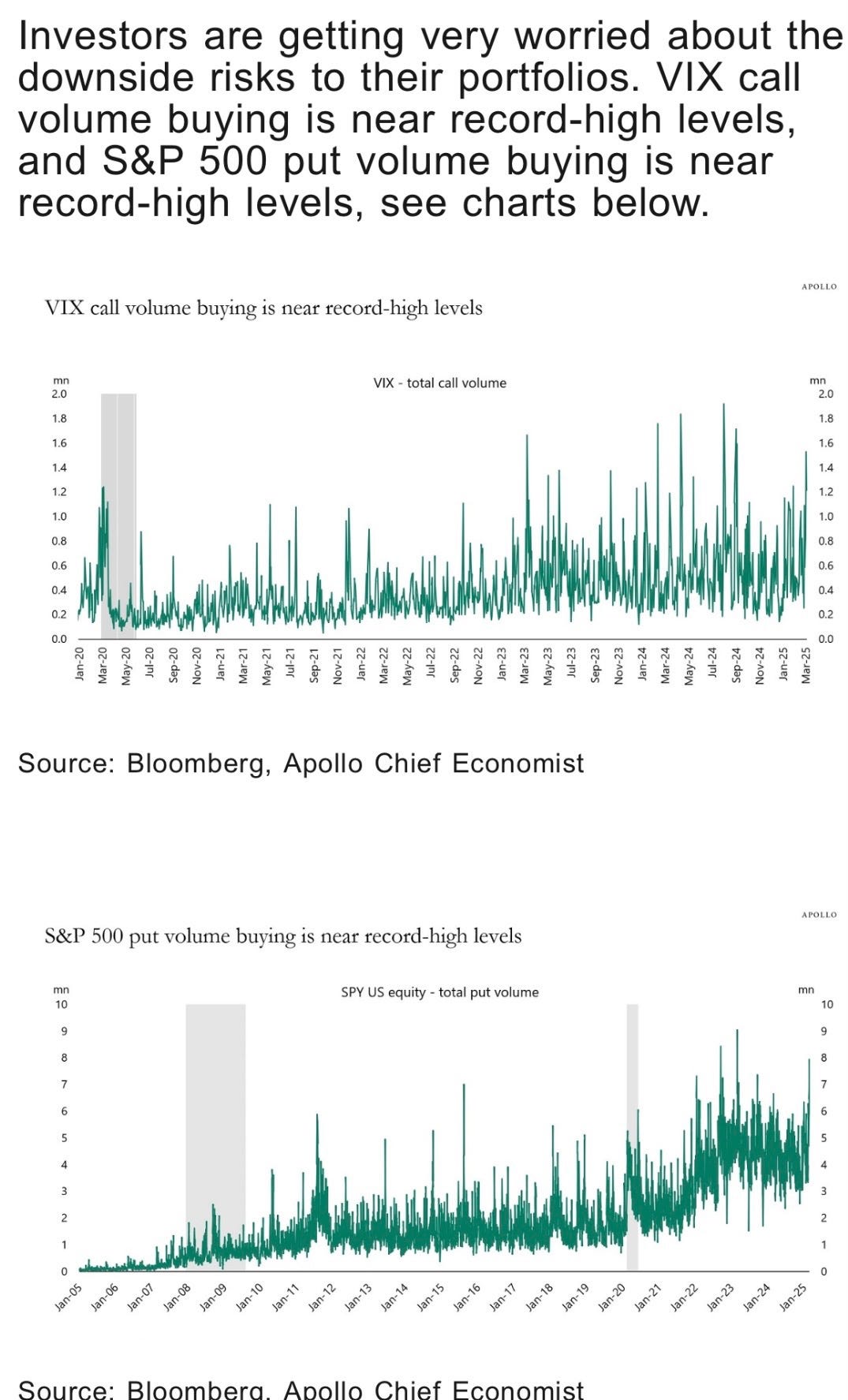

We’re now seeing short-term fear creep in—people are snapping up VIX calls and SPX puts. But keep the big picture in mind: I’m not jumping into stocks with both hands here. Always weigh positioning data against the broader context. Ask yourself: Is this actionable tactically or strategically? Right now, it’s a tactical fear signal, but there’s no sign of people dumping stocks or abandoning the U.S. market. That’ll come eventually—just not yet. That’s why I am busy selling VIX optionality instead of buying US stocks directly.

I saw a hilarious tweet about being contrarian. There’s a thin line between a winning contrarian bet and plain stupidity:

I also stumbled across this quote below. It’s a simple framework that stacks the odds in your favor. Articulate it clearly, tie it to a trigger event, and you don’t even need the idea to fully play out. To make money, you just need the market to reprice the probability of your contrarian scenario.

My take on AI—Mag7 and Capex

I’m really struggling to size up the AI situation. I’ve read super bearish takes and wildly bullish ones. Since my focus is mainly on markets, I’ll keep it short and sweet:

AI is definitely useful—I use it daily.

I’ve been hopping between chatbots. Switching costs? Zero. It’s a commodity.

It’s getting cheaper by the day.

There is 0 network effect.

AI chatbots don’t scale like traditional software. OpenAI bleeds money on every prompt and output. More users, more losses.

U.S. tech giants have poured tons of capex into it. The return on these investments? Unknown. The market won’t boost their stocks until it shows up in earnings. That could take time, and it’ll sting if the return on invested capital (ROIC) drops.

Companies have likely overpaid for capex and talent. I read somewhere: The cost of landing a top AI researcher rivals an NFL quarterback’s price tag. Guys, that’s got to be a peak sentiment red flag!

China’s racing to churn out chips and slash costs.

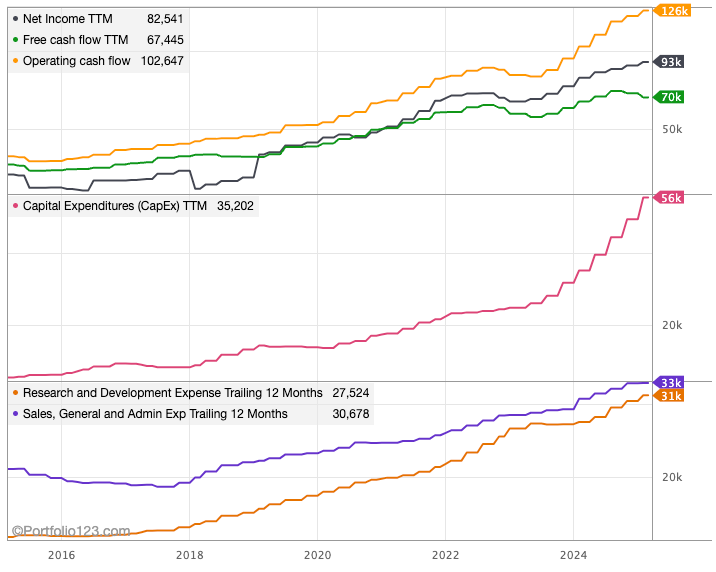

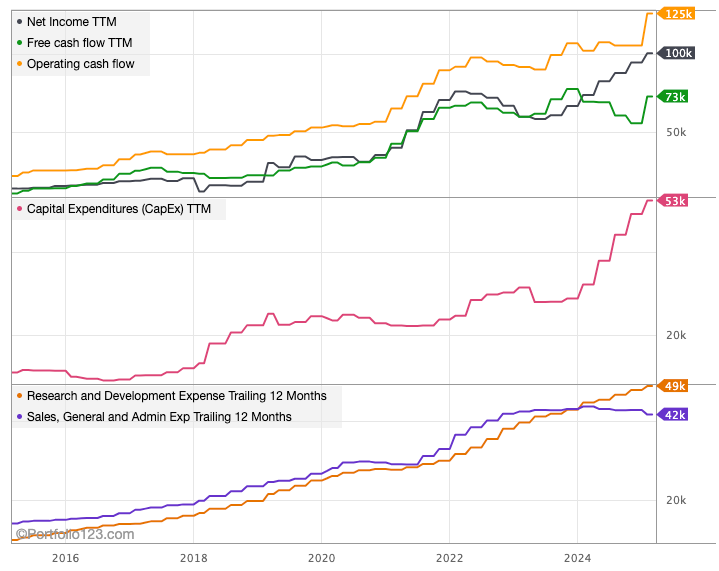

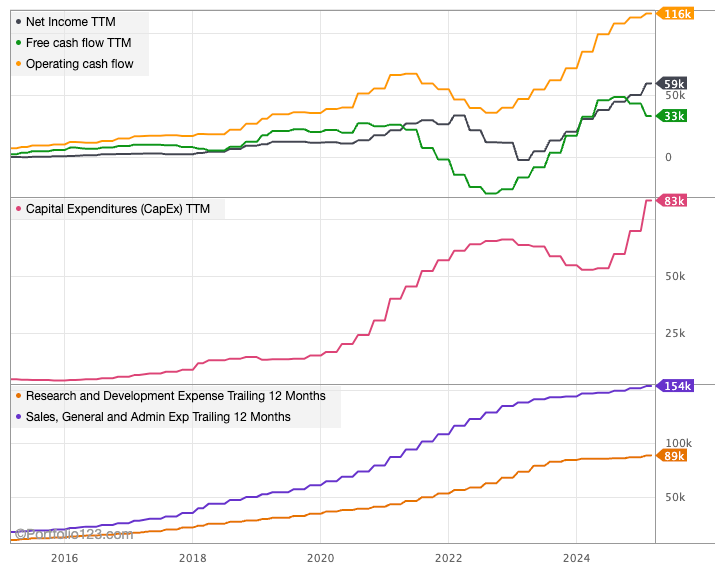

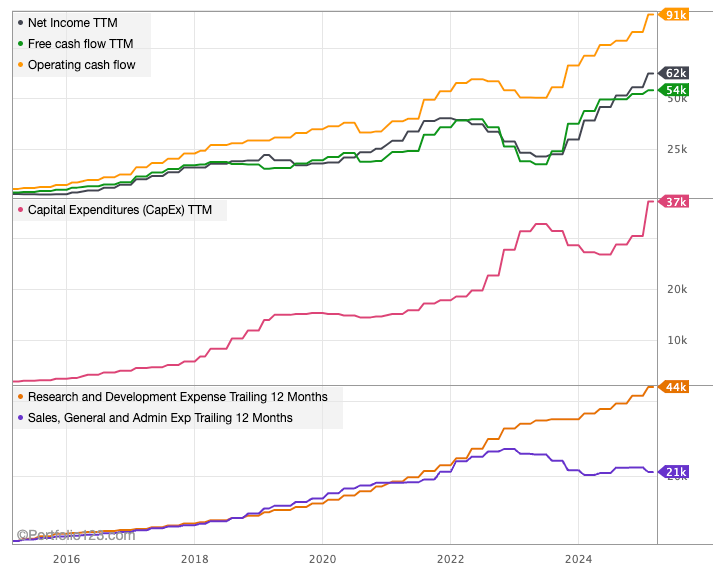

For fun, let’s peek at the cash flows and capex for the big tech giants. Focus on the mid panel with the pink line, that’s the CapEx Trailing Twelve Months:

This is dicey. This capex cycle is dwarfing all the previous ones. The market will keep a skeptical eye on the Return on Invested Capital. Buying the dip on these companies? That’s a high-risk move.

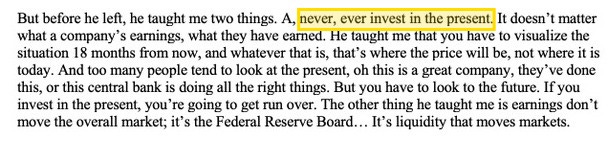

I’ll wrap up this AI detour with a gem from the GOAT, Stanley Druckenmiller. In an interview, he shared his first mentor’s advice: never invest in the present.

I’m convinced many shareholders of NVDA, META, GOOG, MSFT, AAPL, and the like are committing this cardinal sin. You can’t extrapolate a trend forever—especially not in the thick of the biggest capex cycle these companies have ever seen.

The Clarity

Here are the core ideas to take away from this post. They’re actionable, cutting through the noise like beacons in a foggy world:

A shrinking fiscal impulse (government spending dropping) is bad news for stocks in the short and medium term. This hits harder when the market’s priced at lofty multiples—like 21x forward earnings.

Every government intervention creates unintended consequences.

TINA and U.S. Exceptionalism are on shaky ground. As long as the Oval Office keeps its current tune, the risk/reward of holding U.S. stocks looks grim.

US is aiming to lower debt-to-GDP ratio. Rest Of the World wants to increase it. Bearish US risk assets, Bullish ROW risk assets.

Keep an eye on the bond market. If the USD weakens, U.S. yields spike, and the stock market tanks, it’s a death knell for U.S. Exceptionalism. It signals capital fleeing the U.S.

Lower, stable U.S. yields and USD are must-haves for a tradable dip in U.S. equities. That would signal Mission Accomplished for Trump and Bessent. Track the MOVE index and implied volatility on EURUSD and USDJPY.

Stay laser-focused on any shift in tone from the Oval Office on spending and fiscal policy. That’s your cue to go long U.S. stocks again.

We’re in a headline-driven market right now. Trading volatility beats trading delta. First layer: short the vol of vol. Second layer: short the VIX.

The Mag 7 are dicey thanks to this capex cycle. The market needs to reward that capex before we bite. Until then, we’re skeptical—no dip-buying here. We’d rather short any dead-cat bounce outright.

Okay, that’s it for the first issue of Mind Drift to Clarity. Thanks for reading, and if you enjoy please share this post.