Positioning Update (Special Equity Edition)

Deep dive into equity positioning, sentiment, and internals. Not your average analysis.

Quite a lot is happening in equity markets right now. This post focuses solely on equities and is free for everyone, so please feel free to share it.

Paid subscribers will receive positioning updates on other asset classes tomorrow.

If you are new to CoT data, please read the first part of this post:

Positioning Update - CoT (1/2)

One of the unexpected side effects of the last US government shutdown was the lack of new positioning data from the Commitment of Traders (CoT) reports. It was a very annoying inconvenience, as my trading process relies heavily on them. Now we have a lot to catch up on; this will be split into two posts.

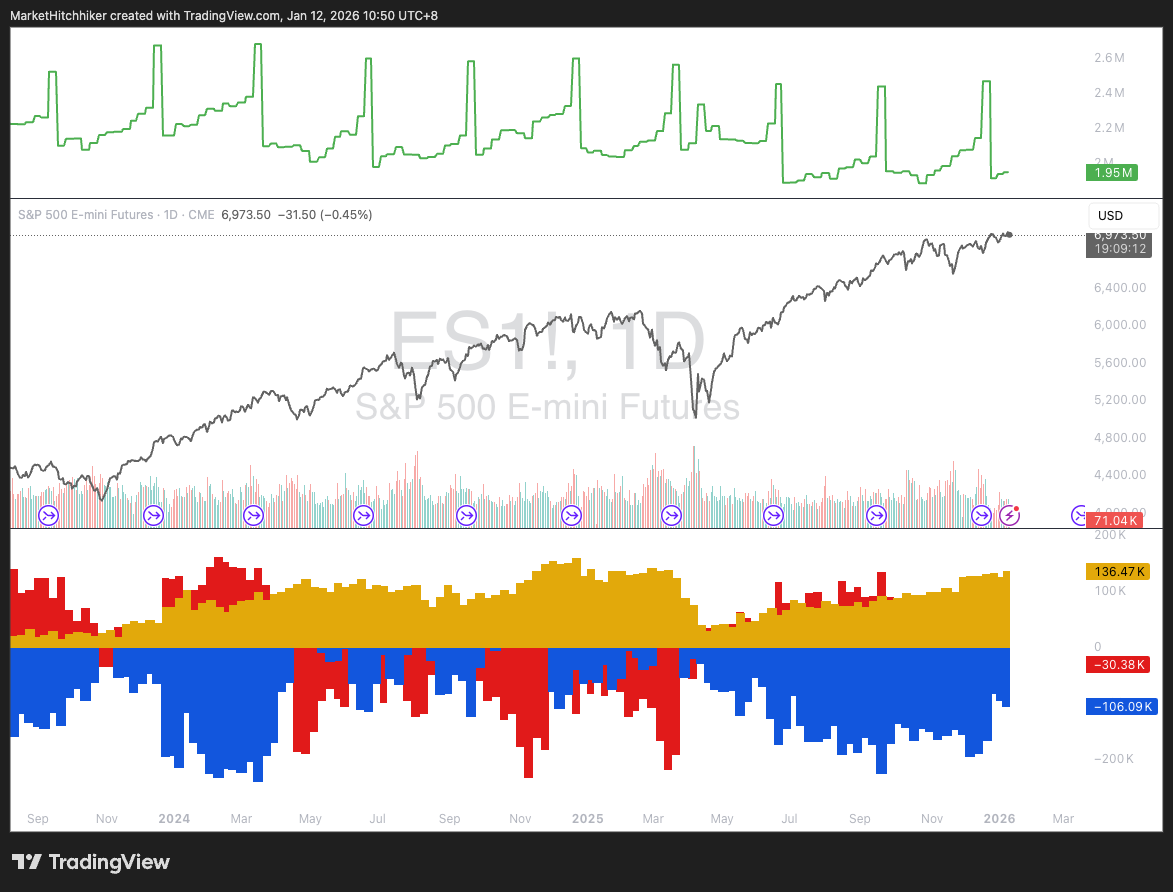

S&P 500 E-mini Futures: Small speculators are getting very long here. It suggests limited upside over the next few months. Large speculators are still net short, but they bought back a significant amount of their shorts toward the end of last year. It could be some end-of-year window dressing; I’m not drawing any firm conclusions here.

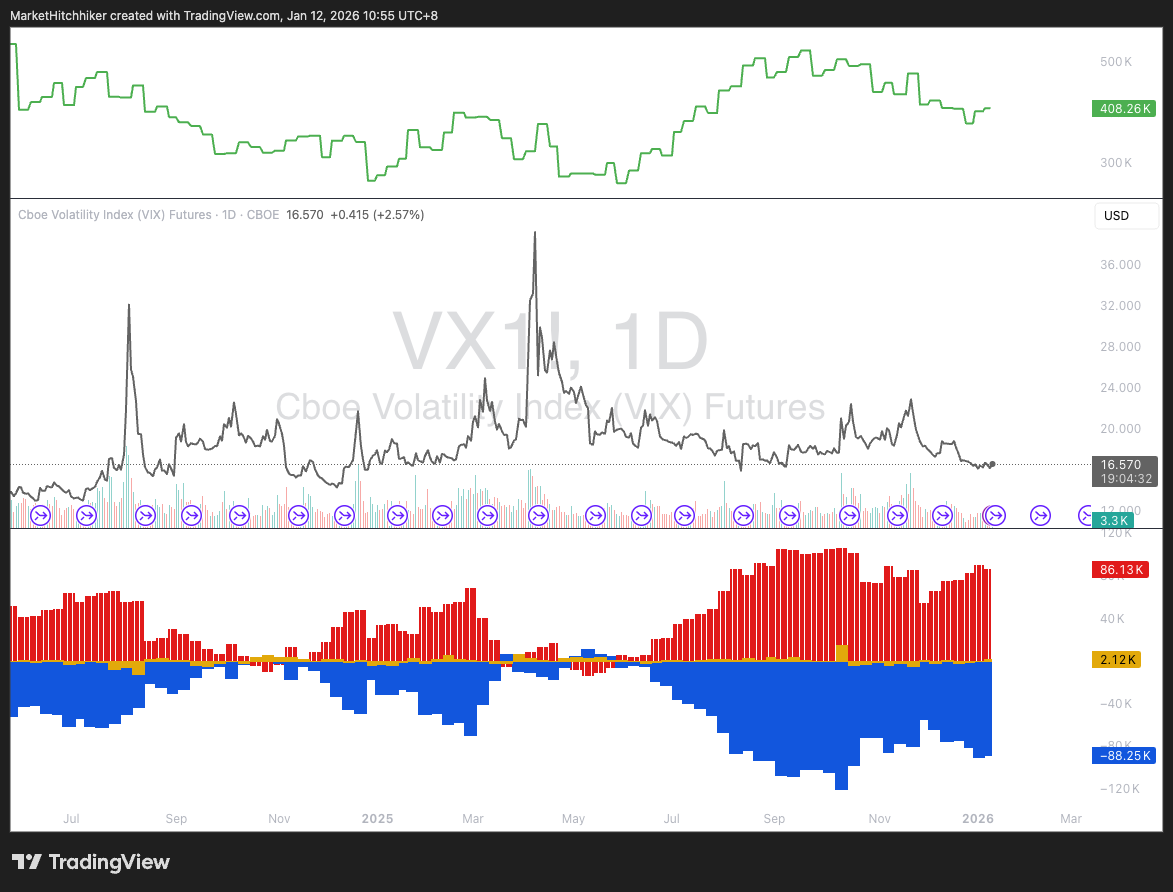

VIX futures: Large speculator positioning can give us a rough idea of how crowded the carry trade has become. With VIX futures in contango and embedding a significant carry premium, this trade is getting fairly crowded. The front-month contract might have found a temporary bottom around 16.00.

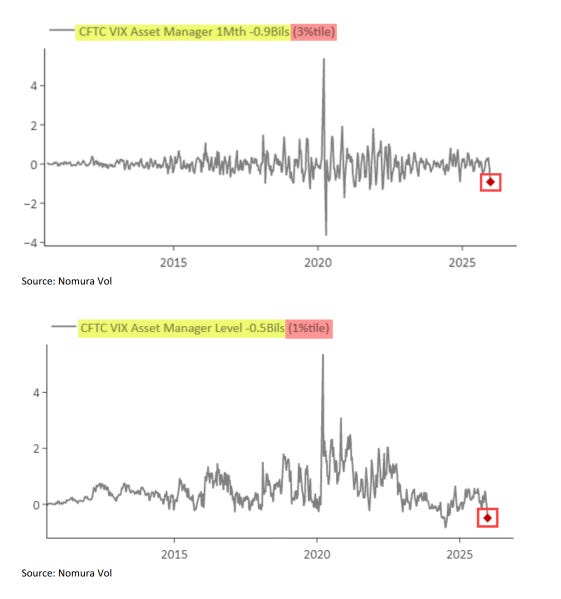

Nomura’s McElligott made the below comment regarding this large short positioning:

ASSET MANAGER positioning / 1m change in VIX futures , [has seen] a major outlier “Short” in futures ( assuming on account of “Rolldown” - type trades, i.e. Long UX3 vs Short UX1) who have just PUKED VIX futures to the tune of ~$51mm of Vega sold / 3%ile change over 1m period, and with the absolute level at -$0.5B, just 1%ile (fwiw, Leveraged has also sold ~$27mm Vega over the same past 1m period)

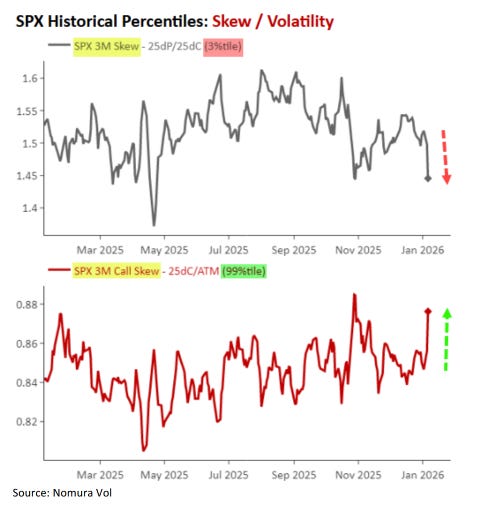

McElligott again:

We’ve actually seen some customer buyers of Vol recently here and away, yet it hasn’t made much of a dent in the HILARIOUS Skew flattening in SPX Options ….due to the more notable stuff in Options demand coming in bits-and-pieces of UPSIDE being [BOUGHT] in both SPX (e.g. buyer of SPX Feb expiry 7200 Calls, 2700 times yday) and Nasdaq QQQ... while Puts / Downside went kinda friendless EOY when folks monetized / de-grossed.…so Skew absolutely CRUNCHED while Call Skew jacks as a function of both a touch of Upside demand

and Downside bleed-out.

So we have this pretty interesting setup where small speculators are very long ES futures and large specs are very short VIX futures—especially on the front end, where speculators have piled into the carry trade. At the same time, we are seeing skew on SPX flatten a lot, meaning speculators have been buying OTM calls and selling OTM puts. This is also confirmed by the put/call ratio, which ticked lower last Friday.

Tactically, the risk/reward looks poor for SPX. This is a nice setup to either sell call spreads or, more aggressively, buy puts or VIX calls.

While the setup for a short is tactically appealing, we can push the analysis further by looking at other positioning data as well as sentiment and market internals like breadth and correlation. This can give us another clue about how attractive the risk/reward is and how large we want to size any position.

DB’s latest update regarding discretionary and systematic positioning signals rather mild overall exposure. Systematic investors are definitely long, but not over their skis. Discretionary investors remain skeptical of this rally, just as they have been throughout 2025 since Liberation Day.

If you’re unsure about discretionary investors and what they are, I wrote this educational post that will answer a lot of your questions:

The Hitchhiker's Guide to Positioning: Part I

Imagine spotting the early signs of a market cascade before it unfolds, volatility spikes triggering systematic sell-offs that amplify downturns across the board, from hedge funds to retail traders. In today’s $50 trillion US equities landscape, understanding positioning isn’t just insightful; it’s essential for anticipating those moves and staying ahead

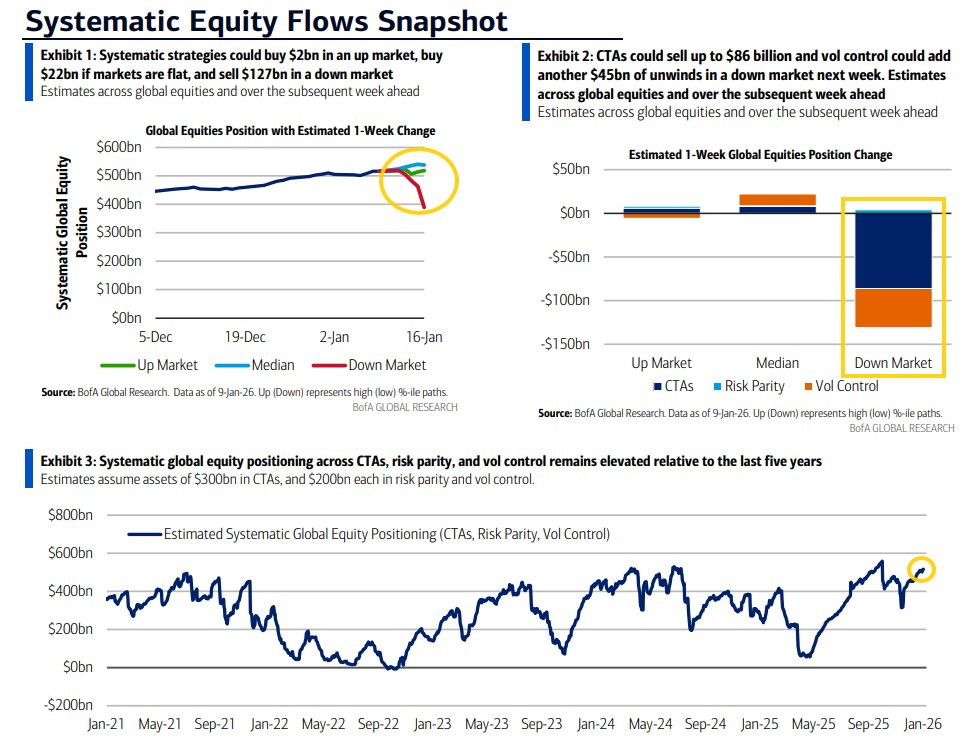

BofA also kindly provides an update on systematic equity flows, with projected buying and selling for CTAs. As expected, when positioning is already rather long and the market is at all-time highs, the selling profile is highly asymmetric: very little buying in an up market, and a lot of selling in a down market. Hot tip: this is not priced in the SPX skew.

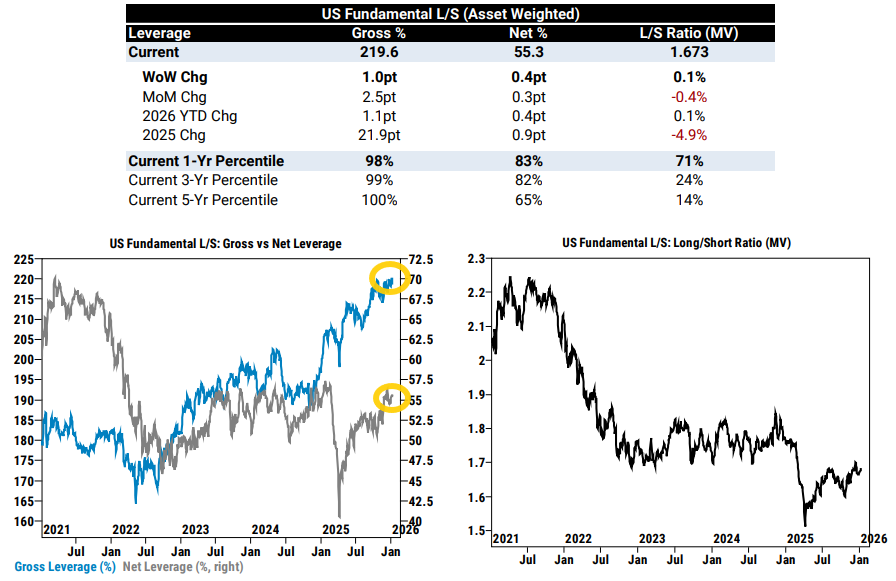

On the discretionary side, Goldman Sachs has the following numbers regarding their long/short hedge fund clients:

This is getting pretty interesting. Gross exposure remains very high, as it has been for a while now. But net exposure has also been climbing, now reaching the 83rd percentile over the past year while sitting only at the 65th percentile over the past five years. This tells me that fundamental hedge fund managers are slowly getting longer and longer, though there is still some room left for them to add exposure.

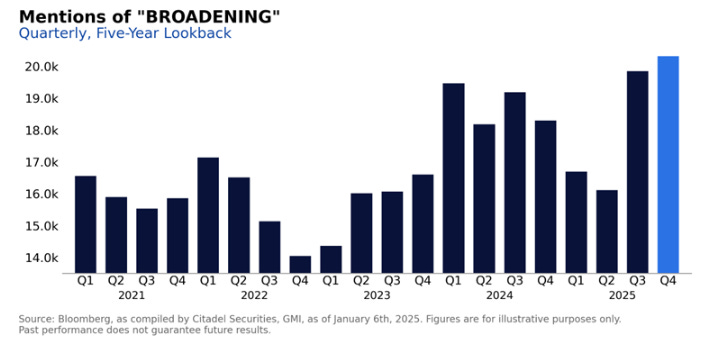

The big theme playing out right now is the broadening of the bull market and the rotation out of the “Mag7” and into the “Impressive 493,” as coined by Dr. Yardeni.

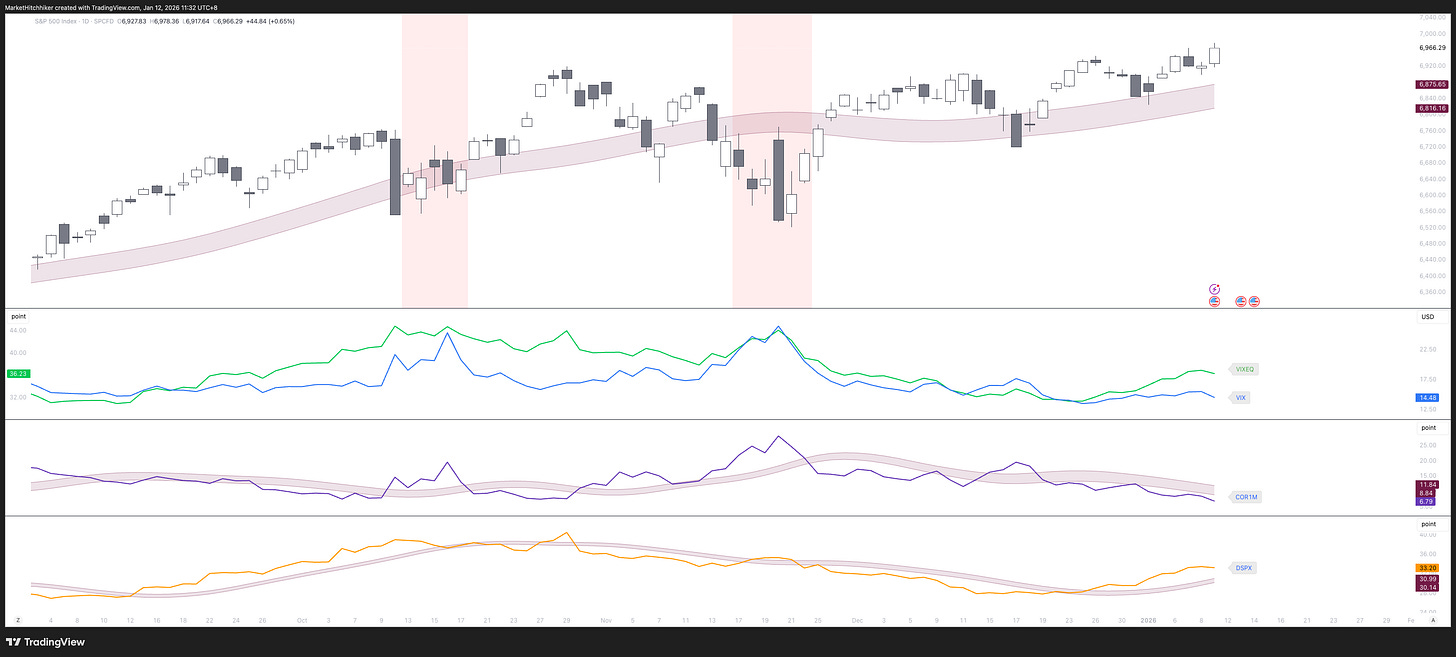

Because in markets, nothing lives in a vacuum, we can link this rotation, the high gross exposure among L/S funds, and the SPX implied volatility picture. Indeed, the hallmark of a rotation is high implied volatility on individual stocks (VIXEQ, see below), low implied volatility at the index level (VIX), and falling implied correlation (COR1M). If you’ve read The Hitchhiker’s Guide to Positioning: Part I, then you know what that means: Dispersion (DSPX) is going up!

This setup is very supportive of the market and usually makes it grind higher. Speculators are busy selling losers and buying winners, buying volatility on single names while limiting their carry cost by selling volatility on the index.

This is a virtuous cycle that pushes the market higher—until it isn’t. The logical effect of this trade is crowding into shorting SPX implied volatility, and therefore the VIX. And now we have come full circle, back to the very beginning of this post where we highlighted the short crowding on VIX futures.

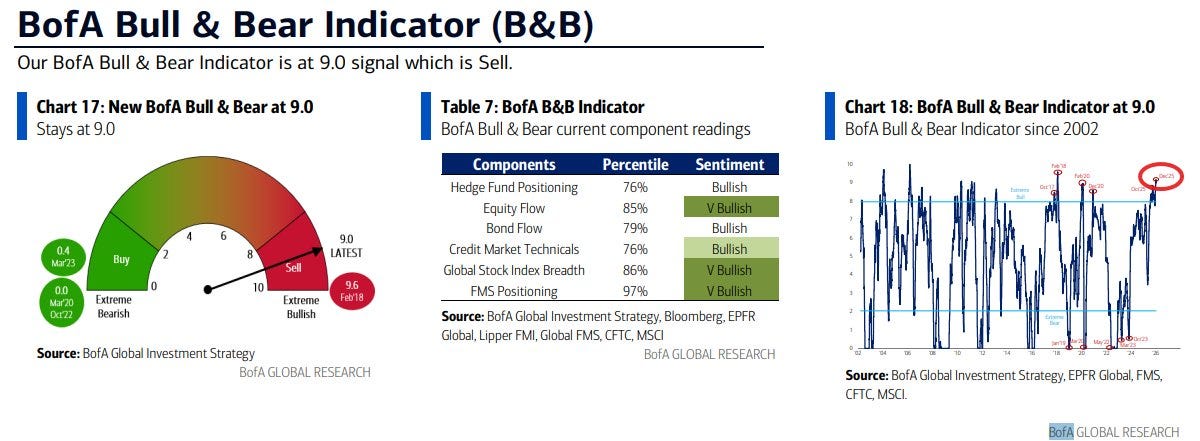

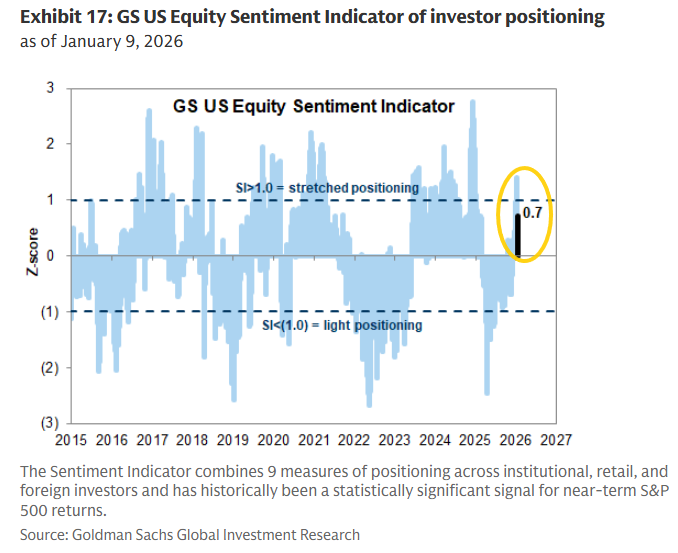

The last missing piece is sentiment. Unfortunately, this is not something we can measure accurately, but BofA and GS have their own composite indices, which are better than nothing:

BofA’s sentiment indicator is significantly more stretched than Goldman Sachs’s. The truth is probably somewhere in between, but it’s no secret anymore that everyone is bullish on equities in 2026.

Two last CoT charts in equity land before jumping to the conclusion.

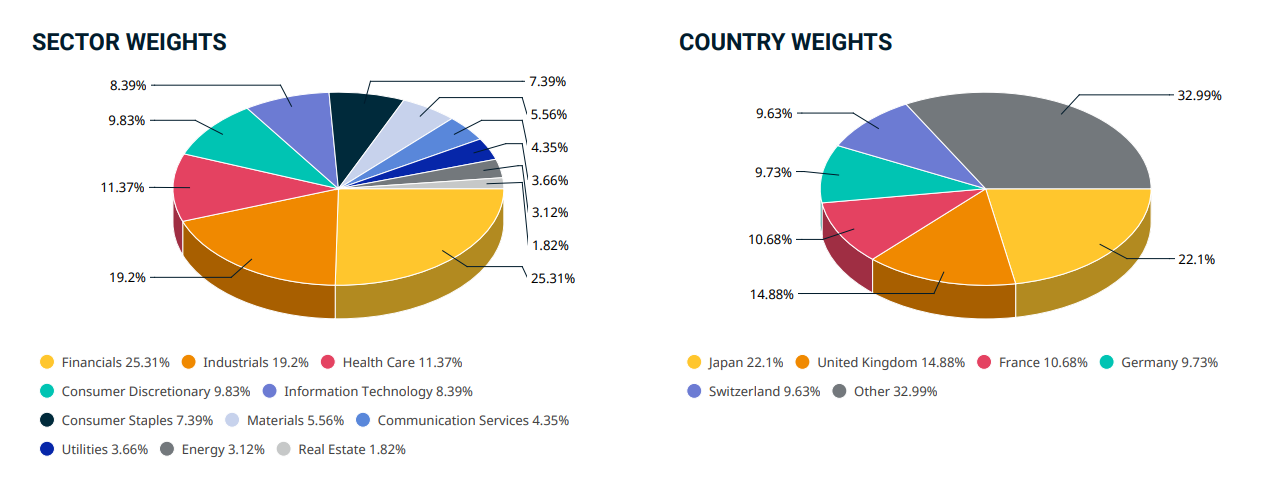

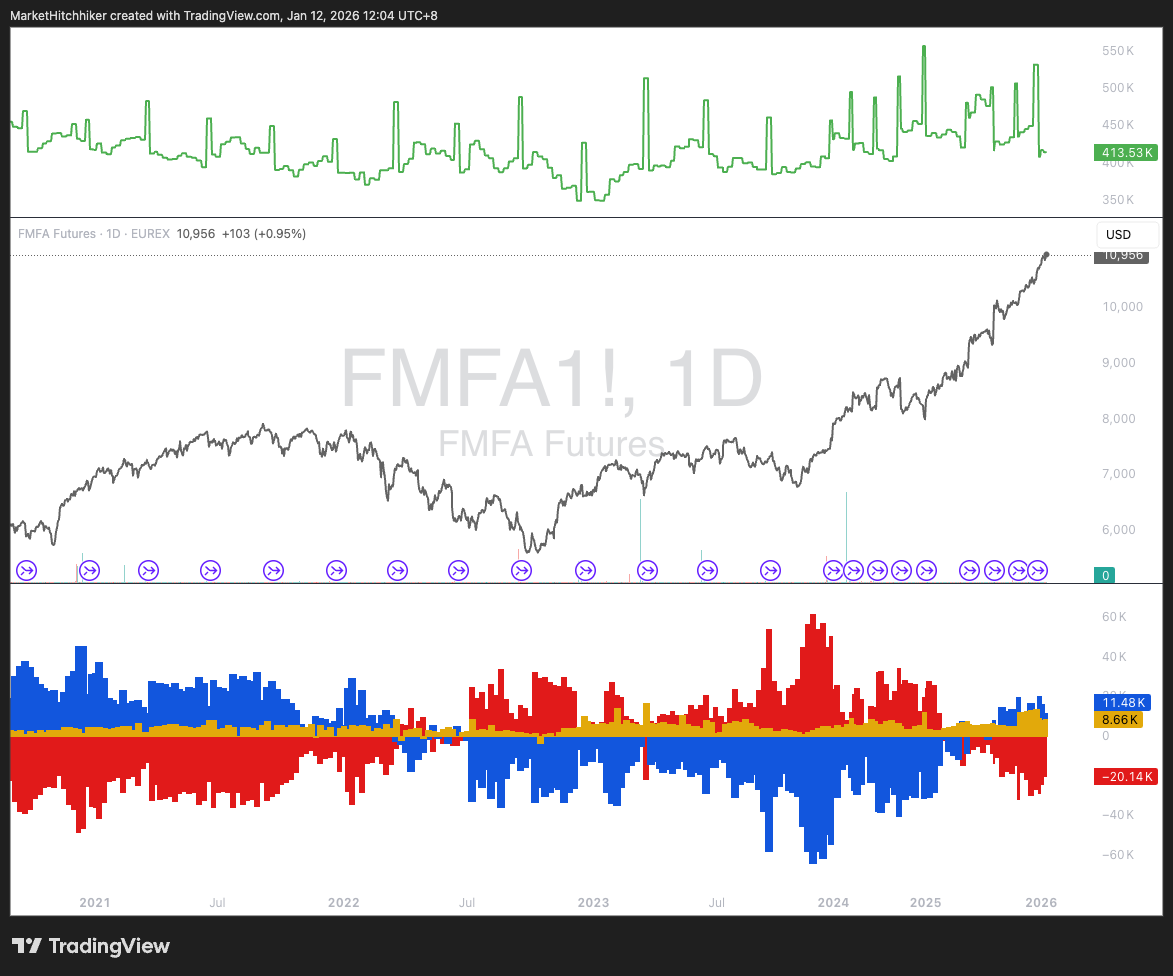

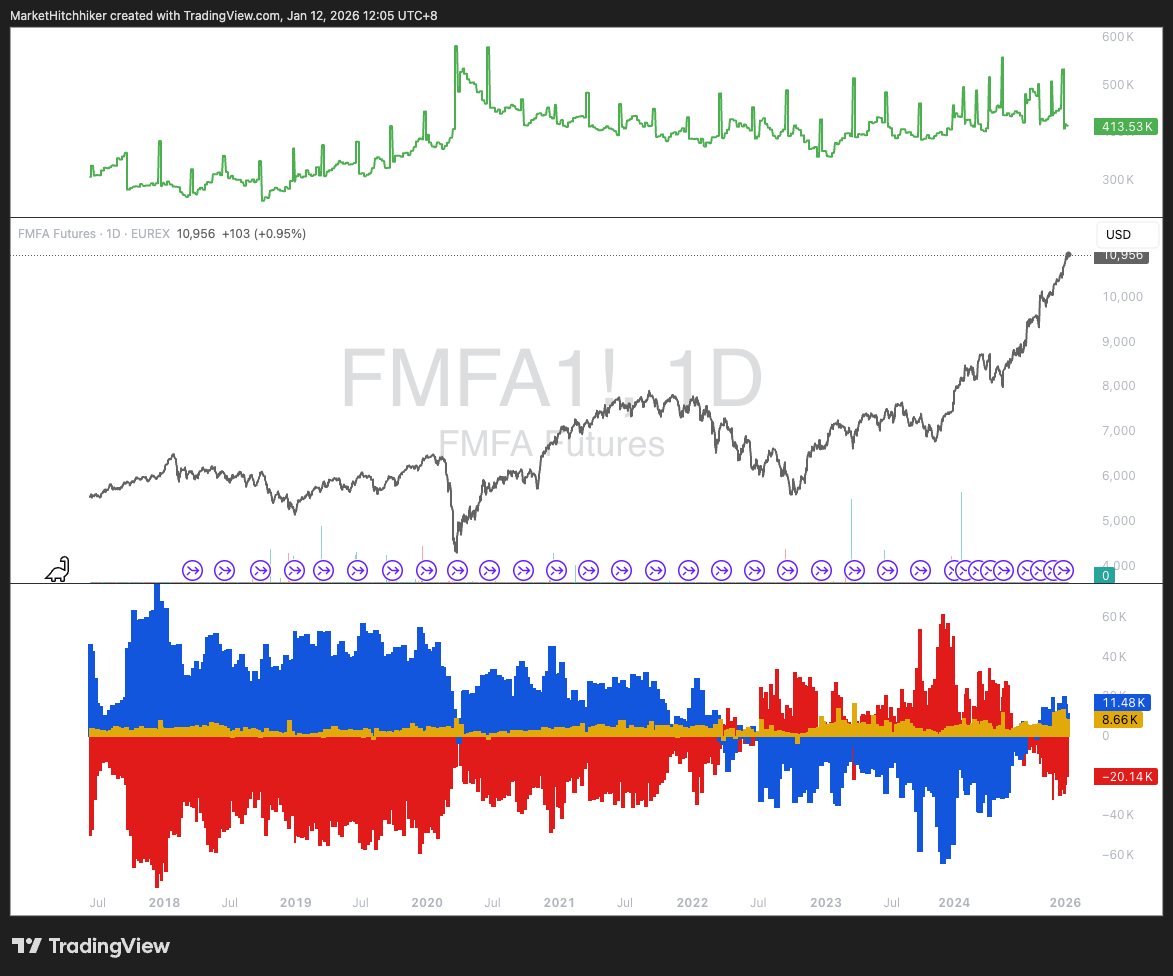

FMFA Future: This is the futures contract tracking the MSCI EAFE (Europe, Australasia, Far East, Japan) Index. It is designed to measure the equity market performance of developed markets outside the U.S. and Canada.

The outperformance of the rest of the world is no secret anymore. The index has been trending up and to the right. It was one of the best trades of 2025, along with gold.

Inevitably, outperformance attracts new capital, and the CoT data shows increasing long positioning. But zooming out, we are still very far from historical highs.

So yeah, the broadening out is not only a rotation within US stocks; it is also a capital rotation from the US to outside the US. And the CoT data is confirming it.

In my opinion, this is not something you want to fade. On the contrary, this could be a new super trend, and you’d be wise to buy the dips instead of selling the rips on this future.

Am I calling for the chart below to break out to the upside? Hell yeah!

To conclude this section on equities, I believe there is a decent chance of a pullback in SPX on the order of 5%. This is a tactical view, not a call for a crash or anything dramatic, just your average drawdown in a bull market.

This correction could come from the dispersion crowd needing to cover their VIX short positions if the broadening trade starts to fail. I’m not entering a trade yet. I’d like to see VIX grind higher slowly—that would pressure anyone short vega to begin covering gradually. A tick up in implied correlation would be the other clue that it’s happening. Stay tuned; it could play out very soon.

For a longer-term view, I actually do believe in the broadening out within the US stock market, but I also believe in capital rotation out of the US and into other developed markets. The long/short FMFA1!/FNG1! spread is a great expression of this trade because it allows you to capitalize on both the broadening (short large-cap tech) and the capital rotation (long FMFA). It fits very well in a global macro portfolio as an uncorrelated long-term position, and I will be adding to this trade on dips.