# Post CPI musings

Mr Market is showing us its cards

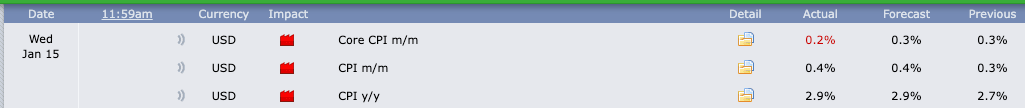

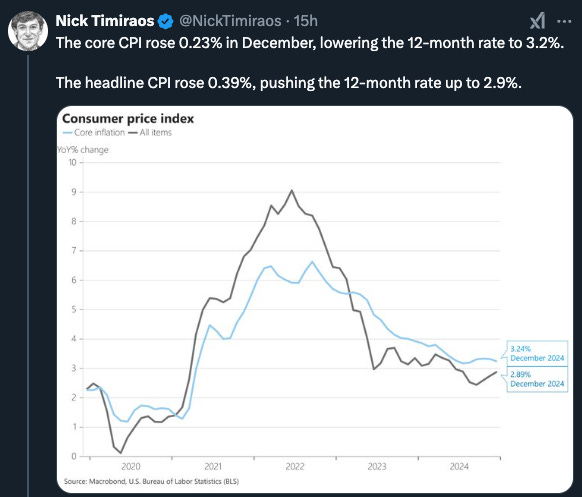

Quite the risk-on move yesterday post CPI release! All it took was a small miss on the Core CPI m/m, while the headline CPI met the forecast. Seems like a lot of folks degrossed their book before the print and bought back their position after the release.

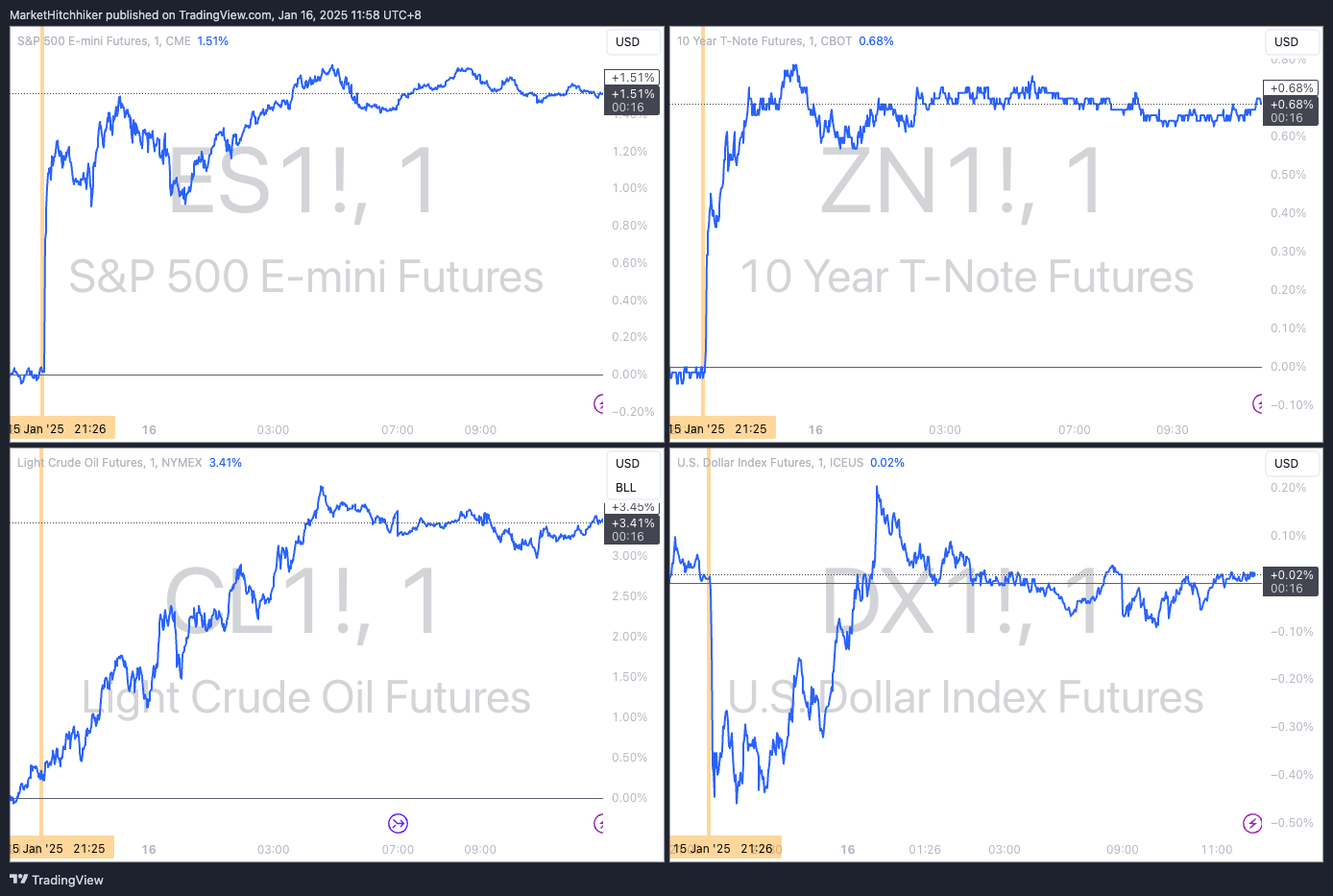

The S&P futures (ES1!) and the 10 Year T-Note Futures (ZN1!) ripped on the CPI release with frenetic algo buying but did not follow through that much during the day. More importantly, we saw the oil future front month (CL1!) rallying from the print and until the close, this is a powerful move on a “cold” CPI!

Meanwhile the DXY future (DX1!) ended-up unchanged on the day, this is not what it was supposed to do! This is quite the correlation failure, my guess is DXY will keep grinding higher in the days to come. As a reminder DXY is heavily skewed toward Euro, we will investigate the details further down this post.

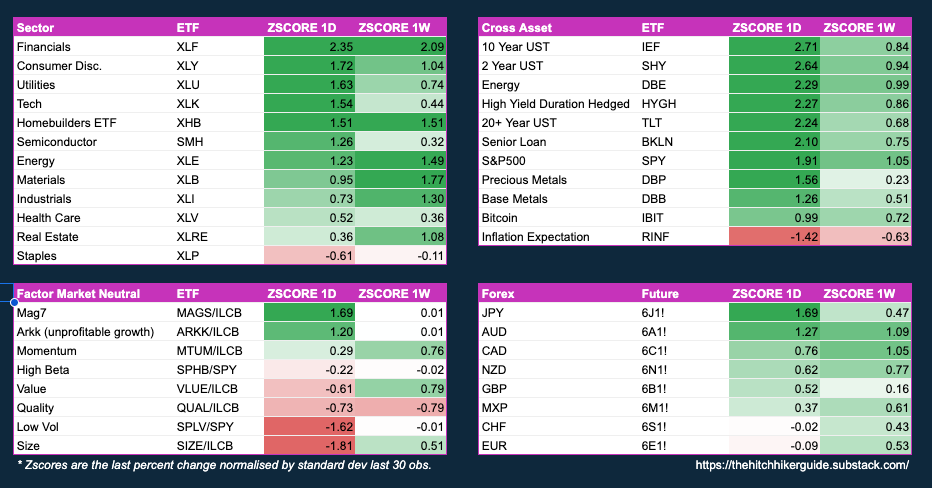

Let’s have a look at the Z-Score 1 day for my macro watchlist. The Z-Score 1 day is simply the last close percentage change divided by the realised volatility 30 days. By normalizing all the returns by their volatility, we can compare across assets the magnitude of the change regardless of the volatility level of each asset.

Sectors:

Financials were the strongest sector as big banks kicked off their earnings seasons, and they are doing extremely well.

Consumer Discretionary had a strong move up, driven by tesla up 8% and amazon up 2.6%.

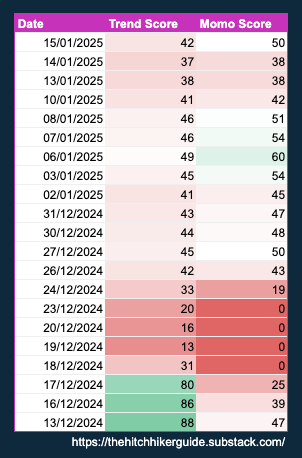

→ Financials and Consumer Discretionary are the top scoring sectors on my Trend score (see table below “Trend & Momentum scores”). When people are degrossed and when they need to buy back some risk, they will most often buy back into what worked before. This is pure pavlovian buying here. I would not read too much into it.

Homebuilders had a strong move, it’s a very sensitive sector to the back end of the yield curve. The move makes sense, and the trend and momentum have been horrendous. It’s probably a good place to bet for lower yields (if that’s your view, not mine).

Energy is super interesting, it’s in the middle of the pack with a decent move up. It confirms the move on the oil future, and it tells a lot about this CPI figure: market is relieved, but overall, it’s still a higher than pre-covid level of inflation. It’s still hot out there.

Real Estate is disappointing with only a 0.36 Z-Score. This sector is doomed as long as refinancing rate are high. It will take lot of time to recover. Homebuilder is a much better place for your money. The refinancing market is dead while we still need more houses to be built.

Staples is the laggard, it’s typical from a risk-on move and shows that the economy growth is still largely positive despite a “lower” inflation.

Factors:

Let’s not fool ourselves, we rallied hard in the most speculative factors: Mag7 (mega caps) and unprofitable growth. Value, Quality and Low Vol are down relatively to the market. It’s not exactly what you want to see if you are bullish equities. We need a broadening of the market into smaller caps, and better quality stuff. This quick factor analysis makes me think we are seeing a counter trend rally. It’s ferocious: a big green candle to retrace half of the down move on SPX, we squeeze the short sellers while we drag new buyers at a bad price.

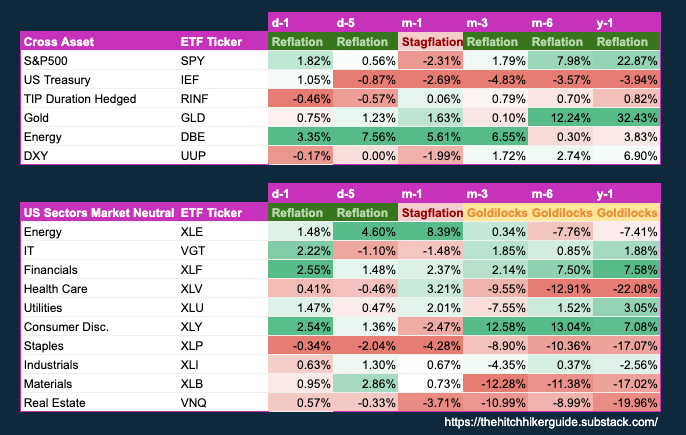

Cross Asset:

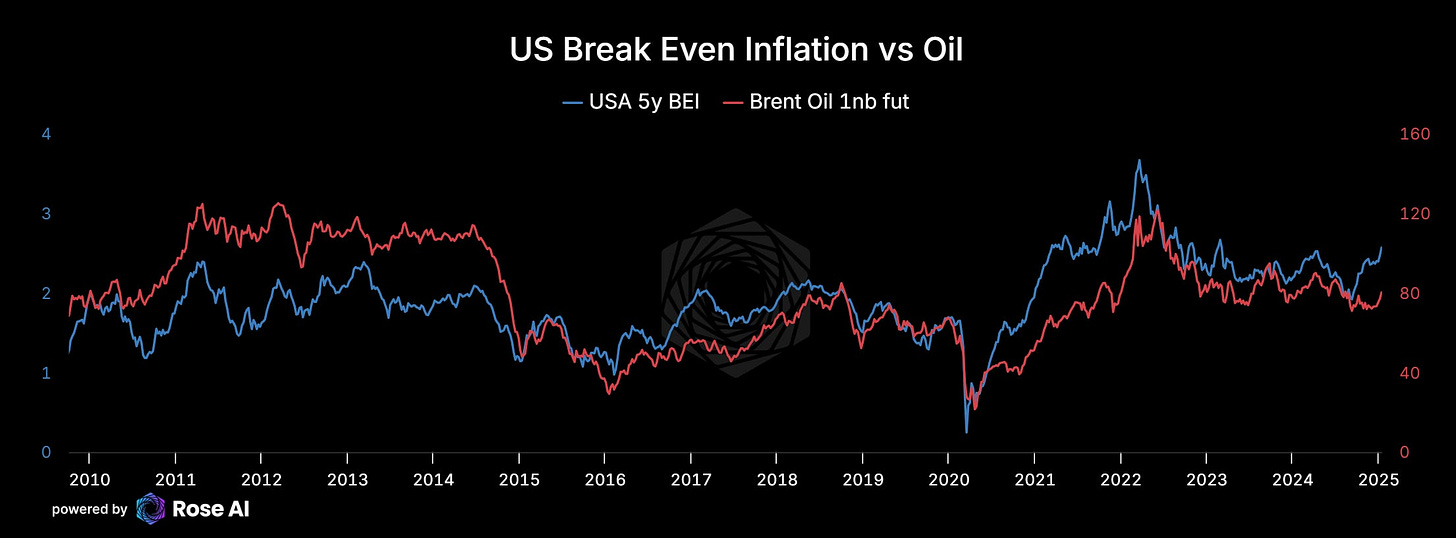

Energy ripping while Inflation Expectations tanking? Excuse me but WTF. They should move together, evidence the below chart from the excellent substack Campbellrumble:

Forex:

Yen is top performer, we had some hawkish news from Japan yesterday and it’s the best forex pair (USD/JPY) to bet on lower yield in the US (and obviously higher yield in Japan). The move makes lot of sense. In fact, I started to buy some call spread 2 months yesterday before the CPI. I’m slowly building the position, implied volatility is a bit high with a one-year window, but I believe it’s still cheap with Trump inauguration next week.

Then you have the pro-commodity pairs performing well: AUD, NZD and CAD. People are massively short these guys. I expect more squeeze in the future. I especially like AUD and NZD for a long position. I’m not expecting crazy tariffs on them as they are mostly exporting commodities and agriculture. Tariffs, if they happen, should be gradual to avoid an inflation spike (these items would flow directly into CPI).

Euro traded like a dog. That’s why your DXY ended up flat on the day. It’s a big correlation failure for the pair. I actually bought Euro call spreads 1m as well before the print. Super disappointing, I’m planning to unwind these call spreads and instead get into AUD and NZD.

Trend & Momentum scores as of today:

So, what does this CPI release tells us about our quads. Are we still in goldilocks? Are we entering deflation regime? First, looking at CPI, even if we had a “low” print yesterday, in absolute level we are still higher than target, hovering around 3% on both Core and Headline inflation. The second derivative, aka momentum, is fading a lot. In other words, the rate of change of inflation YoY is very small. We are stuck in this 3% plateau.

Hitchhiker Reminder:

CPI is a backward looking

CPI is a made-up number, it can be rounded, it can be skewed, methodology can be updated

Market is forward looking

Oil & Energy at large is the number one input for inflation. Growth is coming from transforming energy into actual stuff.

Invesco DB Energy ETF (DBE) has the below holdings. This is NOT the ETF I was buying 2 days ago, instead I bought DBC, it has a broader allocation to commodities (trade alert was in the chat).

Looking at the chart, DBE is challenging the upper range. It failed to break support in September and went on a tear. This is quite interesting as we have two well identified headwinds: Trump with “Drill Baby Drill”, and now the cease fire in Gaza. And yet, oil is ripping. Pay attention.

Long story short, I still believe we are entering a reflation quad, and inflation is unlikely to keep going down now. Looking at the market, my monitor is agreeing with this view:

What about our bearish view on SPX? Well, yesterday hurt a lot, but that’s what a counter trend move does. As said earlier, it squeezes the late short and drag new buyers at bad price. The below resistance line in red is probably what everyone is looking at, therefore it will not work. I can see a path where we break it and reach ~6000 ~6100 level on SPX, rebuild the sentiment a bit, compress the implied volatility a tiny bit. And then we resume lower with a volatility expansion past inauguration day.

My Trend and Momo Score for SPX risk is right in the middle on both. Market is taking a small break here.

In conclusion, not a good time to buy the dip. If you really want to buy some stocks, momentum factor is not in favour anymore, you need to focus on high quality names. The kind of names you will hold for a long time horizon. And just to be clear, a reflation quad is not bearish stocks in the long run. However my bearish view is coming from a necessity of resetting the market valuation, sentiment, and positioning. As explained in the post “Missing: a wall of worry”.

Otherwise I like commodities here, especially Energy. Gold is looking good too.

Oh, and one last thing…

but…

Slowly starting to put money into people’s pocket… Green shoots!

Thanks for reading & stay safu!

PS: a few readers have started to pledge money for this Substack. This is greatly appreciated and is very encouraging for me. For folks who are not familiar with the pledge system, please read here.

in which way can one invest in the forex pair (USD/JPY) if he doesn't want to do an ordinary forex transaction?