Market Update

Defensive positioning in the equity vol market, and a good day for the globalists and metals.

If you’re interested in the volatility market and aren’t following Mandy Xu, you’re not doing yourself any favors. CBOE, her employer, publishes a free volatility report on a regular basis.

Yesterday’s report included the following highlights:

So first of all, all you degens are trying to pick a bottom in oil. 99% of my Substack feed are people picking a bottom. And now it’s showing up in the oil volatility surface, with calls getting bid. Congrats!

But this post isn’t about oil, it’s about US equities. Yesterday I opened a tactical short on Nasdaq futures right after the initial post-open pump. I strongly suspect the systematic 0DTE put sellers pumped the market into unchanged. A spotgamma subscription will give you the answer, but honestly I don’t really care about the why. What matters is that implied vol is grinding higher despite the intraday recovery in the spot.

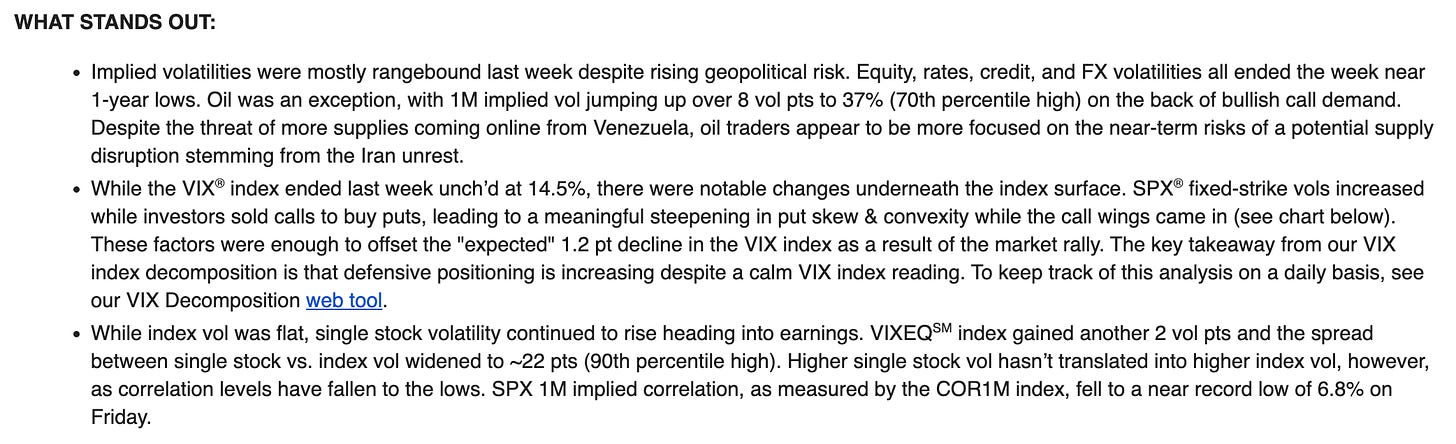

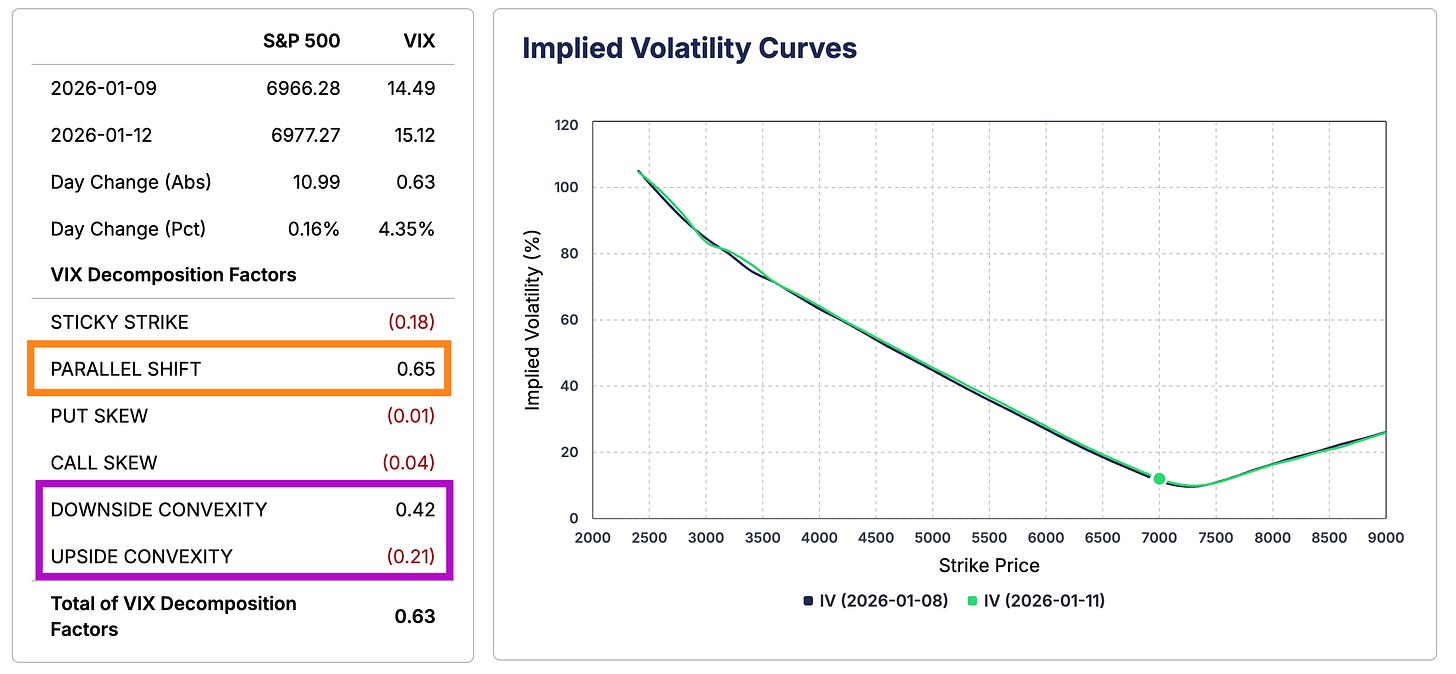

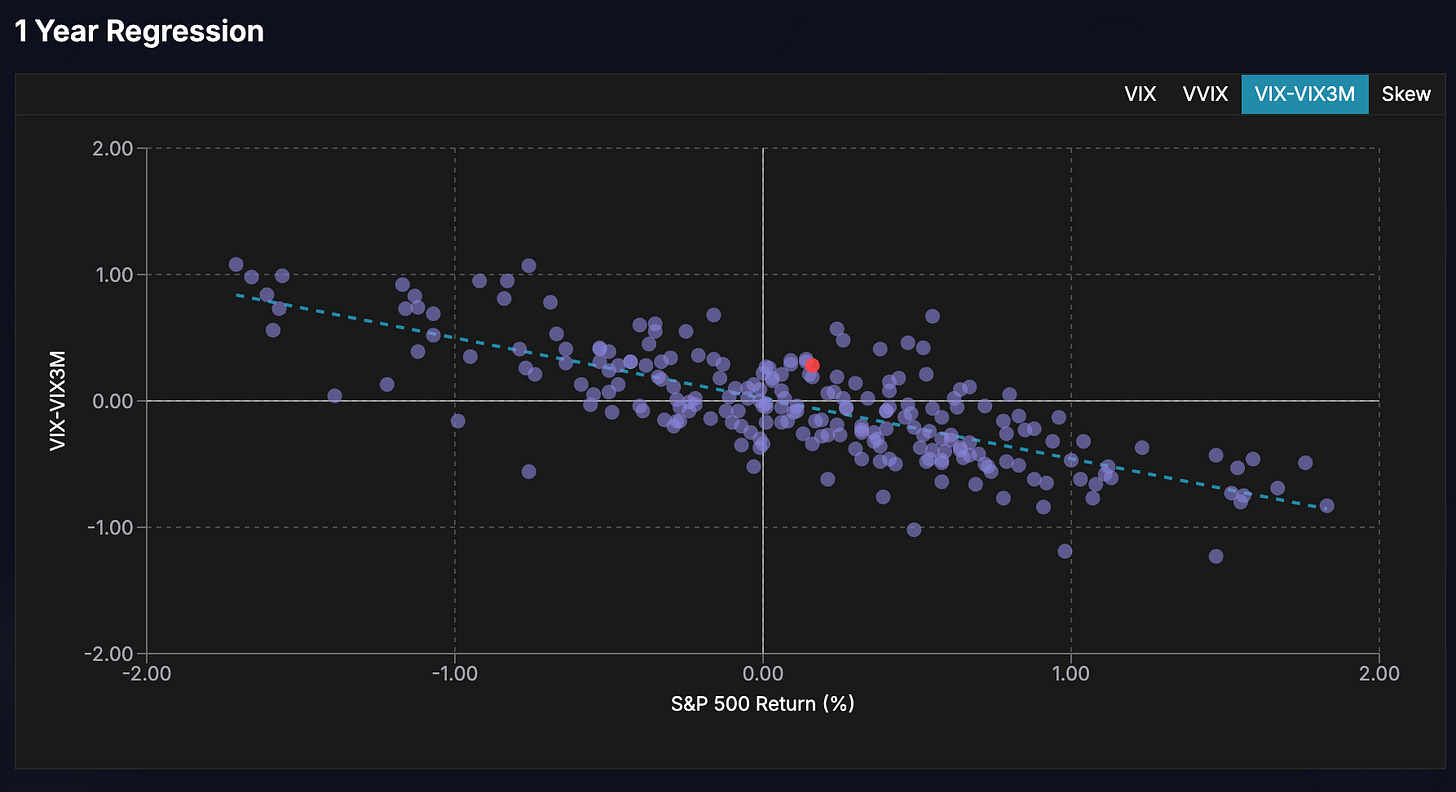

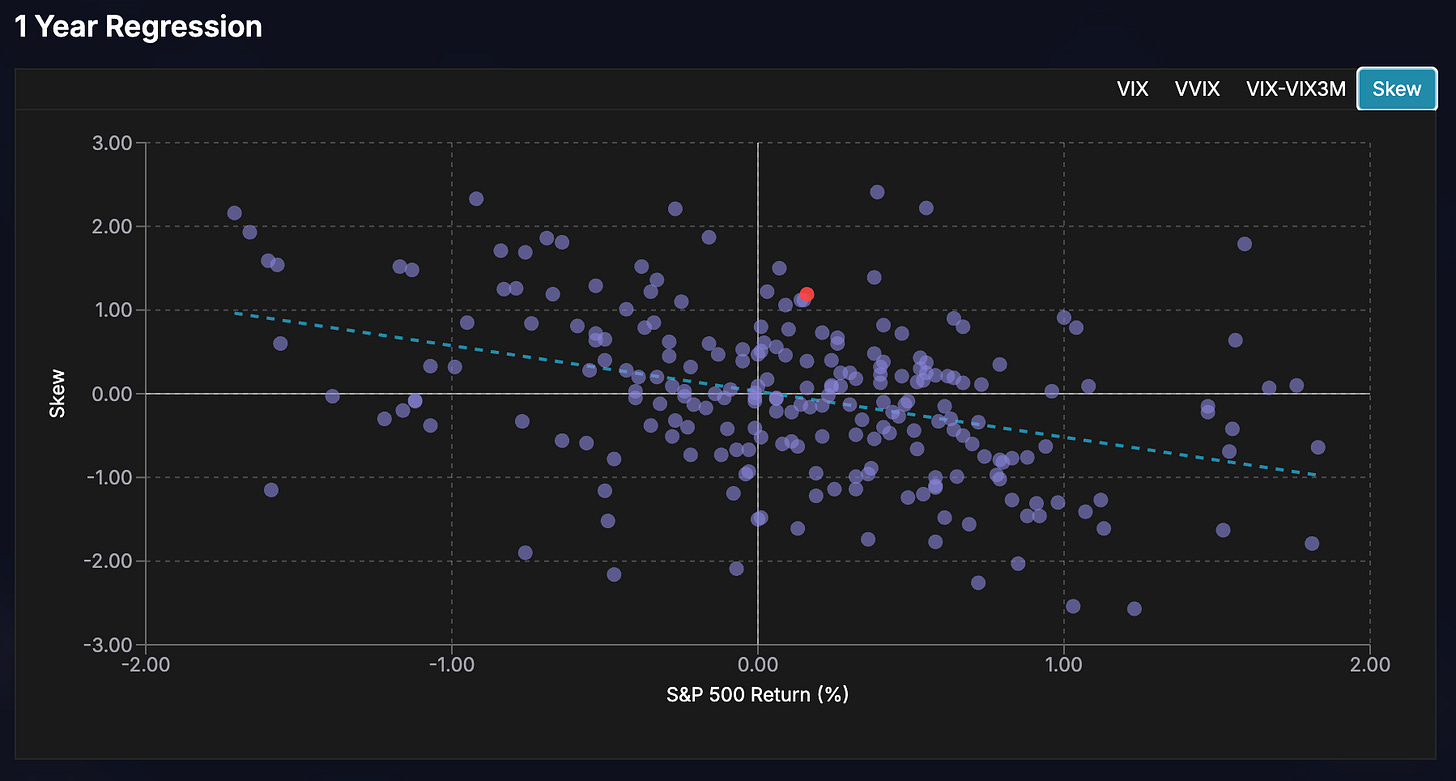

The CBOE report highlights the steepening in put skew and convexity, and we can see it clearly in the VIX decomposition tool:

A parallel shift simply means the vol surface went up across all strikes. This is surprising, as it shouldn’t happen on an unchanged day.

Downside convexity at +0.42 means traders have bought more downside OTM puts, while upside convexity at -0.21 means traders have sold upside OTM calls. This is a reversal from what we saw last week and what I highlighted in yesterday’s positioning note. Re-read it:

Positioning Update (Special Equity Edition)

Quite a lot is happening in equity markets right now. This post focuses solely on equities and is free for everyone, so please feel free to share it.

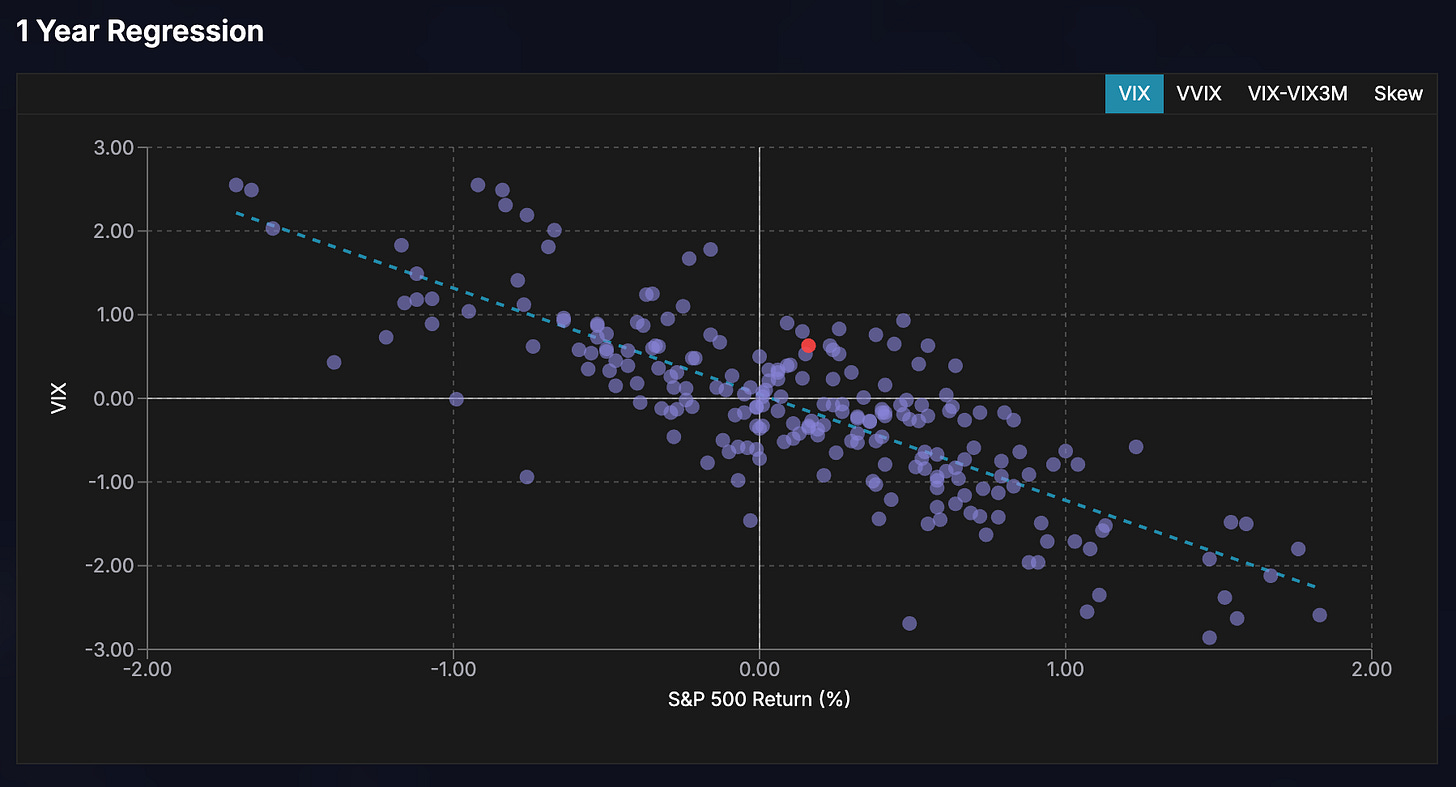

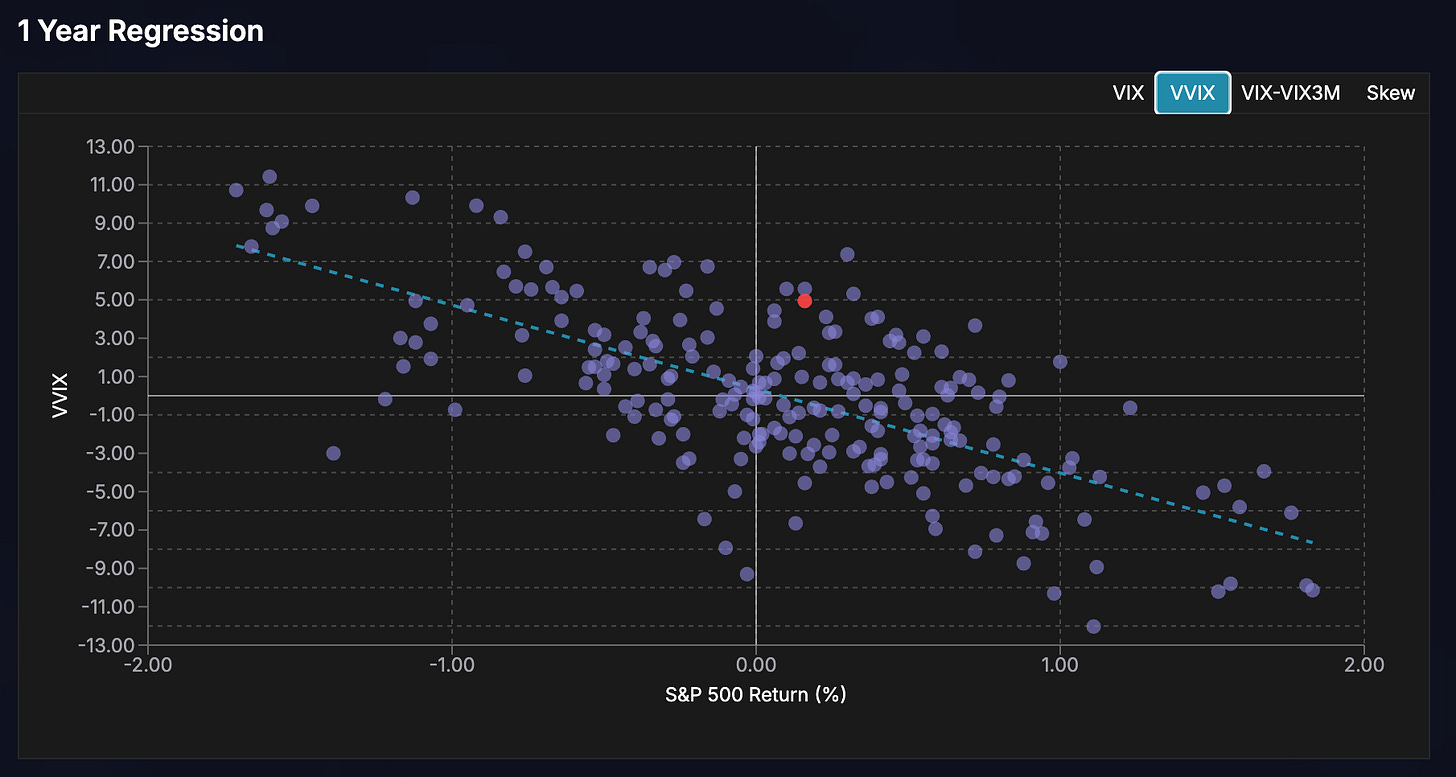

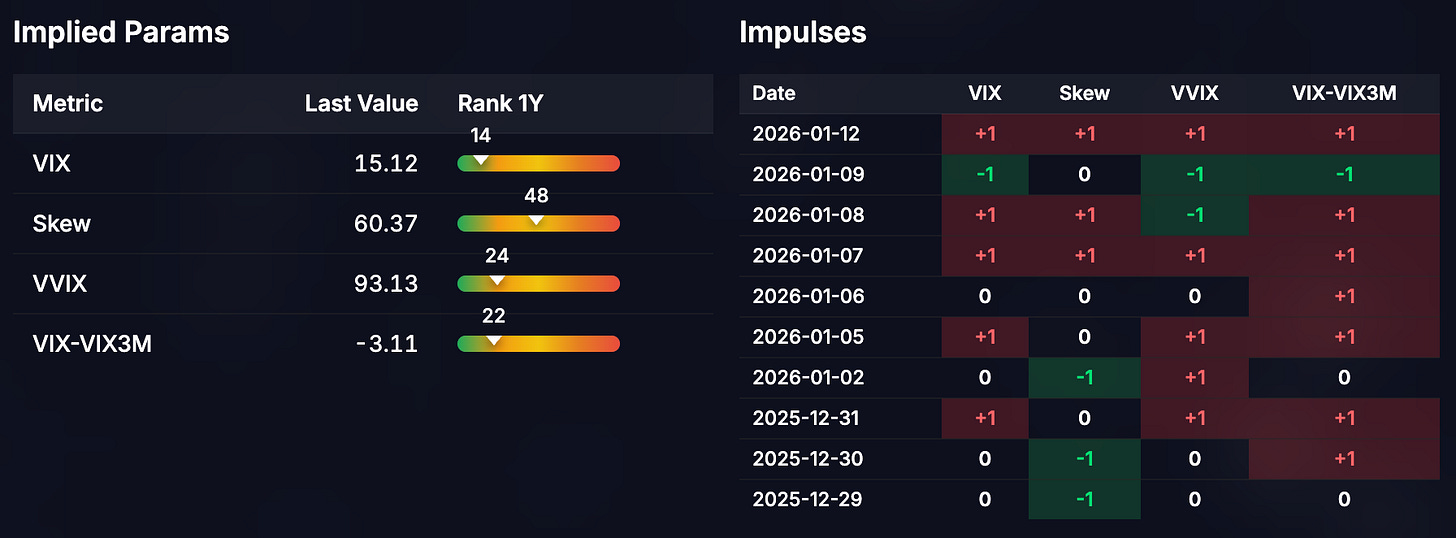

The regression tool in the web app is also a convenient way to check vol dynamics. Pretty much all parameters (VIX, vol-of-vol, term structure, and skew) overshot yesterday relative to the spot move:

This dynamic is occurring while the SPX sits basically at all-time highs. We saw the same pattern last year too: in a speculative bull market, traders tend to hedge their downside as the market reaches all-time highs.

The cost of hedging remains cheap here, and we’re seeing a positive impulse across the entire vol surface. This is what a local bottom in IV looks like.

Mandy Xu is also highlighting that COR1M has fallen to a new low. Single-stock volatility is being pushed higher amid the broadening narrative and the upcoming earnings season. We discussed this dynamic yesterday and pointed toward a possible short squeeze on the short-volatility trade at the index level.

While US equities managed to close flattish, they severely underperformed the rest of the world. A quick look at the Mover screen in the web app gives you a clear picture of what’s happening: bully your central bank and watch capital rotate away from your financial markets.

And that move up in the SPX was driven mostly by momentum in small- and mid-caps. I won’t complain, my quantum computing bag got pumped a bit:

And finally, the cross-asset screen: a good day for the globalists and metals! The more Trump opens his mouth, the more they win!

The market has been sending clear signals since the beginning of the year. Some new secular trends are unfolding right before our eyes, and yesterday’s price action was a preview of them.

Good luck!