When the market is showing signs of extreme risk-taking attitude, the right approach is to be very nimble. [Week # 22]

Everything according to plan: steady growth and dovish winds

Macro dashboard update

Growth

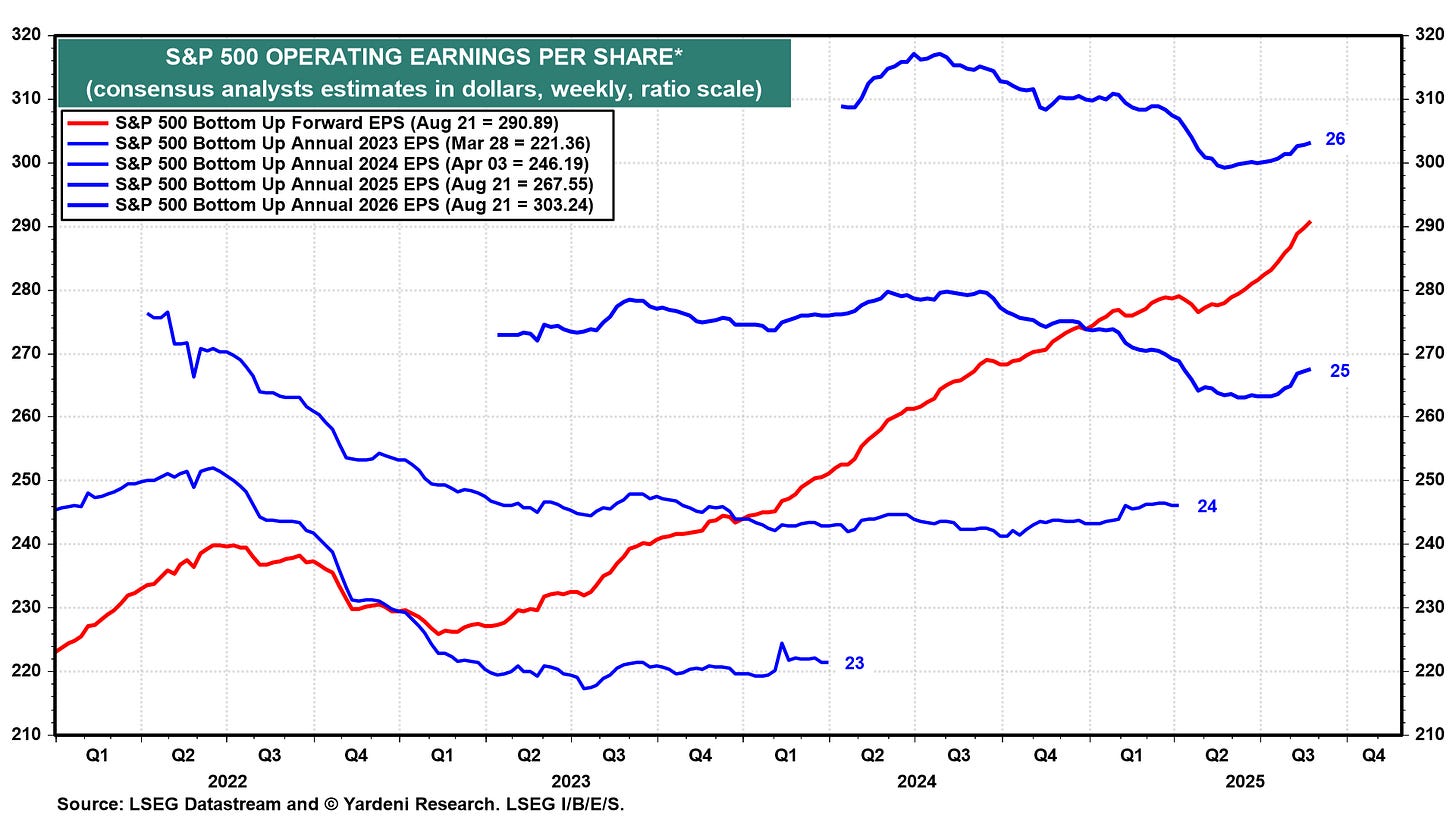

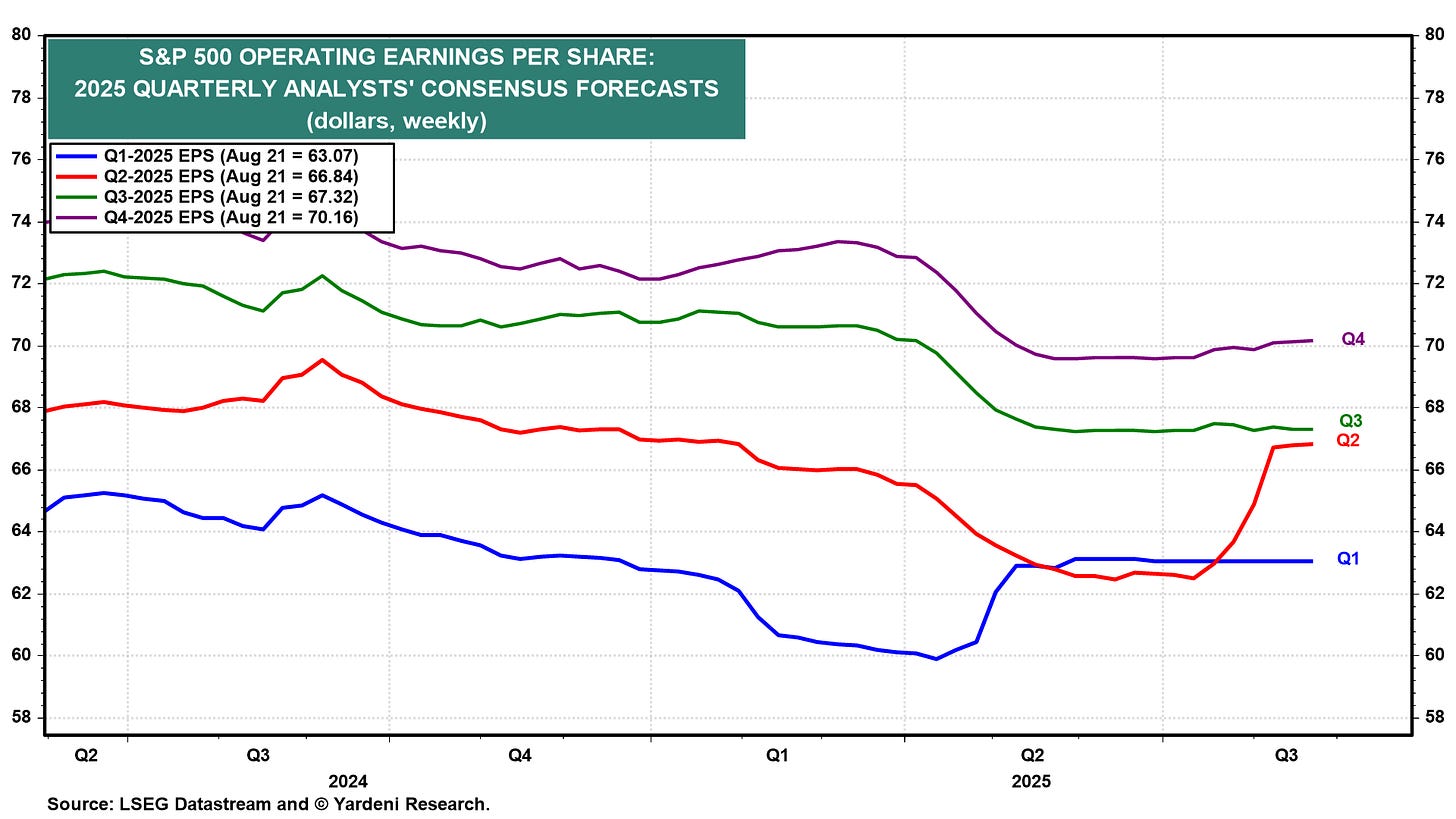

S&P 500 Forward Operating Earnings: There is nothing stopping this melt-up in the S&P 500 Next Twelve Months earnings per share. And we haven’t seen any upward revisions for Q3-2025 yet. We will very likely see some positive revisions as we edge toward the end of the quarter.

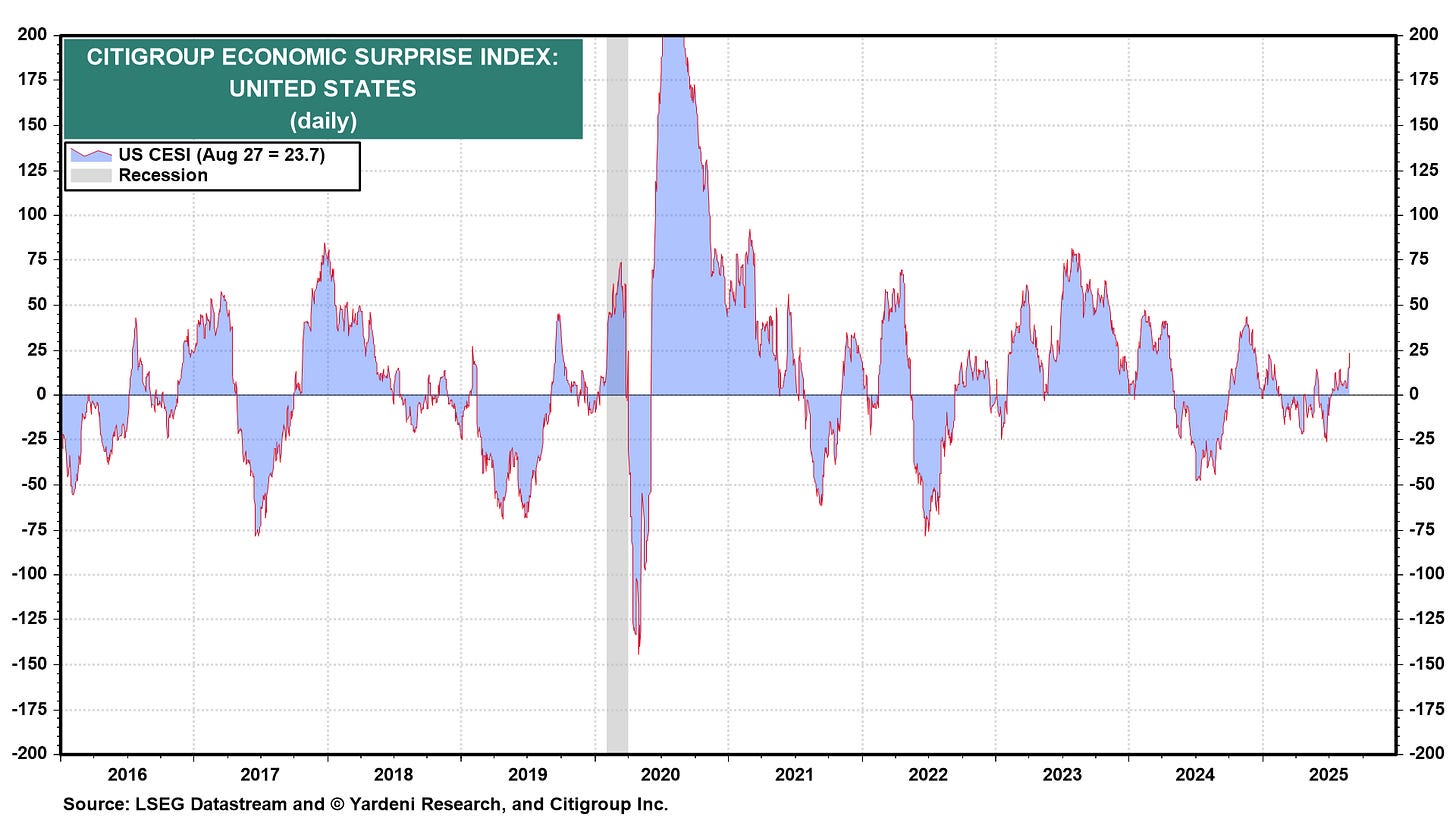

US Economic Surprise: Boom! The surprise index is now definitely in positive territory. The economy is stronger than expected—sound familiar?

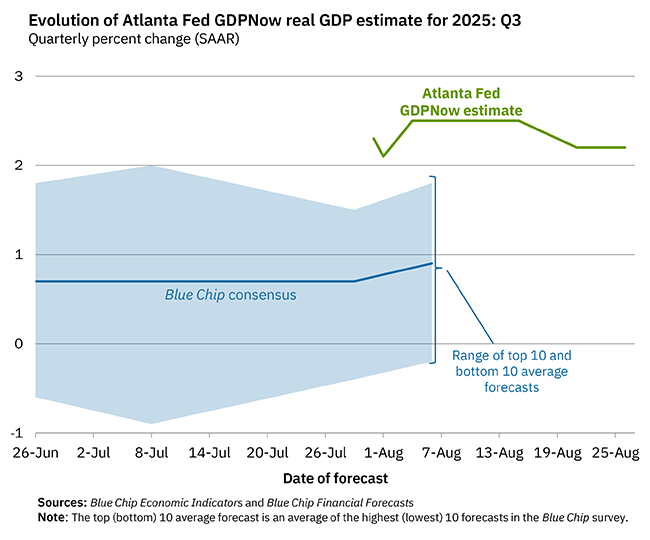

GDP Nowcast: The Atlanta Fed’s GDPNow is forecasting +2.2% for Q3-2025. And great news, we’re starting to see the Blue Chip consensus turning higher.

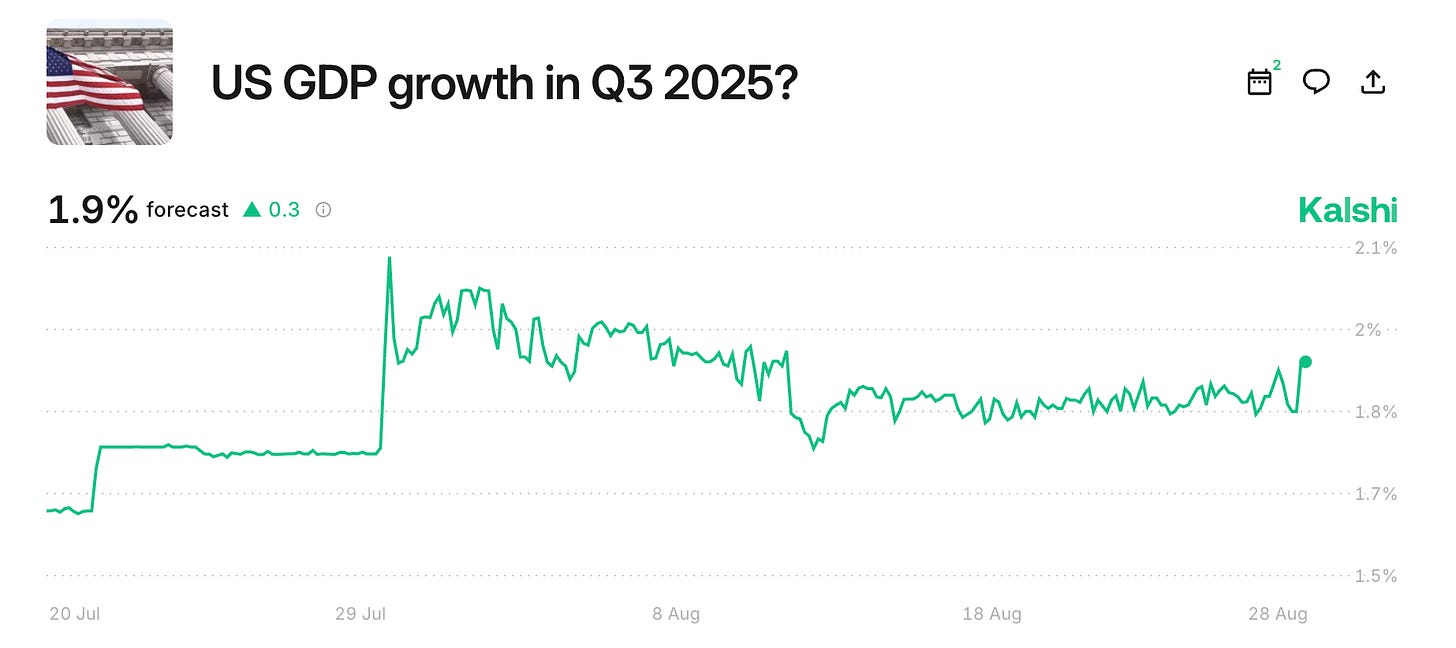

Kalshi at +1.9%:

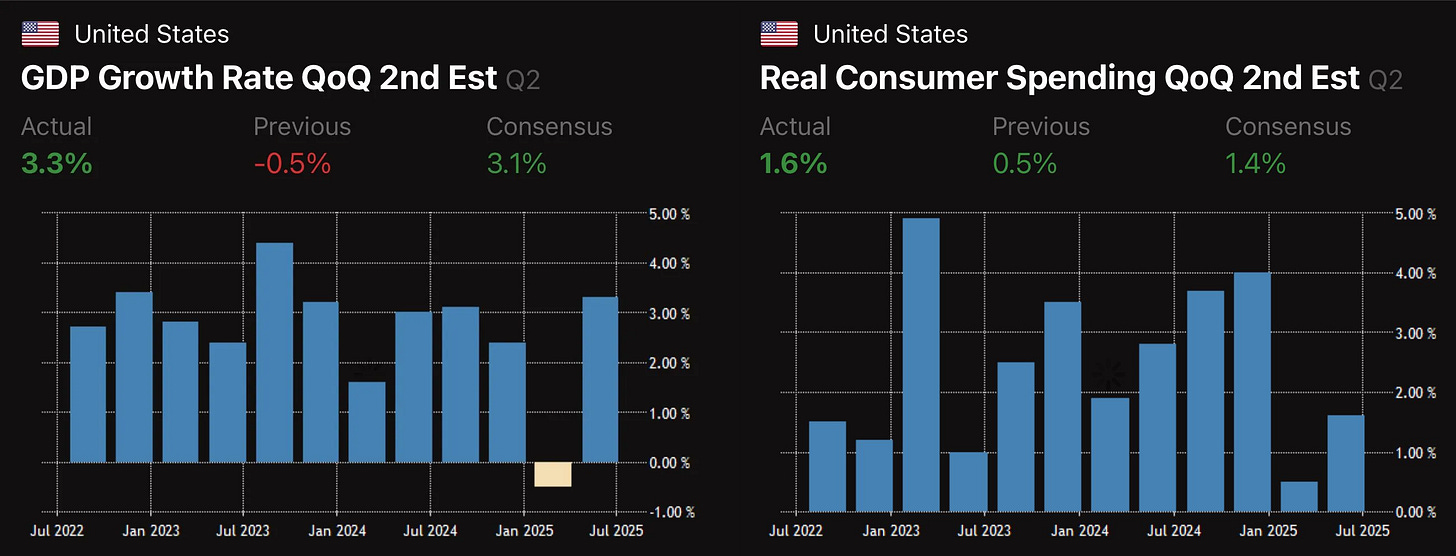

We also add the GDP QoQ estimate published today, it came in above average at +3.3%. Real consumer spending is also strong at +1.6% versus the +1.4% estimate.

Let’s review our usual job market indicators:

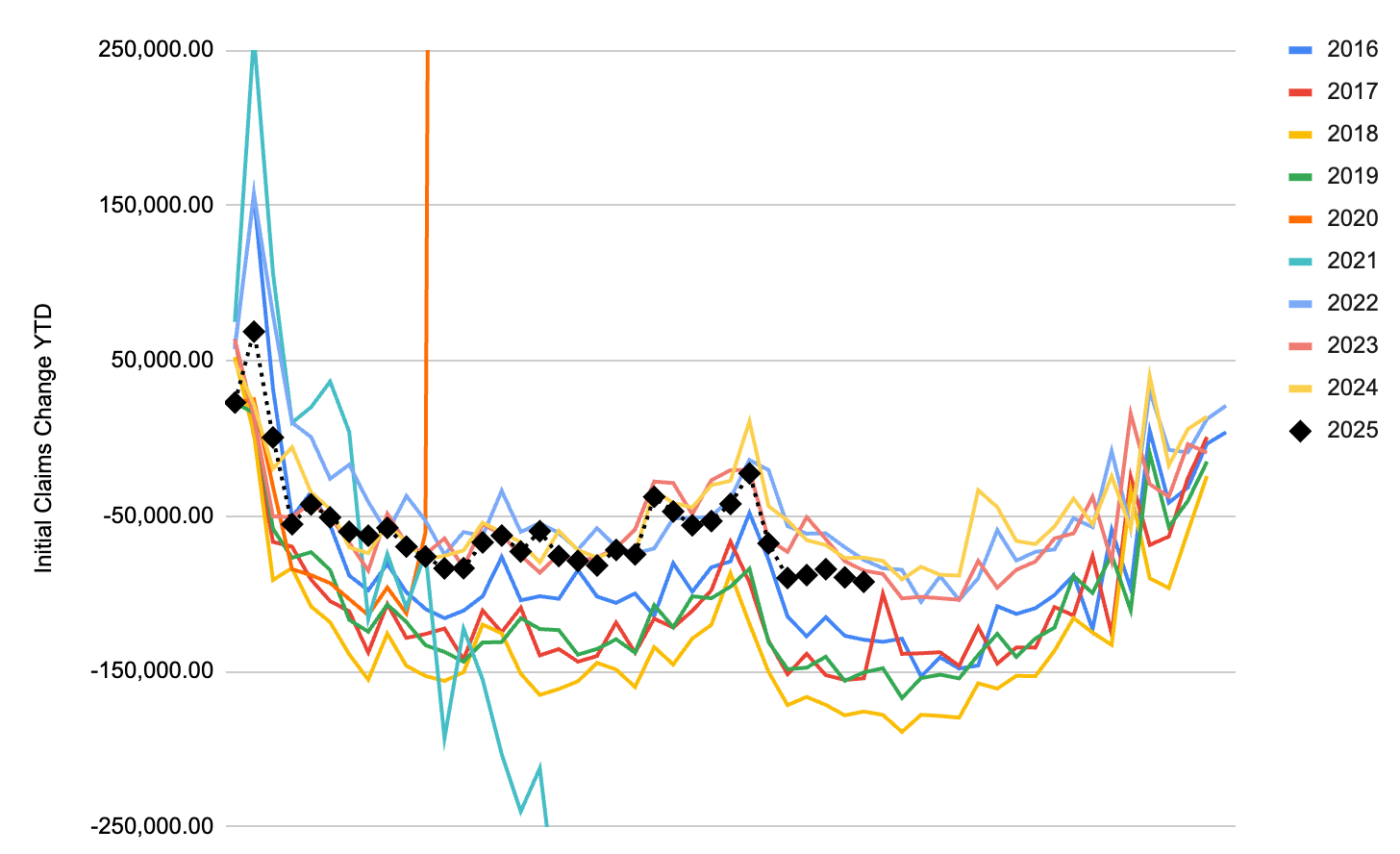

Initial Claims: Still a big nothing burger!

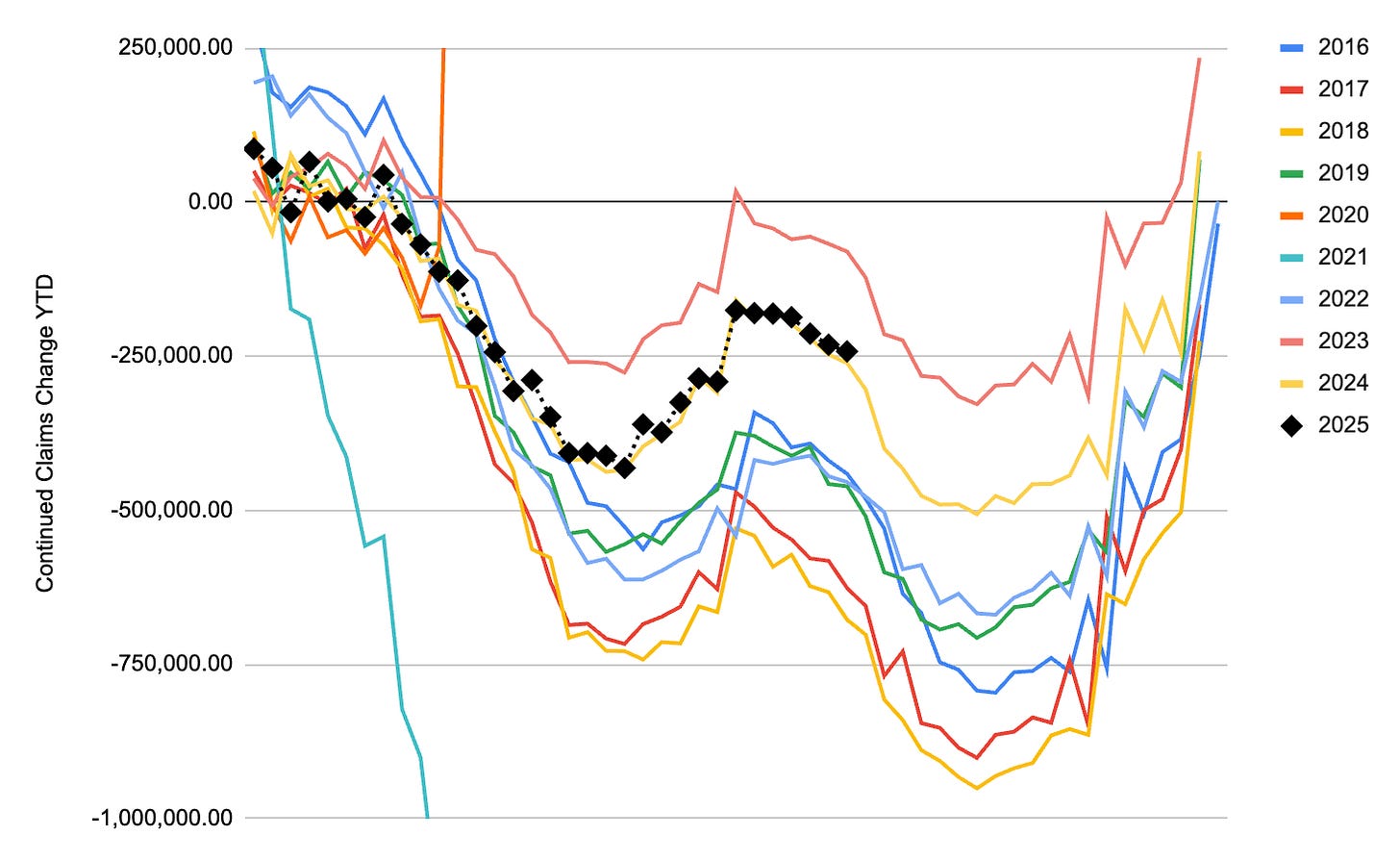

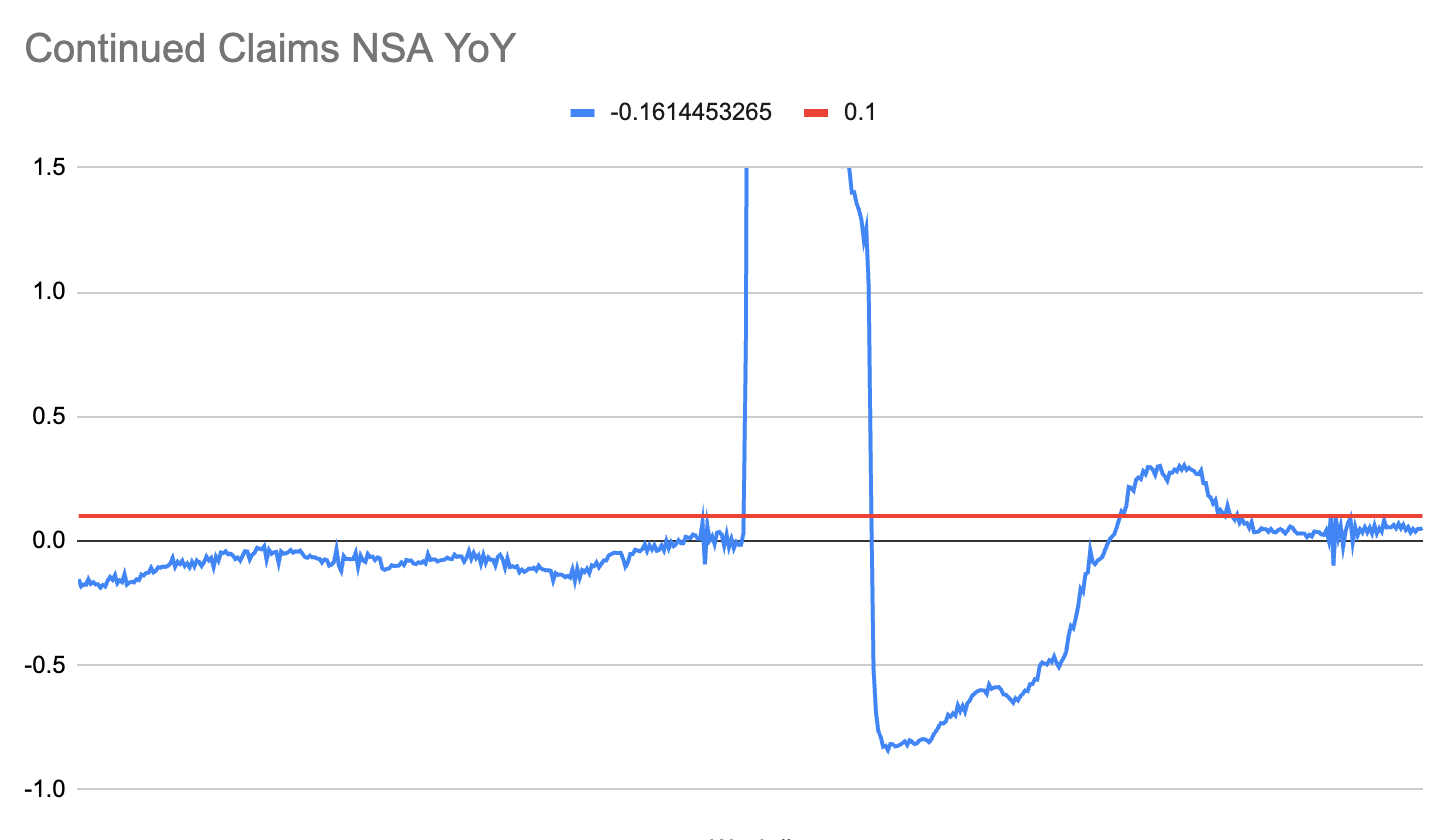

People have been talking a lot about continued claims being elevated. However, in terms of “impulse” (year-to-date added continued claims) we’re still tracking nicely with last year; see the chart below. Also, the year-over-year change in non-seasonally adjusted continued claims is below 10%. This is the historical trigger level for a recession.

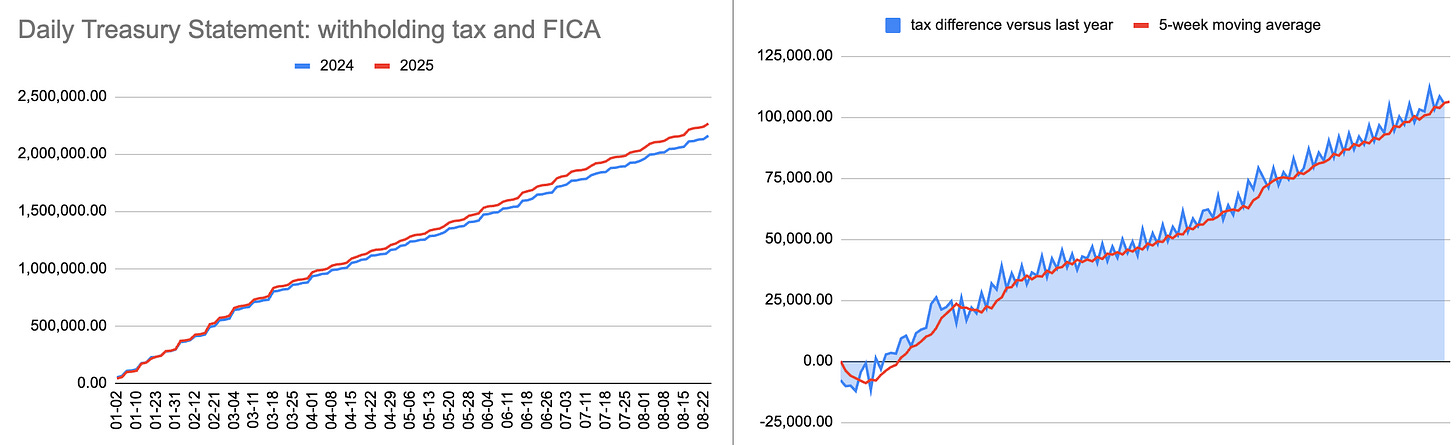

Daily Treasury Statement: The government is still collecting tax at a solid pace compared to last year.

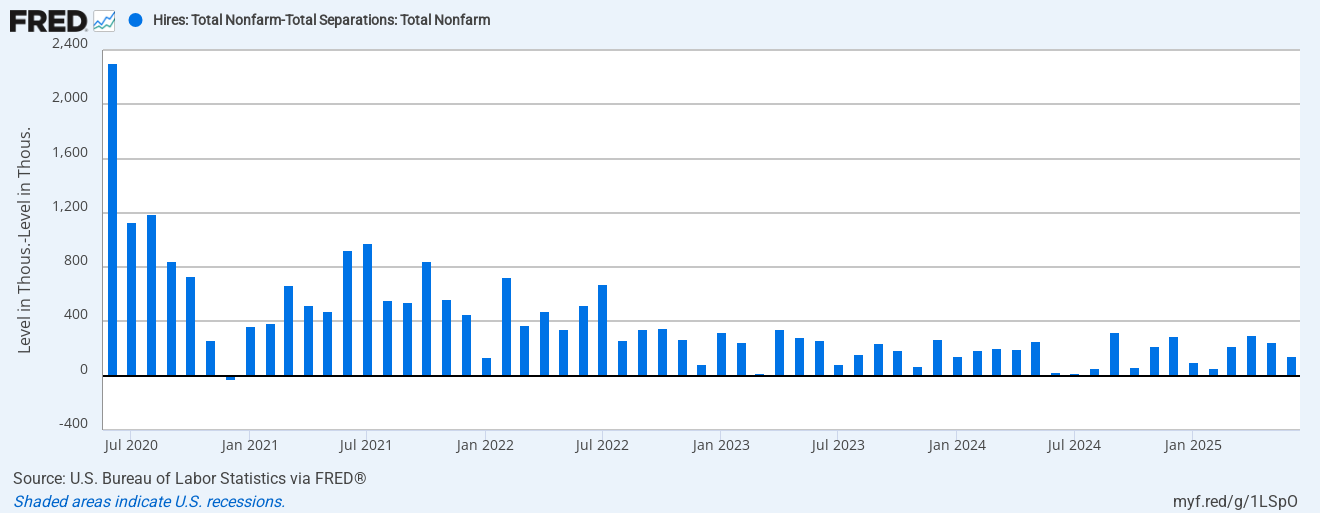

Surprise, surprise… I sound like a broken record now, but the US economy is still doing very well. The job market is easing but still strong. Despite the weak NFP prints, we’re still seeing total hires minus total separations in positive territory. This was already highlighted in this Tactical Update, but I want to make sure everyone is crystal clear about what’s happening with the job market: it’s sending mixed signals, but it’s still holding up well enough to sustain the stock market.

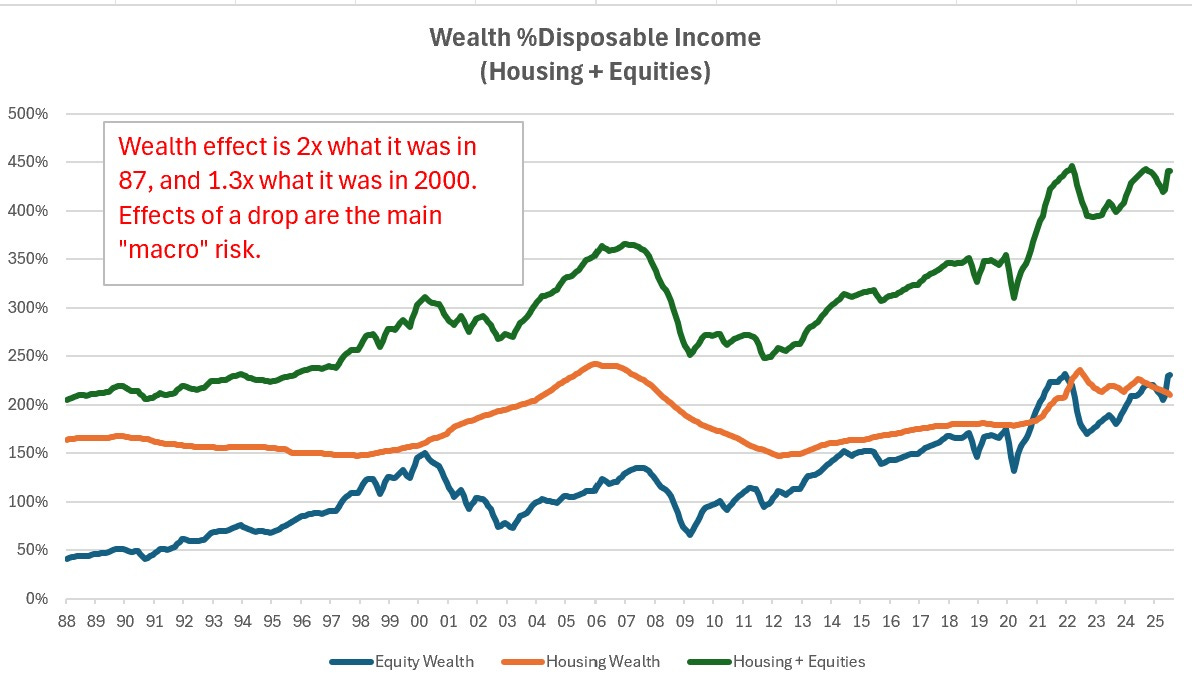

Yes, the job market is sustaining the stock market through passive flows into 401(k)s. But the stock market is also sustaining the job market by creating sustained demand for goods and services through the wealth effect. This effect has never been so important in modern US history:

This is the ultimate reflexive loop, and that’s why I keep repeating to people around me that the S&P 500 is not acting like an equity market, but like a high-yield bond: very strong upward trend, with crazy sharp but unsustainable downside moves. This is a feature, not a bug.

→ In the last weekly post, we upgraded the growth category to a green arrow. This was a prescient call, and I’m sticking to my guns. No update for the growth category.