Bitcoin: another leg up?

During max stupid, you hedge both the left and the right tail

As we enter the very last two weeks of the year, Bitcoin is getting my attention again. I successfully caught the first leg up from 33k up to 100k, and took profit 2 weeks ago on the backdrop of heated sentiment, extremely overbought conditions, fading momentum and an uncomfortable rush of money into shitcoins. I had a strong conviction we would have a big nuke coming. For the “normies” out there, a nuke is a very large move to the downside in a very short timeframe. They are the landmark of every bitcoin bull run. This is where we sacrifice the blood of the late levered bulls, in order to let the price run higher. A small price to pay for HODLER, a death sentence for monkeys. It’s all part of the circle of life in the market.

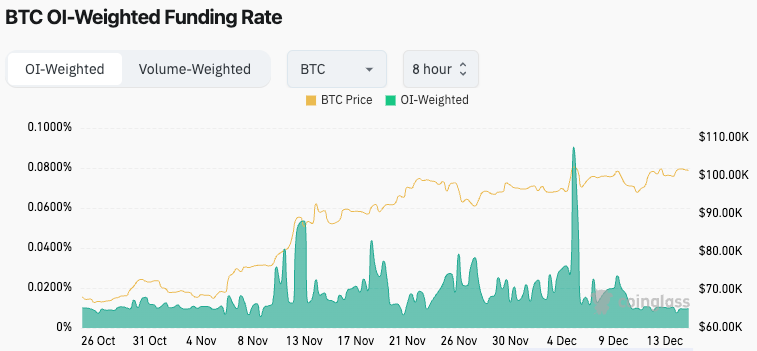

Nukes tend to happen at sentiment top and when a lot of players are max long through futures. A quick glance at the perp future funding level gives you a good idea of the euphoria level. When I sold my position, funding levels were around 30% annualized rate. Shortly after on the 5th of December, as bitcoin was crossing 100k, the funding rate shot up to 130%!

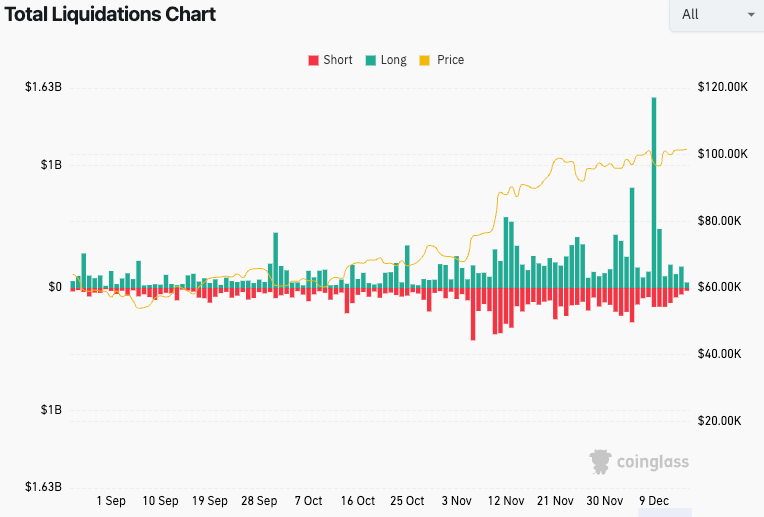

Like clock work, prices got violently rejected from the 100k level and nuked to 92k. Massive liquidation event — approximately $1.1 billion got liquidated. The largest liquidation event I can remember.

But the price recovered from the low instantly and, ironically, liquidated a good chunk of the short futures. What an insane mosh pit!

As the bulls and bears were getting chopped up and forced to deleverage, the price continued to rally the next 3 days. Closing above the 100k on Sunday, 8th of December.

That was enough for the bulls to get euphoric again and pile into leveraged long positions. Sounds familiar. Funding perp yield recovered to 60%. That’s far from 130% but it is still in high territory.

Monday, 9th of December, no ultimatum was given to the bulls. The Asian open is bloody and Bitcoin retreated by 4%, then tried to recover its lost ground. That was just a trap for the bull, setting up the stage for a 6% drop followed by an insane $1.7 billion liquidation event! Even larger than the previous one.

The blood of bulls and bears is being spilled all over the battleground of the 100k level. We are approaching Napoleonic wars epicness!

But as the dust settled down, and following a few days of chop, the price action is getting constructive for bitcoin. The 100k was not Waterloo, it was only Austerlitz! We might be going up again and get to fight another battle in the 125k area.

The price action is constructive because we have a positive drift since 10th of December. Moving average 12 days is still rising nicely, and we are seeing higher lows on each individual daily candle. Finally we have realized volatility compressing significantly, the daily range is very tight:

Give it another couple of days of positive closes, and we will be looking at a momentum making its return (MACD cross with positive histogram, RSI break out):

Finally funding perp yields are low, and according to the latest Commitment of Traders data, we have both small speculators and commercial degrossing. I like to see them degross before a big push up. The 100k breakout traders have all been rinsed and are throwing in the towel. See below chart; second panel is the COT data - red for Commercial, Yellow for small speculators, and Blue for large ones. Note that the Open Interest (green line) is dipping, this is constructive for us.

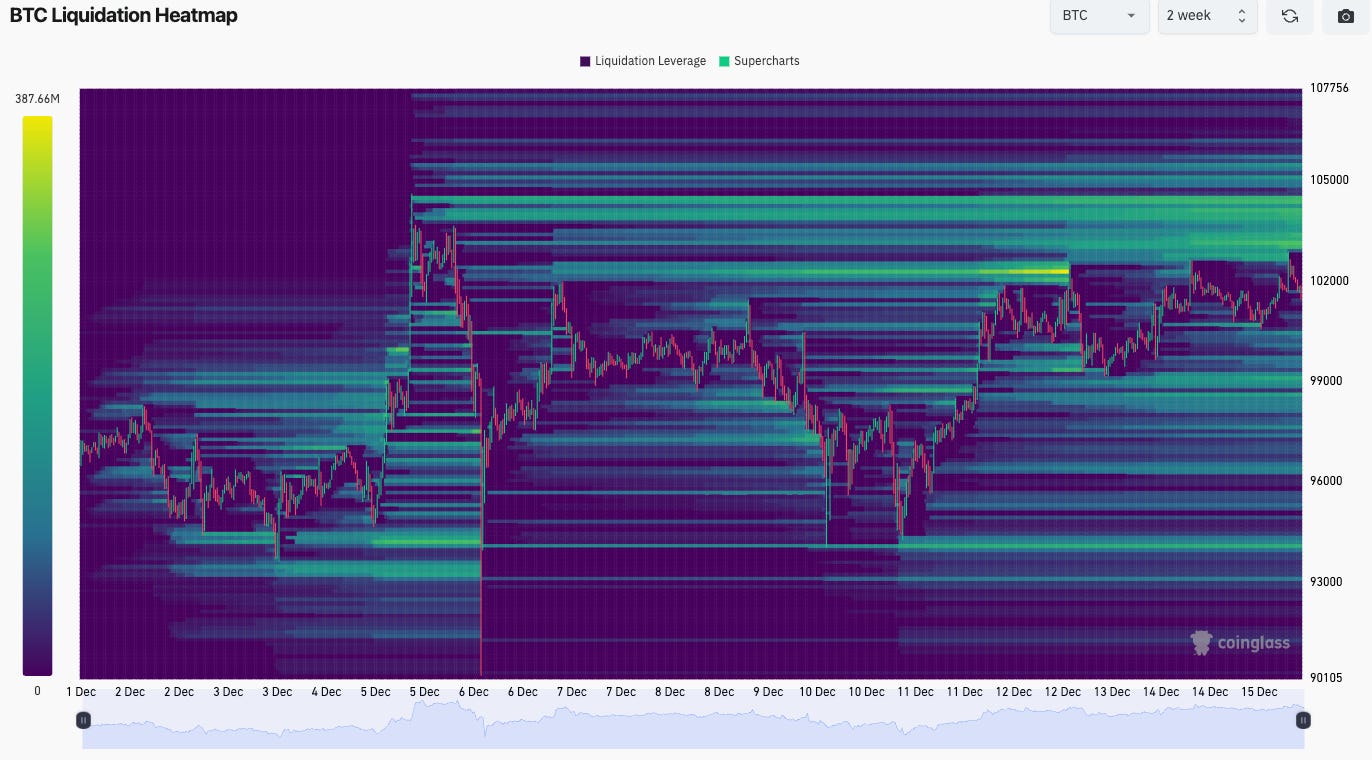

The liquidation heatmap is also showing quite a lot of shorts waiting to be liquidated between 102k and 105k. This will be the fuel to re-ignite the momentum in the short term.

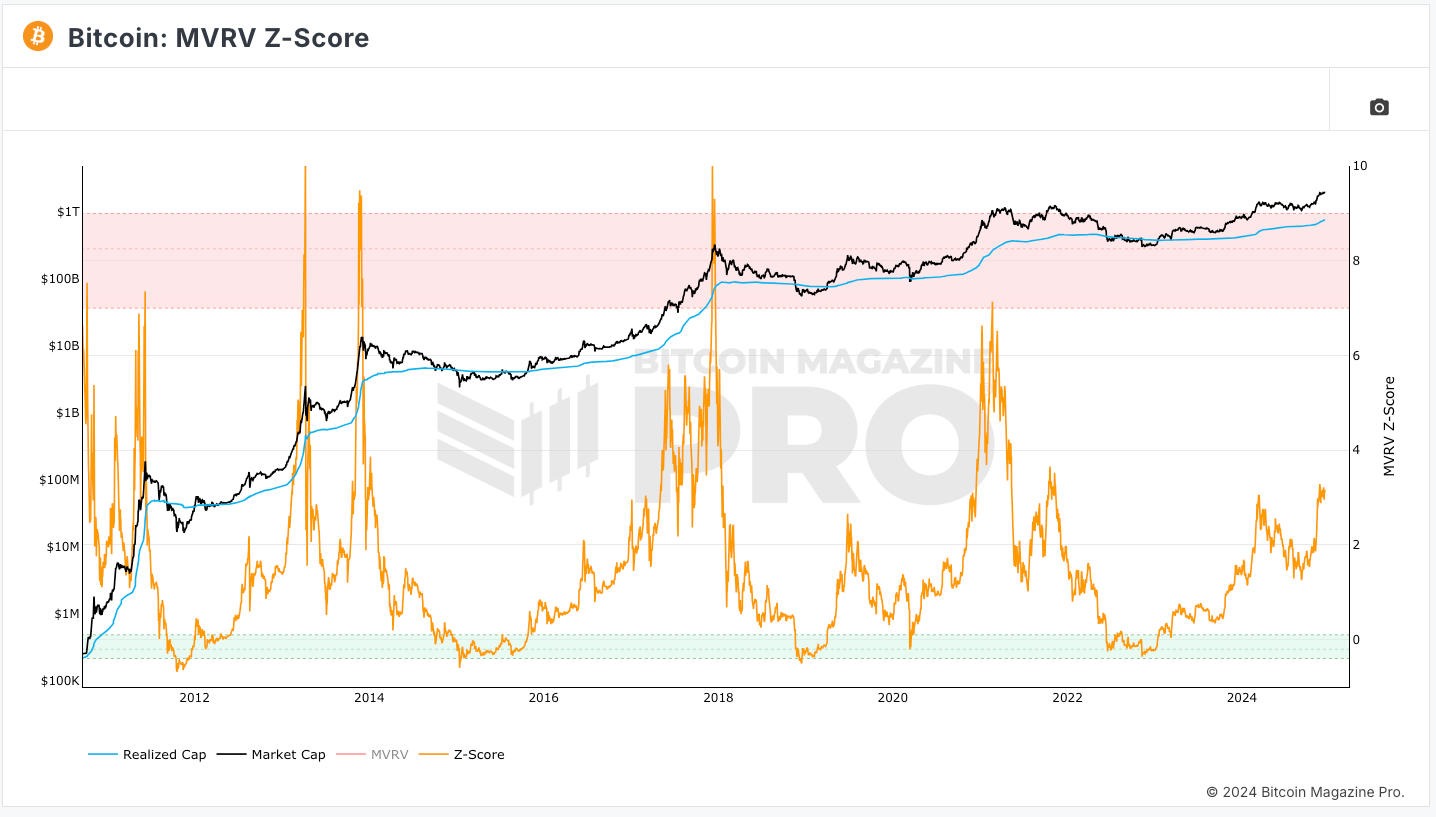

Zooming out, on-chain metrics are not over heating yet. We are well into this bull run — probably 80% into this bull run.

And it seems like there’s some room left on the 1Y HODL wave. Long term holders are selling into strength, but more supply is still available.

This is a tactical trade, risk/reward is good if you have some kind of stop loss. At a macro scale, the potential upside is around 25% (my hitchhiker estimate), while down side is unclear at the moment. I like a tactical long with a stop loss around 93k (we rinsed that level already). That’s leaving you with a risk/reward of around 2:1. It’s good, but don’t YOLO into it with an oversized bet, also we have a big unknown next week: FOMC meeting on Wednesday. A rate cut is priced in at 96%, but we could have a “hawkish cut” which could well create some volatility during the week.

Finally, keep in mind my previous post on the wall of worry. The markets are euphoric, and the bulls are running on thin ice. This tactical trade is your hedge against the right tail, a market melt-up. But it only makes sense if you take care of the downside with a stop loss. Then you will be hedged for both the right and the left tail.

Stay safu and subscribe!

Very nice post! Agree on the Bitcoin overview, not sure if it has much more in the tank for now and ~20% more sounds about right imo, I am also expecting last big push with the altcoins (shitcoins lol) as Bitcoin dominance starts to drop

given all the money which is lost day by day on different exchanges, where does new money come from all the time?

I mean, a few outsized wrong moves, and you are out of the game. But from where are than again coming new people and new money, to replace the previos players (who lost most or all) and to replace money who chabbeled to the small mayority of players, that are acumulating most of the capital through time..?