Tactical Update: stopped out

Nullifying the bear hypothesis, why I'm out and what the market is telling us

I am honoring my trailing stop loss on ES futures, now stopped out from a short position opened last Wednesday. Entry Price: 6409.5 - Exit Price: 6389.50 - PnL: +0.31%

Shorting the SPX during a bull market is, not surprisingly, a painful experiment! Exiting without a loss is already a good result. Cope harder I know!

This kind of trade also provides valuable feedback about the strength of this bull run. The reflexivity is still to the upside, with significant momentum driven by AI and ample liquidity in the system.

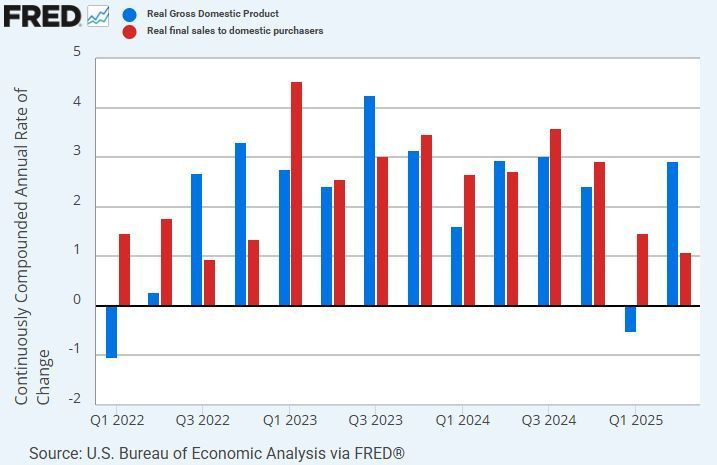

By shorting the market, I tested my hypothesis about an economic slowdown. I shorted after the 'positive' GDP print last week, which I viewed as negative due to slowing real final sales.

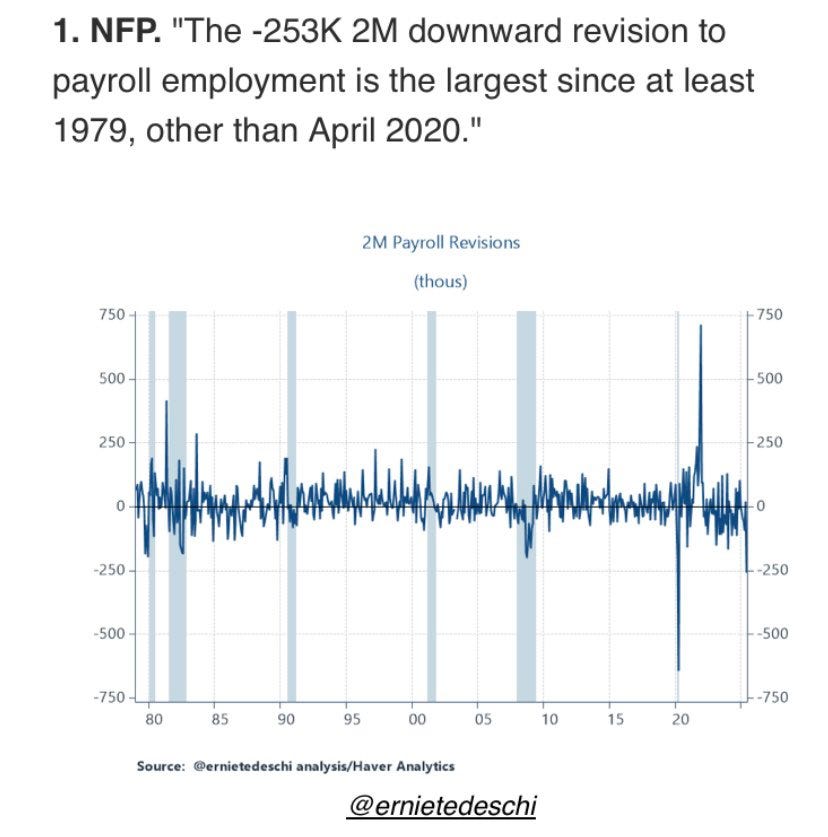

Then we had the news failure on QQQ after Microsoft and Meta’s stellar earnings. Finally, the negative revisions on NFPs were the last bearish news to confirm my hypothesis. A bear’s dream coming true!

Yet, the market is recovering, and volatility is getting crushed.

Making an investment decision is like formulating a scientific hypothesis and submitting it to a practical test. The main difference is that the hypothesis that underlies an investment decision is intended to make money and not to establish a universally valid generalization . . . Taking this view, it is possible to see the financial markets as a laboratory to test hypotheses.

— George Soros in The Alchemy of Finance—

The slowdown narrative I expressed last week is already well-circulated among the FinTwit community. In the past two days, we had two strong contra-signals: Andy Constan on Forward Guidance pitching negative fiscal impulse and poor risk-reward on stocks, and MacroAlf posting a piece titled 'Run It Cold'. While I largely agree with their takes, the market is shrugging them off for now. The market speaks, and I listen. While their argument might hold in a longer timeframe, the market is not reacting to the current negative catalysts, so it is not a tradable narrative.

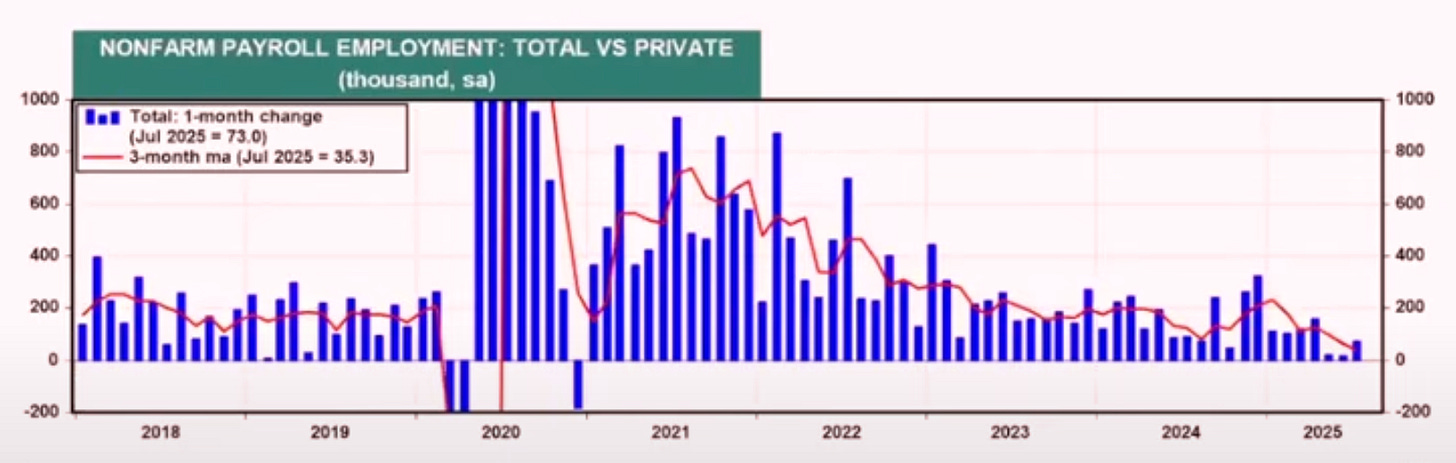

The NFP is a good case study in how different people interpret the same data. An investor with a bearish tilt will scream recession at the streak of negative revisions.

Another investor will focus on the latest print and say: 'Chill out, negative revisions are notably high, but the latest data point indicates a recovery. This is just another artifact of Trump Tariff Turmoil.’

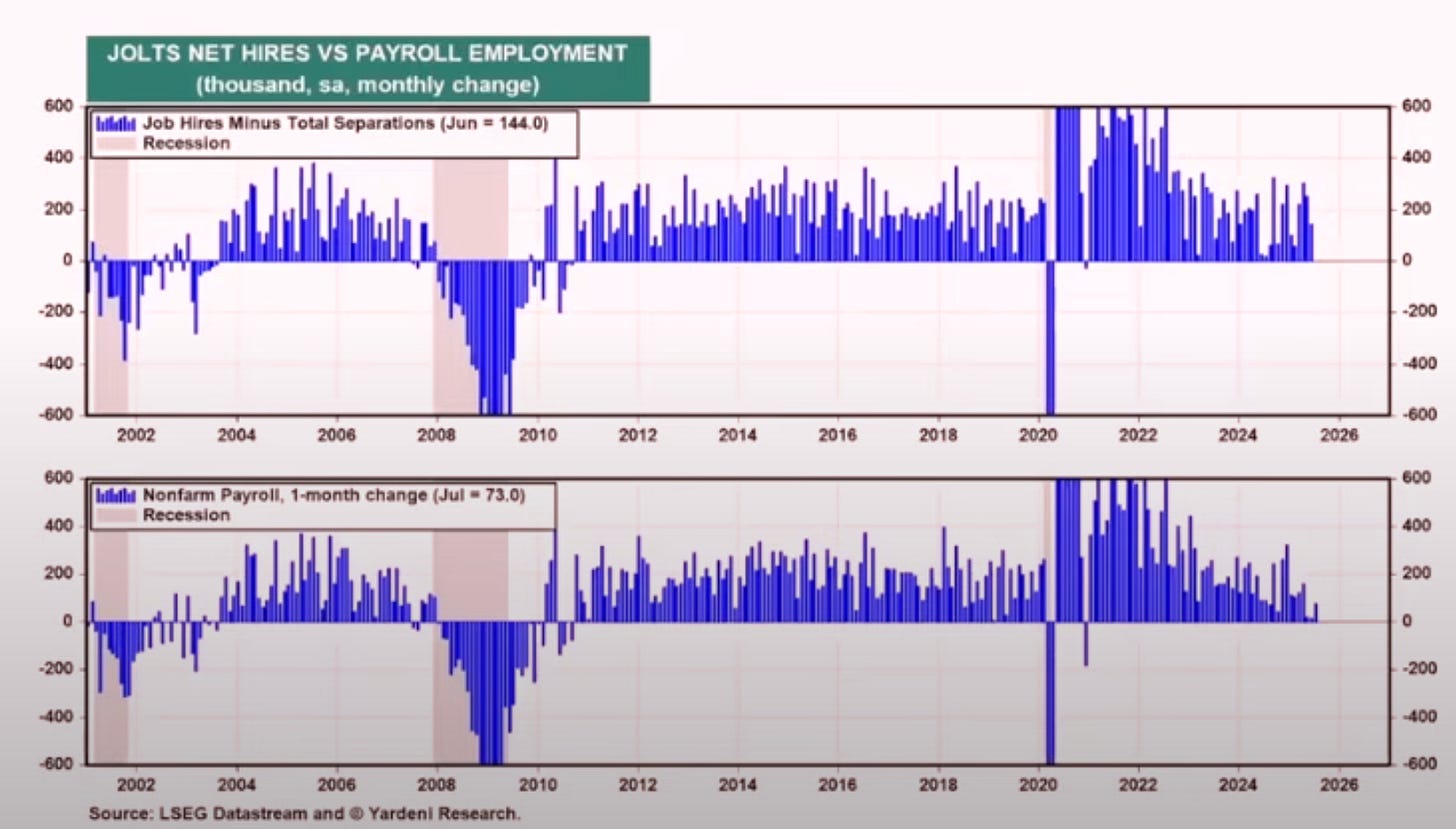

Yardeni also shared a compelling chart comparing JOLTS net hires, which doesn’t confirm the NFP slowdown.

Tonight, we’ll have initial claims, and I’m not expecting fireworks. I anticipate a medium-to-low reading, and the market will likely cheer it. My tracking of the Daily Treasury Statement’s withholding tax and FICA shows they’re still running at a solid pace.

These two indicators are my best real-time measures of the job market, and they’re not confirming the NFP doom narrative. The market and this high-frequency hard data tell me the economy is still doing fine.

In my latest tactical update, I hypothesized the following:

One explanation I have in mind is that the equity market is extremely excited about the idea of rate cuts and will start to front-run the coming liquidity—at the risk of being gaslighted by the incoming slowdown or recession. This kind of reasoning could lead us to a blow-off top into year-end. The market can stay irrational longer than you can remain solvent

I like this hypothesis more and more.

I was watching Dr. Yardeni’s latest weekly call, and one part struck me. He discussed core goods inflation and his belief that the Fed will only cut once by year-end:

So I’m still kind of sticking there with the none and done even though Friday's number convinced everybody that the Fed is about to lower rates. But we'll see how that goes. For the stock market I guess heads you win, tail you win. If the economy is weaker than I think the Fed will cut rates. If the economy is better, consistent with our view, then we won't get a Fed rate cut, but the economy still look pretty good. In any event, the market may kind of churn here for a while as it typically does in August and September and perhaps set us up for a a year-end rally starting sometime in October. But any anything is possible here. I put my bets that this is still a bull market.

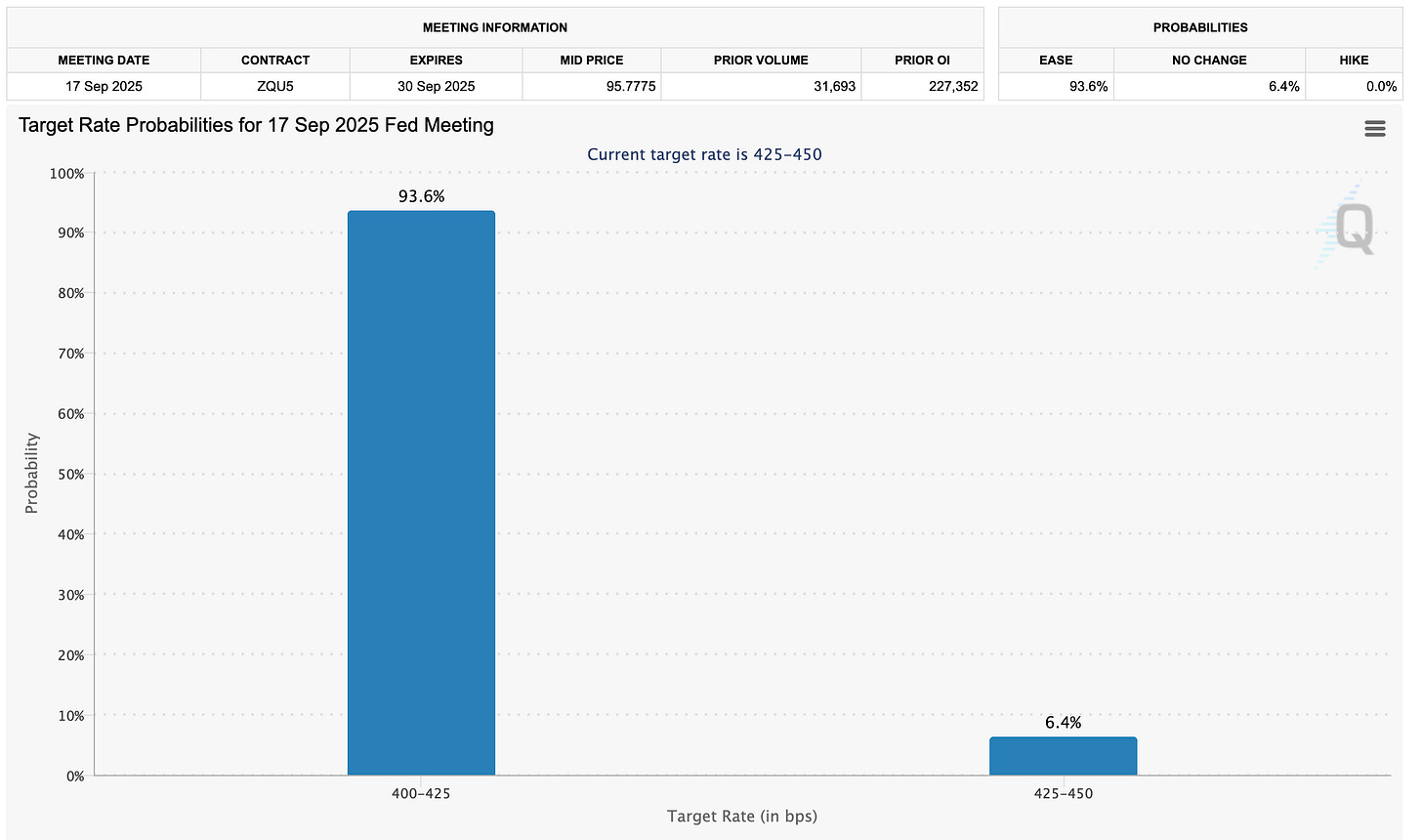

'Heads you win, tails you win'—after the price action over the last week, I can see that happening. The stock market is looking for any reason to rally, shrugging off bad news and climbing despite NFP worries. And, as the cherry on top, this NFP fear led to the pricing of a September cut, resulting in looser financial conditions while we’re 1% from all-time highs. Truly remarkable.

His comment on the sequencing is very consensus: a choppy market in August/September and a rally into year-end. I’ve seen this view everywhere now. Seasonality is too visible here, so I have a feeling we might just go up in August without looking back. That would be the non-consensus view, creating significant pain and renewed FOMO.

For his last point about betting on a bull market, in my opinion, it’s all about AI and Big Tech. Let me cut through the noise: as long as the market rewards increasing AI CapEx, the market is in a bull run. Simple as that.

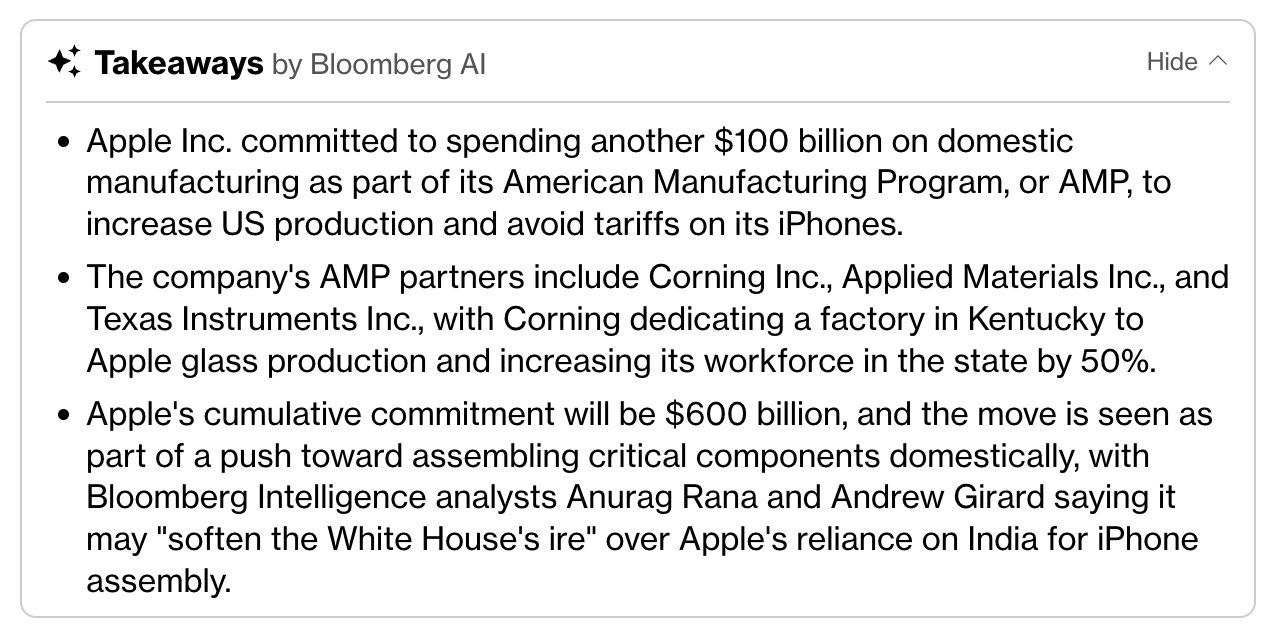

Apple up 7% on this:

Today is the deadline for tariffs, so expect more volatility crush (famous last word). There aren’t many economic releases until CPI next week. If services stay cool and core goods keep climbing, that would continue the trend, and I won’t get too worried for stocks.

Looking forward, the next FOMC meeting is in 41 days—41 days of hopium for risk assets.

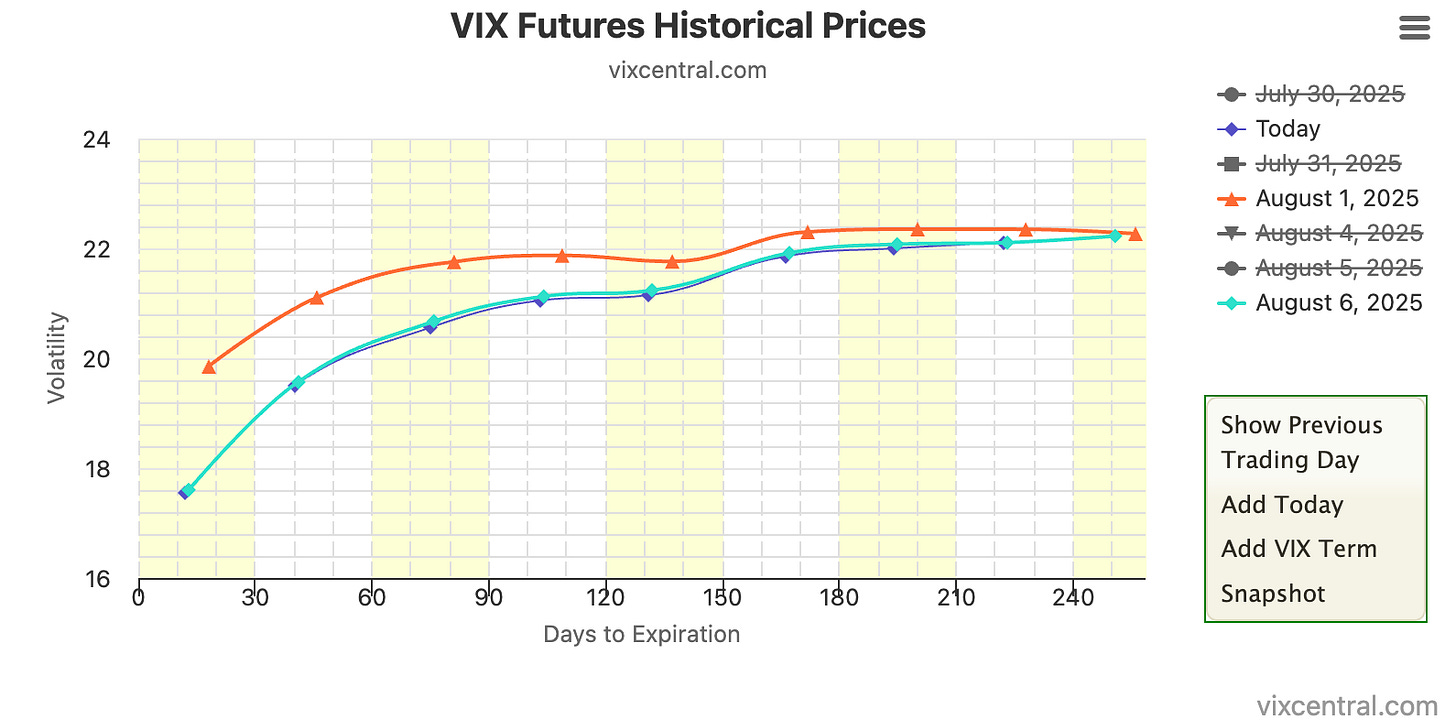

On the technical side, the implied parameters confirm my short position exit. We’ve already done a round trip on the VIX futures curve, like nothing happened!

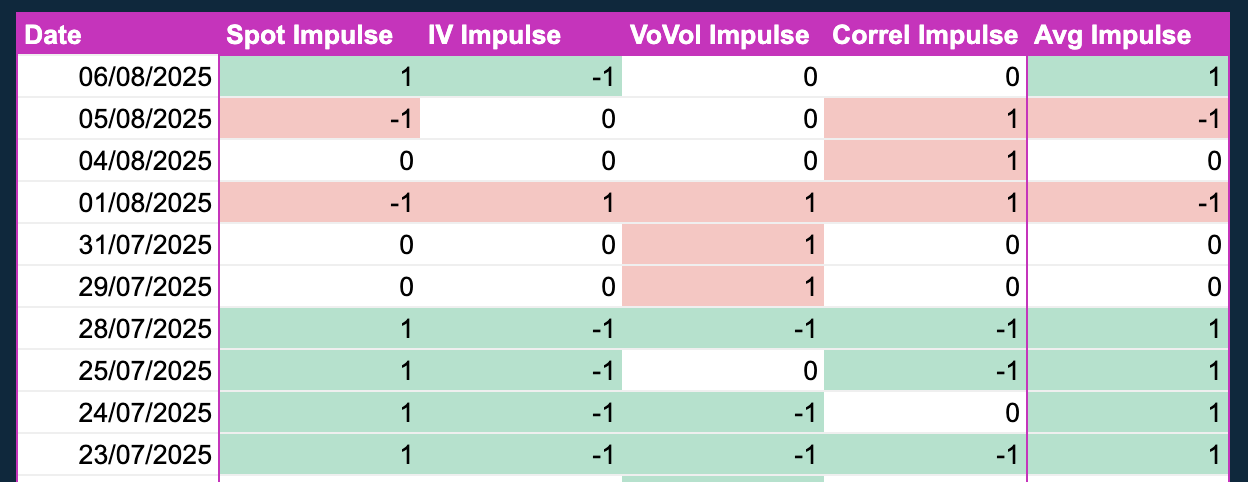

My impulse system indicates the end of the risk-off move:

HYGH has reclaimed its moving averages, and credit spreads remain tight, not responding to shocks.

After these tactical updates, you might wonder if I’m an intraday or swing trader. I’m not. I am longer picture thinking / trading. But I had to take a shot to the dark side. I went short SPX directly through a short futures position, for size, based on a catalyst. The market goes up 95% of the time, so you’d better be perfect with your timing and execution. As soon as I see downside momentum evaporating, I need to get out. Only paranoid bears survive in a bull market.

Stay tuned for the next weekly update, where I’ll refresh all the good stuff and explore another macro narrative for the Trump policy chaos. He’s proven it again: there’s some method behind the madness.

Now that we’re turning back to bullish, I owe you a portfolio update. We’ll discuss Mag7 CapEx, the dollar, and how to maximize upside potential while keeping downside limited.