The dark side has been calling me… again.

Update on positioning, market internals and my trading plan.

To fight or not to fight the trend, that is the question of the day.

We are just below the 50-day moving average on the S&P 500. This is a fast market, and it requires careful monitoring. Let’s review the usual indicators.

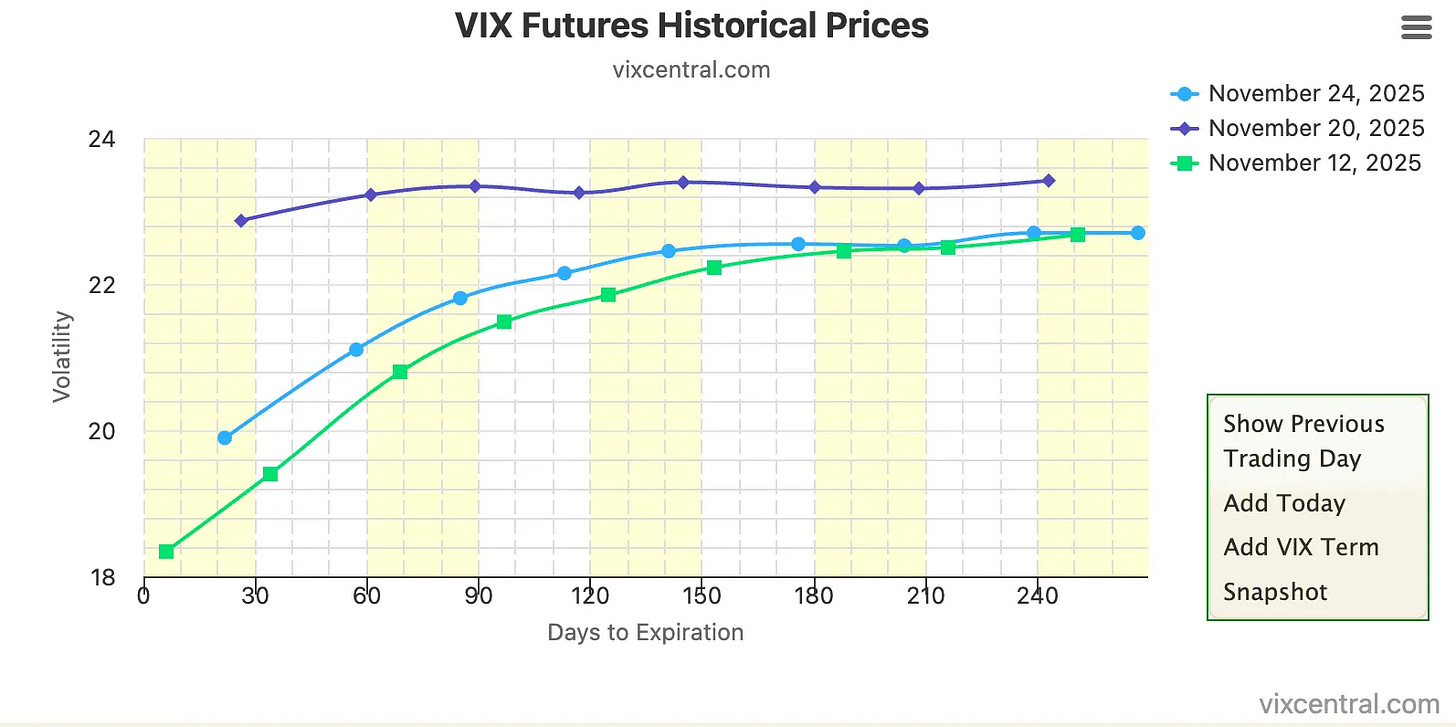

Systematic volatility sellers were active again yesterday. The VIX closed at 20.51 even as realized volatility continues to tick higher. The VVIX (the implied volatility of the VIX) has climbed back to 104, suggesting that most of the volatility crush is behind us and that we may see a sustained period of elevated VIX levels. Skew remains expensive, pointing to greater downside risk.

The VIX futures curve has returned to contango. For context, I’ve overlaid two prior snapshots: last Thursday’s close (purple) and the swing high on November 12 (green). VIX calendar spreads could reach attractive levels very soon.