Tactical Update: A Bear's Lament in a Vol Crush

V-Shaped rally crushes vol premium, squeezes shorts, and my exit plan

I thought I would make a new chat for this, but it’s getting too long (again!). So here goes, let’s unpack yesterday's price action on US stocks, particularly the SPX.

1/ Gap filled.

We saw a V-shaped recovery to last Thursday's close, filling the gap opened Friday morning. Those who shorted on the weak NFP news are now either in the red or got stopped out. So far, this is a typical counter-trend move. I must acknowledge how powerful this one-day rally was; I expected some weakness in the afternoon session, but it never materialized. That said, a +1.47% move in one day is significant in a low-volatility environment, well above the initially priced implied move. As a result, realized volatility has ticked up despite the green day. This should keep the systematic crowd—volatility control funds—away from the buy button.

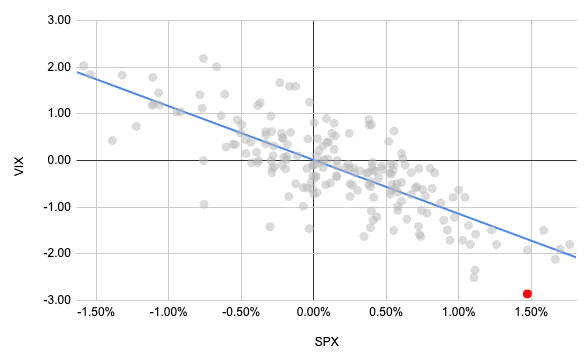

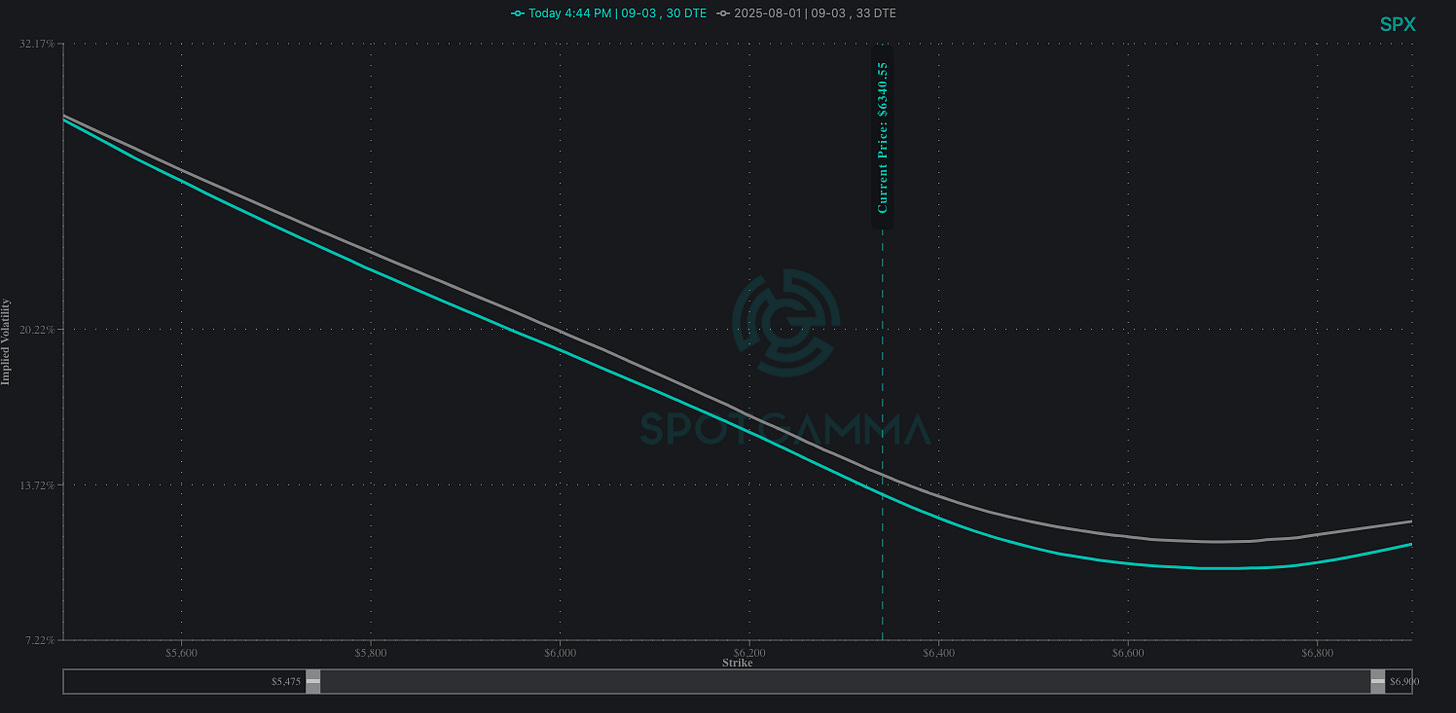

2/ Vol Crush.

Implied volatility has reversed much of the move as well. The VIX is down 3 points, which is a clear overshoot of the regression trend line (see below chart) against SPX daily moves. The 30-day implied volatility has repriced lower across strikes too. Lots of pain for anyone who bought options previously. We've completely backpedaled on the vol premium from the NFPs. Another day of vol crush, and this will give a strong argument for the bulls.

3/ Back into resistance.

Below is the 1-hour candlestick chart on the S&P 500 E-mini futures. We've retraced 61.8% of the move, which is a traditional resistance level if you believe in Fibonacci and astrology. :) One might argue that markets tend to have fractal behavior, often moving two steps forward and one step backward. Benoit Mandelbrot would probably laugh at this simplification, but sometimes we just need a simple heuristic to help risk-manage our trades. I digress! More importantly, Captain Condor is back in the game and placed a large order at the close, creating a gamma resistance at 6350 on the SPX. Magically, this converts to 6377 on the futures (+27 points), which is exactly our 61.8% Fib retracement resistance and where the market lost steam.

While I'm not an intraday trader—and frankly, I don’t enjoy babysitting an intraday trade—I still carry a large short position on the SPX from Thursday. My plan is now quite simple: if we close above 6350 on Tuesday, I will exit the trade at a flat pnl.

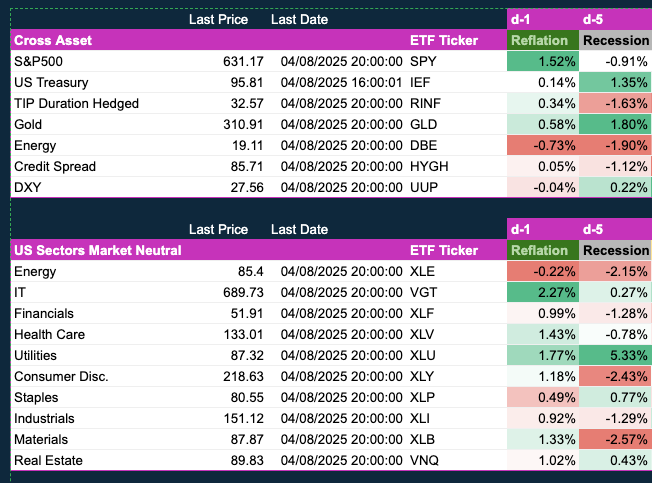

4/ Break in correlation.

The cross-asset analysis is interesting here: we've seen a break in the usual correlations. The S&P 500 went up while bonds, TIPS, and gold were up as well. This is quite unusual. Moreover, credit spreads barely narrowed yesterday, as measured by the HYGH ETF. Also, the SOFR 3M futures contract expiring Dec 2025 has not retraced Friday’s move—it's holding on and not fading last Friday price action.

This is confusing: the bond, energy, and credit markets are telling one story—that the NFP was kind of a big deal, and we're heading toward slower growth. The dollar didn’t move much while TIPS went up, which could indicate sustained inflation.

If it weren't for the S&P 500, my monitor would be pricing a Recession regime!

One explanation I have in mind is that the equity market is extremely excited about the idea of rate cuts and will start to front-run the coming liquidity—at the risk of being gaslighted by the incoming slowdown or recession. This kind of reasoning could lead us to a blow-off top into year-end. The market can stay irrational longer than you can remain solvent

Food for thought…