When life gives you dips, don't make lululemonade

I’m not buying the dip on $LULU; instead, I’m pulling the trigger on another stonk

This is the time of year when everyone is sifting through 13F filings to find the next hot stock to buy. The spotlight is on UNH 0.00%↑ , with both Warren Buffett and Michael Burry buying the dip. However, catching a falling knife like this isn’t my style. While the long-term returns might be solid, I don’t see any clear catalyst for UNH to outperform in the short to medium term.

I also noticed Michael Burry bought a stock I’ve been eyeing for a while: LULU 0.00%↑.

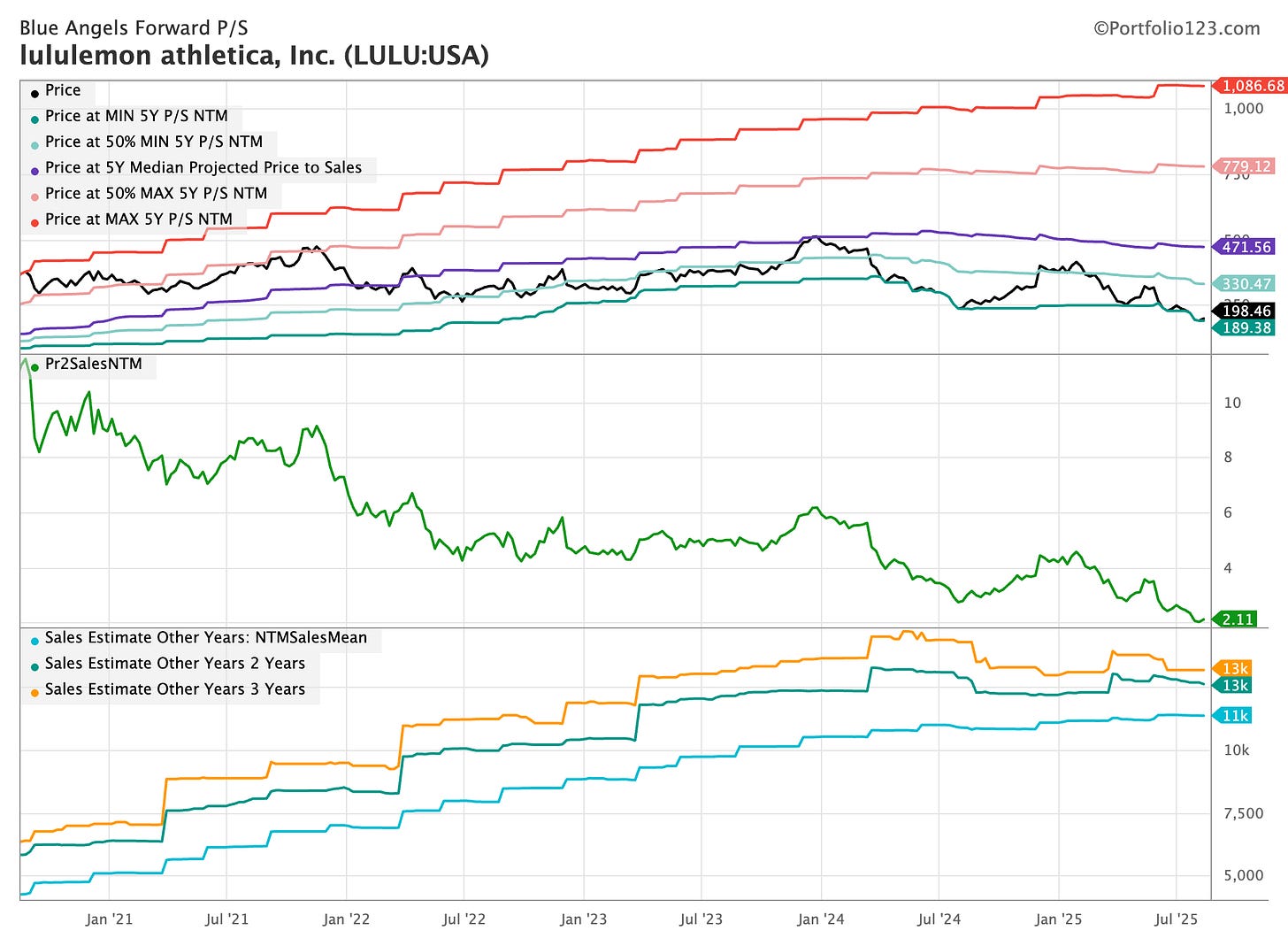

I’ve never bought the dip on Lululemon, and it looks like a classic value trap. The stock is at its lowest forward P/S ratio over the past five years, and forward sales are trending downward. Unlike a stock in a strong uptrend with fundamental tailwinds where you can confidently buy the dip, something more troubling is happening with Lululemon.

A quick glance at Reddit threads reveals the issue: Lululemon, as a brand, isn’t what it used to be. The quality has declined, yet pricing remains premium, and copycats are available at places like Costco. This sounds like a brand in the decline phase of its corporate lifecycle. Lululemon is out of fashion?

So, no, I’m not buying the dip on $LULU. But what about its competitors?

I follow a personal rule that’s served me well for years: if I’m spending a significant or recurring amount on a company’s products, I should probably invest in it—a Peter Lynch-style investment thesis. Last year, I bought my first pair of On Running shoes, and I love them. Since then, I’ve noticed more and more people wearing them. On Running stores are popping up here and there, and they’re always busy.

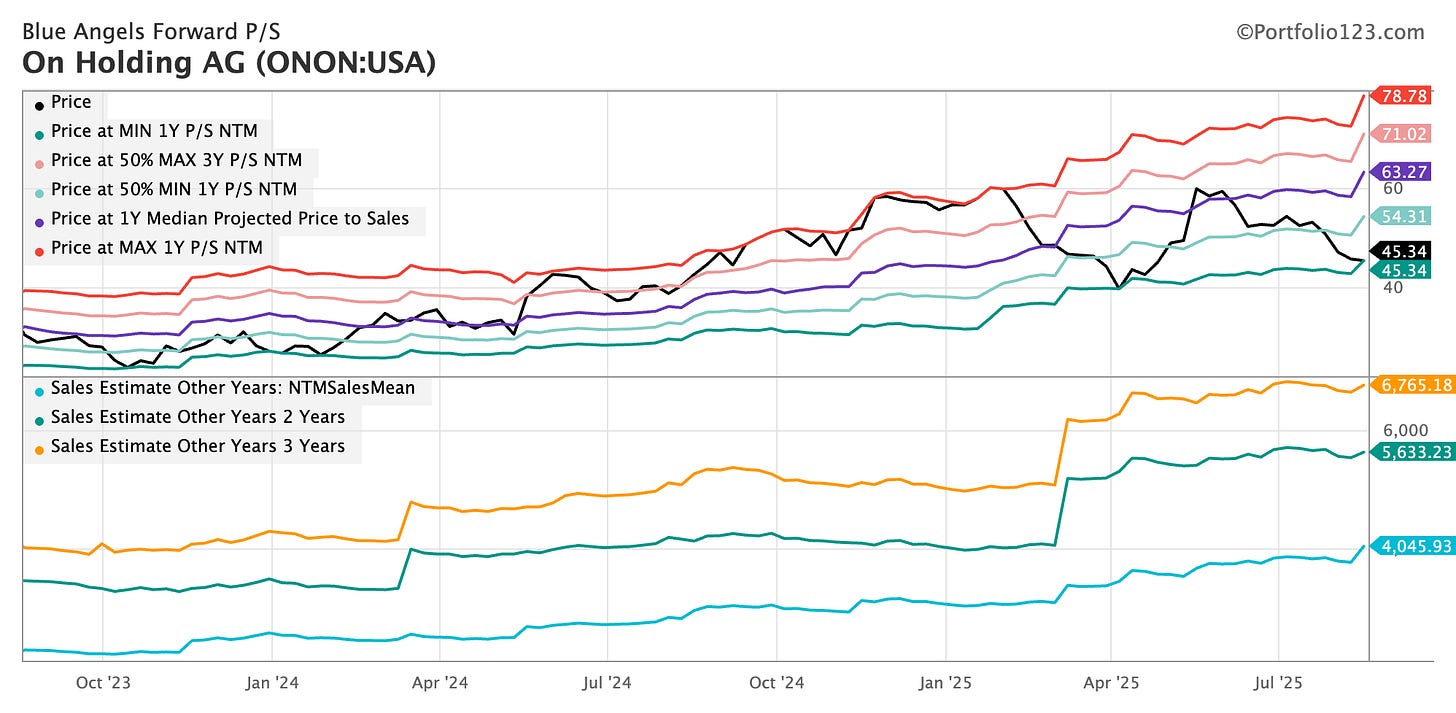

The stock, ONON 0.00%↑, was priced richly last year, so I held off. I didn’t buy the dip in April because I was too busy buying the broader market during the crash. When the market is tanking, you don’t need to get fancy—just buy the most liquid assets, like the S&P 500. But now, with tariffs and a bear market in retail weighing on the sector, I see a buying opportunity for $ONON.

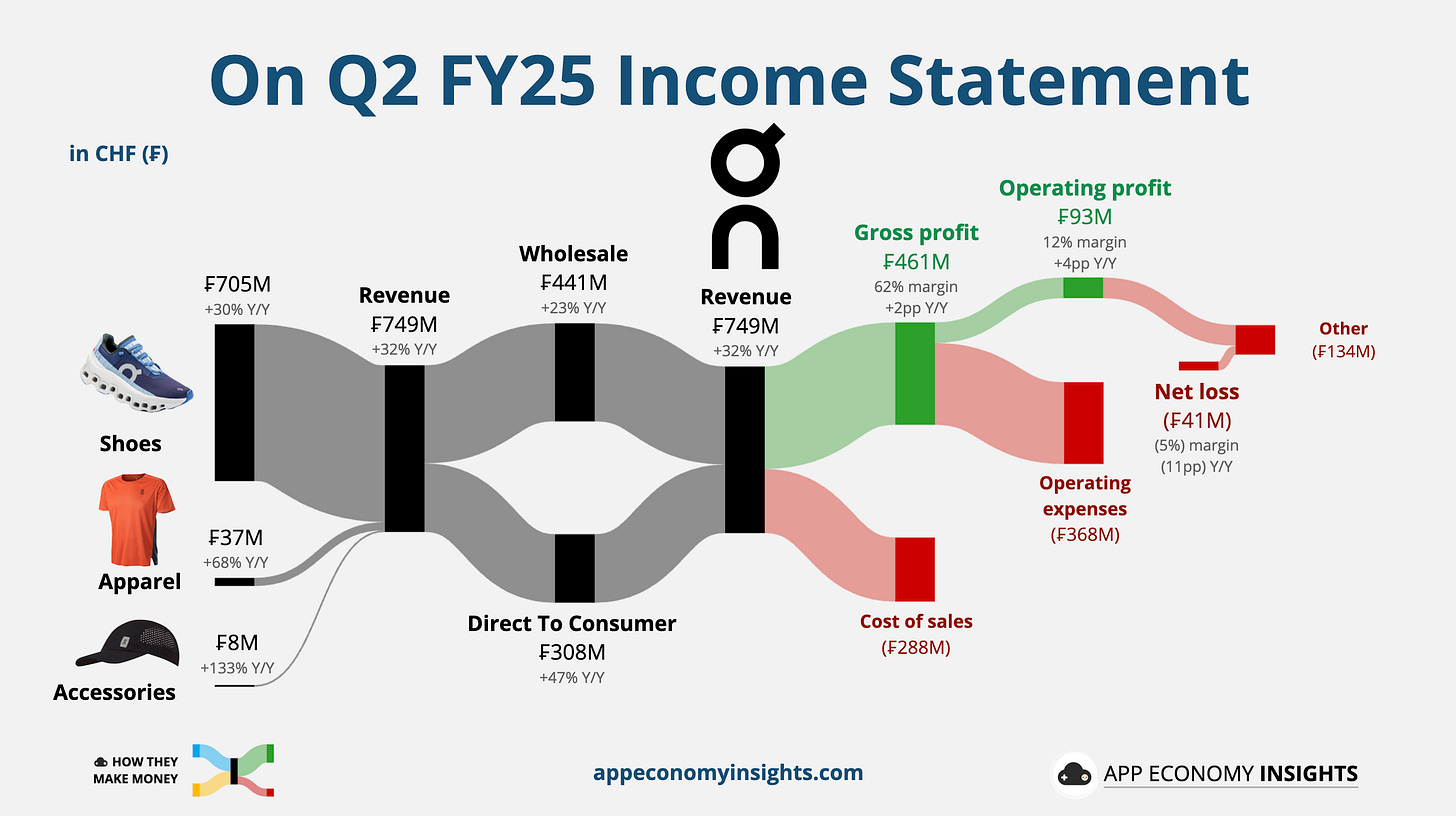

ON released its Q2 earnings last week. Here’s the summary:

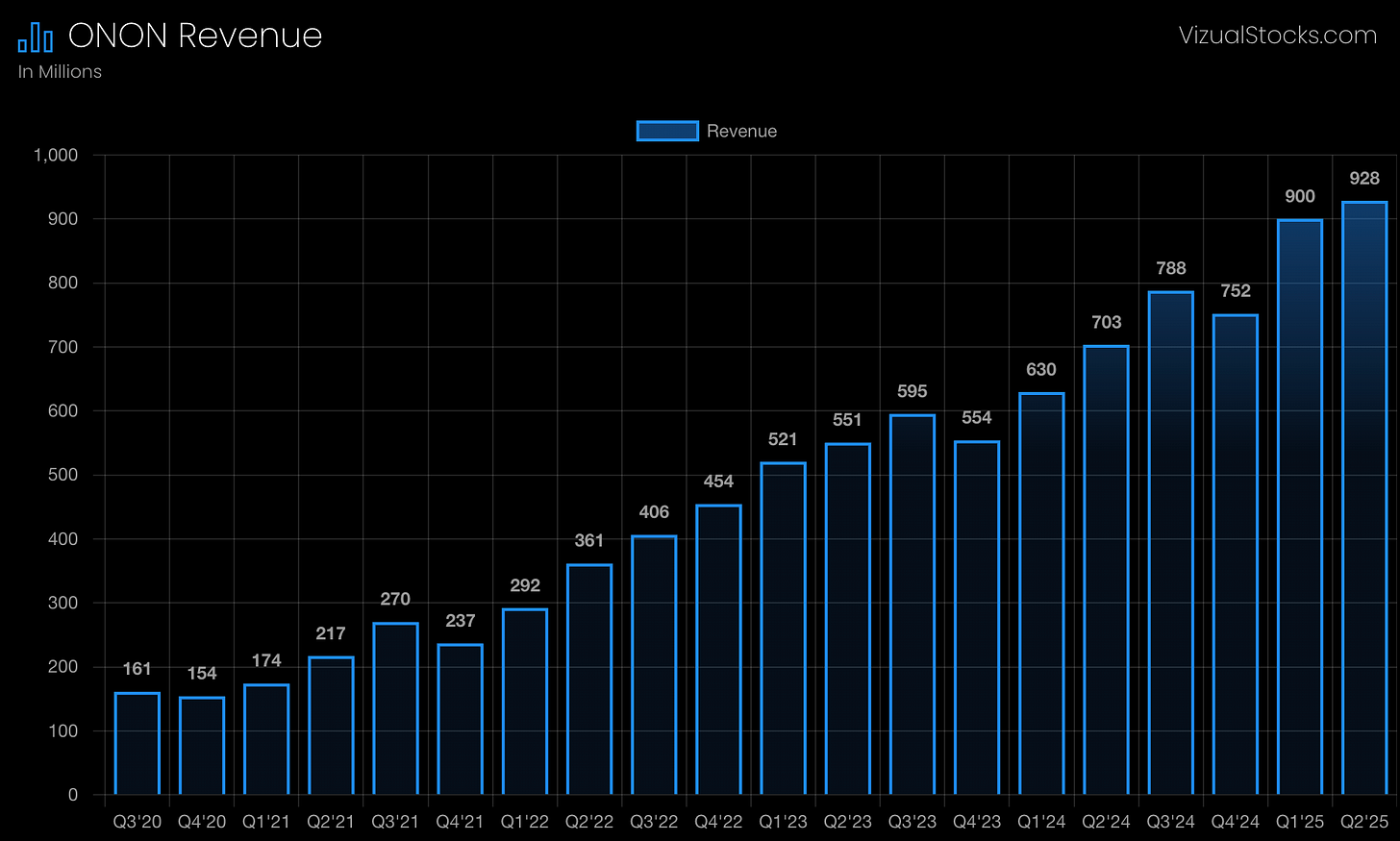

On’s Q2 revenue surged 32% Y/Y to CHF 749 million (US$0.9 billion), with Direct-To-Consumer up 47% to CHF 308 million (now 41% of sales) and wholesale up 23% to CHF 441 million. Gross margin improved by 160 bps to 62%. Adjusted EBITDA hit CHF 136 million (+50%), or 18% margin. On had a surprise net loss of CHF 41 million, driven by FX headwinds from a stronger Swiss franc.

Regionally, growth was driven by APAC (+101%) and EMEA (+43%), while the Americas were slower (+17%). Price increases on July 1 helped offset new US tariffs on Vietnamese imports. Management says demand held, with hikes skewed to lifestyle while protecting core running.

The FY25 revenue outlook got bumped from +28% to at least +31% constant-currency net sales. On keeps taking mindshare in performance running while leaning into lifestyle, filling wholesale shelf space others ceded and scaling DTC for a better mix. FX volatility, tariff pass-through, and Americas growth versus incumbent brands will be critical to watch in the second half.

The stock’s price initially popped on the news but gave back all the gains. Investors seem overly concerned about FX and tariff headwinds, or perhaps too many underwater traders were looking for an exit.

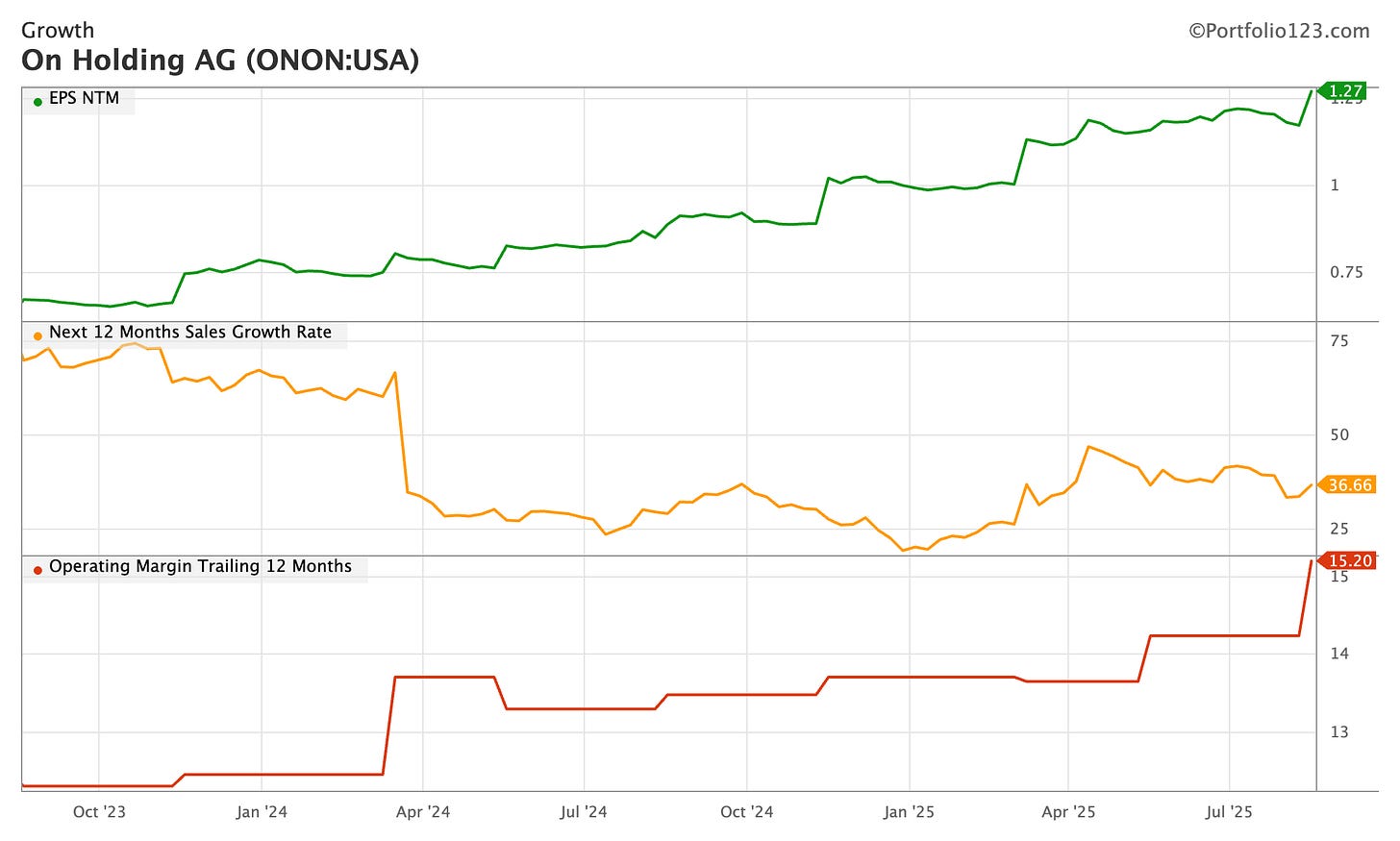

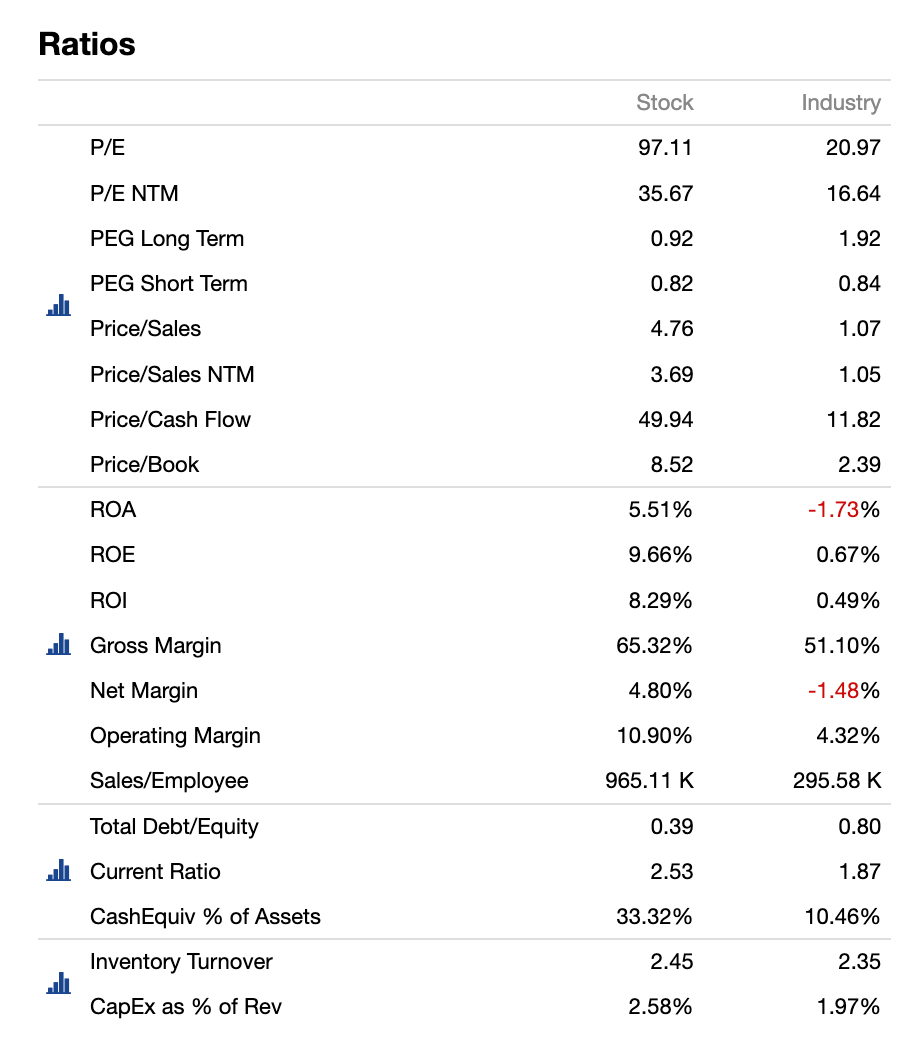

Regardless, the current price is attractive—it’s at its three-year lowest forward P/S, while forward sales are growing and being revised upward. ON’s management provided positive revenue guidance, and analysts are revising their numbers higher.

This is a completely different story from $LULU. Yes, you’re paying a higher forward P/S, but you’re investing in a business growing at 37% NTM sales with a 15% operating margin and with a positive outlook. The APAC growth of +101% is astounding, especially as more luxurious brands see declines in that region. The future looks bright for On Shoes.

My portfolio is already heavily long, with a large position in $IWM and some exposure to $AEO, another retailer. My total net exposure is 117%. To manage downside risk, I’ve bought ATM two-month call options on $ONON with a reasonable implied volatility of 38%. I’m happy to let the options manage risk itself instead of setting a stop-loss on shares, as my portfolio already has enough downside risk elsewhere.

For a sell-side-style report, check out what Grok produced:

https://grok.com/share/bGVnYWN5_b38bc539-e02d-4c56-a903-ea9d8dfa0a31

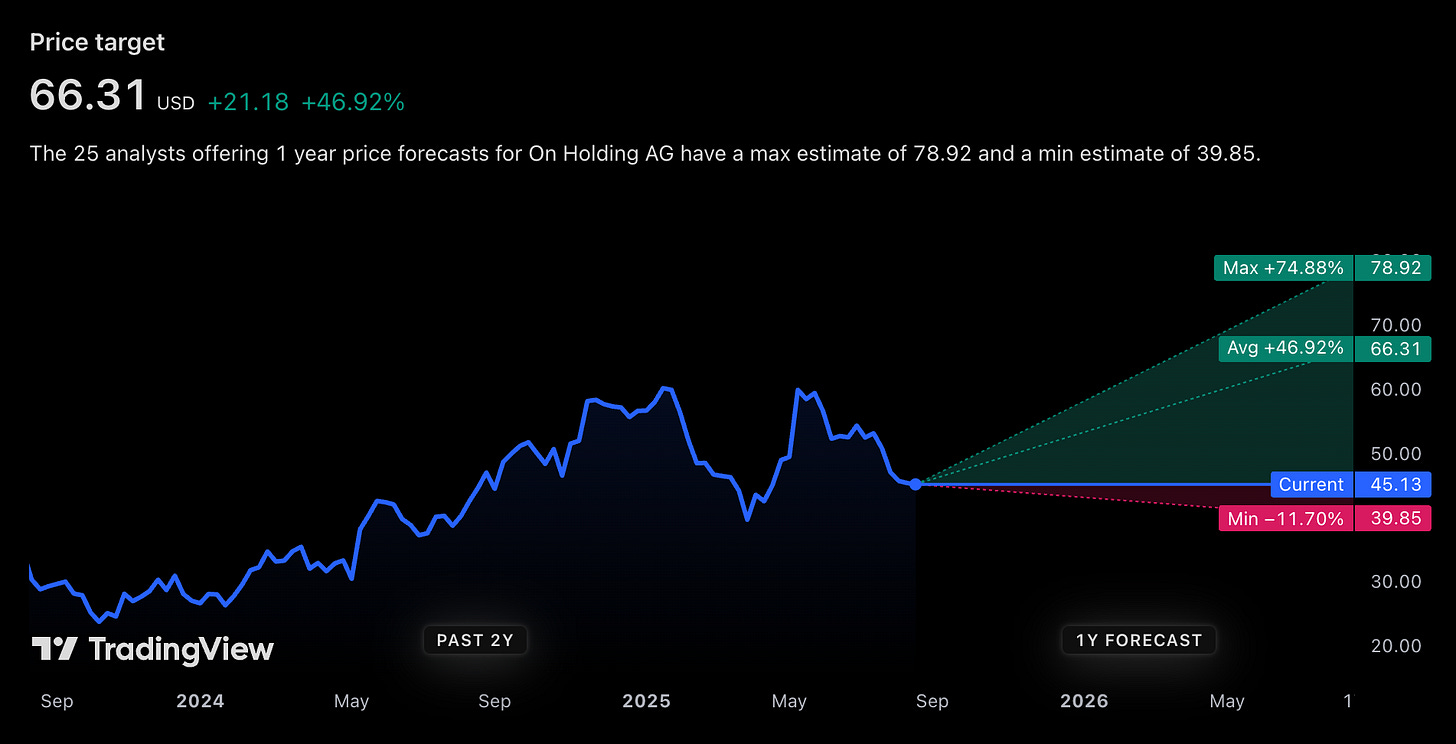

The $68 price target over one year seems reasonable, offering a 54% upside—close to the average analyst target.

Bonus: