Thanksgiving market update

Rotation into light volumes and Hassett's odds rising

Another day of light volume, which sent the SPX straight up for the 4th consecutive day. The upside volatility is a feature not a bug of this new regime driven by 0DTE and option flows.

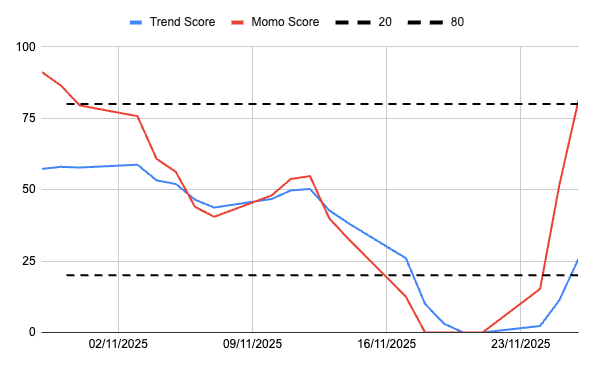

My trend and momentum score has triggered a buy signal with momentum score crossing over 80 while trend score is still around 20.

That’s annoying me a lot because we are short the market. Fortunately for us, it is also going through a rotation favouring small caps over big tech. Shorting NYFANG+ future instead of ES was a good call, it still trading near entry.

This 4-day rally has been triggered by the repricing of the Fed cut, the most sensitive asset like Russell2000 is naturally over-performing.

The AI malaise is still lingering, ORCL is trading below its 200-day MA, GOOGL chart looks like a mini blow-off top, NVDA is still trading below last Thursday’s close.

While I am tactically bearish here, I am also aware of the bull thesis for a Santa Claus rally; yes the same one I tried to play last week:

We just had a sentiment reset, end of October was peak retail mania but now most of the retail favourites are down by at least 20%. Froth has been removed

Retail has capitulated, CTAs have sold and Vol Control funds are at median exposure

Buybacks are about to add a large buying pressure over December

Seasonality is very strong starting now

The Fed is cutting

Everything is a matter of perspective. I can twist this view and turn it into a bear case:

Retail is broke, they won’t be able to buy the dips for some time removing a key support for the market.

Vol Control and CTAs are not max long but they are selling in a flat tape

Buybacks are only 1% of daily volume for December window, this is one of the weakest buyback window of the year.

Seasonality hasn’t worked at all in October / November. It won’t work in December.

The Fed is cutting, but this is priced at 85%. And they have 0 reason to cut in January.

Trading is 90% psychology and understanding your bias. You think you are trading a rational view, but the truth is you are only seeing what you want to see.

Personally, I have decided to follow the tape. AI names are not going up on good news anymore, even international names like BABA are not able to pump after good earnings and positive AI news. The AI trade feels exhausted; it probably won’t crash, but finally there is a chance for the bears to make a statement. Momentum is not at their backs, earnings projected are high, margins look suspiciously high, and analysts have capitulated with very optimistic price targets. And if I’m wrong, I’ll get stopped out and life goes on!

An important development: Kevin Hassett is the new favourite for the nomination of the next Fed Chair.