Something is shifting in the markets. [Week#21]

My new top conviction trade for H2 2025

If you've been following me in the chat, you won't be surprised by my conclusion and the updated portfolio. But first, let’s review the macro dashboard.

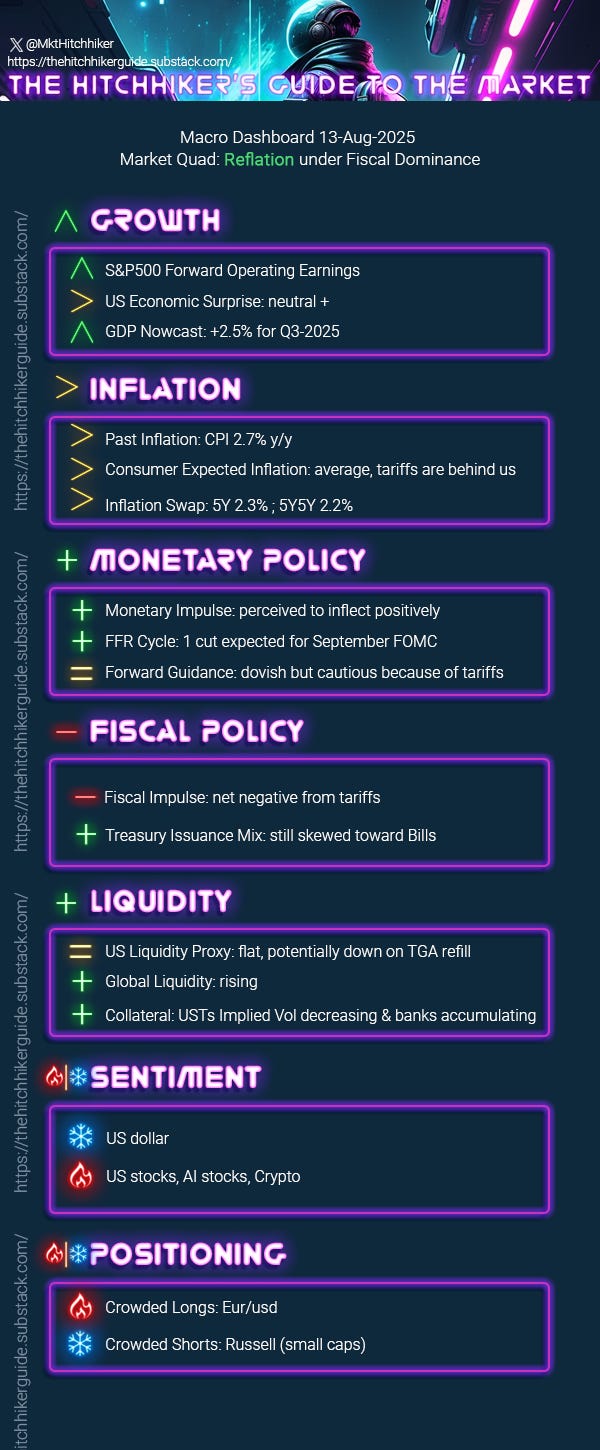

Macro dashboard update

Growth

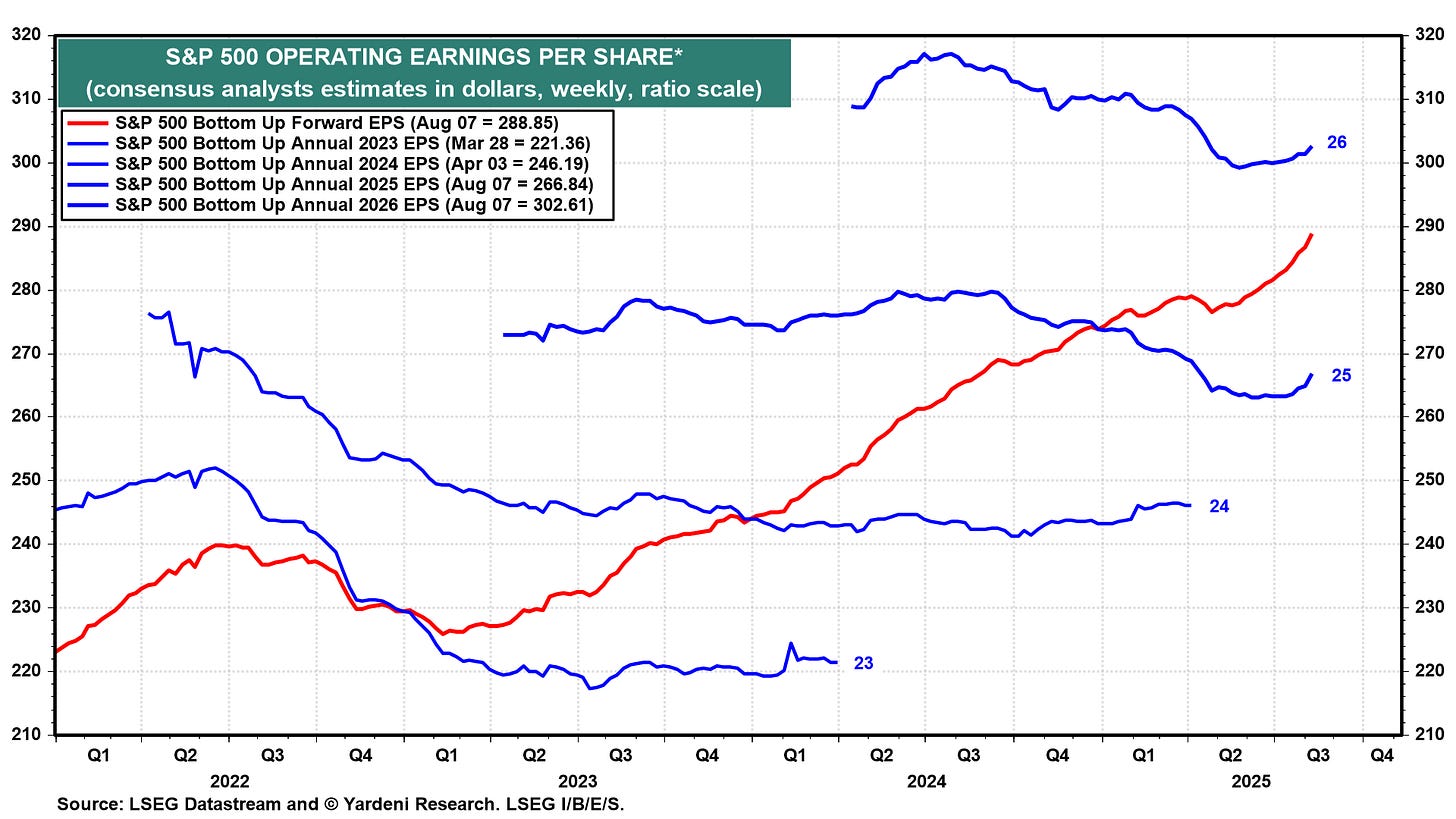

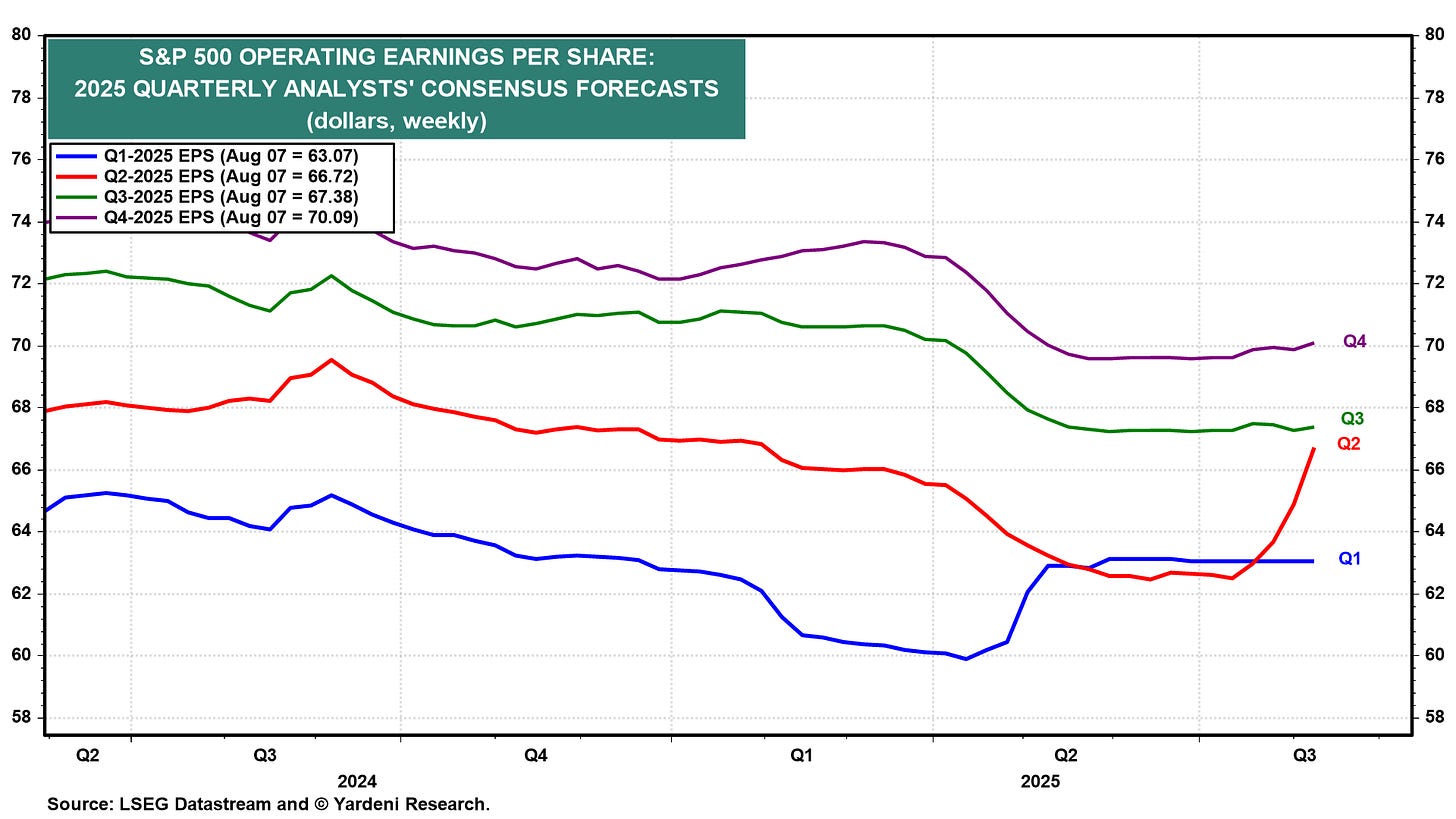

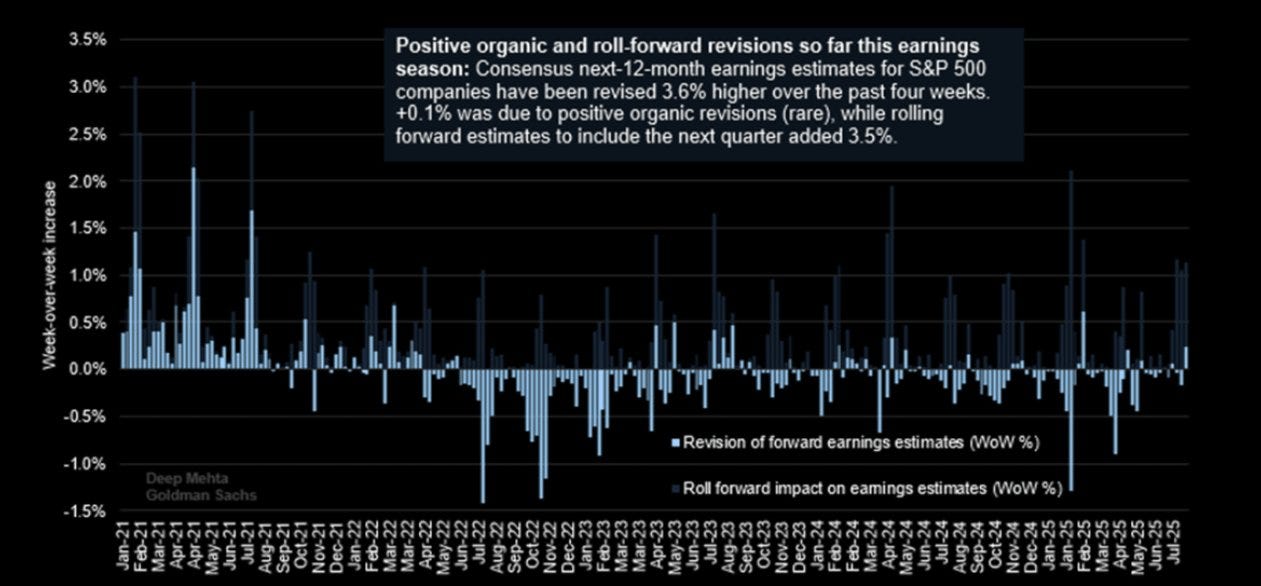

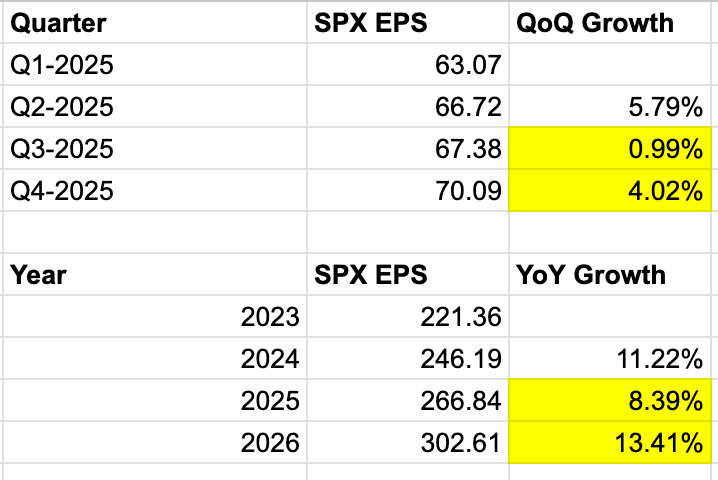

S&P 500 Forward Operating Earnings: Melt up! Even 2026 forward earnings are now going up.

Q2 2025 has driven most of this melt-up, but we're also seeing positive revisions for all subsequent quarters. This is incredibly bullish and flies in the face of lower GDP forecasts for H2 2025 and 2026.

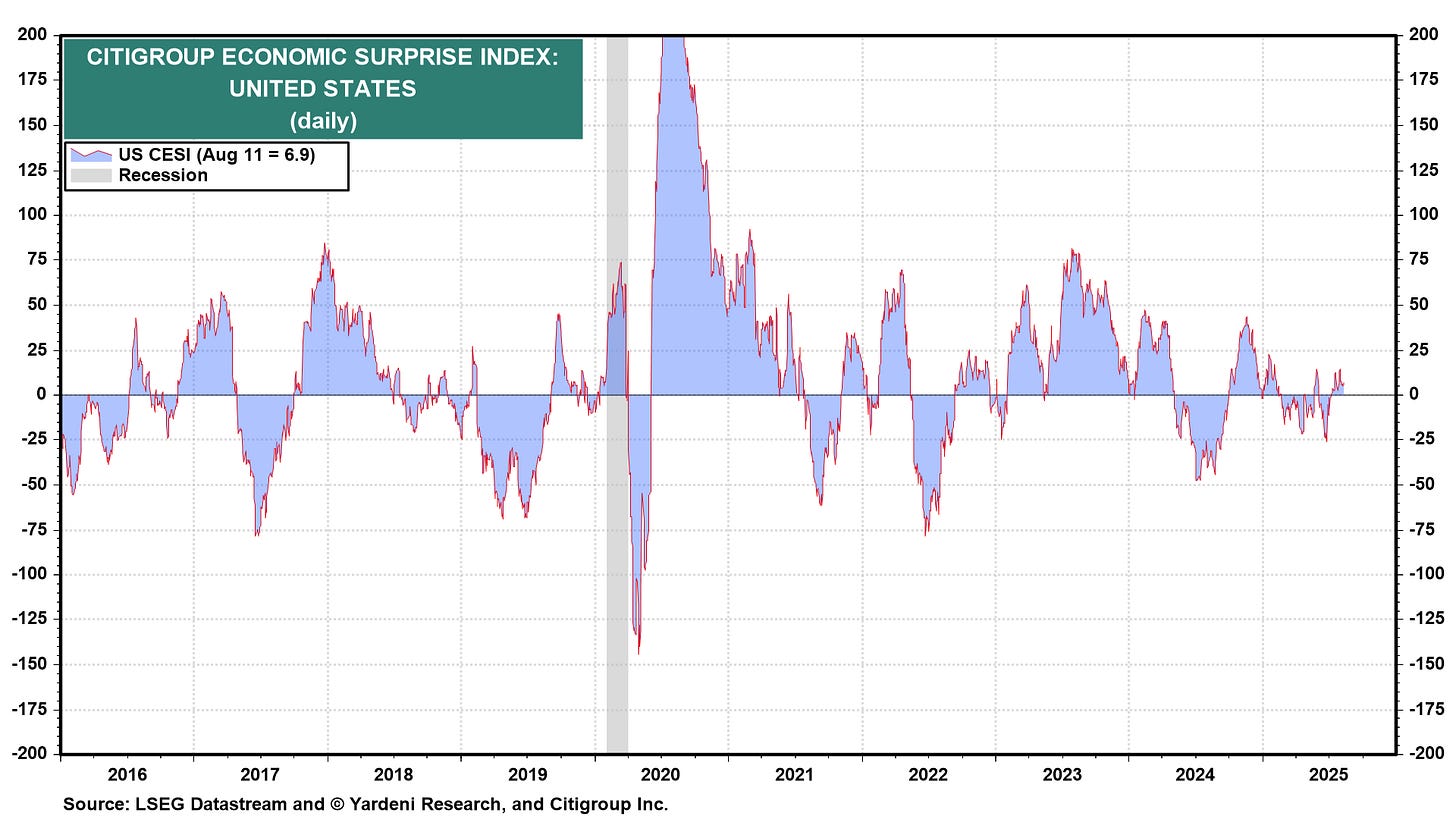

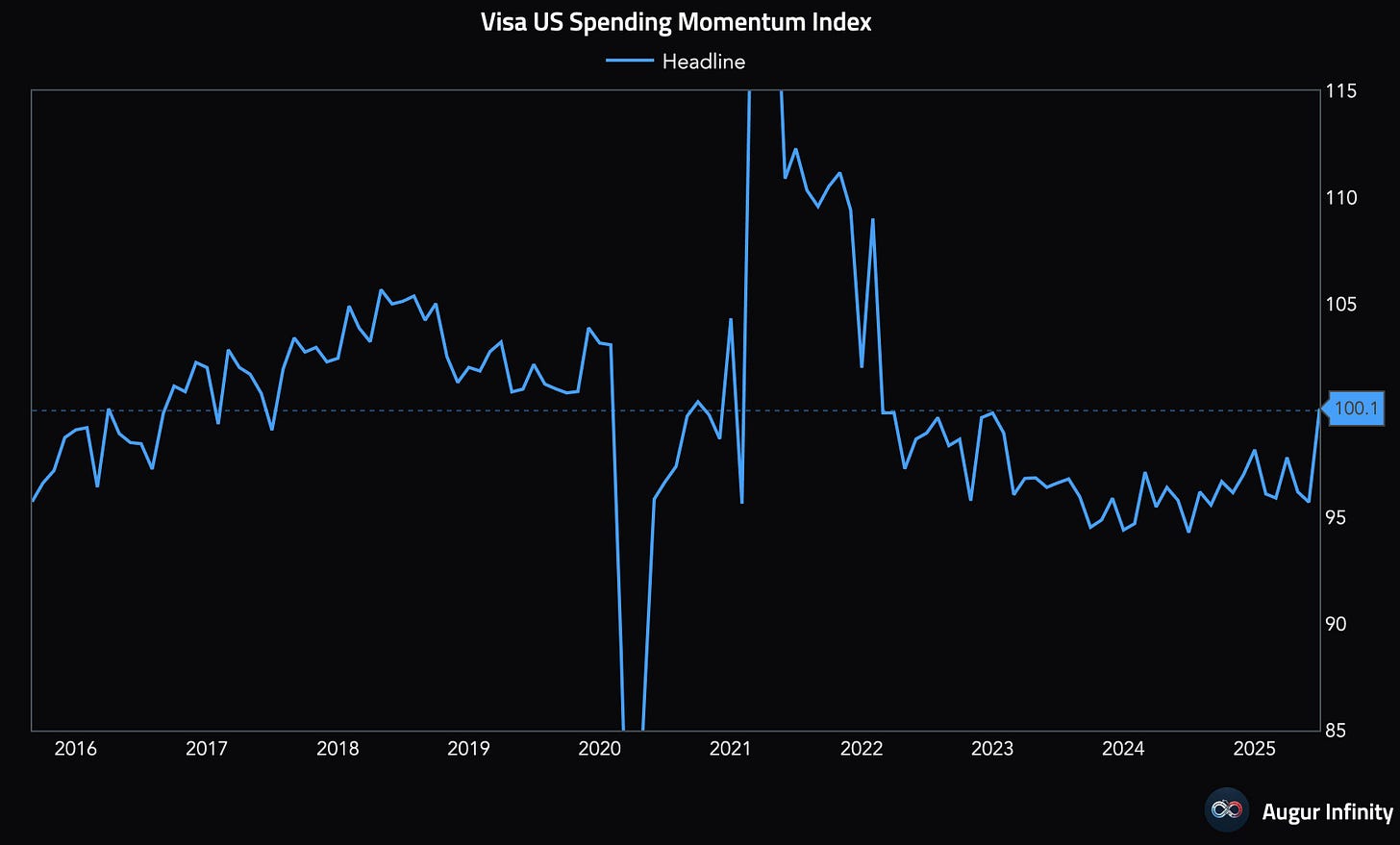

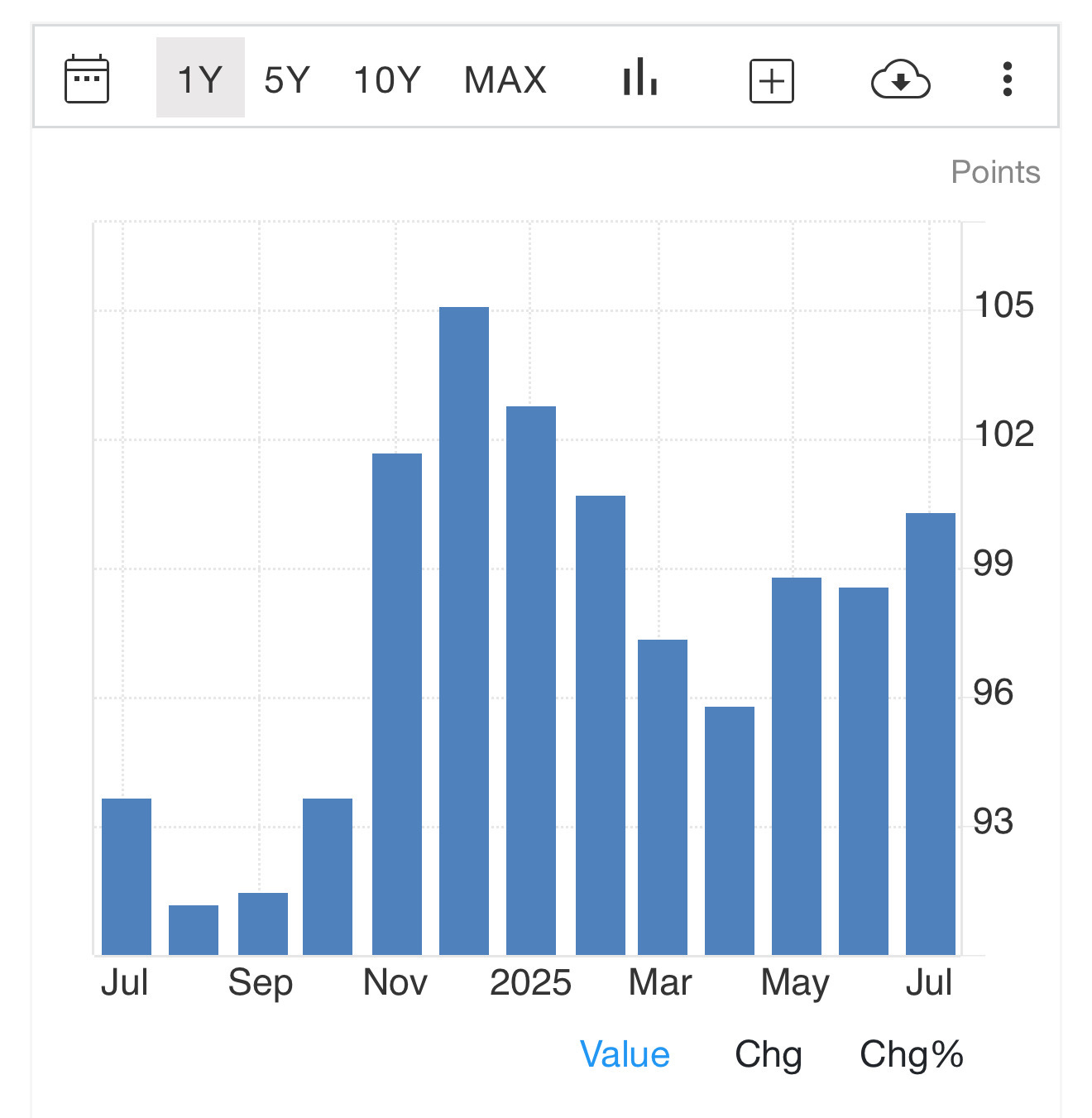

US Economic Surprise: Still no sign of any tariffs impact. We are in small positive territory.

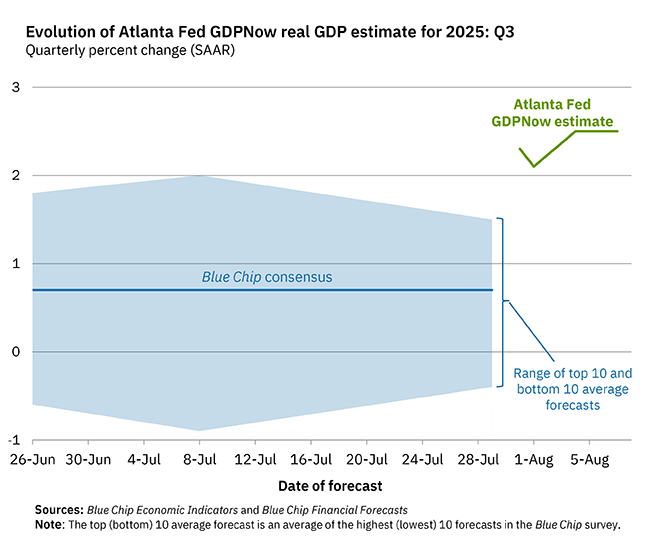

GDP Nowcast: The Atlanta Fed’s GDPNow has shifted to Q3-2025. There’s a stark contrast between the model’s forecast (+2.5%) and economists’ forecasts (+0.75%). We discussed this topic in Week #20, and I offered two interpretations:

OMG Growth is slowing in H2-2025, per economists, and the stock market, at 22x forward P/E, isn’t pricing this. The market is a short here.

The H2-2025 soft patch is already priced in by markets. The stock market looks beyond 2025, and the soft patch provides cover for the Fed to cut rates by 100 basis points. Stay long and strong.

The market appears to be shifting toward Solution 2. After all, fading economists has largely been an positive expected-value strategy, as far as I can recall.

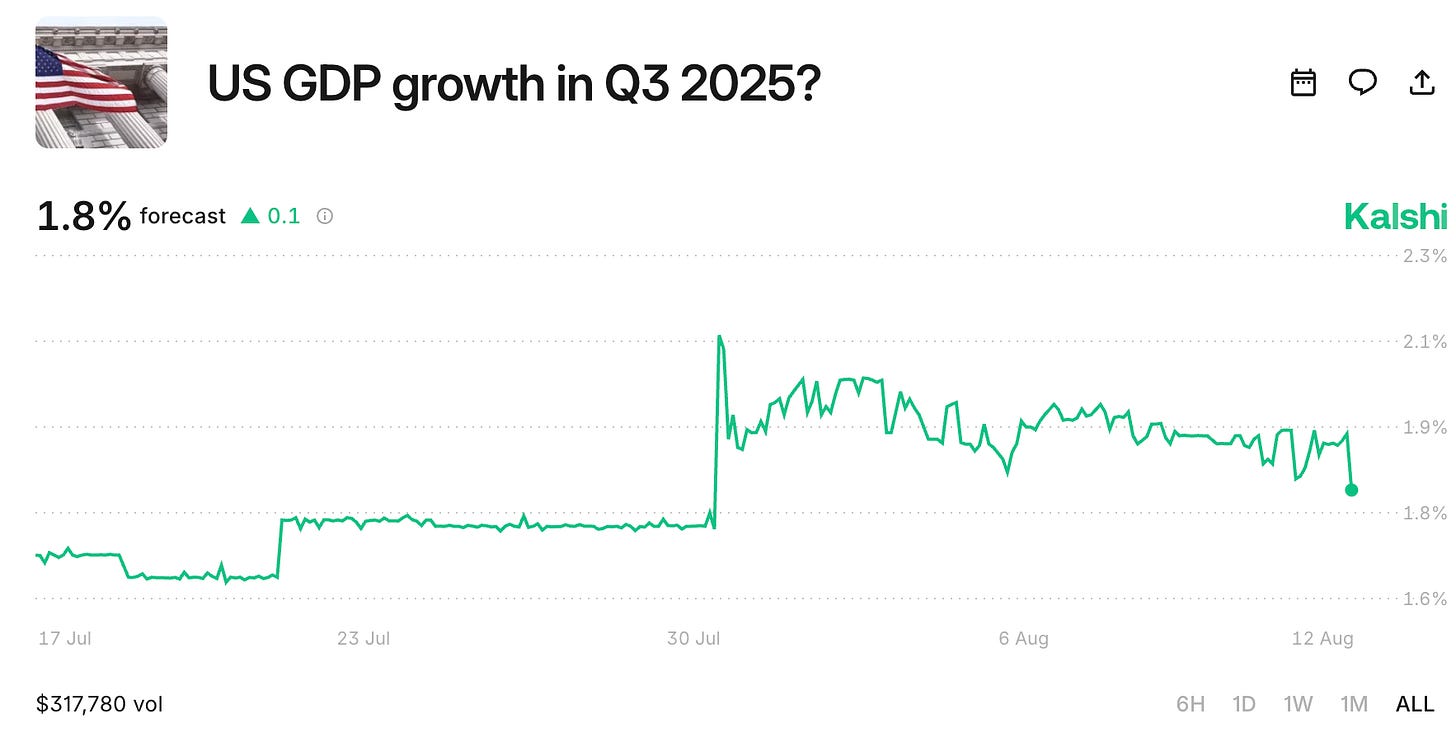

Kalshi is somewhere inbetween at +1.8%:

Let’s review our usual job market indicators:

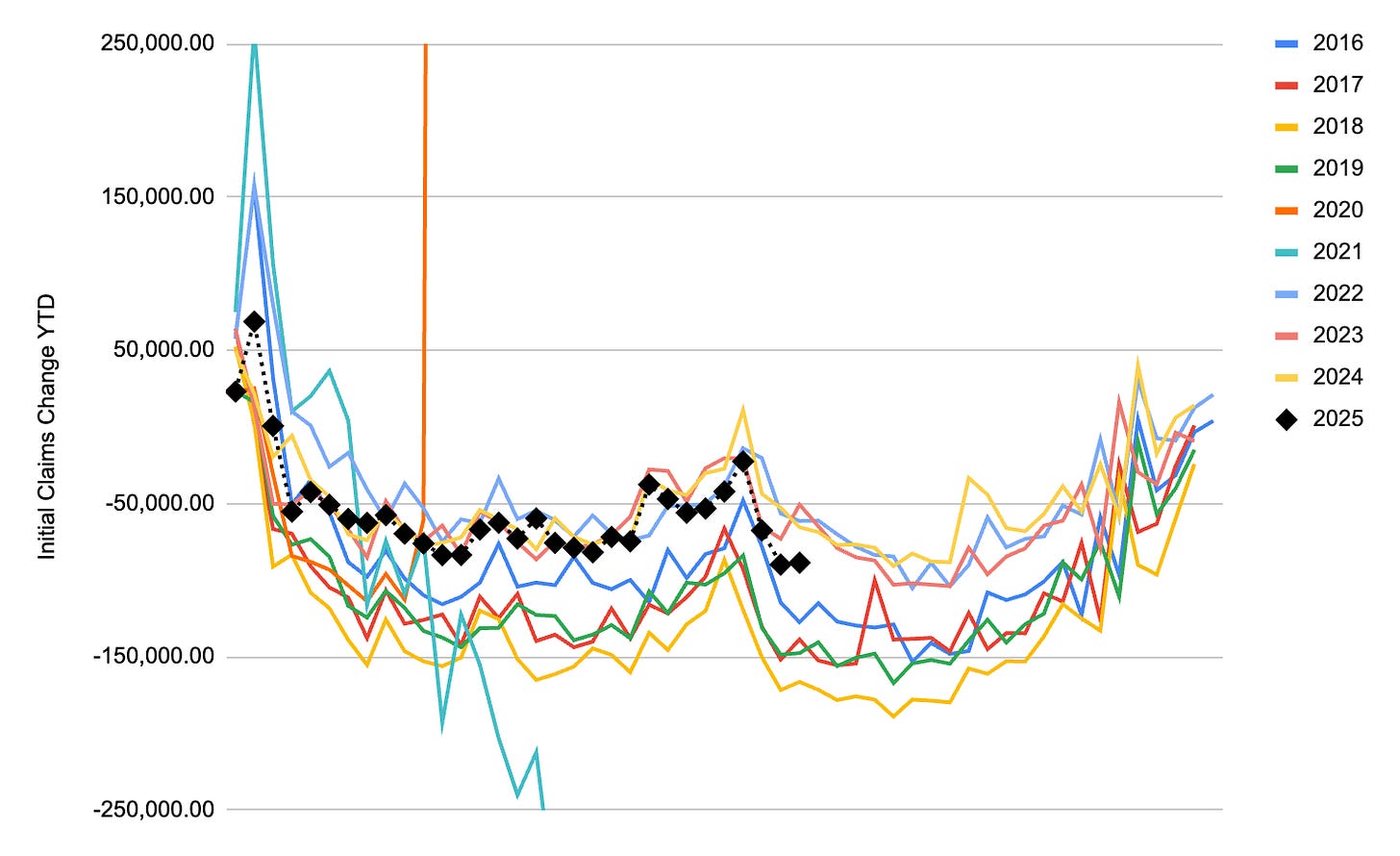

Initial Claims: They are now tracking lower than last year, indicating minimal layoffs in this economy. However, hiring remains stagnant, as evidenced by persistently high continuing claims and the elevated unemployment rate for new entrants. An awkward market.

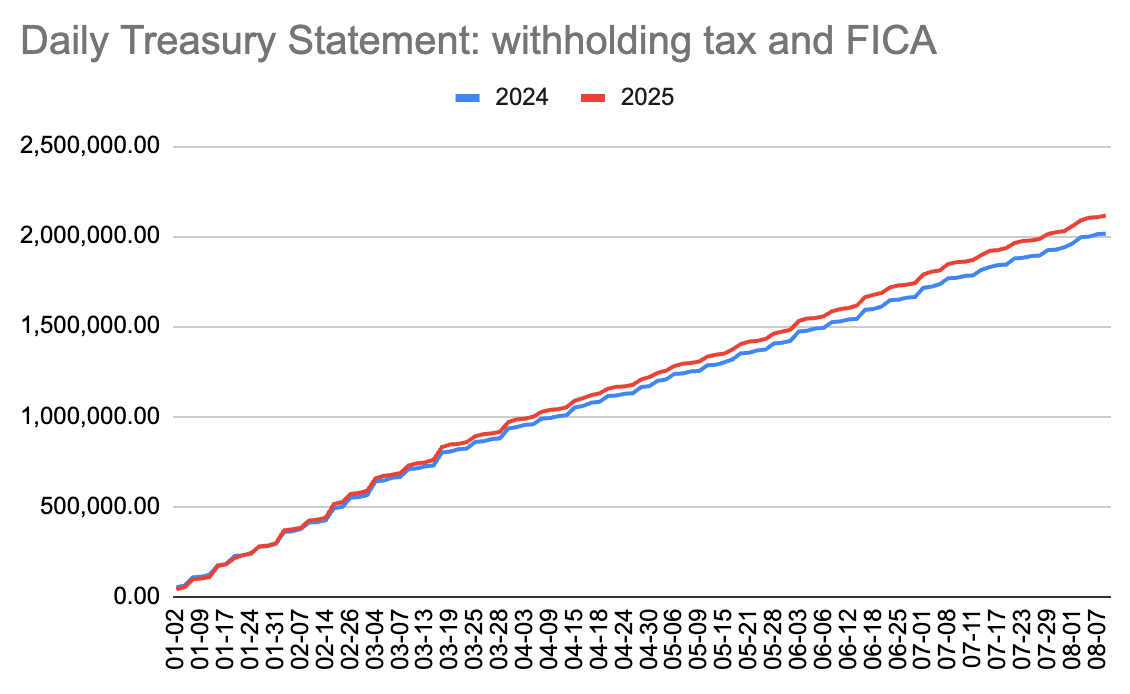

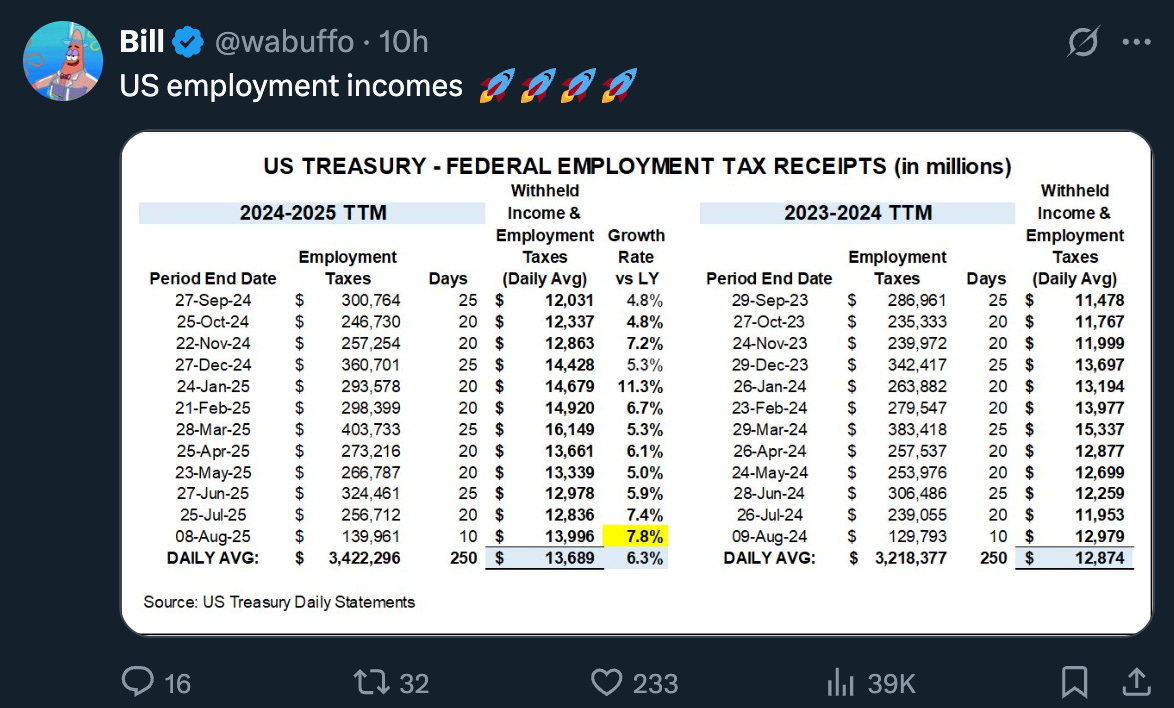

Daily Treasury Statement: The government is still collecting tax at a solid pace compared to last year.

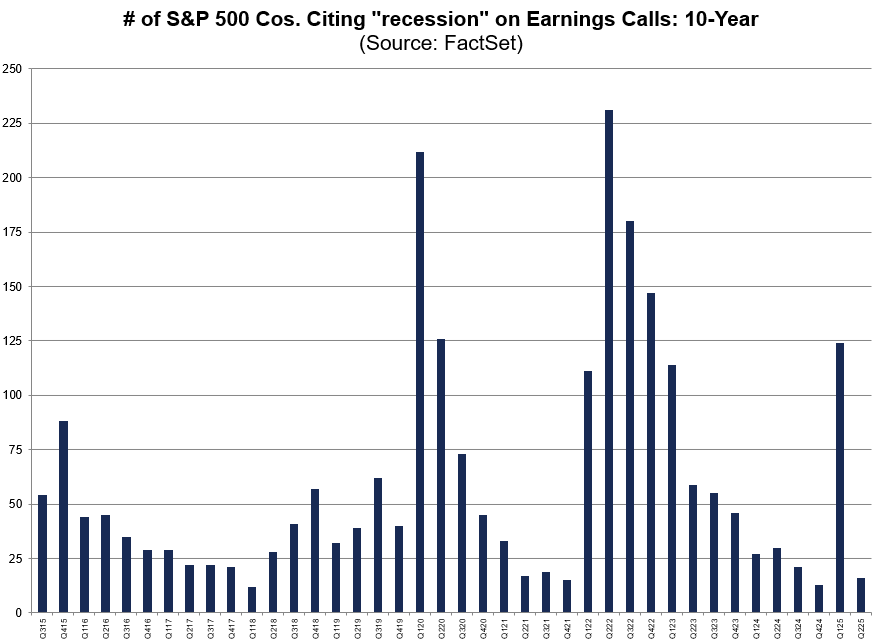

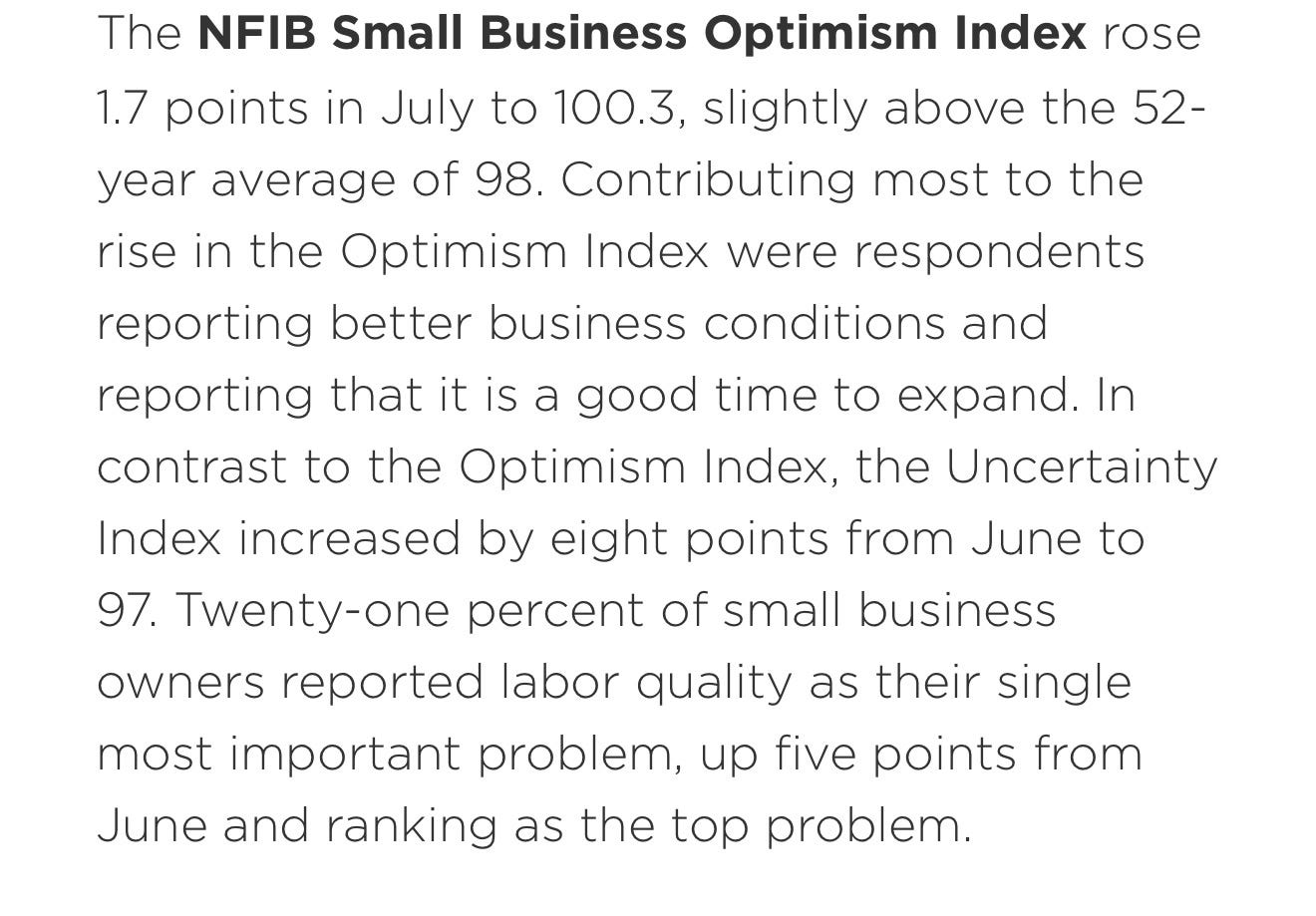

Finally, what’s better than hearing directly from Robert Half’s CEO, Keith Waddell, as he shares his insights:

"Although current hiring and quit rates remain subdued and well below post-COVID highs, job openings continue to be well above historical levels, indicating strong pent-up hiring demand."

"The U.S. job market remains resilient with the overall unemployment at 4.1%. Labor supply constraints remain. Particularly noteworthy is that the unemployment rate for college-educated professionals is holding steady at just 2.5%, with even lower rates prevailing among specialized accounting, finance and technology roles... our small business clients typically expect experienced staff when they come to us for contractors. And so we don't really have that many right out of college graduates that we place on the contract side."

→ The bar is set very low for the economy to surprise to the upside in Q3 2025. Experts are forecasting slow growth below 1%, while the nowcast is at +2.5% and Kalshi at +1.8%. Meanwhile, the stock market is pricing in a weak Q3 2025 and above average growth in 2026. Given the high upside risk to growth relative to consensus, I’m upgrading the Growth item to a green up arrow.

Inflation

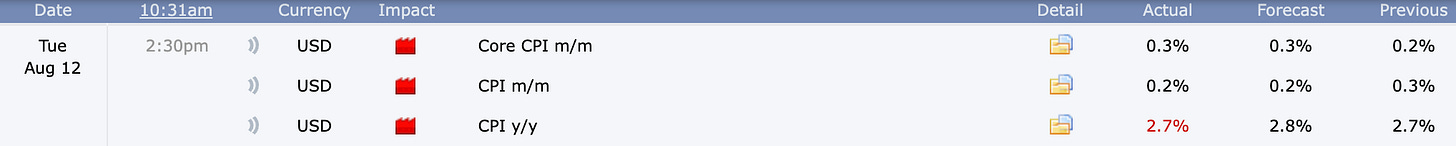

CPI: CPI met expectations. The market rallied strongly on the news, driven by rate-sensitive assets. We even saw Scott Bessent suggest not one but two rate cuts in September!

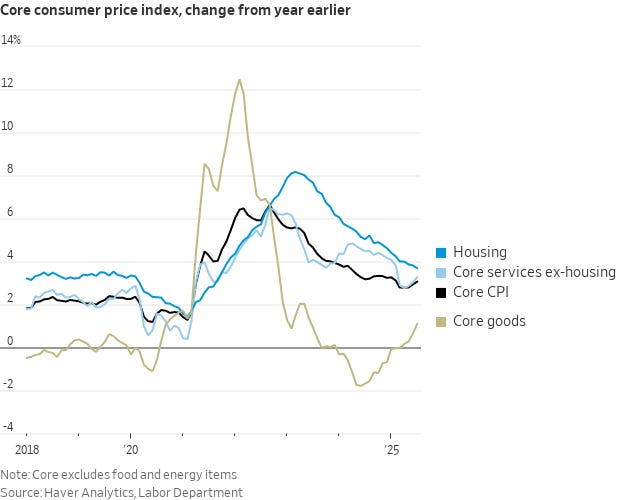

Core goods inflation has been trending upward due to tariffs, but it may not become a concern until later, as the market currently shows little worry. Other deflationary forces remain too dominant.

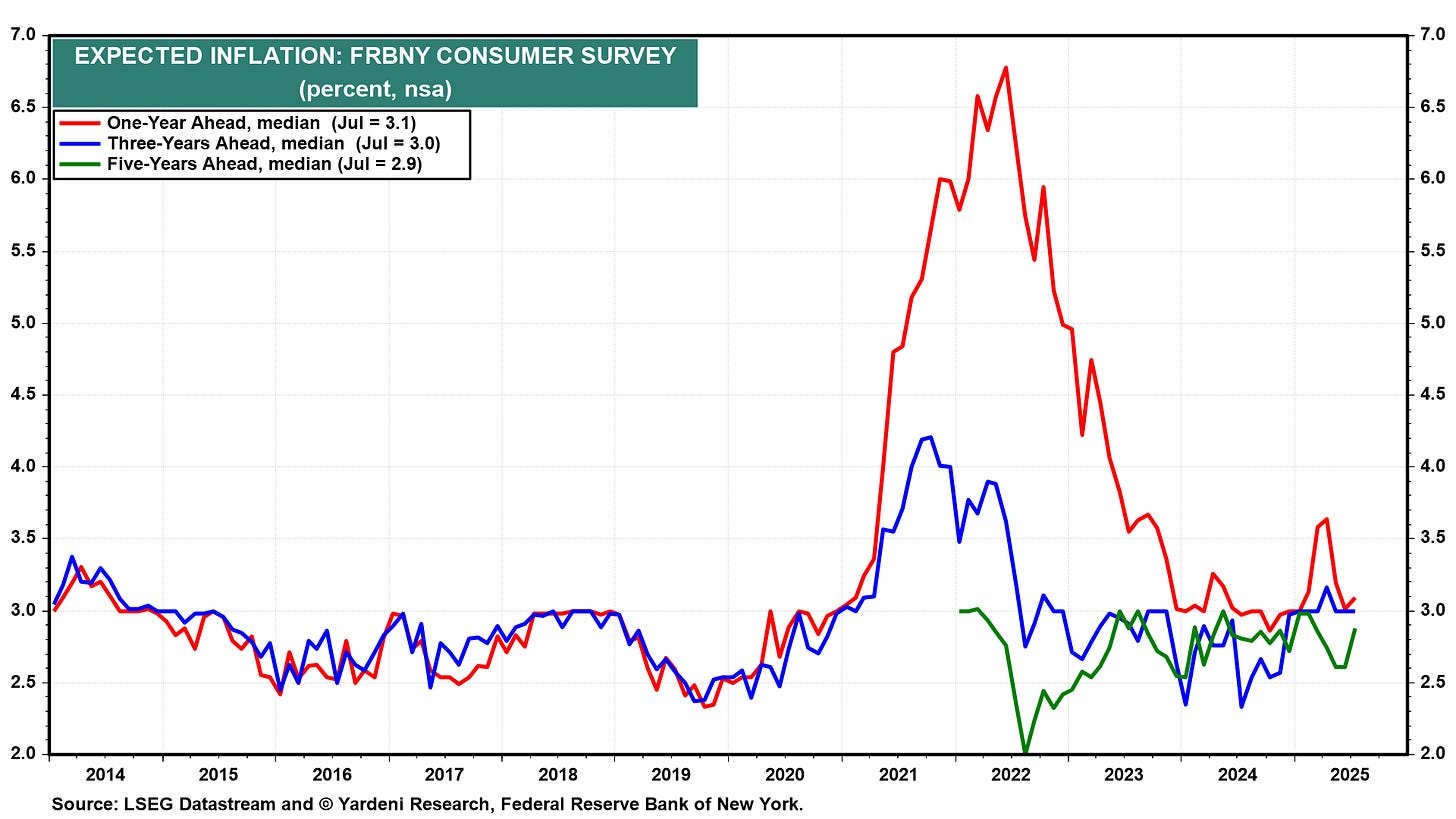

Inflation Expectations: The tariff inflation fear is now behind us. The FED has no excuse not to cut.

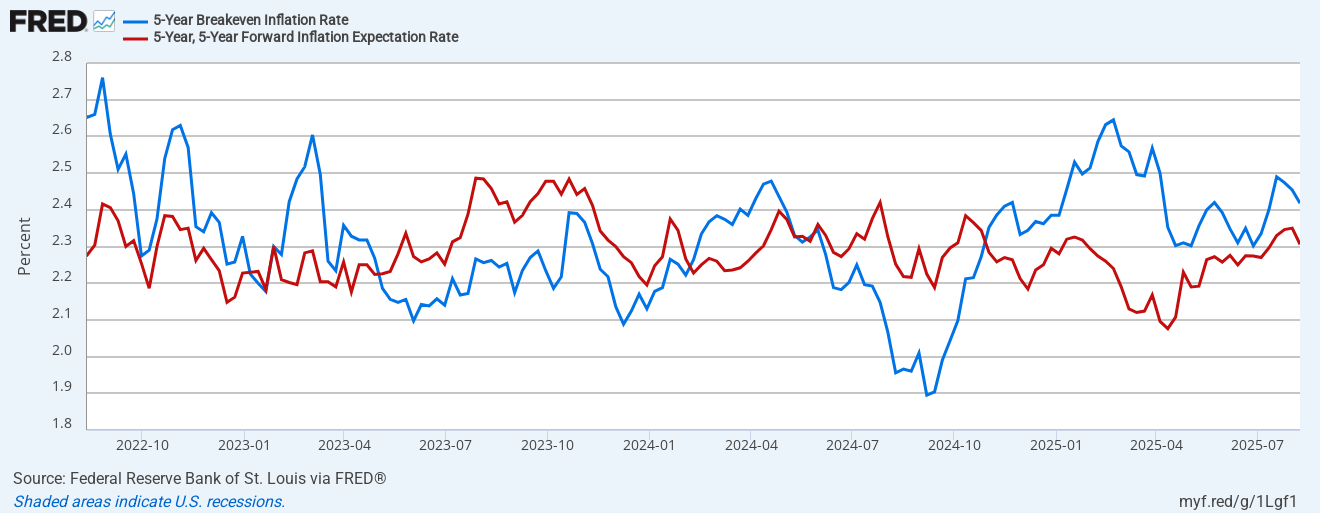

Inflation Swaps: Nothing to see here as well.

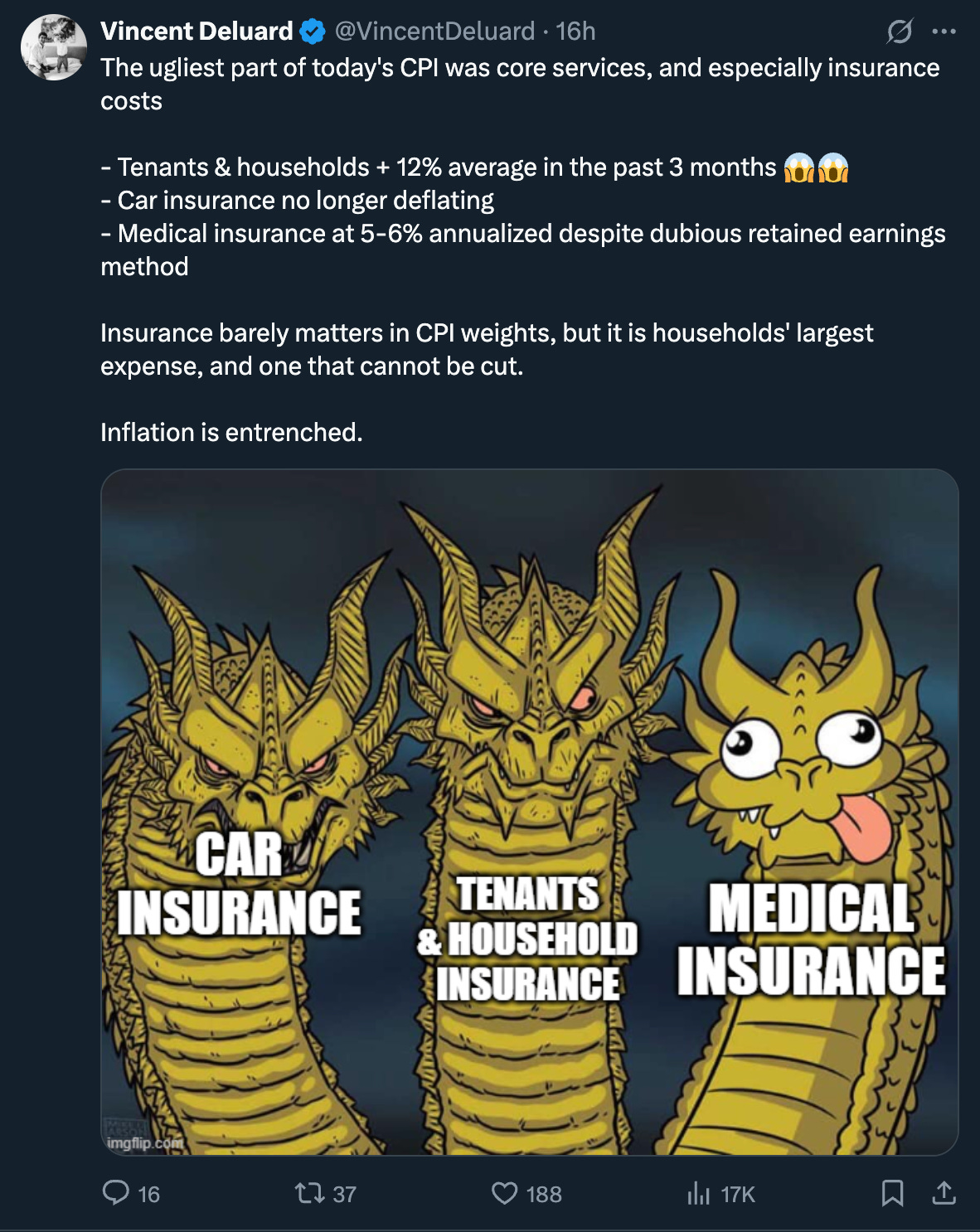

→ No update for the inflation category. We remain in a somewhat disinflationary environment driven by lower housing, oil, and wage pressures. However, we must closely monitor upcoming reports, as core goods inflation continues to accelerate, fueled by gradual upward pressure from tariffs. Certain items, such as tenants’ and household insurance, car insurance, and medical insurance, are also surging. Even if the market interprets the headline CPI as ‘cool,’ don’t be misled: inflation is still running above target, and the CPI is largely a made up number. The average citizen is experiencing significantly worse inflation, and the only effective hedge is staying long stocks.

Monetary Policy

Monetary Impulse: Technically neutral but poised to turn positive as the Fed adopts a dovish stance to support the economy.

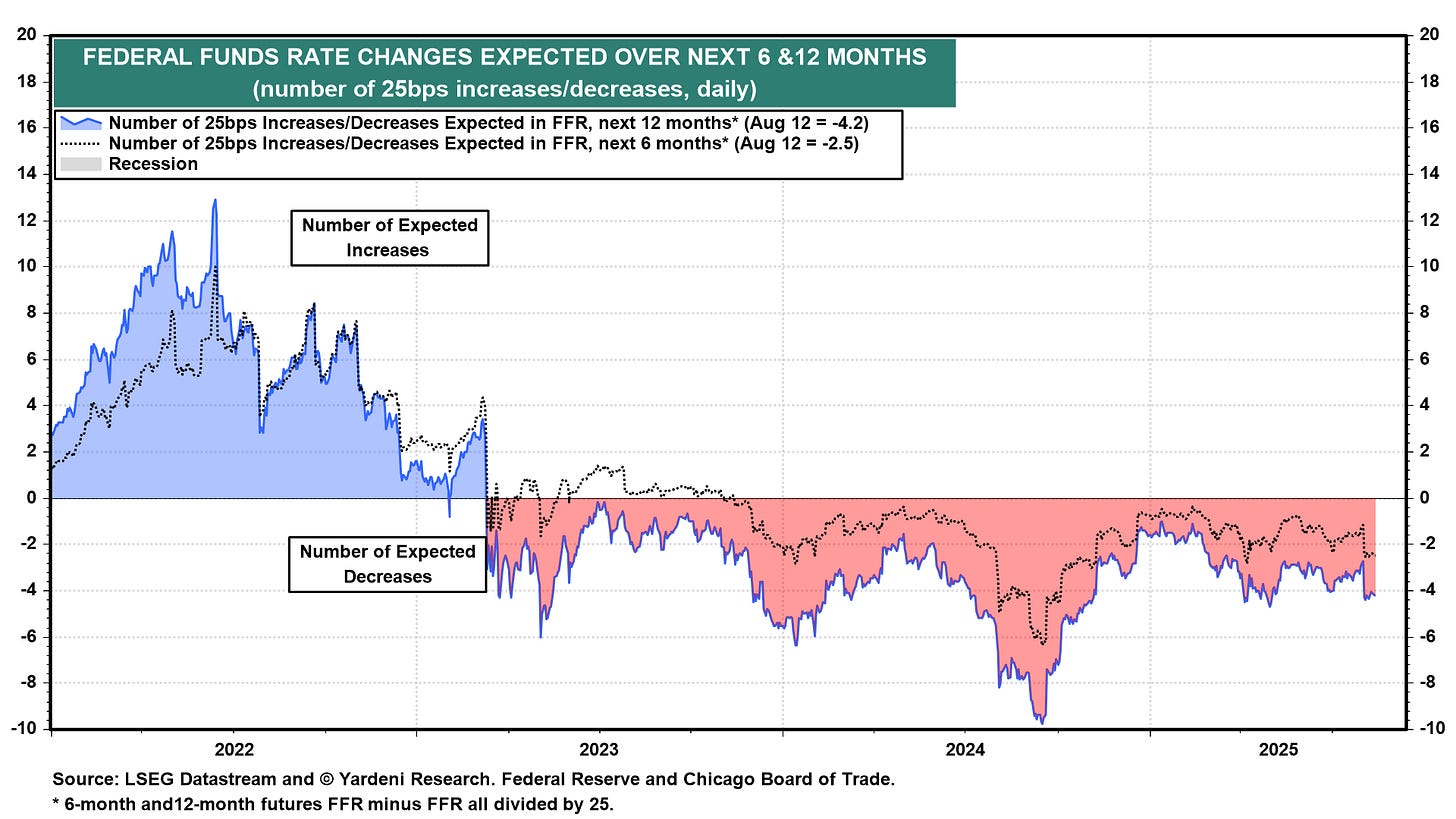

Fed Fund Rate Cycle: The market is pricing in 4.2 rate cuts over the next 12 months and 2.5 cuts in the next six months. Negative NFP revisions prompted a rapid repricing of Fed funds rate futures. Following the CPI release, there is now a 96% probability of a rate cut at the next FOMC meeting (September 16). Rocket emoji? Yes, this is fuelling risk assets until the meeting.

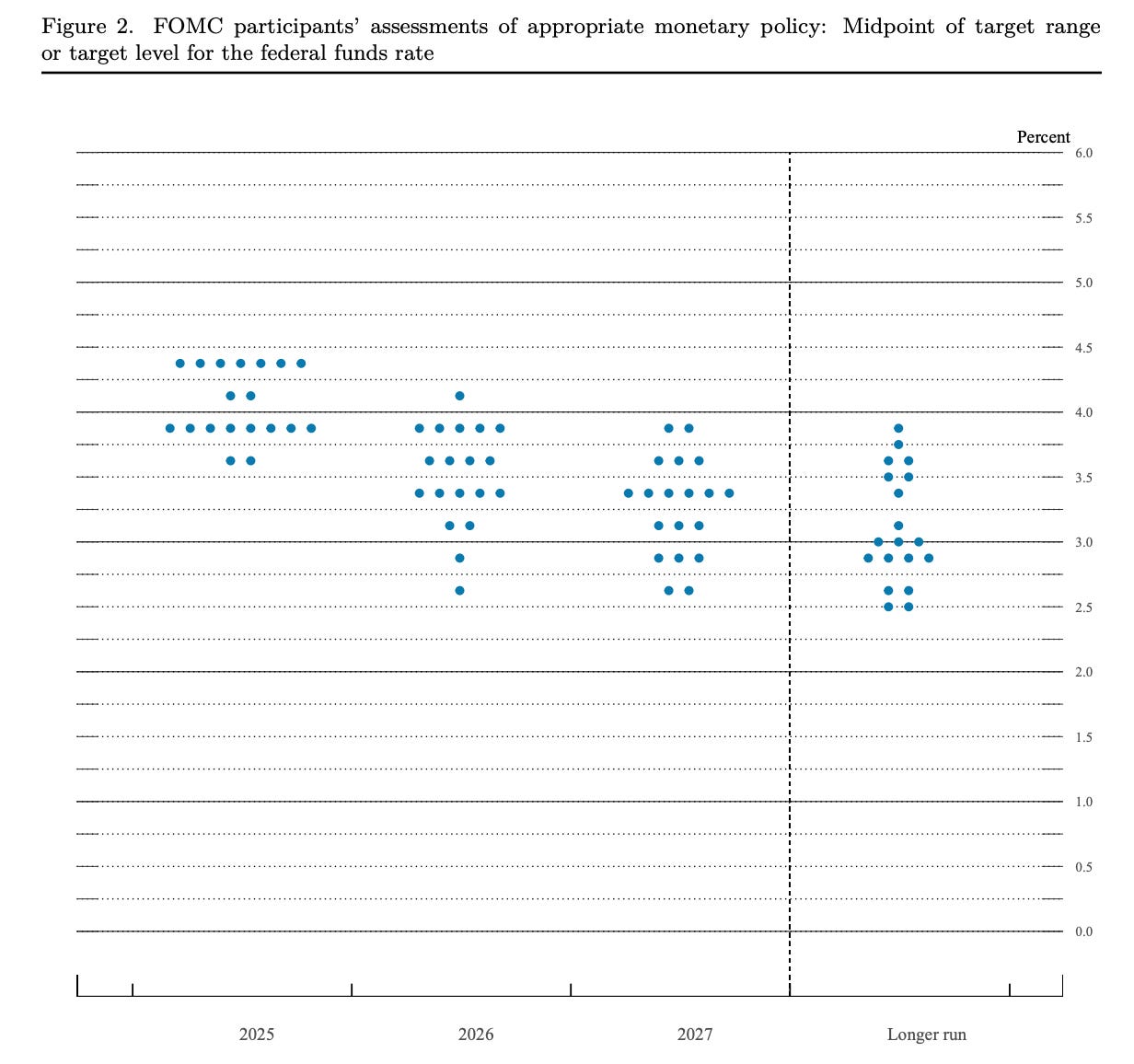

Forward Guidance: The updated dot plot is showing a large dispersion among the FOMC members, with a growing bias toward dovishness.

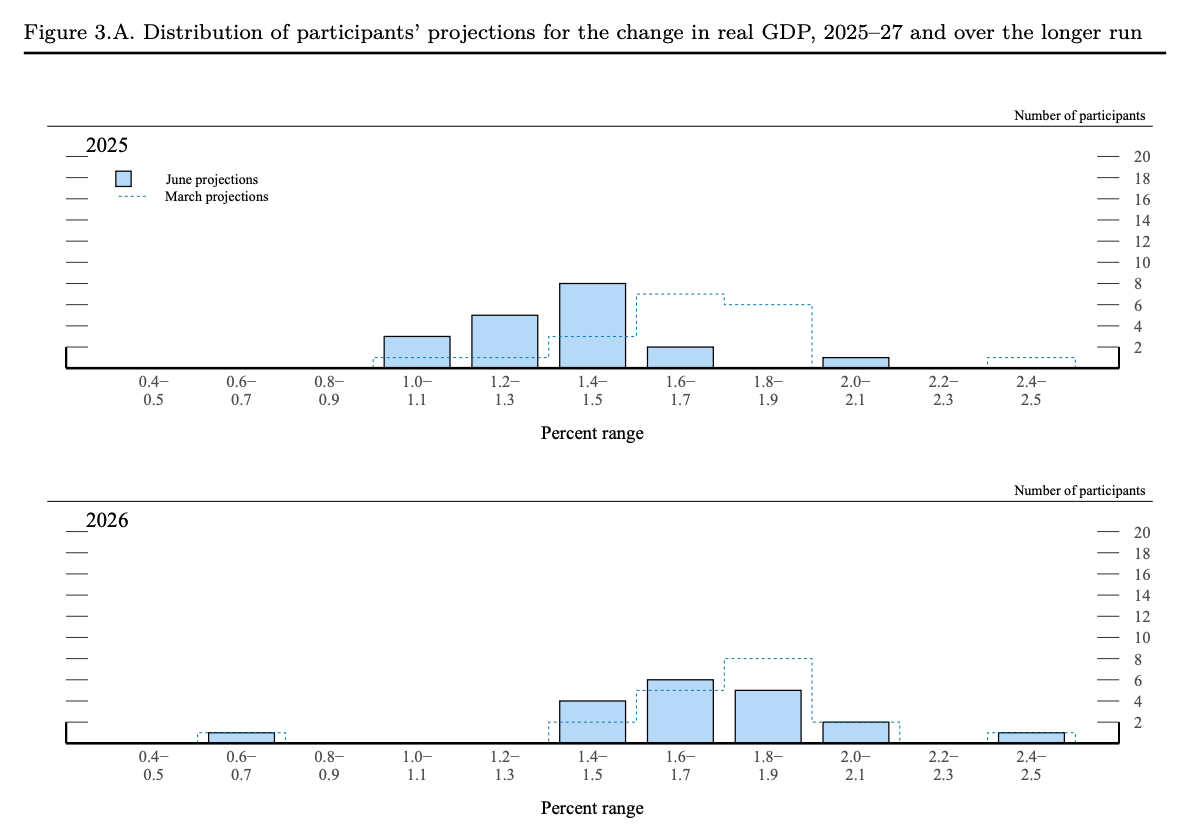

It’s interesting to examine the FOMC’s GDP growth outlook. They have downgraded their GDP target for 2025. Kalshi is pricing 1.6% growth for 2025, but FOMC members appear notably bearish, with most projecting below 1.6%.

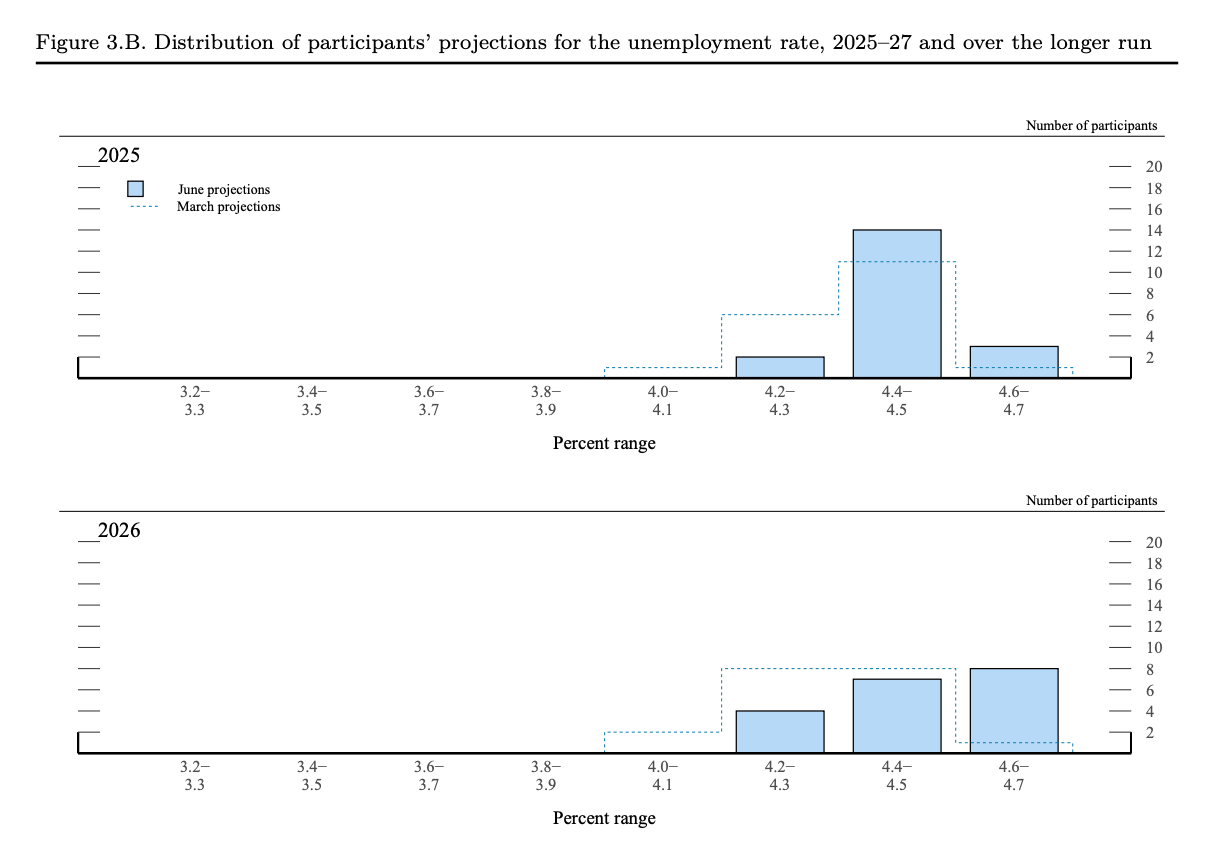

They also downgraded their view on the unemployment rate:

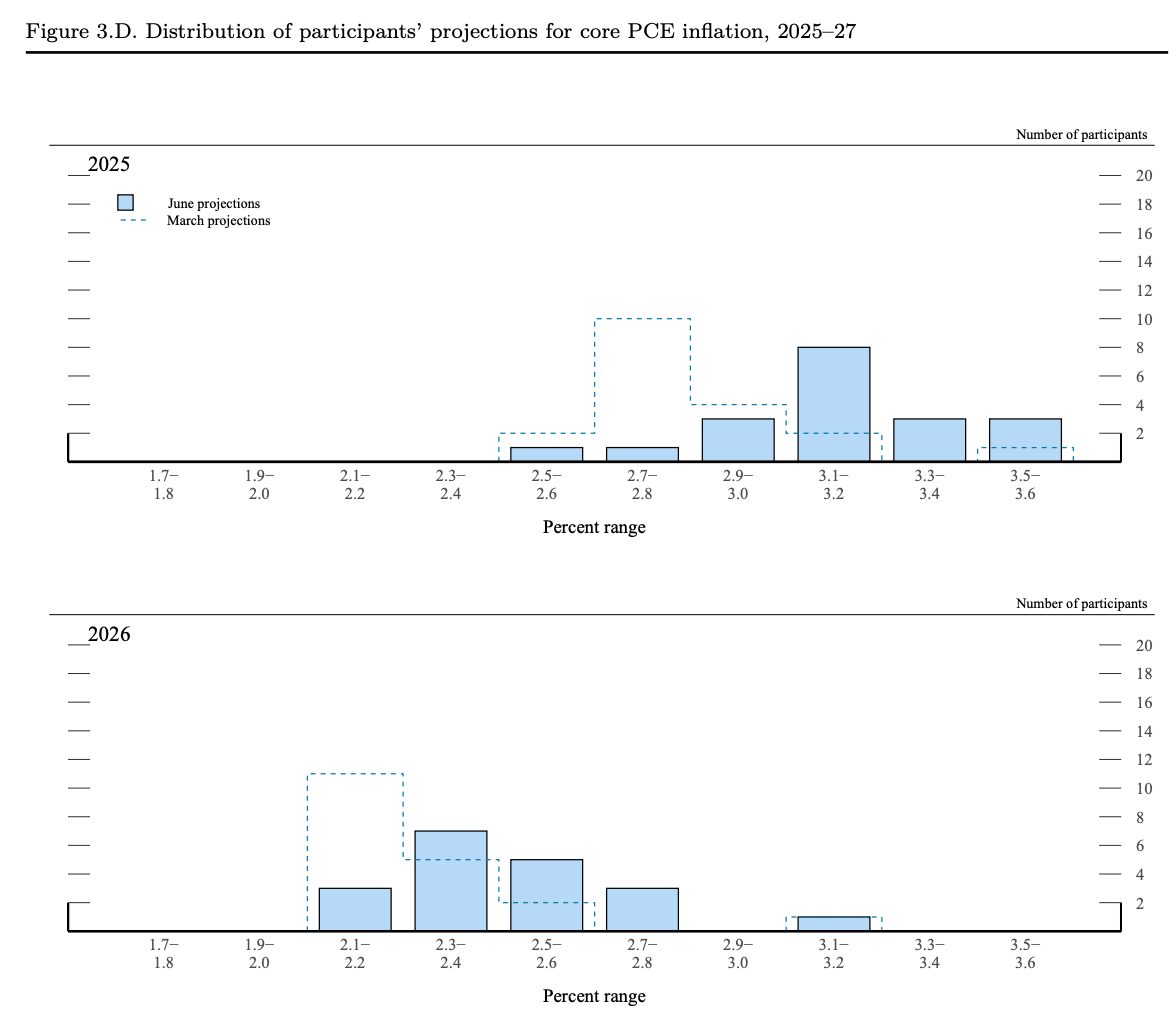

Lastly, their core PCE inflation projections are now much higher.

Overall, FOMC members project a slowing economy, with a slight uptick in unemployment but persistent above-target inflation. View the full report here.

→ I am upgrading the monetary policy category to positive. Although the monetary impulse is not yet a significant force in the economy, I believe market participants will trade on expectations of a positive impulse until the next FOMC meeting. Do not trade against this shift!

Fiscal Policy

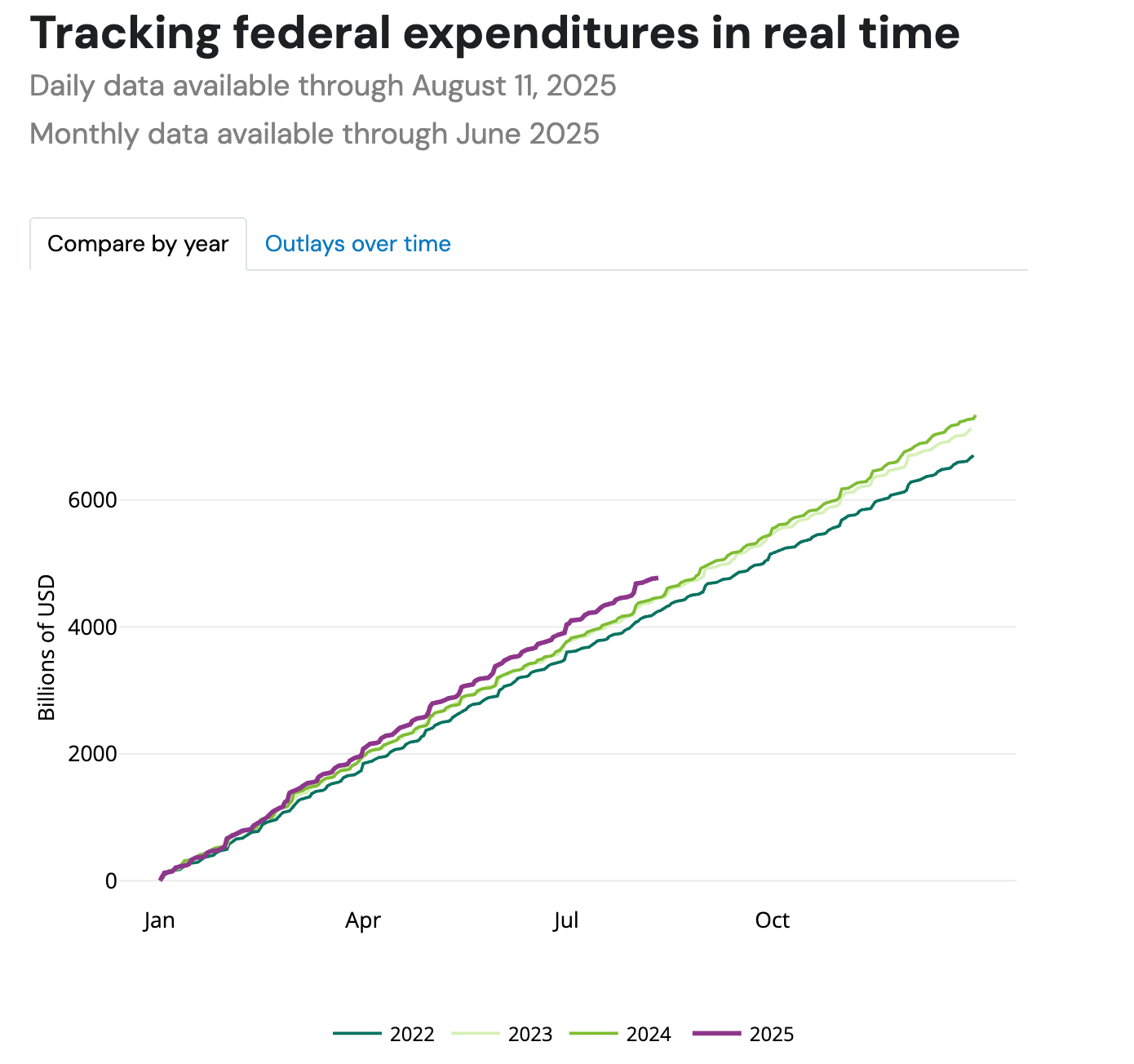

I encourage you to reread my previous post, where I explained why the fiscal impulse is now negative. This remains the primary fundamental headwind for the market, yet it appears to be largely ignored. Nothing seems to matter unless it’s AI-related.

I also invite you to read Michael Kao’s post below. He offers a variant perception of the Trump policies. I particularly like his notion of Reverse Marshall Plan.

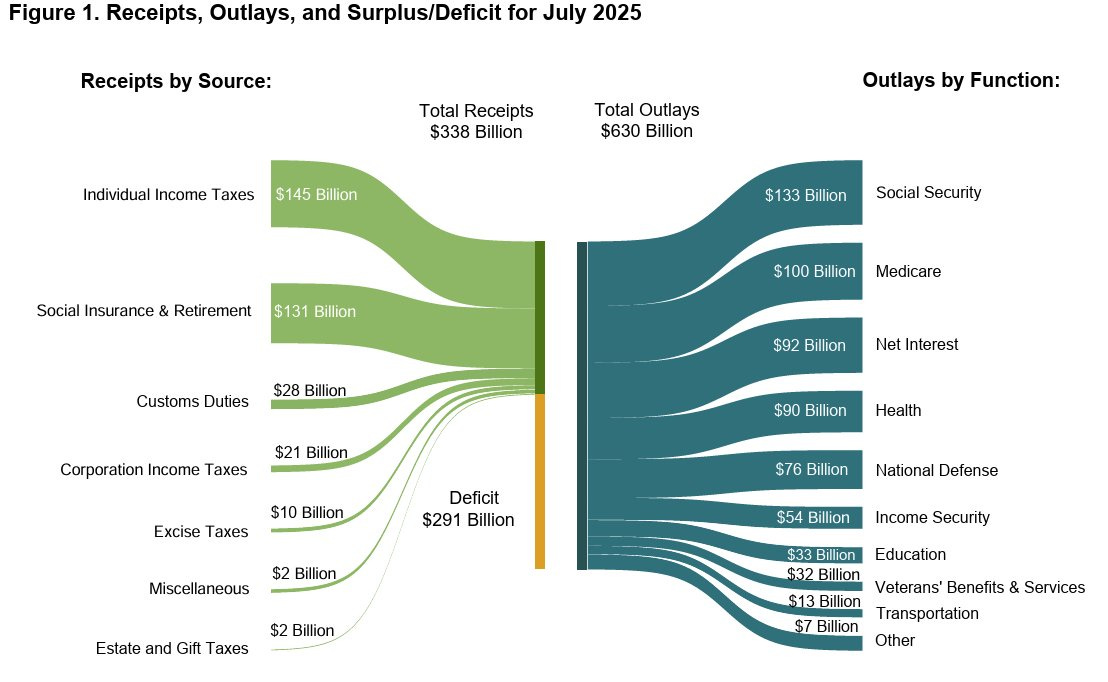

→ No change to the Fiscal Policy category. In my Week 20 post, I downgraded the fiscal policy outlook due to Trump’s policies. While this poses a potential headwind for equities, it does not signal an exit from the fiscal dominance regime. The systemic Ponzi remains robust, and customs duties will not suffice to balance the budget. The latest Monthly Treasury Statement shows a persistent monthly deficit near $300 billion. Do not assume that downgrading fiscal policy means you should buy long-term bonds—far from it.

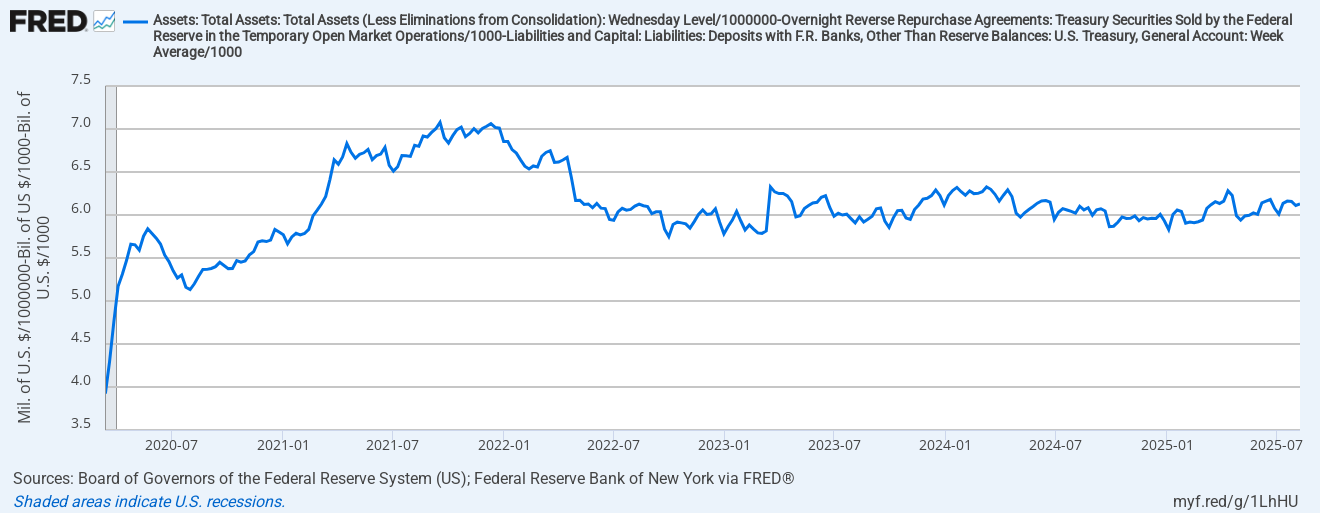

Liquidity

US Liquidity: The proxy index remains stubbornly flat.

Global Liquidity: The global index is pausing here. Bitcoin has been closely tracking the leading index, which is remarkable. The US dollar will now determine the liquidity index’s trajectory. The DXY remains near its long-term channel support, but I’m increasingly skeptical of its ability to rebound. Excessive dovishness in the US undermines the dollar’s potential to resume an uptrend. I’ve exited all long USD positions.

→ No update for the Liquidity category, bitcoin and ethereum are sitting at all time high, liquidity is plentiful and the US Dollar is not showing any strength.

Conclusion

Something is shifting in the markets. For some time, the macro dashboard has shown a positive fiscal policy impulse paired with a negative monetary policy impulse. I believe these trends are about to reverse, which is why I’ve updated the categories accordingly. What has been working may lose momentum, while what hasn’t been working could finally gain traction. This signals a potential market rotation.

I see a highly asymmetric setup and am sizing this next trade BIGLY.

Remember this quote from Mind Drift to Clarity #01?

Time to fade my favourite cohort.

An economist is an expert who will know tomorrow why the things he predicted yesterday didn't happen today

Laurence J. Peter

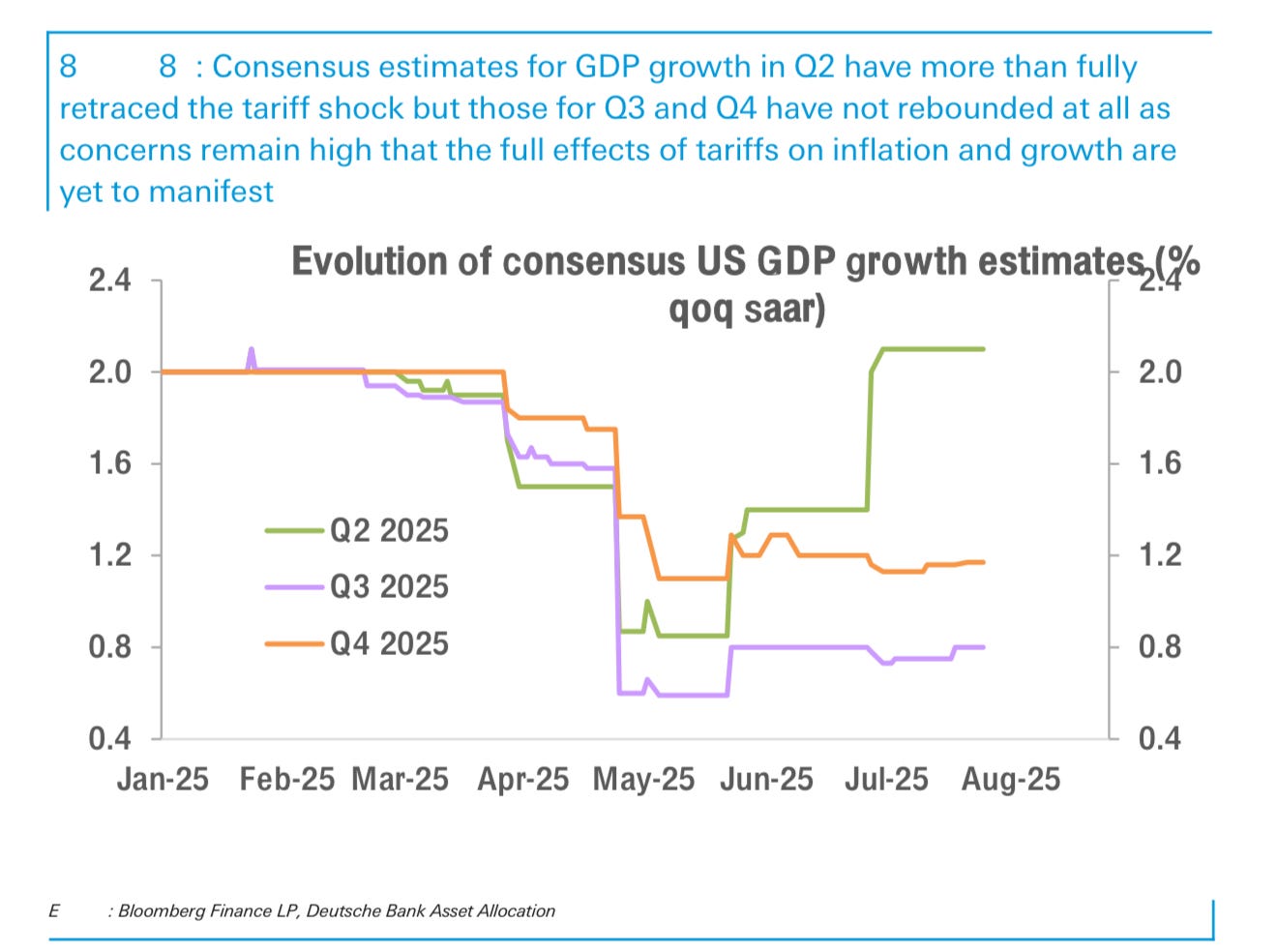

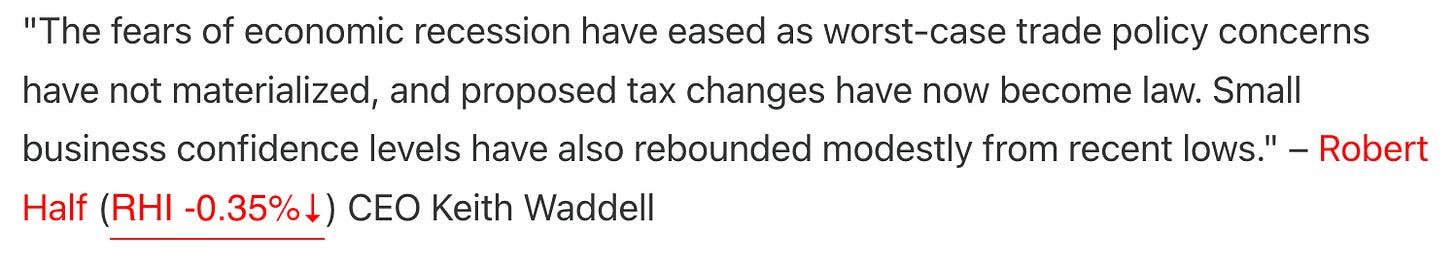

The consensus among forecasters is clear: the US economy will slow in H2 2025 due to tariffs impacting GDP.

The consensus among analysts is also clear: the US market is poised to melt up into year-end, but it will likely first experience a typical summer drawdown.

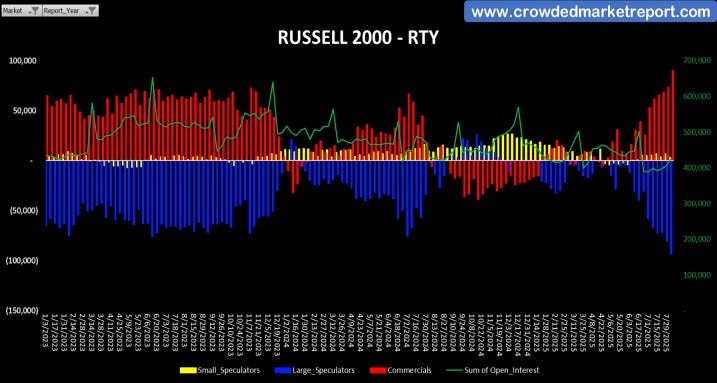

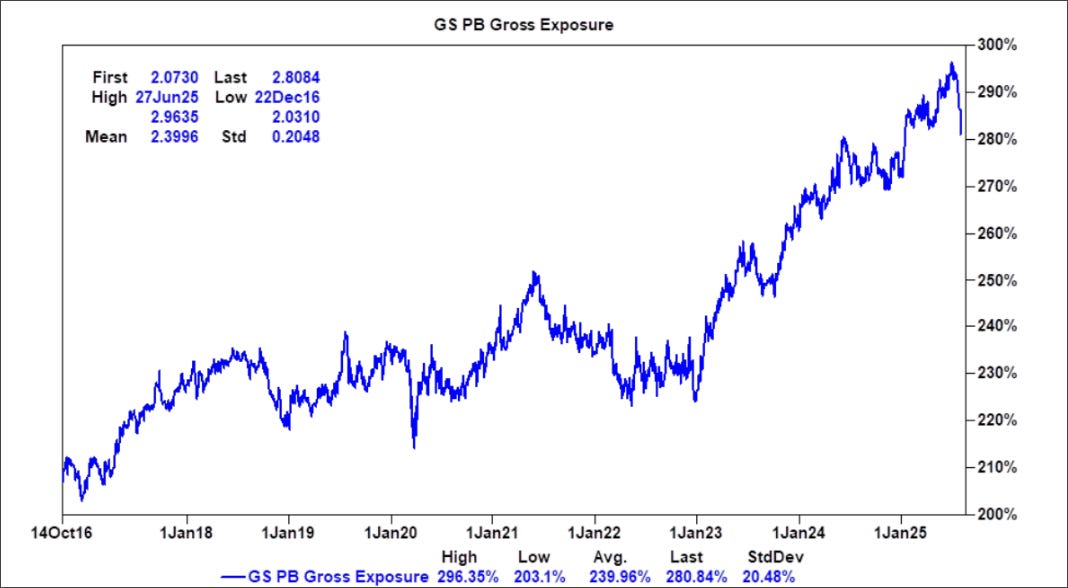

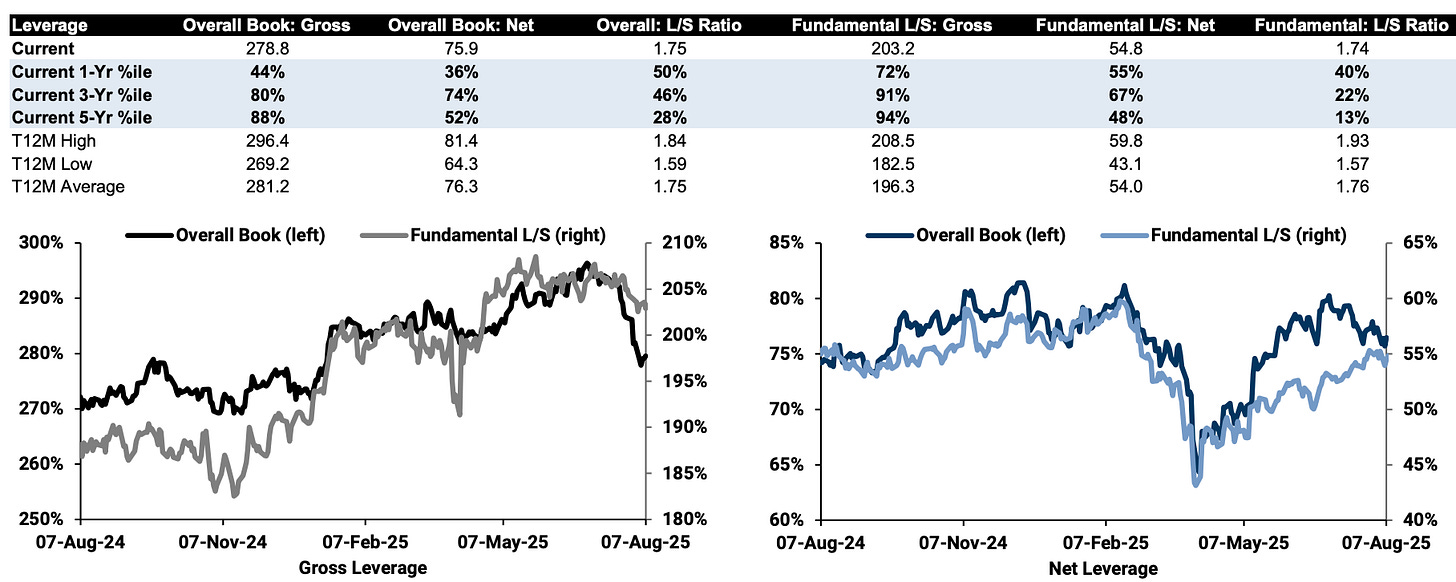

Consensus among long/short hedge fund managers: the market is frothy, prompting high gross exposure but low net exposure. Big Tech will continue to thrive amid a tepid US economy and AI-driven capex and hype. The Russell 2000 is a natural short for them:

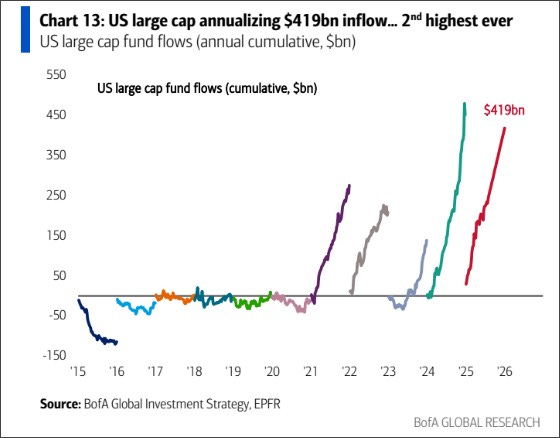

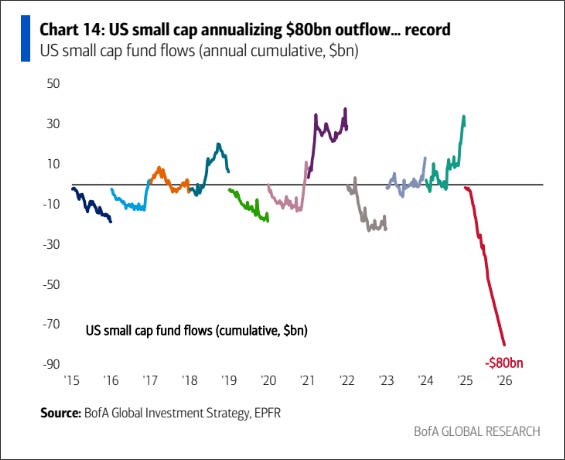

Consensus among market participants is that large caps will continue to outperform small caps. This extrapolates past trends, and the flow mismatch has been INSANE this year.

My variant perception is straightforward: the economy is poised to surprise to the upside while short-term rates are being repriced lower. This creates an ideal environment for small- and mid-cap stocks to perform strongly.

The trade is long Russell 2000

This marks a significant shift from my earlier view that the economy would slow due to a negative fiscal impulse, compounded by NFP negative revisions. I even ventured to the dark side, shorting the S&P 500 for a week. But the market has spoken, and my perspective is now clear, few are positioned for this new shift.

Small caps are heavily shorted, and a trigger event is unfolding: the Fed is cutting rates while the economy is growing.

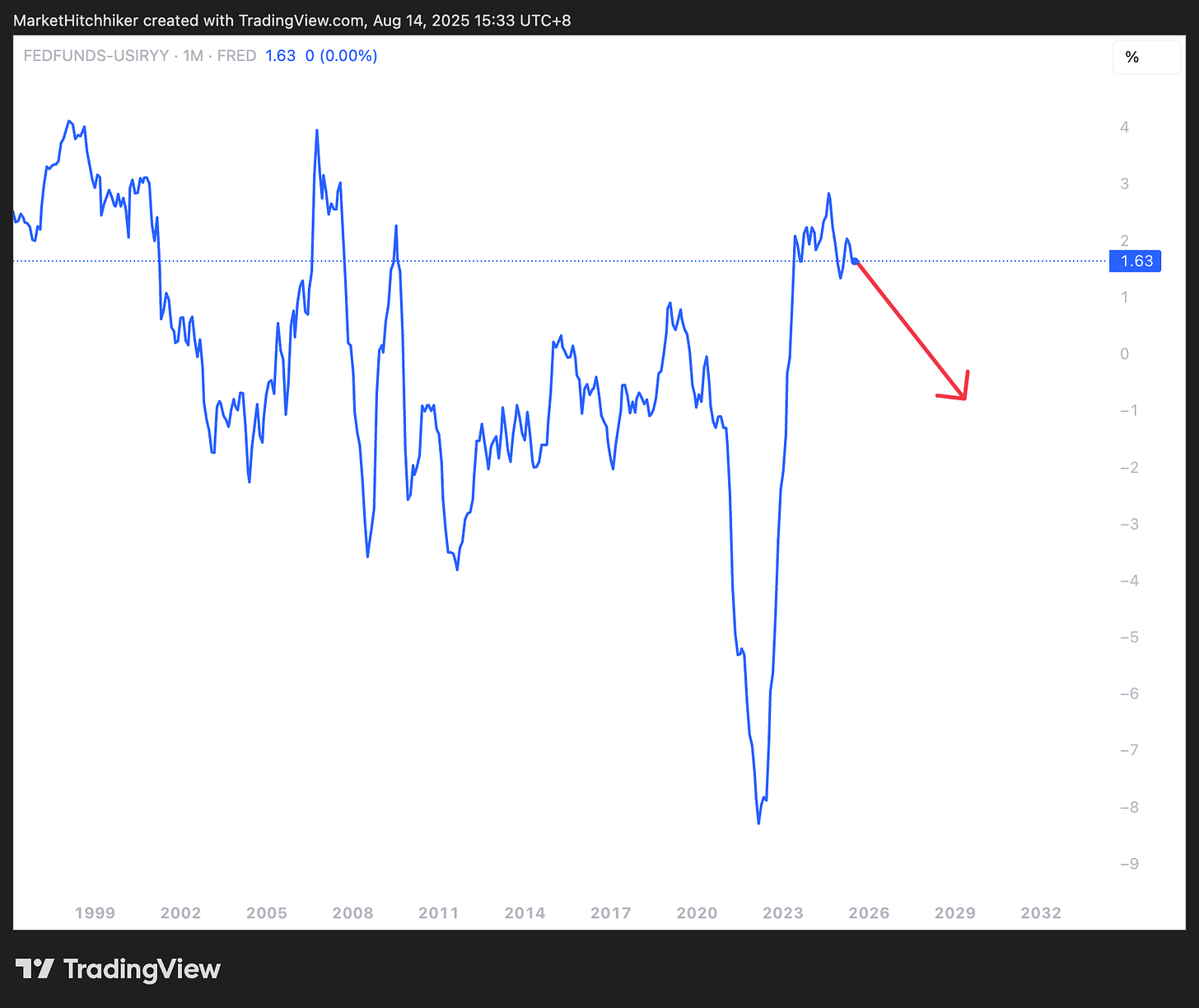

Negative real yields incoming!

The monthly candlestick chart is forming what people-who-believe-in-astrology, aka chartists, call a 'cup and handle.' A breakout from this pattern, following a prolonged correction since 2021, is typically explosive. This isn’t just another rotation episode like those seen a few times last year. I believe this is the beginning of a significant move.

I’ve jettisoned all non-core trades from my portfolio, eliminating index long/short positions and hedges. The portfolio is now streamlined and heavily invested in Russell2000 thanks to IWM ETF.

45% IWM

1.50% NAV into IWM SEP 227 Call option - Delta is ~30% of my NAV

25% in BRK.B

15% in AEO

2.5% in KEP

Total net exposure 117.5%.

One final note: a SCOTUS ruling against Trump’s tariffs would be the cherry on top. It would be highly stimulative for small-cap stocks. One can dream…

Good luck and stay safu!