Tactical Update

How do you feel now? Do you want to puke? Already?

The SPX is now down ~9% from its all-time high, which is about the historical median drawdown. Median means we’re at a fork in the road: 50% chance we go lower, 50% chance we go higher…

Honestly, both options suck :/

For the baby traders out there, here’s the breakdown:

A Dead Cat Bounce is that classic rebound in a bear market. It’s max fuckery price action: suddenly, no marginal sellers are left. Long-term investors are diamond-handing their positions—they ain’t selling now. Hedge funds, algos, scalpers, and paper hands already panic-sold on the way down. Meanwhile, the bear narrative is so loud that every new bear piles in to short the market. Well, guess what? If some random positive news hits the tape, the move up can be violent. Shorts rush to cover, dip-buyers jump back in screaming “15-year bull market, bro! Buy the dip!”—only to get steamrolled on the second leg down.

A VaR Event is when everyone’s puking because the market’s plunging intraday and nothing’s stopping it. Volatility explodes, smashing all the Value-at-Risk models at banks, pod shops, and big players. Even the Long/Short dudes have to sell their winners just to de-gross the book. Correlation hits 1, and everything—from defensive stocks to gold, oil, etc. —starts puking. That’s when you wanna buy the good stuff on discount with both hands.

So where are we now? Dead Cat Bounce or VaR Event?

First, some bad news.

This is probably you right now:

Here’s the law of max fuckery—if you hit PANIC SELL, the market rallies into a Dead Cat Bounce. If you HODL, it tanks into a VaR Event, and you puke when it’s down another 9%, panic-selling at the bottom.

No, but seriously—if the market’s only 9% down and you’re debating whether to sell everything or hodl everything, you’re not playing the game right. Money management isn’t about binary, all-or-nothing moves. There’s a killer quote from George Goodman’s The Money Game that fits here:

Back to the question: VaR Event or Dead Cat Bounce?

I don’t have a freaking crystal ball. If I knew, I’d slap the biggest trade on the market and ride off into the sunset.

But I do know two things…

VaR Events need a buildup. They always hit when two conditions align:

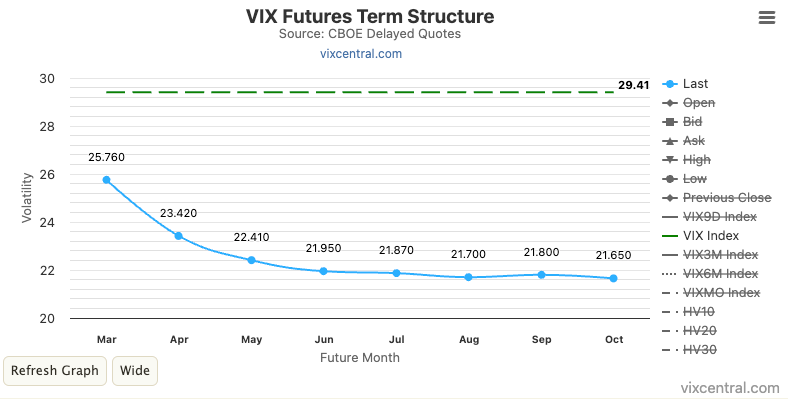

The VIX term structure is in backwardation—nearest expiry contract is higher than the second or third. That’s where we are right now.

The credit market starts puking. This is your cross-asset confirmation. I track the ETF HYGH (High Yield Bond ETF, duration-hedged) as a proxy for credit spreads. As long as we’re below the 5 days and 10 days EMA, we’re in short-term stress—another box checked for a VaR Event.

So, while I can’t predict the market’s direction, I can tell you this: now’s the time to play it smart, not heroic. The setup’s ripe for another 10% drop in the next few days. A Dead Cat Bounce only gets called once we break this insane VIX backwardation and reclaim the EMA on HYGH.

For now, DON’T DO ANYTHING STUPID.

One random green shoot: my Twitter’s drowning in bear posts—the bear narrative’s everywhere. Oh, and Interactive Brokers just hit me with this ad on my IG feed:

A bit late for hedging no?

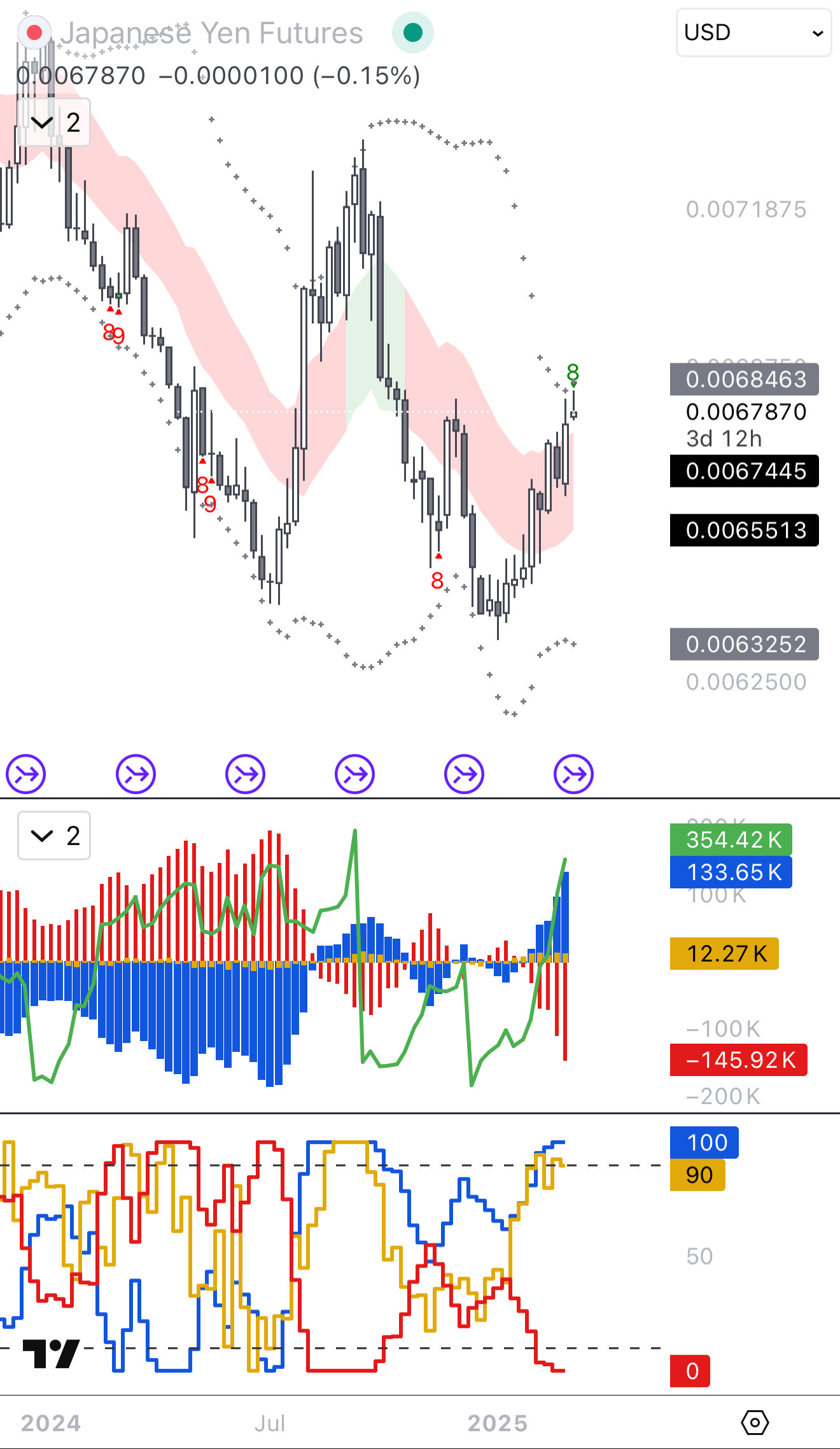

Another green shoot: if you follow me in the chat, I mentioned I took half profits on my JPY position. The CoT data shows large speculators getting insanely long yen—like, longer than they’ve ever been. It’s bullish for the US Stock Market from a contrarian perspective because it kills off the Yen Carry Unwind risk (like the one we saw last summer).

Check the chart below—the Large Speculator Position is the blue columns in the second panel. Open Interest on the futures is exploding too, meaning a ton of fresh money’s piling into the trade. This is both good and bad for our long yen play:

Good: We’re shifting from a heavy FX carry regime where yen was the go-to funding leg for trades. This is a regime change, and we wanna ride it.

Bad: Short-term, the trade’s too obvious—everyone’s in. That leaves us open to meh performance or sharp pullbacks.

My move now? Reenter full size on any dip. But I’m keeping a close eye on yen price action. If we get a correlation breakdown—like SPX tanking but USDJPY climbing—I’ll have to rethink the trade.

That’s it for the tactical update. Good luck out there!

Where is your chat? Nice post!