Positioning Update - CoT (2/2)

Oil, Nat Gas, Soybean, Euro, Cad, R2K

If you haven’t already, please read the first post I published yesterday, in which I covered metals and shared some reminders and insights regarding CoT data.

Positioning Update - CoT (1/2)

One of the unexpected side effects of the last US government shutdown was the lack of new positioning data from the Commitment of Traders (CoT) reports. It was a very annoying inconvenience, as my trading process relies heavily on them. Now we have a lot to catch up on; this will be split into two posts.

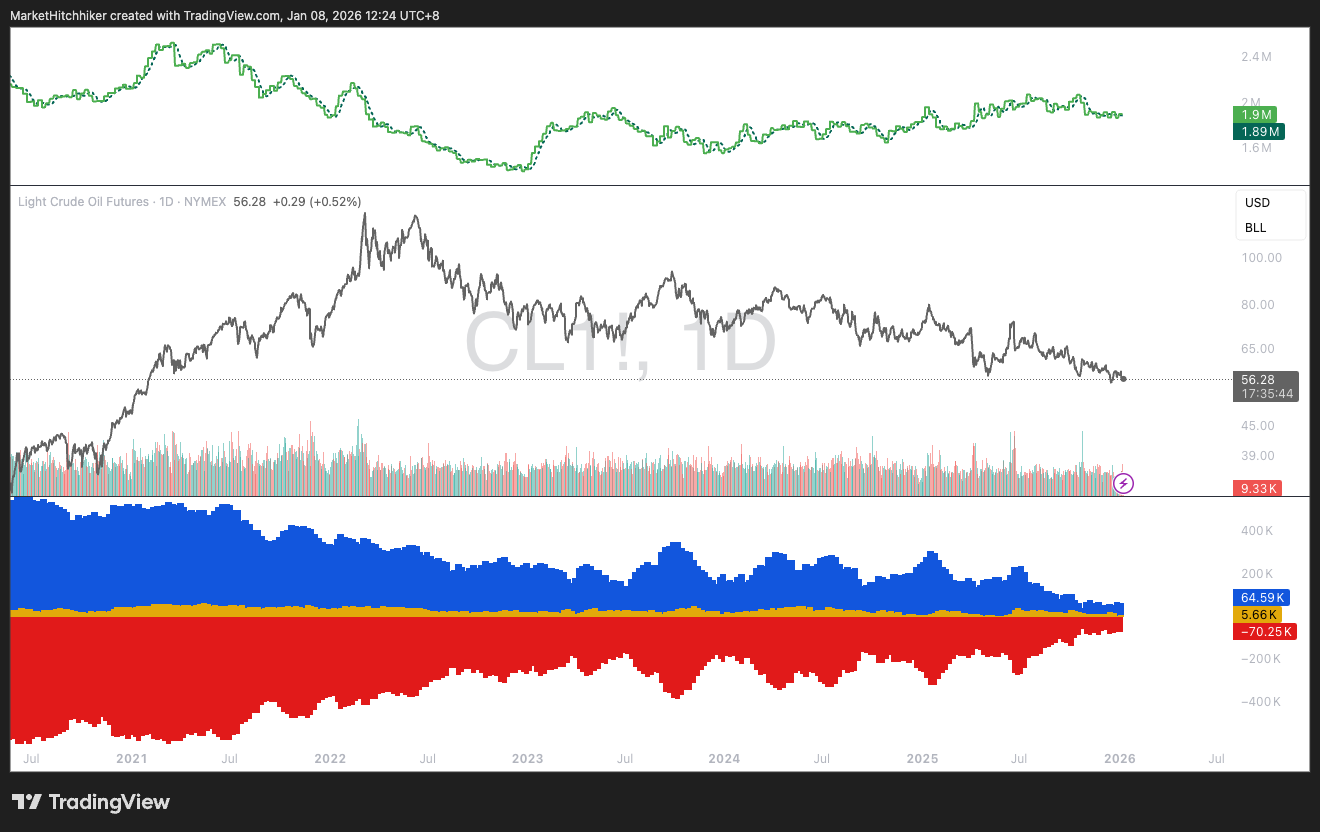

Crude Oil: This has to be one of the most interesting charts right now. Large speculators’ positioning is at a record low; the last time we saw this level was back in 2010. That light positioning is not entirely new, it has persisted for the past three months. Sentiment is also heavily one-sided. It is well established that the Trump administration wants to keep a lid on oil prices and that we are facing an “oil glut”. The latest developments in Venezuela, while not having an immediate significant impact on the oil market, further nourish the bearish thesis.

Is it time to pull the trigger on the oil trade?