Missing: a wall of worry

what's left to climb?

3 axioms from a market hitchhiker

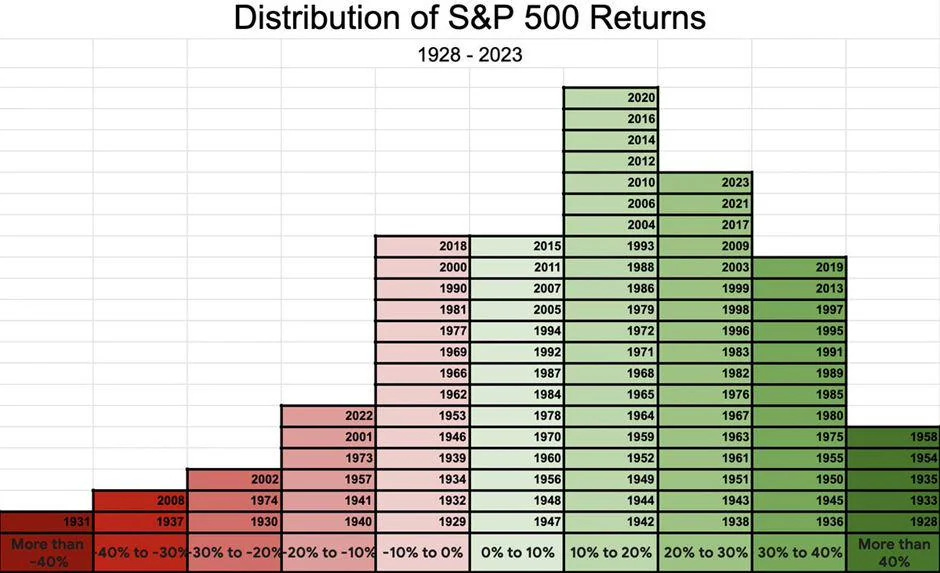

J.P. Morgan allegedly said “Funny thing about these skyscrapers—not a single one was built by a bear!”. And he was quite right! Ever since he died in 1913, the S&P 500 has returned approximately a whopping 35,500%. Good luck being a bear! Over the past 30 years, the US stock market has only recorded 11 down years:

1994: -1.54%

2000: -10.14%

2001: -13.04%

2002: -23.37%

2008: -38.49%

2018: -4.23%

2022: -19.44%

And for all the positive years, the market has returned a median performance of +21.04%.

Amazingly, the probability of [+30%,40%] is the same as [0%;10%], and both inferior to [10%,30%]. When the market is up, it’s up by quite a lot (above any bullish forecast at the beginning of the year).

************************************************************************

Hitchhiker axiom 1: Perma-bulls are right 69% of the time, Perma-bear are not wrong 31% of the time. Eventually only the bulls get to build nice things.

************************************************************************

As a trader and investor, you have to be long the market most of the time, otherwise you are just swimming against the current.

A good trader is optimistic and skeptical at the same time. So is the market.

By nature the market is optimistic, and it is pricing economic growth. But it is also skeptical: it is made of rational agents who are critical thinkers.

Why do we have bubbles & cycles in the market?

Here enters Psychology of Crowds by Gustave Le Bon. This book never gets old, it gave us some key insights which are still relevant today. Here are some concepts we can apply to market dynamics:

The Loss of Individual Rationality: individuals within a crowd often lose their capacity for rational thought, succumbing instead to a "crowd mind” (animal spirits). This phenomenon leads to behaviors driven by emotion rather than logic, making crowds susceptible to manipulation by charismatic leaders or prevailing sentiments. In markets, this is the fuel for irrational exuberance during bull markets or panic selling during downturns, where investors act against their better judgment due to collective emotions.

Herding Behavior: this principle suggests that when a significant number of investors adopt a particular view—be it bullish or bearish—others are likely to follow suit, reinforcing the trend. This can create price movements that are not supported by fundamental analysis, resulting in asset bubbles or crashes. Understanding this can help investors recognize when market movements may be driven more by sentiment than by fundamentals. Looking at you Palantir trading at 420x P/E

************************************************************************

Hitchhiker axiom 2: progress and development create secular trends, human pyschology creates volatility around the trends.

************************************************************************

The cure to this madness is a healthy contrarian approach: a shrewd investor can identify points of extreme greed or fear and take action against the trend. However, it requires careful planning and a very good understanding of the market signals flashing in front of their eyes.

Getting in front of a trend, solely based on price, is asking for trouble. An overbought market can always get more overbought (Cocoa, Nvidia), and oversold can always get more oversold (Oil future dipping in negative price).

We don’t want to be contrarian price, but contrarian participation (positioning & sentiment)

************************************************************************

Hitchhiker axiom 3: don’t be contrarian price but be contrarian participation

************************************************************************

Don’t be a fool, the real money is made riding a trend. Only the act of profit taking is contrarian. You want to hop on a freight train while it’s leaving the station at low speed, not when it’s riding at 200 miles per hour towards you.

A market with no fear

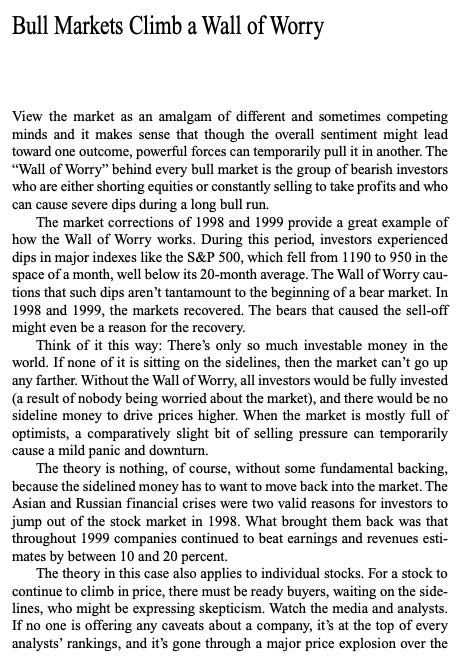

As the wall street maxim goes: Bull markets climb a wall of worry. But if there is no wall of worry, what’s left to worry about?

From the book Buy the Rumor, Sell the Fact : 85 Maxims of Investing and What They Really Mean

This wall of worry is currently missing, bears are dead and capitulating.

I’ve curated a slide deck for you. Not so often you get to see such stretched levels in sentiment, flows, positioning, and obviously valuations. While stupid can get more stupider, eventually the elastic band will snap back.

I’m also here to remind you of rules #5 and #9 from Bob Farrell's 10 Rules:

#5 - The public buys the most at the top and the least at the bottom

A quick proxy real time assessment of the retail involvment is simply tracking Robinhood stock. Well well… Back to IPO level and the crazyness of Q4 2021.

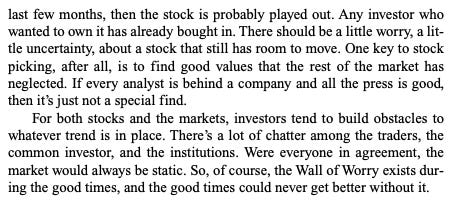

#9 - When all the experts and forecasts agree – something else is going to happen

Warren the GOAT:

Catalyst

What could be the trigger event for a move down in the S&P 500? Let’s reverse the question and look at the current condition: why is the S&P500 volatility so low at the moment?

Exponential historical vol, ATR & Bolling Bands Width are in max contraction mode

1st reason: the JPM option whale. If you are not familiar with it, JP Morgan is basically long of ~40k call options on the S&P500 expiring 31st December, strike 6050. We are right at this level, the volatility is pinned because of the long gamma position held by the bank/dealers.

2nd reason: momentum factor had an incredible run this year, retails are sitting on massive positive pnl from their favorite stocks (MSTR, CVNA, RDDT, PLTR, NVDA etc). And guess what, they don’t like to pay tax! So they hold until year end, and at the same time are harvesting tax losses by selling their underperformers. As long as the momentum factor is doing well, the volatility on the index level remains low and will keep contracting.

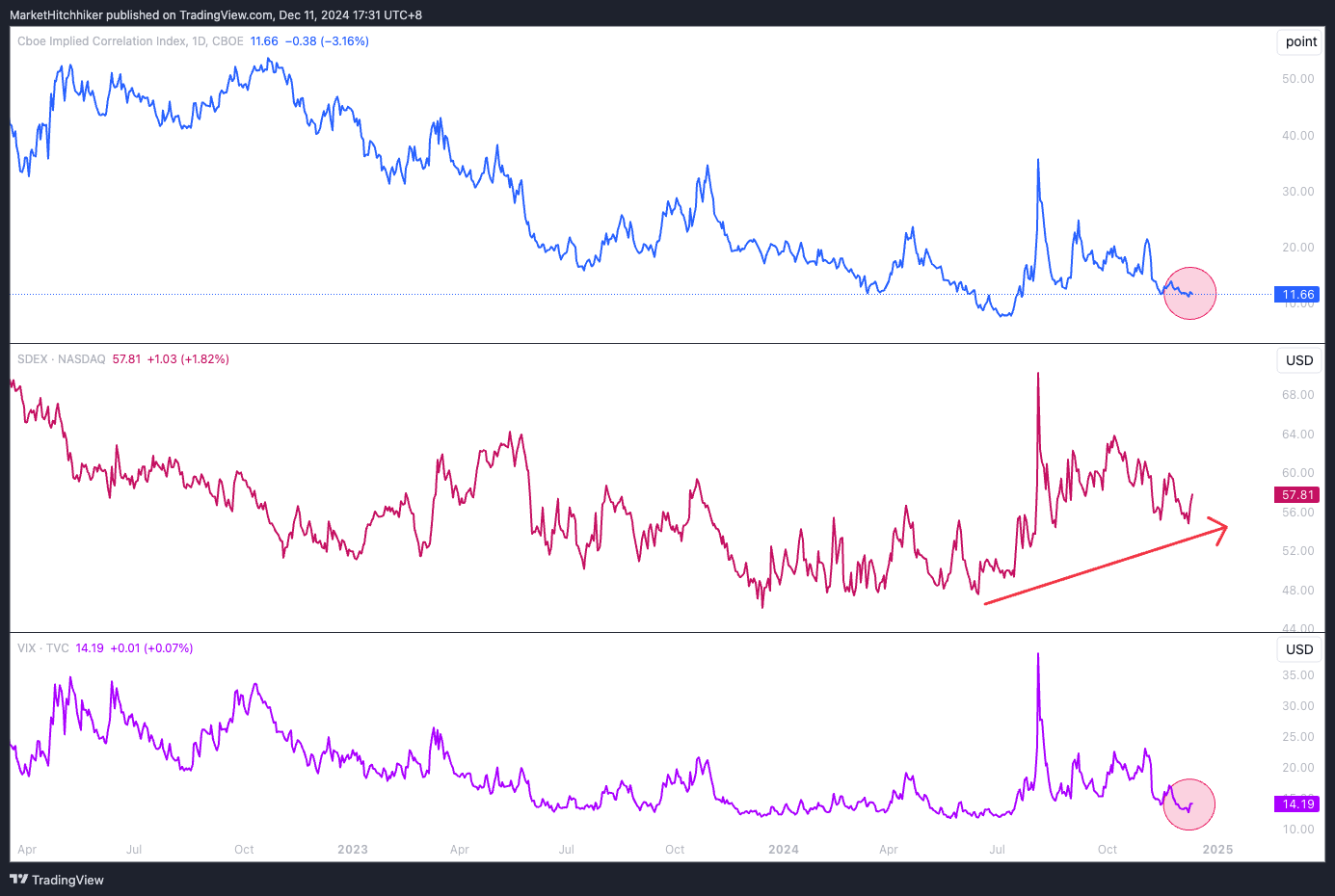

3rd reason: correlation is really low, stocks are moving in the opposite direction while the index is not doing anything. This is a dispersion heaven for pods.

Implied correl 3m in the lows, skew is basing higher, vix in the lows.

4th reason: no one care about geopolitical events anymore, Ukraine/Middle-East/Taiwan, big news fatigue on these guys. No more vol premium, it’s priced out.

Well… if the vol gets un-pinned after the 31st of December following the JPM whale expiry, then we might be in for a lot of surprises in January or February.

Momo, correl, geopol events…

Be ready to…

Action & Trades

Guys, I am not asking you to outright short the market, instead I’m nudging you to take some risk off the table. You had a great run? Great! Now it’s time to baby-sit those gains and look at tactical trades, or degross the book, or simply re-focus your portfolio on your strong conviction holdings.

The tactical trade

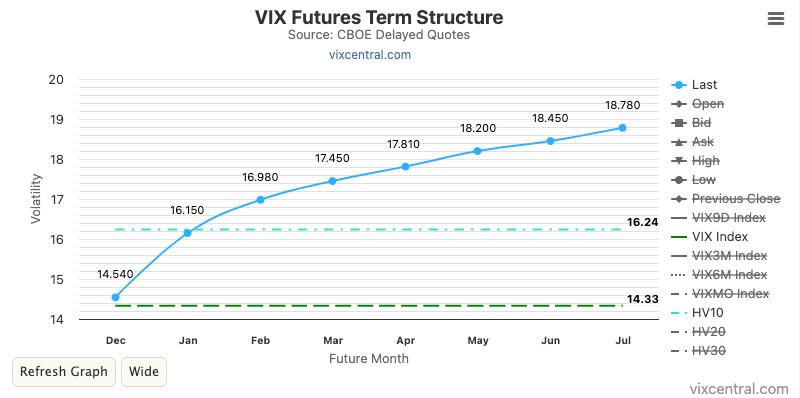

I like the below VIX combo:

+1x VIX 13C 2/19/25 at 4.22

-1× VIX 20C 2/19/25 at 1.63

-1× VIX 16P 2/19/25 at 1.59

Total cost 1.00$ (at mid)

Pnl profile of the combo for one contract with the passage of time:

The structure helps you remain close to flat pnl if the vix realizes its term structure, albeit you give up some upside.

If you don’t feel like going for the combo, you can buy the Feb contract, but roll it in mid-Jan to avoid the last painful month of roll down (steepest part of the curve).

Time to degross!

For non-tactical portfolios, like simple buy and hold with a long time horizon, one does not need to buy VIX. You can simply decrease your risk by degrossing and allocating some part of your portfolio in cash. Warren Buffet is close to 30% cash.

It is also a great time to review each stock individually, do you really have strong convictions on this name? How would you feel if the share drops by 50%?

And don’t let dust stack in! What do I mean by that? If you have many small positions on some random stocks for which you don’t have a strong opinion, then sell them! In a market correction, correlation goes to 1 and all this dust will tank and show a big fat red pnl on your screen.

TL;DR

Market is VERY frothy, every taxi driver is long momo stocks or crypto shitcoins, and bears are now officially a Critically Endangered species

Being a bear sucks; being a bull is awesome 69% of the time

Don’t fade price, but participation

Volatility will remain low until end of the year, but then there is a window of weakness

Implied Volatility is cheap, buy it! Or at least degross your book

Stay safu in 2025 and don’t get jinxed!

Not only the content is insightful and informative but it’s also a pleasure to read through.

Blending substance with a touch of humour, well done !

I love it thanks for the insights!

Feeling we have shared common experience along the way :D

Any cheaper tactical hedge you’d recommend?