When the Most Hated Investor Buys the Most Hated Asset

You're going to hate this trade so much—so much that you'll love it.

If I Had to Do It All Over Again

I can calculate the motion of heavenly bodies, but not the madness of people.

Isaac Newton

Quantitative skills are overrated. I know some great quants who can build advanced stochastic models, but I also know great quants who can’t make a dime in their portfolios. The causal link is weak between PnL and pure mathematical abilities. A basic understanding of mathematics will get you far enough. A good risk management system is a simple one, one you can understand with basic concepts, grounded in reality and common sense, not behind a black-box model.

Quantitative skills will get you only so far because the market is not a physical phenomenon. It is not a system governed by normative laws. In a market, there are no standards, no acceptable behavior or guiding conduct through rules and principles. The market is also not governed by empirical laws. You can observe the market and find patterns, but can you be sure these patterns are not the result of some overfitting? And if not, how long can this pattern repeat in the future without being arbitraged by other people smarter than you?

The market is hectic because it is an aggregate of individuals, acting and thinking independently — or not. In theory, an economic agent is rational and will take decisions based on a thoughtful optimization problem. In reality, most people are just following their instincts. The cycle of greed and fear is as old as time. One can think independently and rationally for some time, only until this thinking gets challenged by people around you, by society, by the media. There is no true independent thinking because there is always a psychology of crowds.

In my first Substack post, I introduced some key concepts from Gustave Le Bon’s book. Let’s revisit them:

The Loss of Individual Rationality: Individuals within a crowd often lose their capacity for rational thought, succumbing instead to a “crowd mind” (animal spirits). This phenomenon leads to behaviors driven by emotion rather than logic, making crowds susceptible to manipulation by charismatic leaders or prevailing sentiments. In markets, this is the fuel for irrational exuberance during bull markets or panic selling during downturns, where investors act against their better judgment due to collective emotions.

Herding Behavior: This principle suggests that when a significant number of investors adopt a particular view—be it bullish or bearish—others are likely to follow suit, reinforcing the trend. This can create price movements that are not supported by fundamental analysis, resulting in asset bubbles or crashes. Understanding this can help investors recognize when market movements may be driven more by sentiment than by fundamentals.

If I had to do it all over again, I would not have studied Economics and Financial Engineering. Instead, I would have studied Psychology.

The Most Hated Asset

Heavy is the crown when you are a contrarian KOL. I pay particular attention when someone is getting absolutely dunked on X or other social media. Sentiment is a hard thing to measure; it is more an art than a science. But sometimes, it is plainly visible. A hallmark of a sentiment extreme is the use of ad hominem insults. It takes a particular level of confidence and cockiness to insult someone on X for having a different view than yours. We should all be grateful to have someone on the other side to trade with; otherwise, there would be no market.

The signal-to-noise ratio is very high here. See for yourself:

Thank you, Kuppy, for taking one for the team 🙏🏻. I might not agree with everything you say, but you are doing a fantastic job for us sentiment watchers.

What’s Obvious Is Obviously Wrong

Yes, I know. I know it makes zero sense to buy bonds when there is a big debasement trade going on with gold up 1% every single day. While US stocks are refusing to go down. While Bitcoin, despite the largest liquidation ever, is still up 15% YTD and trading above 100k. While CPI is stuck in the mud at 3%. While Atlanta Fed GDPNow is clocking at +3.8% real GDP.

But I also know that you know. And you know that everyone knows. And everyone knows that everyone starts to get the fucking joke!

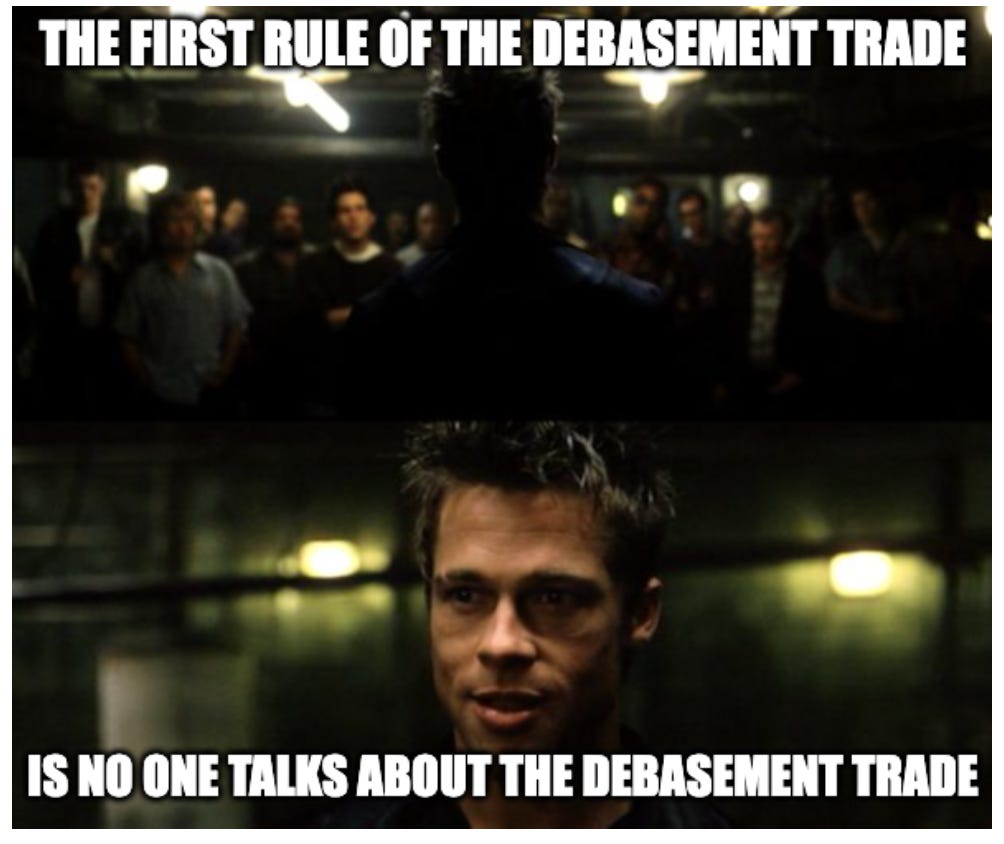

This is like Fight Club: it’s so secret that everyone is in it!

6.6M views on this X post:

What’s obvious is obviously wrong. The bull (resp. bear) case is always most compelling at the top (resp. bottom).

I am buying Ultra UST Bond Futures, 50% NAV allocation.

If you are a long-only investor, this bond allocation will hedge your equity allocation. The 60:40 portfolio is not dead yet.

Your fight club meme is spot on :)