S&P500 at support, now what?

Looking at sentiment through the lens of options. And discussing at which stage of the bull market we are.

In today’s post, I’m looking very tactically at the S&P 500 sitting on its support trend line. Is this a buying opportunity or not? And no, just drawing a line on a chart is not an edge—sorry if you thought so. Instead, it only indicates that the market has deviated a bit from its historical trend. Now the real question is assessing the risk/reward of a long or short position here.

I’ll also discuss my view on the market over the next 3 to 6 months. I believe we’ve entered a new phase where macro risk will matter again.

Speaking of macro, don’t miss my latest post, where I lay the groundwork for my view on the economy, where the job market is heading, and how I’m trading it through bond exposure. Link here:

Where is the fear?

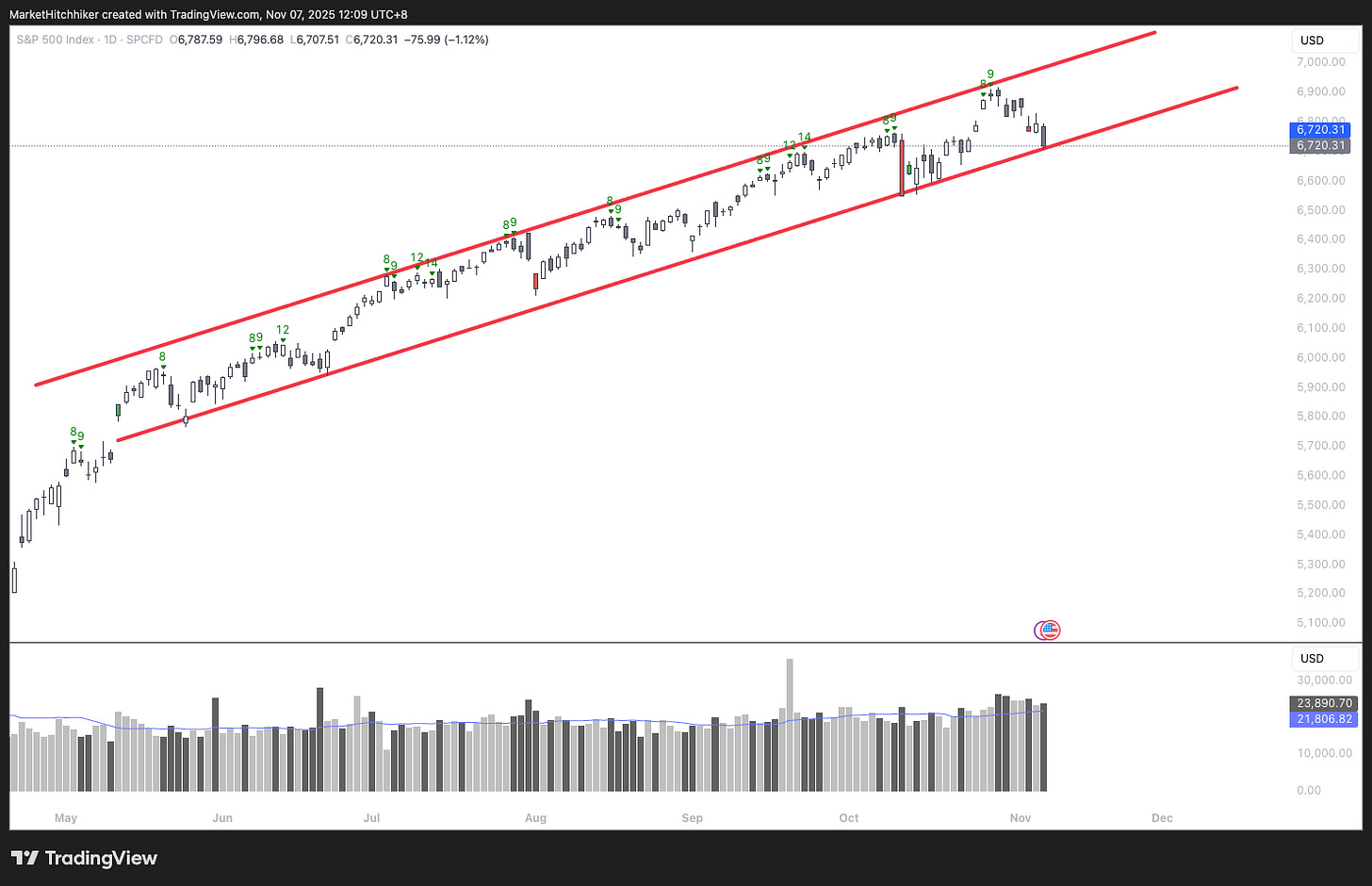

The S&P 500 index is sitting at the support of the bullish channel. This is the “Buy the dip” area for any market tourist:

Are we seeing any sign of fear?

VIX is at 19.50, it is trending up but not spiking => fear is building up but far from extreme

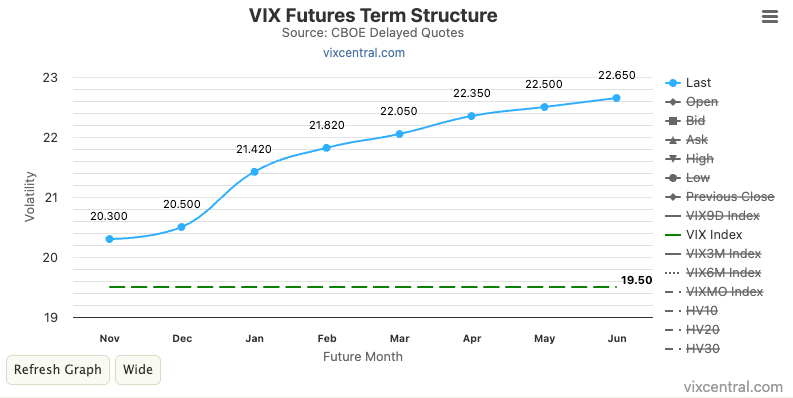

VIX future term structure => we are still in contango, holding a VIX future is costing you money as the remaining maturity decreases through time. I start to see fear when the term structure is flat, we are not even there.

VVIX is at 105.71, that is a median reading => it confirms the absence of spike in the VIX and leaves the door open to more fear